FUSION - A WHOLE NEW WORLD OF CRYPTOFINANCE

Introduction

Bitcoin and blockchain were introduced in 2008. The Bitcoin blockchain enables one to exchange the computerized asset, Bitcoin, to another without a third party medium. The Ethereum blockchain, established by Vitalik Bouterin in 2014, permits the cooperation between parties with various arrangement of standards that can't be changed and are straightforward to all, with the inclusion of digital assets on the Ethereum Blockchain. From that point forward, a wide range of blockchains (private and open) have been made, serving distinctive utility cases.

The considerable capability of the blockchain is its capacity to trade and deal with a wide range of assets without a mediator, in the blink of an eye, and with to a great degree low expenses (Internet of Values). The way toward digitizing true resources like bonds, land, substance, content, identity, personality and more has just started. Be that as it may, these digital assets are not on the same blockchain. They are on various blockchains – private and open.

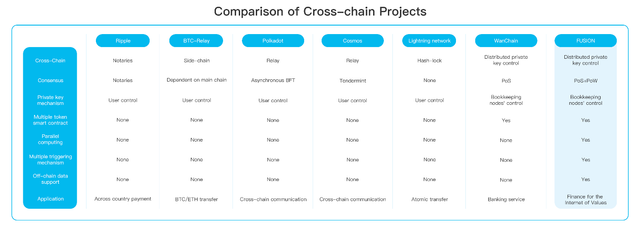

The interoperability between blockchains is targeted by notable blockchain projects like Polkadot, Cosmos, Wanchain, Lightning Network, Ripple and more.

Great potential is hidden in the Interoperability between blockchains. FUSION blockchain is aiming to serve as the infrastructure for the Internet of Value with an innovative approach. It will allow multiple token smart contracts, parallel computing, off chain data support, and multiple triggering mechanisms for the smart contract (Time, data and more).

FUSION is a project led by the CEO of BitSE. BitSE is an incubation company that created QTUM Blockchain and VeChain blockchain, both are very successful crypto projects.

The Internet of Value (IoV)

Some attribute the creation of the blockchain to the start of the Internet of Value. The Internet of value alludes to the conceivable trade and administration of digital assets safely and without a mediator. Today we can trade and oversee resources by private substances like Banks (Money exchanges, Loans), Governments (Land, auto, flat possession), AirBnB (associating free lofts with bed searchers), Uber (Connecting free drivers with transportation searchers) et cetera. Banks for instance have administration frameworks to ensure there is no twofold spending or that somebody really holds the cash they wish to exchange. These frameworks cost time, expenses, and are defenseless against hacks (one framework to hack). The blockchain enables somebody to exchange a digital asset for another without a middle person. The miners/nodes approve that there is no twofold spending and that one has the cash he expects to send. It fundamentally diminishes costs, time, and is to a great degree secure.

In order for the Internet of Values to exist, assets first need to be digitized and loaded on the blockchain, for example, bonds, energy assets, real estate, content (music, art, scientific inventions, etc.), identities, and more.

The three main issues for the existence of the IoV

To enable individuals to exchange and oversee value by means of the IoV (Internet of Values), similarly as we do with data on the IOI (Internet of information), there must be critical advance in three noteworthy issues: Interoperability, Scalability and Usability.

Interoperability: the alternative for various blockchains, incorporated associations and information sources to speak with each other. Not only for nuclear capacities, for example, a straightforward value exchange, however the alternative to make progressed multi chain brilliant contracts.

Versatility(Scalability): Currently, the IoV is being utilized for an extremely constrained scope of situations. To end up more standard, the Internet of Values should be usable in a variety of situations, for example, fund, assembling and government administration.

Convenience(Usability): while the computing power, storage capacity, and synchronous speed of the Internet of Information has possessed the capacity to help most requests of data administration, the Internet of Values can scarcely bolster non-entangled undertakings. The Internet of Values has a great deal of work to do as far as institutionalization, "platformization", useful measured quality, application ecology, interoperability, and anti-quantum assaults and so forth.

Of the over three kinds of bottlenecks, interoperability is the most pressing. By upgrading interoperability, we can exchange an incentive between various blockchains, program smart contracts with various tokens, and enhance adaptability all the more effortlessly.

Notwithstanding, ease of use is a long-term fundamental assignment, while interoperability and versatility, which have extraordinarily ruined the advancement of the Internet of Values, need a fleeting arrangement and have turned into the two most pressing bottlenecks to be understood.

FUSION'S Vision

The main vision of the FUSION project is to solve the interoperability issue by establishing a platform-level public chain which can connect all kinds of values, provide complete financial functions, communicate between diverse communities and tokens, and bridge centralized and decentralized organizations to bring the Internet of Values as early as possible.

In order to achieve this vision, one must build a public chain which allows different tokens to be mapped to it. This will allow these tokens in the same chain to be used to achieve multi-token smart contracts. It will increase the interoperability of the Internet of Values by allowing different tokens from different blockchains to communicate and it will also provide interfaces with centralized organizations and off-chain data sources to communicate with the decentralized world.

How could one chain hold tokens from various blockchains?

The main key in the FUSION chain is that the private keys of the different tokens are securely controlled in a distributed fashion by a public chain. In this way, the new blockchain manages the control rights of those tokens. This means that each token (doesn’t matter from which blockchain) can be represented on the FUSION blockchain. This innovative approach allows FUSION to implement an on-chain value transfer between various tokens and provides the ability to create multi-token smart contracts.

Distributed Control Rights Management (DCRM)

DCRM is the procedure that hands over the control of digital assets by people or centralized organizations to the decentralized nodes administration. The dispersed generation and appropriated storage of a private key guarantees that no single individual can get to the entire private key, which implies that no single node can acquire the control of the digital asset under the condition of disseminated control rights administration.

We call the process of creating relating tokens utilized for accounting on FUSION for a managed object cryptoasset mapping. Through mapping, one token can unreservedly associate with other mapped assets.

The distributed control rights management comprises of two essential activities, Lock-in and Lock-out. The Lock-in maps the token into the FUSION chain by a rundown of minute transactions. The Lock-out capacity enables the token to be discharged from the mapping and dismantles it from the distributed control rights management.

Lock-in operation

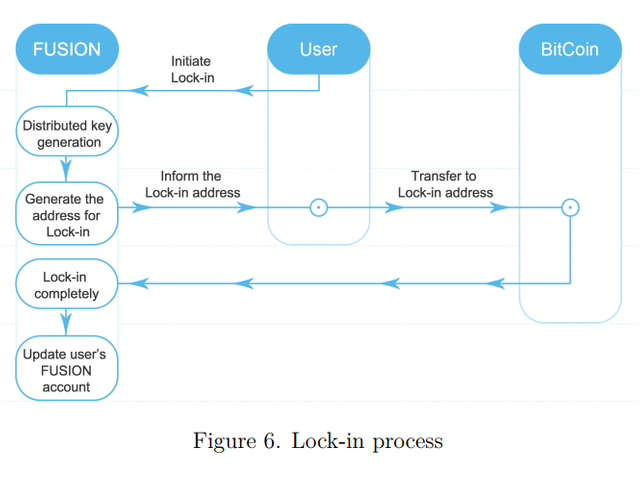

In order to start the Lock-in request the user initiates a Lock-in request to the FUSION network by using Lock-in’s program interface in the FUSION wallet.

The request will trigger a Lock-in smart contract on the FUSION network which will generate a new private key in a distributed manner.

As a part of the request initialization process the Lock-in smart contact will generate a public address on the originating blockchain of the token. To complete the transition of the control rights of the token to the hands of the distributed management, the user will transfer the token to the newly generated public key.

After the transaction is confirmed (by the original blockchain and by the FUSION blockchain) the smart contract will update the user’s FUSION account.

Lock out

Same as in the Lock-in operation, the user initiates the Lock-out operation via the FUSION program interface. The Lock-out operation will eventually transfer the user’s token into an address on the original blockchain, where the user has their private key, outside of the FUSION network.

The request will trigger the Lock-out smart contract which will transfer the tokens from the FUSION address to a different public address outside the FUSION network.

The transaction will be validated by the FUSION nodes according to its distributed private key. This procedure of validating a transaction with a distributed private key is called Threshold signature.

The nodes that are involved in those operations are being rewarded by the FUSION network.

Multi Triggering Mechanism

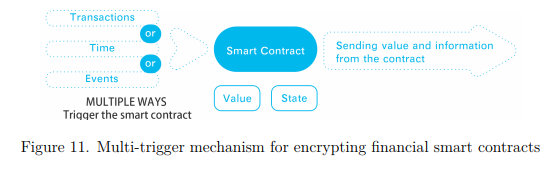

The current implementation of smart contracts is based on the transfer of ownership of digital assets because the current smart contract is triggered by a value transfer to the contract.

The FUSION implementation extends the current smart contract trigger mechanism with two essential triggers: timing triggering and event triggering. The enhanced triggering mechanism is called the multi-triggering mechanism.

The multiple triggering mechanism has the following three trigger modes:

Transaction trigger: The active triggering mode is consistent with the current smart contract triggering mode and can be supported by all types of smart contracts.

Timing triggering: this mode means that the smart contract can be triggered by time conditions such as a time point or length of time.

Event triggering mode means that a smart contract will be triggered when a certain event occurs. Those events can be imported from off-chain data sources via HTTP or socks based on the standard API’s provide by third-party data sources. For example, in automated trading and quantitative trading, capturing events is very important.

Hierarchical Hybrid Consensus Mechanism (HHCM)

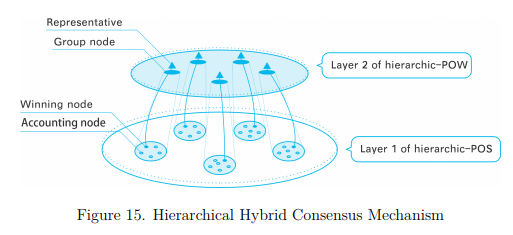

The Hierarchical Hybrid Consensus Mechanism (HHCM) used by FUSION is for stratifying the computational work of generating blocks and adopting a suitable consensus mechanism in different layers. HHCM introduced the concept of grouping to achieve private keys’ generation, management and parallel computing. HHCM combines the advantages of PoW and PoS to balance safety, efficiency, scale and other aspects.

The Hierarchical Structure the HHCM

The HHCM is built of two layers:

The first layer consists of virtual groups of physical nodes. The nodes of each group will jointly process one of all the transactions assigned to the group and the work among the different groups will not overlap each other. In this layer each virtual group is responsible for a distinct part of the transactions. This allows for parallel computing which can significantly increase the amount of transactions that can be processed per second.

The second layer is the block generation layer. It packs the results submitted by the first layer to form a block record on the blockchain.

Hybrid Consensus Mechanism

The so-called hybrid consensus mechanism is reflected in the block creation process:

The nodes in the virtual groups in the first layer are elected by a POS method. Those nodes are chosen from all the nodes in the FUSION network.

Next, in each virtual group the nodes validate transactions and smart contract, using a POS approach.

From each virtual group one node is selected to move to the second layer, this node is called the Group Node. In the second layer, the different Group Nodes are competing with each other to publish the next block on the FUSION blockchain. This is done using a POW consensus mechanism.

Use case for the Internet of Values and FUSION blockchain

FUSION smart contracts can be thought as a trust mechanism for a certain financial agreement between peers. The smart contract can be customized upon the agreement, but once launched, it cannot be changed.

The following is an example of how the FUSION smart contracts can be used to validate a mortgage agreement between a house buyer and a bank.

Current financial system

Without the use of the trust mechanism, the system that validates and executes the mortgage agreement includes:

Bank: The buyer’s bank account will usually need to be managed in the bank that gave the mortgage. The Bank has an internal system to validate that the loaner pays his monthly payments on time.

Land registry office: If the buyer misses a certain amount of payments, the bank can take custody of the house, by communicating with the land registry office.

FUSION solution

For this example, we will assume that the real estate in the country are digital assets on the government private blockchain.

On FUSION, the house’s seller will initiate a house sale smart contract (C1) and put the house smart lock’s control right into the smart contract. The owner of the smart contract will have the right to control the house’s smart lock.

C1 prescribes that anyone who sends 100 BTC into the smart contract will be the new owner of C1 and acquire control of the house.

A buyer has negotiated with a mortgage provider. They will initiate a mortgage smart contract (C2), which prescribe that:

No. 1: if the buyer sends 30 BTC to C2.

No. 2: if the mortgage provider sends 70 BTC to C2.

Then C2 will send the 100 BCT to C1 and transfer the control right of C1 to C2.

C2 also prescribes that the buyer will have the password of the house’s smart lock as long as the buyer sends in 1 BTC at the end of every month for 120 months.

If the buyer sends in 1 BTC at the end of a month, C2 will use a transaction-trigger and time-trigger to send the password of the house to the buyer’s address. Otherwise, C2 will do nothing, which means the passwords will not be sent to the house buyer.

If the buyer fails to send the BTC to C2 for three months, then C2 will let the mortgage provider, as the owner, have full control rights of the house.

However, if the 1 BTC has been sent to C2, the mortgage provider will have no right to stop the sending of passwords.

After 120 BTC has sent to C2, C2 will let the buyer become the full owner of the control rights of the house.

User case 1

Use case 2

Use case 3

To conclude: With the FUSION smart contract, the financial institute that provides the loan, does not need to trust the authorities or the borrower when it signs the mortgage agreement. If the borrower fails to pay back his loan, the financial institute will receive the custody of the house automatically (upon the agreement).

Use of token

FSN will be used to pay fees on the FUSION network. Smart contracts will consume FSN in order to work. FSN use correlates to the use of ETH in the Ethereum network.

Project potential

FUSION is a project that means to fill in as the framework for the Internet of Values. The capacity to exchange and oversee bonds, monetary forms, arrive properties, substance, and personalities in a safe way without the need to confide in an outsider is required. The market for the IoV is gigantic and the undertaking that breaks the obstructions between blockchains will unquestionably prosper. The FSN token request will increment alongside the infiltration of the FUSION blockchain to the market as it is utilized to fuel the system.

TEAM

FUSION is attempting to pull off a creative undertaking with changes to the blockchain innovation that presently can't seem to be seen in different other projects. Keeping in mind the end goal to effectively launch FUSION main net, the group must be profoundly experienced. Dejun Qian is driving on the FUSION venture. As the CEO of BitSE, he has driven and been engaged with the fruitful launch as of late of two goal-oriented blockchain ventures – QTUM and VeChain. It appears that the group has the correct involvement to effectively launch FUSION. In the interim, the FUSION venture has a lot of chosen supporters and consultants with rich experience from various sectors and businesses, particularly the finance related industry.

Core team

Dejun Qian – Visionary & Principal

CEO and Founder of BitSE, created Qtum and Vechain. Previously was a branch general manager at IBM. Holds a Bachelor of computer science, Fudan University.

Dr. Jiangang Wu – Foundation Development

Holds a PhD in financial mathematics and engineering, Shanghai University of Finance and Economics. He is a Research fellow at the China Europe International Business School, and a lecturer at the Management School of the Shanghai University.

Noam Cohen– Foundation Communication

Former VP of marketing and business development at Orbotech, over 15 years of experience in marketing for various Tech organizations. Holds a Bachelor’s in Electronic Engineering from the Technion (Haifa, Israel) and MBA from Insead.

Advisory Board

Daniel P. Petrozzo

Daniel serves as an advisor and board member to several companies. Previously, he was a Partner and the Global Head of Technology for investment management at Goldman Sachs.

Michael Hosana

For the past 9 years and currently, Michael has been the managing director of Barclays Investment Bank. Previously he worked for Lehman Brothers as an Equity Derivatives Trader. Holds a Master of Financial Engineering Science, Columbia Engineering.

To explore all team members, please visit Fusion.org

All pictures were sourced from the [fusion website](http://fusion.org) and white paper.

This is my entry for the Original works contest

fusion2018

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!