Tax season is upon us - don't forget about the FinCen FBAR!

To start, let me disclose that I am not a financial advisor, tax advisor, or an accountant. I am just a regular guy working an 8 to 5 job that also likes to trade cryptocurrencies on the side while staying on the right side of the law.

The law, the taxation law to be exact, has been anything but straight-forward in explaining the rules revolving around cryptocurrency transactions. With the regulations lacking and constantly changing, tax payers are often left confused. Over the years I've witnessed many instances of people interpreting current laws and regulations towards their advantage when it comes to situations such as 1031 (like-kind) Exchanges. If you recall, this was once a common argument that exchanging one cryptocurrency for another is a non-taxable event because they fall under the rule of exchanging like assets without generating a taxable event until the sale of said asset. This was eventually clarified by the IRS that this rule only applies to real estate properties.

While I am not here to discuss the legality of taxation in the first place, and I am not here to choose sides between bending the interpretation of the laws in favor of the tax payer or the government, I am here to touch on one point I have learned over the past few years:

When it comes to paying taxes, don't f*** with the government.

It is simple. IRS, and the government as a whole, have the absolute resources and power to make your life miserable. Penalties for breaking some of the laws, purposefully or mistakenly, can be costly - both to your finances and to your freedom.

A perfect such example of where you should not bend the law is FBAR.

What is FBAR?

First of, FBAR doesn't really have anything to do with taxes or the IRS. It stands for "Foreign Bank Account Report". It is a report that is filed with FinCen (The Financial Crimes Enforcement Network bureau of the US Department of the Treasury) form 114 each year by every US person (citizen or resident) who owns or has authority over at least one foreign financial account AND the combined value of these accounts equals or exceeds $10,000 USD.

For more specific information on what FBAR is and who must file FinCen form 114 visit https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

So what does this have to do with cryprocurrencies?

Well, here is where the financial advisors, crypto traders and enthusiasts disagree. In short, if you happen to trade cryptocurrencies on an exchange that is not US based but is a based on a foreign land, it could be interpreted as a foreign account. An example of this is Binance, which is not a US based exchange (not to confuse with Binance.US which is headquartered in the US and abides under US financial laws and regulations). If you have an account with Binance and have had crypto assets there at any time in the calendar year, you might be required to file the FBAR.

But it gets even more confusing. The IRS regulation states that FBAR must be filed if the total value of all assets in foreign accounts exceeds $10,000. That means that even you had less than $10k worth of cryptocurrencies with one foreign exchange, you must consider all foreign exchanges and accounts before determining your requirement to file the FBAR.

How to determine the value.

This is even harder to figure out. The rule specifies that the total value of all your foreign accounts must exceed $10,000 at any time in a calendar year. This means that you must know the USD value of all the cryptocurrencies for any given calendar day. With the prices fluctuating from minute to minute it is not an easy task.

There as some obvious scenarios here - if you bought 1 BTC on a foreign exchange for $6,000 and kept it there until it reached $10,000 in value - you must file the FBAR. I suppose similarly, if you bought 1 BTC for $6,000 and transferred it out of the foreign account to say your private wallet, then later purchased another BTC at say $7,000 and again transferred it to your personal wallet, then the account value would not had exceeded $10,000 USD and you would not need to file the FBAR. In this case the account value would not had exceeded $7,000 USD.

Please note again that it is my personal interpretation and not a professional one.

So what if I don't file the FBAR?

Well, you might get away with it, or you may not. IRS and the government want their portion of your profits, and they are up to all the tricks. Their job is to collect your money. FinCen is not here to collect your profits, however; they want to know what do you do financially outside the US.

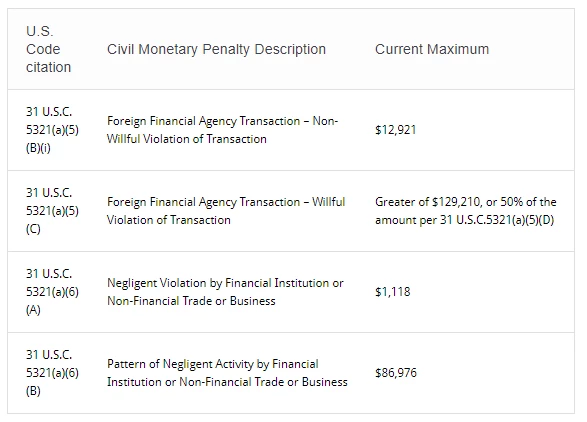

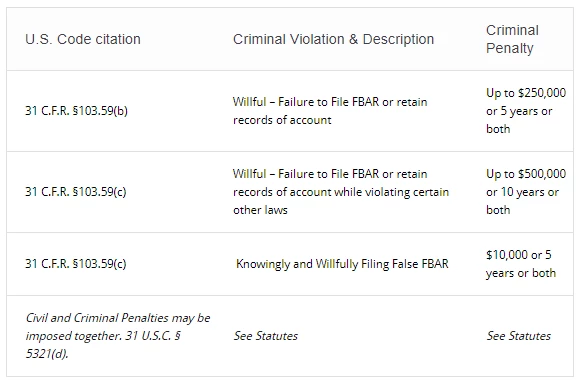

So what are some penalties for not filing the FBAR? Well, they are frankly quite steep, reaching up to $500,000 in penalties, or 10 years of imprisonment, or both. Here's a breakdown according to https://www.goldinglawyers.com/a-summary-of-fbar-penalties-faq-common-questions-answers/:

Civil Violations:

Criminal Violations:

How to file.

If you determine you need to file the FBAR, you can do so electronically through the Financial Crimes Enforcement Network’s BSA E-Filing System.

The filing due date is April 15th. It is a short form, but you will need to obtain account numbers and values for each foreign asset, as well as addresses of the financial institutions where the accounts are held.

Once more, all of the above is my own interpretation of the laws. When in doubt, always contact a professional.

Resources

https://americansoverseas.org/en/knowledge-centre/explanation-of-the-us-tax-system/what-is-fbar/

https://www.investopedia.com/financial-edge/0110/10-things-to-know-about-1031-exchanges.aspx

https://www.irs.gov/businesses/small-businesses-self-employed/report-of-foreign-bank-and-financial-accounts-fbar

https://www.goldinglawyers.com/a-summary-of-fbar-penalties-faq-common-questions-answers/