Can’t Beat ‘Em, Join ‘Em; JP Morgan Seems to Be Coming to Terms with Cryptos Not Going Away

A JP Morgan internal document has surfaced that highlights the risks of the crypto space, but, surprisingly, it also acknowledges that cryptos are here to stay.

.jpg)

Up until January, JP Morgan’s CEO Jamie Dimon had been extremely negative on just about everything related to cryptos, especially Bitcoin.

So imagine the surprise to those who’d heard him deem the space to be a bubble when they learned that his staff had crafted an internal document that acknowledges that digital currencies are here to stay.

The document surfaced over the weekend when a writer at Zero Hedge published it. He dubbed it the Bitcoin Bible, and news of the 71-page document quickly went viral. In it are what the writer calls “excruciating detail on everything from the technology of cryptocurrencies, to their applications and challenges.”

Here we’ll discuss some of the highlights.

Admitting when one’s wrong

Few can forget the damning comments Dimon made about Bitcoin in the fall of last year. The head of the largest bank in the U.S. even went so far as to question the intelligence of Bitcoin buyers.

He said:

"If you're stupid enough to buy it, you'll pay the price for it one day."

In January, however, the banking guru, who’s one of the most respected in the business, seemed to muster the courage to admit that he may have been a bit off kilter with his earlier comments.

To Fox Business, Dimon, in reference to his previous comments on Bitcoin, said:

“I regret making them.”

He said this right around the time Bitcoin had started to make its precipitous slide from the $17,000 price where it had been trading, to the $8,700 price it stands near now.

Here to stay

While its leader bashed cryptos, and expressed extreme reluctance about acknowledging the legitimacy of the space, this internal report shows how JP Morgan saw it could resist no longer.

Take this excerpt, for example. Note, that in the report, cryptocurrencies are referred to as CCs.

“CCs are unlikely to disappear completely and could easily survive in varying forms and shapes among players who desire greater decentralization, peer-to-peer networks and anonymity, even as the latter is under threat. The underlying technology for CCs could have the greatest application in areas where current payments systems are slow, such as across borders, as payment, reward tokens or funding systems for other Blockchain innovations and the Internet of Things, as well as parts of the underground economy.”

While acknowledging that cryptos aren’t going way, the bank still sees good old-fashioned fiat money as king. In the “bible,” it’s state:

“In addition, we find that local legal tender money tends to be a natural monopoly with only extreme hyperinflation leading people to seek out a monetary alternative. To add, we do not find that CCs are currently meeting the standards of what constitutes money as the huge volatility of CC has made use of it as a unit of account impractical.”

Although cryptos won’t just go away, there will be pushback from banks. The drafters of the document insinuated that central banks and governments are possessive of their currencies, and will be hard-pressed to relinquish control of it.

“…given the huge returns from running a central bank (seignior age), governments will be quite possessive of their legal tender role and will likely put up a fight if CCs were to gain broader traction domestically.”

Investment portfolios may need some crypto

As you know, last week was one of the most volatile for stock markets around the world. In the U.S., for example, the Dow fluctuated wildly from being at least 500 points down, or up, in a day.

Those whiplash-causing movements made some investors start to rethink their investment portfolio holdings.

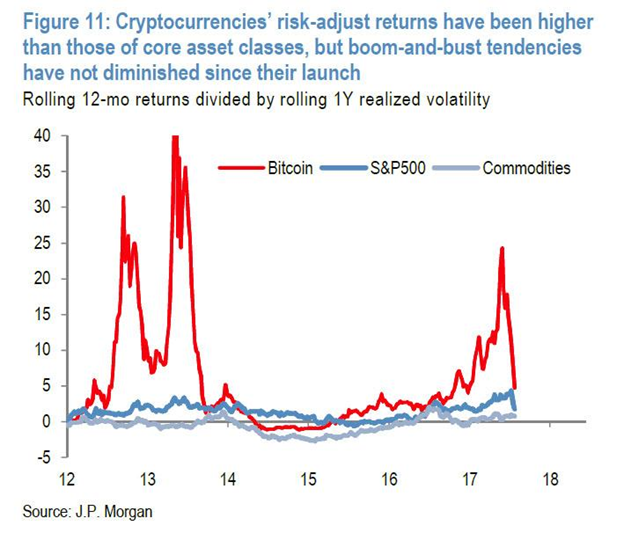

The Bitcoin Bible examines the potential role of cryptos in terms of offering diversification in a global portfolio, given both their high returns over the past several years and their low correlation with the major asset classes, offsetting some of the cost of high volatility.

The document states:

“If past returns, volatilities and correlations persist, CCs could potentially have a role in diversifying one’s global bond and equity portfolio. But in our view, that is a big if given the astronomic returns and volatilities of the past few years.”

The Bitcoin Bible cautions that with the Dow and other major markets being so volatile right now, it’s not the time to use cryptos as a hedge.

“In the current market conditions, we do not believe that an allocation to cryptocurrencies as insurance should be a portfolio’s main or only hedge. Note that even though CCs have improved risk-adjusted returns over the past several years, they have not prevented portfolio drawdown during periods of acute market stress, like the equity flash crashes of August 2015 and February 2018.”

One of the crypto areas Dimon has championed is Blockchain. Here’s an excerpt from the document about the cutting-edge technology.

“Cryptocurrencies are both a new technology — Blockchain — and a new currency (many new ones). The new shape and form of the CC market in the future will likely ultimately depend on what economic value they are perceived to add. We would expect the marketplace and regulators to ultimately weed out what are perceived the negative, less useful characteristics of CCs and retain the positive elements that add economic value.”

Follow for Daily News.

Upvote, drop a comment.

Interesting post ;)

Leaving comments asking for votes, follows, or other self promotional messages could be seen as spam.

Your Reputation Could be a Tasty Snack with the Wrong Comment!

Thank You! ⚜