The Ultimate Guide to Bitcoin Forks — Part II

by Crystal Stranger, Founder of PeaCounts

Image By Business Insider UK

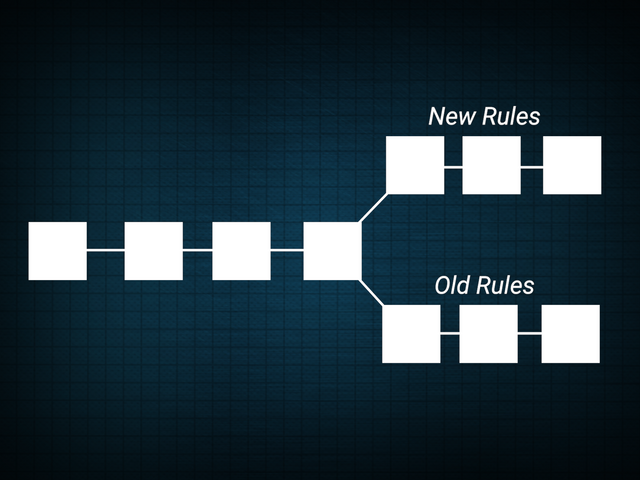

Bitcoin forks have been used for more than just spin-off technical changes. Companies have also used hard forks instead of issuing tokens for an ICO. Instead of building on top of another chain such as Ethereum or EOS, it is possible to clone Bitcoin at any block point and copy the code into the new blockchain along with other attributes added at that genesis point.

The first article in this series discussed the forks that developed various improvements to the Bitcoin blockchain while maintaining their cryptocurrency status. In this article, we will go deeper into some of the projects that have spun-off from Bitcoin with more creative applications.

.jpeg)

Bitcoin Atom

Peer-to-peer (P2P) exchanges are all the rage right now. For most investors, this will not be a good thing as true P2P transactions don’t clear participants for the Anti-Money Laundering (AML) rules such as the Know Your Customer (KYC) verification process. Atomic swaps are a P2P exchange without any intermediary involvement and are the focus of Bitcoin Atom. Using its own hash time-locked contract API, Bitcoin Atom has the robust technology necessary to make atomic swaps happen. Hopefully, they begin implementing KYC controls soon to protect investors trading using their product.

Bitcoin New

Games are typically the first project developers learn to build in coding classes. Bitcoin New takes it one step further and has developed a blockchain that comes with nine games built in. The setup is similar to how PCs used to come with pre-installed games like Minesweeper and Solitaire. History does repeat itself. Aside from offering games, Bitcoin New has created a decentralized application (DAPP) platform that offers an insurance product, although it’s not clear exactly what it insures.

Bitcoin God

This fork happened on Christmas Day, so they missed a great opportunity to name it Bitcoin Jesus instead of Bitcoin God. All jokes aside though, this P2P platform is a non-profit that distributes a significant portion of the coins mined to charities, though it’s not specified which ones.

Decentralized storage of files is the foundation of Blockchain technology, so it always great to see a company do it well. InterPlanetary file systems (IPFS) are undisputed for their potential benefits of spreading file storage into small bits worldwide, making data essentially unhackable. But few companies have done this well as there are many issues with both popular files and those that get little use. Bitcoin File uses an enhanced access protocol to address these issues. Additionally, Bitcoin File uses a Proof of Capacity mining system to fairly allocate tokens in exchange for storage resources provided by the network.

Bitcoin Smart

This project aims to both allow issuance of tokens easily on the Bitcoin Smart network and then allow these tokens to be immediately listed on an exchange. This allows for immediate liquidity for investors in micro-funding projects. However, it also could lead to another massive bubble of ICOs like what occurred in 2017. Only time will tell.

BitVote

Satoshi Nakamoto’s original vision was for the existence of decentralized financial systems where each small miner had a vote in the overall system. BitVote attempts to bring this vision to life by giving each CPU a single vote in the future of the system and on other decision factors. This structure is similar to that of Decentralized Autonomous Organizations (DAOs) which are typically used to pool investment funds and purchase tokens in a group controlled by voting members.

Bitcoin Interest

This platform was spun off of Bitcoin as a way to create an interest-bearing cryptocurrency account. The award of interest and percentages earned on staking is paid at a similar rate to what Ethereum pays out in Gas costs. Technology-wise, Bitcoin Interest is robust, and the idea is a clever way to decentralize savings, but how the project can be sustainable without a long-term purpose beyond earning interest is still up for debate. Unlike Ethereum where the Gas is based on fees paid, Bitcoin Interest splits a small portion of the mining pool between stakeholders, creating a POW/POS hybrid.

Banks can pay interest because they lend the funds on deposit out to borrowers, but there doesn’t appear to be a lending platform or other use of the money staked in Bitcoin Interest that would make it stable in the long-term. What will the company do when all the coins are mined since there will be no mining pool then to provide interest rewards from? While they may have a solution to this and prove people wrong, investors should be wary of this project.

Bitcoin Community

While the stated mission is to have one hundred million people understand blockchain, Bitcoin Community’s strategy is so confusing that how they are planning to do this. They are trying to reduce the energy costs of a POW model by using a currency specific unspent transaction output (UTXO) database. This is purportedly to reduce the size of the UTXO in place of needing a larger block size, thus making mining fairer to smaller miners. I wish I could read Mandarin to understand their tech better.

Big Bitcoin

Designed as a “best of all worlds” solution, Big Bitcoin integrates a 16x larger block size than Bitcoin, Equihash, SegWit, lightning network, and Graphene Technology, which is the toolset that allows the cryptocurrency beneath Steemit, STEEM, to have high validation speeds. While technologically very strong, it will be interesting to see if this project gains acceptance as a platform for DAPPs.

Bitcoin Private

This fork was in a sense a merger between Bitcoin and the privacy coin Zclassic, which was itself originally a fork of Zcash. The basic premise of Zclassic was to remove the “founder’s tax” where the founders were taking a 20% stake of all coins mined on the Zcash network. However, Zclassic suffered from lack of funding and could not raise much interest in the project amongst the developer community. This led the team to fork to Bitcoin Private in order to create a new model that would create a voluntary fund contributed to by miners for development initiatives. In addition, a similar fork based on Zclassic and Bitcoin called Anonymous Bitcoin appears to be another up and coming privacy coin on the market.

Bitcoin Clean

A few new coins forked off Bitcoin this year with the goal of creating a more environmentally-friendly cryptocurrency. The most notable was Bitcoin Clean, offering a new proofing model for mining they call Proof of Green. This verifies through peer reviews that the mining is being done using green energy sources.

Bitcoin Hex

A Bitcoin fork- onto the Ethereum network. The stated intent of Bitcoin Hex is to prevent 51% attacks by changing the code so miners cannot attack the system. Additionally, it proffers a Robin Hood idealism of creating a cryptocurrency that takes tokens away from the rich members of their staking pools and awards it to everyone else.

Bitcoin Prime

One future fork is Bitcoin Prime, which is a combination of Bitcoin and Primecoin that searches for prime numbers in the mathematical equations that make up their POW. Their stated goal is to have a cryptocurrency where the POW does more than just random equations, so it can also make mathematical advancements at the same time.

Other Upcoming Forks

Additional upcoming forks include new payment systems Bitcoin Air, Bitcoin Zero (which merges with the privacy coin Hexx (HXX)), and finally, Bitcoinx2 which advertises 200 times faster transaction speeds than Bitcoin. Though the volume of Bitcoin forks has slowed, it is easier to issue a token on Ethereum than create a new chain entirely. But this is not to say the Ethereum route is better.

Conclusion

Certainly, it is easier to issue a token on Ethereum, given its robust developer network and the fact that coding in Solidity is rather straightforward. But recently, Ethereum has had many issues with network congestion causing slow transaction speeds and spikes in Gas prices. Bitcoin was slow last year, but SegWit and the Lightning Network are solutions for that. The potential solutions to improve Ethereum, like Casper, are full of possible security vulnerabilities. There are some ideas in the developer community that can potentially solve these issues, but few people will want to stake their company’s future on untested technology, especially not when a solution with ten years of hack-proof testing and constant community improvements is available.

Bitcoin and PeaCounts

The team at PeaCounts feel so strongly about this issue that we have decided to use Bitcoin as a platform for PeaCounts by doing a hard fork while implementing all the technology we want to add into the code base. It isn’t the easiest method to build a token, but the trade-off is that we will have a more robust ecosystem for developers to build payroll solutions on our platform. This series of articles on Bitcoin forks came out of my own research leading up to the revisions of our whitepaper. I couldn’t find a good online resource discussing the previous Bitcoin forks, so I created my own. I hope this helps others out there who are looking for a better solution, and you can reach out to me on LinkedIn or Telegram with any questions.

I follow you, I hope for your reciprocity