Clear The Crypto Mechanism - Simplifying Your Portfolio For BO$$ Profits

Whether you have been in the game a while or are just getting started, there are two things for certain; #1 the crypto game is volatile & exciting and #2 it moves at lighting speed. It is very difficult to keep up and requires checking your Blockfolio, and Twitter often while smashing that like button on YouTube over and over again. There is always a new coin coming out, rumors to check into, news to follow, price swings and everything else to keep you distracted from the goal of any successful long term portfolio. Half of the game is just to be in the game, get properly educated and let your investments play out with solid entry points and alerts set for possible profit taking or opportunities to BTFD (Buy the F'in Dip!). Overall, yes in crypto its about the world changing disruption, the crypto community and reclaiming ownership of our finances & privacy, but any good portfolio also is looking for BO$$ profits while REDUCING risk so that you can live your life the way you personally want in the long term. (True Freedom)

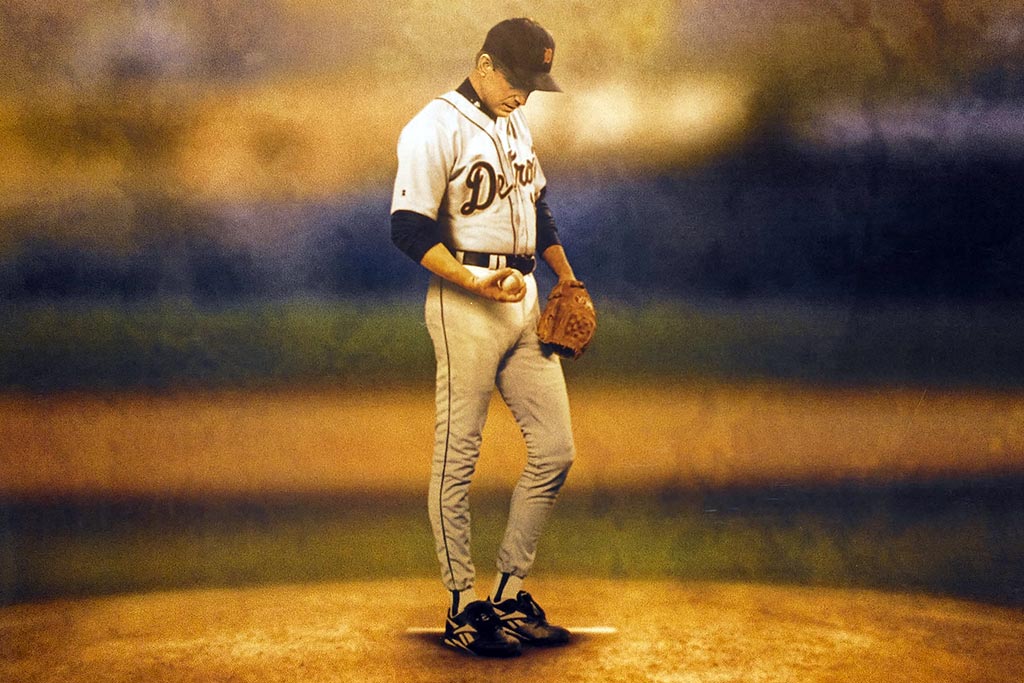

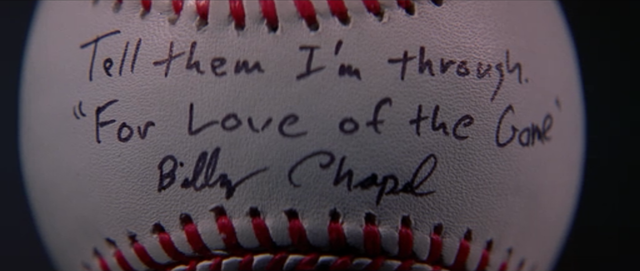

In the movie "For The Love Of The Game", Billy Chapel was in the twilight of his career and the midst of a perfect game. Pitching under the bright lights of Yankee Stadium, a capacity crowd and in the process of losing his love, he found it necessary to focus and "Clear The Mechanism" Through everything going on, he was able to concentrate on the task, and pitched the perfect game. Billy realized he needed to make a few changes to simplify his life and live the life that he wanted. Chapel realizing that he only gave everything to his baseball career wrote on the ball "I'm Through, For The Love Of The Game" In the end, by clearing the mechanism, he was able to finish his career in style and reconcile with Jane for a happy ever after. Many crypto investors would like to reach their goals and live happily ever after, so in a world under the bright lights its time to "Clear The Mechanism" simply your portfolio for the love of the game and of course leave with Bo$$ Profits.

There are few things to understand when designing a portfolio of your own.

#1 What are your goals?

#2 When are your goals expected?

#3 What is your risk tolerance?

Once you have those answers, it is time to develop YOUR portfolio. Everyone's answers will be different so make sure that your token investments meet your own criteria and not just what you hear from everyone else's videos or posts. Watching and listening is the best way to learn and find out about new opportunities in the market, but make sure you do your own research and truly believe in the projects you decide to invest in. When you do, you are less likely to panic or get emotional during market movements.

Many of the 1,494 current and growing list of crypto's on coinmarketcap will eventually disappear, so its important to build a crypto portfolio like you would a traditional portfolio: What are the market trends for the next 3-5 years? Which are likely to develop measurable and long term adoption with real world disruption and utility? which are building brand recognition and a loyal online community? There are currencies, platforms, protocols and other crypto categories. It is important to understand the overall market potential, which sectors are likely to gain a portion of the long term block chain ecosystem and what utility or problem will they solve.

The good news unlike like previous tech revolutions, the development of entire platforms and ecosystems will lead to a likely higher retention rate for long term success. You can see that today with many companies finding it hard to break through against Apple, Amazon, Google, Facebook and Netflix. (Example: There has to be a better social network platform, but no one wants to leave Facebook.) Once they are locked into the ecosystem it is very difficult to change so the Crypto's out of the gate who are building their brand and community with true utility will likely have more staying power than the AOL's of the world.

Here is a list of trends and tokens that meet my criteria and I believe are likely to win long term.

Market Trend Themes

- Crypto exponentially growing - More exchange registrations, more transactions, more trades, more fees

- Digital Cash - Fast, Secure, Cheap

- Cross Border Payments

- Decentralized Platforms

- Privacy

- ICO's, Smart Contracts, DAPPS

Long Term Sample Portfolio:

#1 Crypto Market - The OG Bitcoin - (Mack daddy of them all. Needs to be in the portfolio as everything moves in step with the BITS. This includes BTC & Yes having some Bitcoin Cash is a smart idea whether you agree with them or not)

#2 Digital Cash - Litecoin or Dash (Could potentially substitute Digibyte. If your a Bitcoin Cash enthusiast could add more) This is my least favorite trend as someone will always be faster, more secure and cheaper and could go either way for payments as there is no clear winner as of today. However this has the biggest potential as the market is $100 Trillion so it pays to be diversified

#2 Platforms - Ethereum (ERC-20 - NEO (China) - Steem (Social Media Disrupter!) (Can Substitute Cardano (ADA) Potentially add Funfair (FUN) Large Casino/Gaming opportunity or EOS)

#3 Cross Border Payments Stellar (XLM) or Ripple (XRP)

#4 Exchanges -Binance (BNB) - Exchange - Bitshares (BTS) Decentralized Exchange

#5 Decentralized Exchange Protocols OX Project (ZRX) or Loopring (LRC)

#6 Privacy - Monero (Could add Verge, Zcash)

#7 Wild Cards - Bread (Top Wallet APP) - Safex (Private & Anonymous Marketplace) (Small Percentage but worth a flyer)

There are certainly others that would fit the criteria, but in my opinion, this for the average investor should help them "Clear The Mechanism" slow down the noise and focus to simplify their portfolio allowing them to move forward and reach their goals in the future. Sometimes the greedy get slaughtered. Is a 3-10X return good enough? No other investment can compare so maximizing profitability while reducing risk makes sense. Remember unless you are a trader, 5 good trades can be negated by one bad trade, so look for good entry points and HODL unless their is a reason to leave other than taking small profits along the way to buy the dip. In the end, the overall trend should continue to move higher over the medium to long term.

In my opinion, 2018 is going to be a great year so most importantly you gotta be in it (And stay in it) to WIN it. Trust your due diligence and your picks and let them work their magic. If you are diversified, each project will have at some point its breakout leading to significant returns. (Assuming the market hits it projections)

With a clear focus and a simplified portfolio, I believe we will be able to enjoy the things that are important to us and the freedom many are after. When you reach that point, you will be in a position to write "I'm through, for the love of the game"

@cryptolegendhodl AKA J$

Appreciate your follow and upvotes as we build this Steem Community to the top!

If you are not on Binance and are looking to add some of those mentioned above https://www.binance.com/?ref=16733320

*This is my opinion and what I am doing. This is not financial advice

This is some great advice...

My goal is to double everything in the foreseeable future, the quicker the better of course. Honestly though, right now I think I could spread my coins out between the top 200 and that’s will be a sure thing. I keep at least half of my non-Steem crypto in some of the safer gen2 coins with dapps, mostly Etherium, eos and neo. The other half are in a whole mishmash, wabi and substratum are the most notable, but there are some more I’d really love to pick up.

Appreciate the comment! Keep rocking. Gonna be a big year. Upvoted you and will follow as we build this Steem Community.

Definitely keeping things simple will make investing much easier. Got to stay in the game long enough in order to get gains so I agree have to hold coins/tokens that I believe in and be in it for a long time.

Great post, there are thousands of shitty coins out there and thus determining the right set of portfolio is a not exactly a walk in the park, you need to research a great deal so you don't end up with a dead bit coin.

Thanks appreciate the kind words. Yes there are a lot of shitty coins. Finding the right ones that have great growth potential but also reduce risk makes all the difference in the down times. Followed and upvoted!

All the market fluctuations in cryptocurrency and

cryptocurrency is still trending !

Can this one thing gives the hope for the future growth?

I hope that those bitconnect scammers have to pay every cent back that they stole

I like your portfolio, gaming and social are very nice additions as people will most likely always play games and communicate. For the cluster of secrecy/privacy I am not sure, especially on Verge. I am holding some but am not sure where it goes.

What is your opinion about Energy? Is keeping Powerledger and future WePower worth it as enrichment of the portfolio?

I personally believe in both.

It is as you say though and I am very happy about this. Do not blindly follow others, develop your own plan and follow it! Great point!

Appreciate the comment. Power Ledger seems like it has long term potential, but for now have stuck to certain trends. I upvoted and will follow as we build the steem community! 2018 is going to be a great year.

Nice, this is really helpful. The portfolio aspect is going to be more important moving forward as cryptos become more mainstream and the volatility decreases.

I like the categories, and it helps to simplify it. The hardest part for me is deciding what crypto to first take money out of before I trade it for another for gains. Might want to include ICOs or very new coins in there as well.

Its nice to read something that reaffirms my strategy and that what I am thinking, at least one other is too...there is safety in numbers :)

Definitely keeping things simple will make investing much easier. Got to stay in the game long enough in order to get gains so I agree have to hold coins/tokens that I believe in and be in it for a long time. If it is simply a quick trade then I would not invest a lot in, but long term hold I would put in more after I do my due diligence. Thanks.