You don’t have to suck at this game if you follow these 5 rules

TMC #14! Only 5–10% manage to generate consistent excess returns over a long period of time and they all religiously follow a set of rules.

I considered writing an article about how to avoid sucking at the game of earning extra profits. These recommendations, in my opinion, apply to both short-term traders and long-term investors seeking to exceed benchmarks.

Rule #1: Realistic expectations

Excess returns are an almost certain method to get wealthy: you either exponentially raise your money or find someone to sponsor you and receive a percentage payout of very huge profits.

Approximately as follows:

But it’s not quite that simple. You have to be realistic. To begin with, commissions and other frictional charges eat away at your profits. You must be able to create extra profits after accounting for frictional expenses.

Second, nearly every investment is attempting to attain the same result. As a result, it is extremely close to a zero-sum game. The graph below depicts how difficult it is:

Third, keep in mind that most investors who lend you money want you to earn extra returns after adjusting for risk. They are concerned about the volatility of your performance and the drawdowns you are experiencing. Increasing the risk in order to increase the return is insufficient.

Rule #2: Build or find opportunities where risk and reward are skewed

One of the most important things to grasp about trading/investing is that you will not always be correct. You will make some good transactions and some bad ones. Whether you are Paul Tudor Jones or someone who trades in their spare time, your profit and loss statement will look somewhat like this at the end of the year:

P&L = (% winning trades * P&L winning trades) — (% losing trades * P&L losing trades)

In theory, you may profit by being correct <50% of the time, as long as your losses are minor and the P&L of your few winning trades is significant enough.

How do you make sure of that? You focus on skewed risk/reward opportunities.

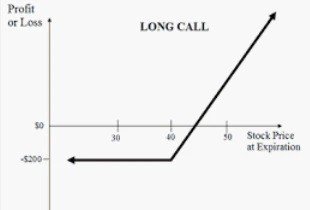

A simple way to imagine this is to visualize the payoff of a long option position.

The worst that can happen if you are a long call is that you lose your premium. You know the amount ahead of time, so your risk is limited…However, your potential upside return is far greater.

Risk/reward ratio is skewed.

There are other built-in ways to accomplish skewed risk/reward trades by design, but you don’t have to be driven into options to do so.

There is another method, the traditional way…

Rule #3: cut your losses and let your profits run

This is most likely “grandma advise” in terms of creating alpha. Enter a trading floor and ask two seasoned traders what they do before placing a trade: I can almost ensure that the answer will be “I set my stop loss.”

I find this to be the best piece of advice I’ve ever gotten.

If you can accomplish this, you will not be trapped in a single bad investment decision that will destroy your whole year’s P&L and limit your capacity to take risks. You’ll just approach each transaction the same and exit when the time comes. There are no harsh feelings.

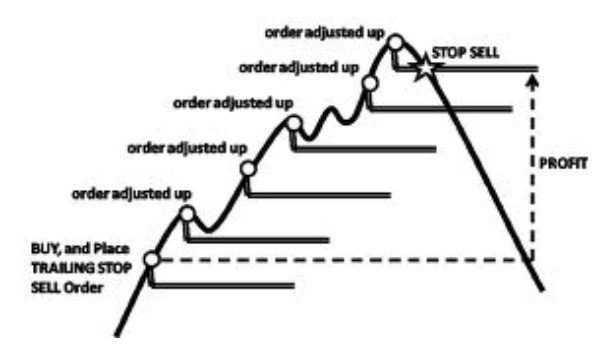

If you find yourself in a profitable trade, trailing stops will assist you in maintaining your earnings for as long as the trend is favorable. And, of course, they will minimize your loss if the trend reverses.

If you feel you are getting stopped out too often and losing too much money, maybe it’s because you are not adhering to rule #4 that much…

Rule #4: Size your positions correctly

The majority of individuals would just utilize the same size for each deal. Whether it’s the EUR/USD, a short-term bond, a utility stock, or Bitcoin. That’s as awful as putting ketchup on noodles, guys (yeah, really bad).

The size of your position and the location of your stop loss should be proportionate to the volatility of the underlying instrument and the recent volatility of the market.

- The first question should be, “How much am I willing to lose on this trade?” And the response should be a modest portion of your remaining funds.

- The next stage should be to determine how big of a move I need in this asset considering its volatility in order to strike my stop. Let’s adjust the size of the position accordingly.

Essentially, don’t use 1% stops on BTC and invest 20% of your remaining money at each round. That is not trading or investing; it is gambling.

Rule #5: Diversification and proxy hedging should be considered

‘‘I don’t use stop losses because my portfolio diversifiers are going to protect my downside risk’’.

This has been mentioned a few times, and it may work for a while…as long as (negative) correlations persist. However, as correlations begin to weaken, these accounts are frequently wiped entirely.

Keep in mind that the association does not have to break totally and even change sign. All that is required is for the correlation coefficient to begin diminishing, and the first fractures will surface immediately. Diversification and proxy hedging are vital components of a portfolio/trading strategy, but they should, in my opinion, supplement rather than replace stop losses.

The best way to hedge your risk…is to sell your risk.

Bonus quotes!

Three additional quotations are now fully included into my investment strategy. They were all shared by the right people: hedge fund portfolio managers and/or high-risk investors.

- Never be emotionally committed to a transaction or a worldview: get out of the trade, and get your ego out as well. Be adaptable: if the facts change, your perspective must alter as well.

- If you have a terrific macro story with evidence to back it up, but the market isn’t paying attention…Your deal will not be successful. Be patient if no one cares and the narrative is missing.

- Every day, ask yourself, “With the information I know and at today’s price, would I enter the same trade today?” for each transaction in your portfolio. If the answer is no, why are you holding the trade?