BITCOIN VS. GOLD - DAY 2 OF PROJECT #WOKE

Why is Bitcoin, or a cryptocurrency similar to Bitcoin, better than gold?

Welcome to our topic for Day 2 of Project #WOKE! We are presenting the case for "Why is Bitcoin, or a cryptocurrency similar to Bitcoin, better than the US dollar?" through a series of topics in this group. If you haven't read our previous day's topic, find it HERE

DAY 1

https://steemit.com/crypto/@cryptoautonomy/bitcoin-vs-u-s-dollar-project-woke

DAY 2 - LET'S BEGIN

.

.

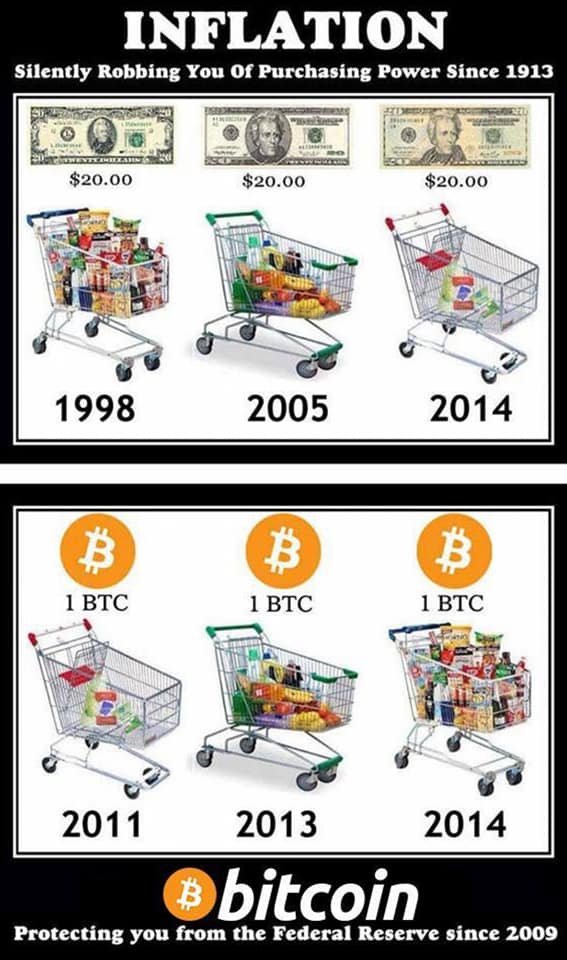

Yesterday we discussed why the US dollar is considered to be "bad" money. Some supporters of the gold industry have been calling to reinstate a gold backed currency in our country as we had, once upon a time. So why haven't we? Aren't we one of the wealthiest nations in the world? Don't we have gold reserves?

"Gold is a physically heavy commodity and cannot be efficiently used as money at the scale that we would need. Imagine trying to run payroll with physical gold coins, or trying to make change for a piece of gold bullion. Gold, in its physical form, is impractical for commerce in today's day and age.

For gold to work in a modern economy, it must be warehoused by a company and then digital certificates or credits must be issued against that gold. Those digital certificates could theoretically work well as money in a modern economy, except for one problem: CENTRALIZATION. A digital gold payment service or any privately issued market based money requires some form of centralized control or custody, and thus exposes users to counterparty risk. This is fatal because if such a private company ever grows to scale, the government could shut it down, unplug its servers, arrest its principles, and seize its assets. This exact thing happened with the company, E-Gold."

Watch Erik Voorhees, CEO of Shapeshift

E-Gold was a company founded by an oncologist, Doug Jackson in Florida, in 1996. Jackson sought out to find an alternative to fiat by providing customers with a digital currency that was backed by actual gold. He was very successful for several years, and at E-Gold's peak, the currency was backed by 3.8 metric tons of gold, valued at more than $85 million. Their customer accounts numbered about 3.5 million in 165 countries, with 1,000 new accounts opening every day. Millions of dollars were zipping through E-Gold's system 24-hours-a-day, bouncing between the U.S., Europe, South America, and Asia. E-Gold collected 1 percent of every transaction, with a cap at 50 cents.

This gold-backed digital currency eventually got caught up in criminal activities, but not because Doug Jackson was a criminal. E-Gold was attractive to both law abiding citizens and criminals because of the ease at which it exchanged currency globally. In fact, when Doug realized that there was suspicious and possibly criminal behavior occurring, he fully cooperated with FBI investigations and gave them access to his customers' data, without even waiting for a subpoena. Regardless of all the help he gave and all the rules he thought he was following, Doug was held accountable for the fact that his company's existence made the criminal activities easier to occur.

Doug took a plea bargain and plead guilty to conspiracy to operate an unlicensed money transmitting service and conspiracy to commit money laundering. He was also sentenced to 36 months of supervised released – including six months of house arrest and electronic monitoring, and 300 hours of community service. In addition to forfeiting about $1.2 million to the government, his two companies – Gold and Silver Reserve and E-Gold Limited – were fined $300,000. The Feds took away all of his assets, and banned his company's operations, until he can get the proper regulations and overseeing that they require, which never happened. When his sentence was completed, he was broke. He still hopes to begin again, but admits the hurdles of regulations that he would have to go through to reopen his business makes it extremely difficult to do so.

You can read more about E-Gold's background history here: https://www.wired.com/2009/06/e-gold/

Another company, GoldMoney, also experienced similar challenges that E-Gold faced: https://www.forbes.com/…/goldmoney-is-the-answer-do-you-k…/…

GoldMoney, also came under the scrutiny of the FBI, and out of fear of undergoing the same fate as E-Gold, the company shut down it's user-to-user payment system.

Now, what do these 2 companies have in common that became their biggest weakness? It was that they were both private, centralized, institutions. Private money, when centralized, cannot attain the scale it needs to surpass fiat because the government will not allow this to happen. As I stated earlier in this post: "If such a private company every grows to scale, the government could shut it down, unplug its servers, arrest its principles, and seize its assets."

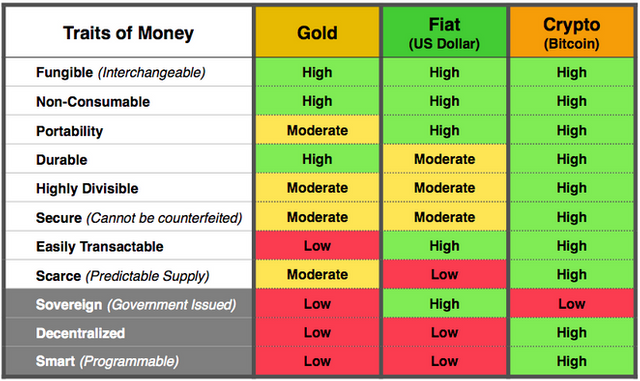

So, back to today's main topic: Why would Bitcoin or a cryptocurrency similar to Bitcoin win over gold and fiat?

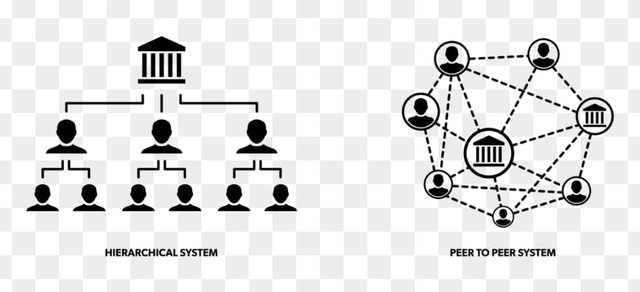

Because it's decentralized, and therefore, it cannot be stopped. Gold and fiat currency require a centralized authority to oversee it and act as a mediator between 2 users that want to carry out an exchange. Bitcoin, and other similar cryptos, do not need a centralized system like this, hence the term, DECENTRALIZED. Bitcoin is the first ever, direct peer to peer exchange to exist in our modern times. It cannot be manipulated by politicians backed by large financial institutions like a centralized system (banks), and for this reason, Bitcoin and its blockchain are described as being "Trustless." Trustless means that you don't need to trust any central authority that the amount of Bitcoin you are sending or receiving to another user is accurate because of the way that consensus was designed into blockchain. When was the last time you felt you could 100% trust ALL of our nation's leaders and the wealthy class of America to make decisions for the good of 100% of ALL citizens?

Read more about how Bitcoin is DECENTRALIZED here: https://www.bitcoinmarketjournal.com/decentralization-bitc…/

Bitcoin is also transparent, unlike a centralized system. How many times have there been a call for an audit to be done for the Federal Reserve? Currently, Senator Rand Paul, a Republican from Kentucky, has been unsuccessful in prior attempts to pass his so-called, "Audit the Fed" legislation, calling for a Government Accountability Office review of the Federal Reserve. It hasn't passed yet. Click here to read more about this issue: https://www.marketwatch.com/…/rand-paul-struggling-to-get-v…

Is there transparency with how the US dollar is used? If someone gave cash to a drug dealer, no one would know that transaction went down unless they were being followed, photographed, or recorded. With Bitcoin, transactions on the blockchain are traceable, unlike fiat/ US dollar.

"Mass adoption of cryptocurrency is not going to happen all at once. Nobody switches immediately from fiat and banks to Bitcoin and blockchain. Rather, Bitcoin will simply, gradually, come to be used as an occasional alternative to fiat. Individuals will find specific times and places in which it is easier, faster, and cheaper to use Bitcoin to store and transfer wealth, than to use credit cards or banks. There are at least 2 billion people in the world who don't even have credit cards or banks and for them, the choice will be easy.

Despite the failings of the legacy system (governments/banks), Bitcoin can now be used by anyone on Earth with financial sovereignty. With Bitcoin, anyone of any age, race, or creed, no matter what background they were born into, and has access to a $50 smartphone, can send and receive money anywhere in the world, instantly at near zero cost, and there isn't anything that any one in the world can do about it. It is one of the most potent tools of individual empowerment, and it is happening right before us," Erik Voorhees, CEO of Shapeshift

What do you think about decentralization? Do you think it's better for power to rest in the hands of one, or in the hands of many?

[Knowledge is Power] + [Time is Money] = $ucce$$!!!

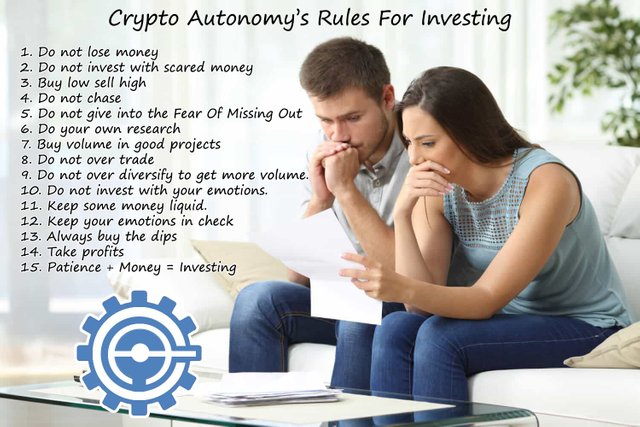

FOLLOW YOUR OWN RULES FOR INVESTING

Please, engage with us, it only takes a second to RESTEEM, UPVOTE, OR FOLLOW; and it may only take a second to change someone’s the world. Be the difference!

BEST ENDEAVORS!

OUR OTHER INTERESTING READS

HOW TO SPOT AND AVOID URL SCAMS OF CRYPTOCURRENCY EXCHANGES?

CRYPTOCURRENCY HAS A SECRET WEAPON

CRYPTO VS. U.S. DOLLAR: WHO BOUGHT MORE DRUGS?

Legal Disclaimer

All content found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, or supplemental information, expressed or implied herein, are for, entertainment or educational purposes only and should not be construed as personal investment advice. We are not financial advisors. It is very important that you do your own research and due diligence as to make the best informed decision. Always DYOR = Do Your Own Research.

BUY LOW

Nice post. Im excited to see where the crypto future take us!

THE FUTURE WILL BE LIKE THIS

Resteemed by @resteembot! Good Luck!

Check @resteembot's introduction post or the other great posts I already resteemed.

You got a 25.00% upvote from @nado.bot courtesy of @cryptoautonomy!

Send at least 0.1 SBD to participate in bid and get upvote of 0%-100% with full voting power.

@cryptoautonomy Taram-pam-pam

hey, this post resteemed by @manikchandsk to over 7600 followers and voted. good luck

thanks for using our service.

send 0.300 sbd or steem to @manikchandsk and keep post link in memo that you want resteem + 40 upvote +@manikchandsk 100%upvote.

click for details..https://steemit.com/manikchandsk/@manikchandsk/post-resteem-upvote-service

where are my upvotes?