5 Cryptocurrency Portfolios for the Long Term 📈

Here's some trading advice for those looking to hodl Cryptocurrency for the long term. This will be positive for you conservative investors out there. This information is brought to you by Data Dash, we're here to share this valuable information which we support!

Portfolio #1 : The Leaders

- Bitcoin (20%)

- Ethereum (20%)

- Ripple (15%)

- Litecoin (20%)

- NEO (25%)

Bitcoin, the Gold standard of Crypto. Followed by Ethereuem, a very positive coin with several ERC20 tokens out there. Ripple will see mass adoption in good time. Litecoin, the silver to Bitcoin which I believe will have more and more use as the value of Bitcoin increases and transacting with a decimal in so many zeros becomes difficult, Litecoin is viewed as the go to currency to trade your "gold" with for simple spending. And then we have NEO, rebranded from Antshares coined the Ethereum of China will grow massively. Already its price has shot up sky high but is stabilizing.

Portfolio #2: The Top Ten

- Bitcoin (20%)

- Ethereum (10%)

- Ripple (10%)

- Litecoin (10%)

- NEO (10%)

- IOTA (10%)

- TenX (10%)

- Stratis (8%)

- Safe Exchange Coin (8%)

- Mysterium (4%)

As you can see, Bitcoin is a staple with it being the pioneer for other altcoins, followed by the crypto from the previous portfolio. IOTA has a very unique value proposition and has a very philosophical standpoint offering a new transactional settlement and data integrity layer for the Internet of Things. Based on a new distributed ledger architecture, the Tangle, which overcomes the inefficiencies of current Blockchain designs and introduces a new way of reaching consensus in a decentralized peer-to-peer system. We will go through what IOTA is and the ins and outs in another Steemit Post!

TenX with their recent ICO offers great payment innovations and we will see crypto growing and it's going to be massive when adoption picks up.

Then there is Stratis. Their concept is to have a multitude of features covering every possible need in the blockchain space, so they can offer their services up to other companies. The BaaS (Blockchain as a service) concept allows a company to come to Stratis and setup a blockchain on their own on the Stratis' platform without having to start all over and reinvent the wheel, it allows any company in the world to quickly get and utilize blockchain. This is generally referred to as a sidechain. This means a blockchain that is built and operating as a branch off of another blockchain. It simplifies everything for the client company.

Safe Exchange Coin is trying to build a decentralized anonymous blockchain where people can interact amongst each other in a decentralized marketplace. (Reminds one of Bitshares but it offers strong security).

Mysterium is trying to tackle the VPN market which is centralized and allows you to browse the web at ease and with freedom. In countries with restricted internet freedom, it can be a big issue. Bringing such services to the blockchain is a feat but it is a valuable one indeed.

Portfolio #3: Crypto Finance (Industry Specific)

- Bitcoin (20%)

- Ripple (20%)

- TenX (15%)

- Metal (15%)

- OmiseGO (10%)

- Lumens (10%)

- Bitshares (10%)

Ripple has a lot of optimism and a lot of room to rise given that they get adopted at their scale. A lot more banks need to adopt this for it to grow but it has been very positive so far as the no.4 ranking on coinmarketcap.

Metal is a new mid cap payment solution that is rising up.

OmiseGo which seems to be having a lot of activity in Thailand, recently they had met up with the Central Bank of Thailand with Vitalik as their advisor on their matter. They want to "Bank the Unbanked" and their value proposition and existing reach towards a number of companies with their payment solutions will revolutionize it with their new Blockchain initiative.

Lumens focuses on remittances and lowering fees and has a very strong target market. Nobody likes to pay massive amounts to remit cash via Western Union. Let alone when you're working in a foreign country trying to send cash to home.

Bitshares, a crypto with its technology to provide a platform to exchange goods on their decentralized exchange, made by our founder Dan Larimer. I'm the many of us know about his initiative and how brilliant he is with designing blockchain as such.

Portfolio #4: Cloud Storage

- Bitcoin (20%)

- Neo (20%)

- Siacoin (15%)

- Filecoin (15%)

- Storj (15%)

- MaidSafeCoin (15%)

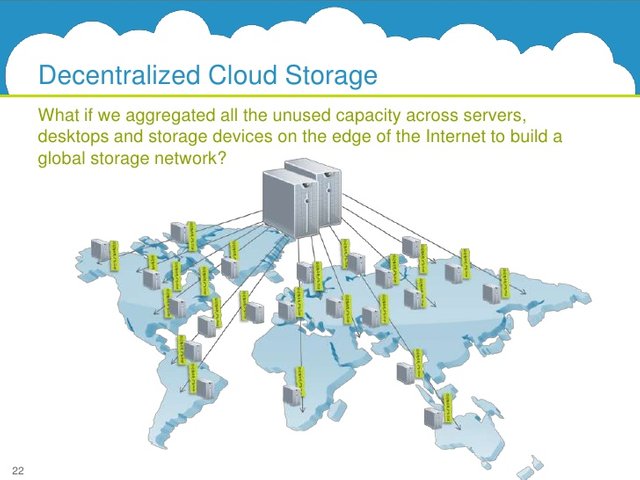

Storage on the Blockchain, to tackle the centralized file storage methods.

So why is Neo back in there? As it turns out, they've been busy working on an application and will only deliver when it is scaled to its full potential, a cloud service storage. With the current rate of its growth, its bound for it to be seen as a very attractive file storage platform.

Siacoin seems like the leader on the cloud storage industry.

Filecoin and Storjwhich are recent ICO's which have the same goal, decentralizing file storage by being incentivized via crypto to hold information for others.

MaifSafeCoin with a very successful ICO, bringing storage onto the Blockchain.

Portfolio #5: Web 2.0

- Bitcoin (20%)

- Neo (15%)

- Distrit0x (15%)

- Pillar (15%)

- Substratum (15%)

- Mysterium (10%)

- STEEM (10%)

Neo is an all rounder that would be safe to invest in on all cases, so do jump in while its cheap!

District0x a recent ICO has a unique value proposition, trying build separate districts, that allow people and communities to govern and vote on what happens in those districts. Those being marketplaces or information platforms. We will make a Steemit article on this in a while.

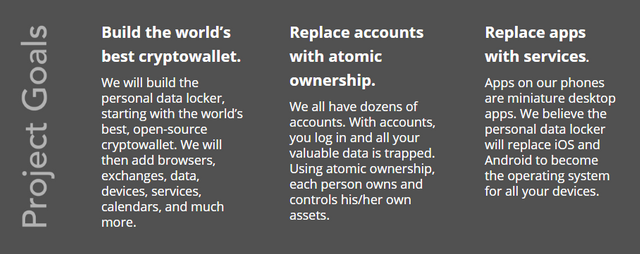

Pillar Platform, aiming to build an all in one platform where you get all your information in one screen. here are their goals:

Substratum a new ICO which aims to decentralize web hosting for the long term on the Substratum Network. Allowing people to host websites on the Substratum Nodes.

Steem Do I really need to explain what Steem is? We will continue to keep growing and the more we are here to revolutionize social media!

Note: These portfolios are recommended by Data Dash on youtube. We at Crypto Hype agree with his Portfolios and recommend you to check out his channel and his video here:

](

](

%20%E2%80%94%20Steemit%20-%20https___steemit.com_%40crypto.hype.png)

.png)

.png)

.png)

.png)

.png)

Nice post.i resteem it

followed you,if you want to know about https://steemit.com/@movietrailar,please follow me

Followed right at you!

I follow you.please follow me

Having a diverse portfolio is critical, I like this post as one the portfolios is a close mirror of mine.

short and sweet details of each currency.

Great ideas and portfolios. Check out my Long term hold 2018 portfolio and my diversification Steemits!

Will

This post has received a 0.52 % upvote from @drotto thanks to: @banjo.

Nice one. Upvoted and resteemed

For the right timing, checkout my technical analysis for today on Steemit. Covering Bitcoin Cash, Bitcoin, Ethereum, Iota, Litecoin, Monero, NEO, Ripple, Steem, Gold and Silver.

https://steemit.com/trading/@tradersharpe/technical-analysis-2017-08-25

with Support and Resistance and watch levels.

Great list. It's my first time to hear a few coins on the list but I'll check it out. It will be a very tough decision of whether to trade or hold some of the coins there. It requires lots of tracking and rebalancing them in the portfolio. Good thing Cryptocurrencies.Ai will be released in the market this November. This is the platform that I have been waiting for so long, this will bring together fundamental and technical data to be a single source of market research and portfolio management for traders and investors.

The website is now open and interested users are now able to subscribe to reserve their spot on the free beta platform. https://cryptocurrencies.ai

Also, join their telegram link for latest news and updates. https://t.me/CryptocurrenciesAi