Why all the reasons given against increasing the Bitcoin blocksize are bunk

As those who've been following/using Bitcoin over the past year(s) will probably be aware, Bitcoin has been crippled for some time now by its blocksize limit, which limits the number of transactions it can handle to what is a rather tiny amount for an ostensibly world-changing payment processing system - somewhere between 3.3 - 7 transactions per second. This has led to the network reaching its transaction limit earlier last year, and 'clogging up', leading to many problems:

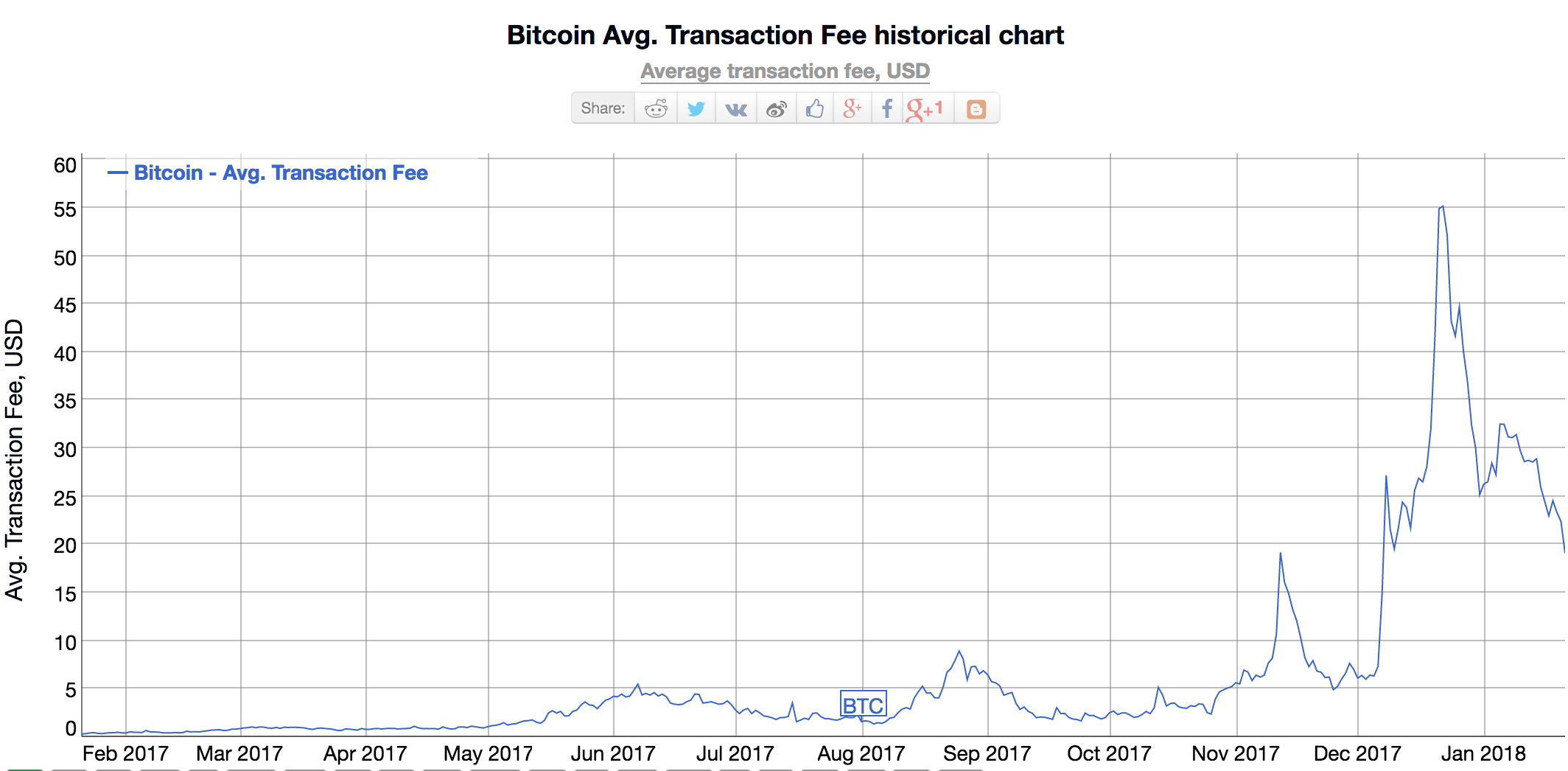

- The cost of doing transactions has become higher+higher, and very unstable - the average transaction fee peaked over $50 in the last month. Users that try to pay lower fees risk their transactions getting stuck for a long time in the transaction queue - currently 130,000 transactions are stuck in this queue at time of writing (January 2018).

- As a result of the high transaction fees, Bitcoin has lost countless existing and potential uses - Bitcoin used to be talked about as a thing we one day might use as an actual currency to do useful real-world things with - "Bitcoin: A Peer-to-Peer Electronic Cash System" - Original Bitcoin White Paper, Satoshi Nakamoto - i.e. to buy coffee (which it used to indeed be possible to do in some places), or send money abroad, or as a lower-cost electronic payment system to displace the old+'expensive' incumbents .... but not any more.

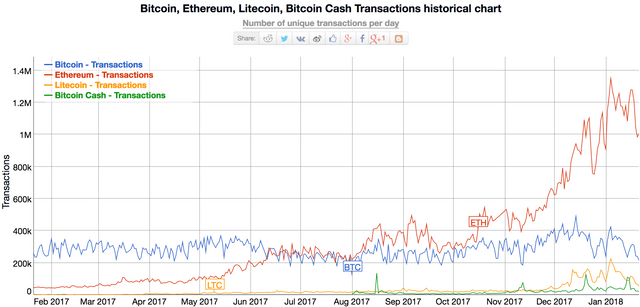

- Arguably as a result of all this also, the market cap of Bitcoin relative to altcoins like Ethereum has dramatically dropped (albeit with plenty of fluctuation on the way), while the transaction volume of Bitcoin has long since been surpassed by these 'altcoins' (Ethereum processes around 3x-4x Bitcoin's transactions daily, on average).

Despite all this, the core development team behind + controlling Bitcoin development - 'Bitcoin Core', closely tied with 'Blockstream' (whom you'll also see mentioned here, somewhat interchangeably), have steadfastly refused for years now to do/allow what amounts to basically changing a single line of code (a constant originally temporarily added to the code as a temporary limit to prevent spam at the time) to increase the limit.

Not only have they refused to make this change themselves, but they and/or their supporters have orchestrated mass censorship and attacks against anyone pushing/arguing in any way for a blocksize increase, and against anyone supporting any kind of initiatives to increase it. This eventually led to the recently hugely contentious attempts to fork Bitcoin, including Bitcoin Cash (which succeeded, at least in creating an altcoin with a larger blocksize), and Segwit 2x (which was aborted last minute). I won't go into all of the censorship and attacks in this post, but some references about this are:

- A Brief and Incomplete History of Censorship in /r/bitcoin (Medium Post)

- /r/bitcoin Censorship Revisited (Medium Post)

In this post, I want to just examine all of the reasons that Bitcoin Core + supporters put forth for why they refuse to increase the blocksize, and explain why every single reason is rather weak, especially when weighed against the significant+real costs of not increasing. It's a tricky thing to even nail down their reasons/excuses, as they often jump between different ones, i.e. when one reason becomes more patently false, others are invoked to take its place .... I'll do my best to try to accurately convey each argument made before debunking it.

This post should be worth a read if you're invested-in, or looking at investing-in, the cryptocurrency space, as the question being addressed here - whether there's any good reason behind why Bitcoin's big problems haven't been fixed already - is rather relevant to whether Bitcoin itself is a good investment or not.

Argument 1: Increasing the blocksize would hurt decentralization

Adam Black - Blockstream CEO (youtube); [2]

This is currently probably the most commonly given reason nowadays (perhaps because most of the others have been so clearly proven wrong already), so I'll start with it ...

The argument is that, if you increase Bitcoin's blocksize, this will make the hardware+network requirements for running a full node higher, thus reducing the number of people able or willing to run such nodes.

On the hand, one can argue that, if there was a slight reduction in 'decentralization', any cost(s) from this (which are an extremely vague concept, given that it's really the miners that secure the network, not the nodes, but we'll leave that argument out for now), would surely be more than made up for by bitcoin actually being more usable, for more things, again ... and that it might be more important to make actually using bitcoin affordable for the average person, than to make running a full bitcoin node affordable to the average person (given that its reaching a point where for the cost a few bitcoin transactions you could buy the hardware to run a node, which is a bit ridiculous given that running a node is something only a fraction of the users do+should do, whereas every user ideally, given the initial vision, should be making many transactions with bitcoin).

However, we don't even need to fully succeed in making that argument, because increasing the blocksize most likely actually increases decentralization. This is an argument I've hardly seen made anywhere, but it should be pretty obvious with a little consideration. Let's examine for example what happens if we increase the blocksize 8x (as Bitcoin Cash has done), and usage correspondingly increases 8x (note that the hardware+network requirements only increase insofar as the actual usage increases, so if the usage increase were to be less, so would correspondingly the increase in hardware requirements be less .. in any case, given that Bitcoin was always steadily increasing until it hit this cap, and given how much it's being crippled by the high transaction fees that would be instantly fixed, it's reasonable to assume that the usage would increase pretty quick):

- firstly, a small percentage of the pool of people wanting to run nodes would now be unable to:

- to examine what this percentage might be, first we need to look at the cost of running a full node - to quote a random source - https://news.bitcoin.com/cost-full-bitcoin-node/:

- "To run a node today, one needs generally 125 gigabytes of free disk space, 2 gigabytes of memory (RAM), a broadband Internet connection with upload speeds of at least 400 kilobits (50 kilobytes) per second, and a connection with sufficient download limits.

- Bitcoin nodes commonly use 200 gigabytes upload or more a month and download around 20 gigabytes per month."

- this article refers to the hardware costs as being around or below $100. This is nowadays anything close to significantly burdensome hardware requirements. And the hardware costs if the amount of data+processing increases 8x are less than 8x this, i.e. compare the cost of a 500gb harddisk with a 5tb harddisk, it's typically about 2x-3x more expensive for the 10x increase ... so, a reasonable estimate of the overall cost increase would be around 3x, a cost that is dropping over time (and corresponds to just doing a few Bitcoin transactions when the transaction price is high).

- it should be clear that this is not going to be a problem for the large majority of people that are running or might run a full node - sure some will stop, but we're talking a small percentage, nowhere near say an 8x drop

- to examine what this percentage might be, first we need to look at the cost of running a full node - to quote a random source - https://news.bitcoin.com/cost-full-bitcoin-node/:

- secondly, as the amount Bitcoin is actually used increases 8x, the userbase + interest in Bitcoin raises significantly, and this leads to a corresponding increase in the amount of users interested in running full nodes

- would this increase in users interested in running full nodes be 8x? Probably not .... but it's really hard to imagine that this increase would be outweighed by the small percentage of people now unable to run nodes ...

- for example, lets say the number of people now wanting to run nodes increases 3x thanks to the huge increase in Bitcoin usage and popularity and all the extra people now able to use Bitcoin for more things ... and at the same time 20% of these people are now unable to due to the increased hardware requirements - the net result is 2.4x as many nodes - a huge increase in decentralization.

A final argument to note, of course, is that it's really the miners that secure the network, and need to ideally be more decentralized, and that the hardware requirement increase in a mining rig when increasing the blocksize a little are dwarfed by the super-powerful mining hardware being used (if the mining rig even needs to store the blockchain at all).

Sure, miner centralization might be / be-becoming an issue, but this problem is not at all helped by keeping the blocksize small. Indeed, quite the contrary - the above argument (that increased blocksize increases the number of people willing to run nodes without too significantly decreasing the number of people able to) is even stronger with regards to mining, as the effect on overall hardware costs for mining is even more minuscule, and also because, when bitcoin usage increases, not only do the number of people involved in the ecosystem increase, but so to does the reward for mining in dollar terms, because the bitcoin price will tend to increase as usage increases, thus leading to more miners.

Argument 2. But hardforking is contentious and dangerous

Andreas Antonopoulos - Bitcoin Q&A: The dangers of hard forks in protocol evolution (youtube)

Adam Back - Bitcoin scaling tradeoffs (youtube)

This has long been another main argument put forward by opponents of forking to increase the blocksize.

One piece of evidence that forking to scale such a network doesn't have to be problematic/dangerous/contentious, is that other altcoins like Ethereum do such hardforks regularly, without any issues. While some point to the fact that Ethereum split into Ethereum Classic and Ethereum as the result of one hardfork, it's very important to note that this was not the usual 'technological improvement' hardfork (the kind of which Ethereum has regularly, the kind of which a blocksize increase should come under) - rather it was a very special case, a politically contentious hardfork in response to a very specific+urgent situation, where it was well understood in advance that people had different philosophical stances, and where really the splitting into two was the perfect best result for all, such that the two groups with their different philosophical views about what Ethereum both got the coin they wanted, and were free to go their separate ways.

Now, some might compare Bitcoin and it's splitting off into Bitcoin and Bitcoin Cash as a similar split over different philosophical views where both sides get what they want. Except for a couple of points:

- even if this is kind of the case, the entire point of this article is to point out that the (not particularly philosophical) views of the Bitcoin Core (anti-scaling) camp are rather baseless - there's simply no sensible view/version of what Bitcoin should be that can rationally say that crippling it in this way is a 'good thing'. And certainly none in line with what early pioneers of it intended, nor with what it needs in order to stay at all relevant going forward.

- secondly, increasing bitcoin's scale through raising the (originally intended to be temporary) blocksize limit should never ever have been a point of big philosophical disagreement - increasing the blocksize was always intended to be part of the plan [1] [2], and makes total sense, and small increases in the blocksize don't change Bitcoin's philosophy in any deep fundamental way

The only reason that, in Bitcoin's case, hardforking became contentious, was precisely that Bitcoin Core were so steadfastly + stubbornly against the hardforking to increase the blocksize, which so many see as so so long overdue and essential. There can surely be little doubt that, if at any point in the last 2-3 years a couple of the bigger voices in Bitcoin Core had said "ok, we agree with all the people clamouring for a blocksize increase, lets increase the blocksize 2x or 4x", there would easily have been a very simple + uncontentious hardfork (as, again, evidenced by all the successful uncontentious hardforks other coins often do). So, creating contention around hardforking where none ever needed to exist, and then pointing to this contention as a reason not to hardfork, is a rather circular / self-fulfilling argument.

Argument 3: But every single user needs to be able to run a full node in order to verify their transactions

This is a kind of bizarre argument, as Bitcoin was always designed for this to not be necessary [1] [2] - you can simply run a SPV wallet and you don't lose any 'security' in doing so.

Argument 4: But it's not safe to increase the blocksize, due to technical issues

The argument here is that there's some technical limitations, such that if we increase the blocksize, the network won't be able to handle it. There's a lot of clear reasons why this is bunk:

- One initiative at bitcoin scaling - Bitcoin Unlimited - tested massively (1000x) larger blocks, and proved there are no issues even that that much larger scale than is being debated - https://news.bitcoin.com/bitcoin-unlimited-reveals-gigablock-testnet-performance/

- If 1mb blocks have been working for years with older hardware, then it should be pretty obvious that current hardware+networks (which have gotten a lot more powerful over recent years) should easily be able to manage slightly larger blocks - Satoshi saw Bitcoin scaling all the way to Visa levels and beyond as hardware improvements kept-up with the blocksize increases - http://www.trustnodes.com/2017/08/12/new-satoshi-nakamoto-e-mails-revealed.

- Ethereum, a blockchain for which many of the transactions are massively more complicated, and thus for which the processing+storage requirements are significantly higher per transaction, and which like Bitcoin requires every full node to process+store+verify all transactions, has now reached over 3x the number of daily transactions that Bitcoin has been stuck at - https://bitinfocharts.com/comparison/transactions-btc-eth-ltc-bch.html#1y. Sure, the Ethereum developers are now having to make technological improvements in order to further scale, however they're also solving a much more complicated challenge than Bitcoin needs to - it has already been well proven that Bitcoin can safely scale much higher before reaching similar problems.

Argument 5: But it's a complicated technical problem, and if any other altcoin would reach Bitcoin's scale, they'd have similar technical and political issues

Andreas Antonopoulos - April 2017 - "Ethereum scales 10x worse than Bitcoin - the fact that you haven't hit a scalability thing yet, is because you haven't scale to the point of hitting the scalability things"

Andreas Antonopoulos - Bitcoin Scaling - Prague 2016

I would hope people might have finally given up making this argument now that it is so patently false (given that, as just mentioned in the previous point, Ethereum has already scaled to over 3x the size of Bitcoin, without any such 'political' issues like all the craziness that happened in Bitcoin), but I note this here given that it was being repeated often, at least until quite recently.

Argument 6: Bitcoin is a store of value - it doesn't need to (or wasn't intended to) be a medium of exchange or useful in any other way

This is quite a braindead argument, so let's breakdown a few reasons why ...

Firstly, the vision and excitement around Bitcoin was always about it serving as a currency - using it for buying coffee, or to send money between countries cheaper than with banks, or as a lower-cost electronic payment system to displace the old+expensive incumbents .... "Bitcoin: A Peer-to-Peer Electronic Cash System" - Original Bitcoin White Paper, Satoshi Nakamoto.

Secondly, if Bitcoin has no utility, then really there is very little reason left for it to be assigned value. While it is taking (and may well continue to take) some time for the markets to fully realize how limited Bitcoin's utility has become, and how limited its vision/roadmap for future utility improvements is looking, and for Bitcoin's price to fully drop correspondingly while alternatives offering more utility start to surpass it in value .... if Bitcoin does continue to be useless while other alternatives continue to improve and expand their use-cases, then Bitcoin will more likely be just remembered as an early failed pioneer in a new space like Netscape, etc ... no one is treasuring holding their Blackberry/Compaq/Netscape stock (or any other Company that ceased to create value despite being the first-mover and having the name everyone knew), as a 'store of value' independent of the company actually serving its/any purpose.

A big part of the question here, is whether we should be comparing Bitcoin to companies (where the stock price always follows the actual revenue + value + profits the company is generating, and while the stock price can detach from this reality briefly, it always eventually falls to zero if the company is truly generating no revenue/profits) ... or ... should we be comparing it to gold (which has relatively little utility, but functions as a 'store of value')?

- firstly - if all Bitcoin does is to become the new gold, then that's a far far sight from the idea of it changing the world .... and if investors realize this is the limit of it's vision and potential, it's extremely hard to imagine that, after the hype then quickly fizzles, that Bitcoin is still given anything close to its current value, let alone what it potentially could be worth if allowed to continue to grow in usage

- what is the reason for Bitcoin to be assigned any value at all if it is just trying to be a modern gold? Sure it has inbuilt scarcity like gold ... but ... anyone can invent something with scarcity (such as the thousands of altcoins and forks - and arguably the existence of these forks+altcoins points to a lack of any true scarcity here, when you broaden the concept beyond 'bitcoin' to 'all cryptocurrency') .... whereas gold also has thousands of years of history of being+staying this unique store of value - gold has proven to have rather unique properties as an element, making it suitable as an ongoingly scarce monetary resource, whereas the properties of Bitcoin are largely duplicable by any half-competent developer in a way that gold simply isn't .... Bitcoin "has it's name", but the value of that name (like a company's name) going forward is really more dependent on Bitcoin continuing to serve it's purpose - do we really believe that if, in 10 years, Ethereum or some other coin is being used for all the world's commerce, and Bitcoin is still relatively useless, that the Bitcoin name will still somehow justify it having a higher (or any) valuation?

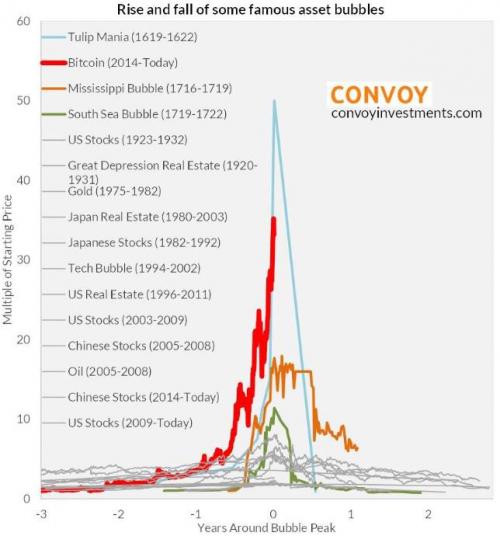

- also, it's worth noting that Bitcoin so far shows all the signs of being a speculative instrument with extreme volatility, rather than a stable store of value - i.e. Bitcoin is far more analogous to an over-hyped internet bubble company, which will come crashing down when it's failure to offer any value is realised, than a store of value like gold.

Argument 7: Segwit will solve the scaling issues (or, at least, will do so until Lightning Network is ready)

Tony Vays making this claim in a debate with Roger Ver in Feb 2017

The idea that Segwit was a/the 'scaling solution' is what was claimed by many for a long time, before Segwit actually finally got released and did next to nothing to help scaling to any degree close to that required to reduce the transaction price and unclog the network. At this point many anti-block-increase people switched their arguments and said that Segwit had never been intended to be a scaling solution.

In any case, it has become blatantly clear that Segwit is not providing enough of a scaling bump to even keep up with the continuing increase in demand, let alone to get ahead of it and thus give any brief respite to the high transaction fees. At best, if every single Bitcoin transaction used Segwit, it's around a potential 1.7x increase, which corresponds to just a few months of demand growth (at least, it would do if Bitcoin had been allowed to continue to grow) - hardly worth waiting years for, and something which is still leaving Bitcoin stuck way behind Ethereum, which Bitcoin used to dwarf in transaction volume before this self-inflicted catastrophe reversed the situation ...

Argument 8: Increasing the blocksize can't get us to VISA levels, so it's better to wait for Lightning

There's so much wrong with this way of thinking ....

Firstly, it's a clear case of the perfect being the enemy of the good - sure, there may be better solutions down the road, and increasing the blocksize may eventually hit some limits .... but the point is, it's by far the simplest + best solution right now, to solve the massive problem that exists right now.

Secondly, if+when lightning (or any other solutions) finally do arrive, they will still work much better if the blocksize is larger. It's very questionable how well Lightning Network can work/help if the current transaction fee situation isn't also massively alleviated first through other methods. A blocksize increase certainly in no way runs counter to any other such scaling efforts.

Thirdly, it was known that the blocksize limit was going to be hit and that something needed to be done for years in advance .... in all that time, no other solution has been made ready ..... Lightning Network has been long talked about and promised as 'coming soon' for many years now .... it's very reasonable to be extremely suspicious that Lightning Network will be a magical solve it all any time soon - it's still an unproven technology - Mathematical Proof That the Lightning Network Cannot Be a Decentralized Bitcoin Scaling Solution (Medium) - and a solution is sorely needed yesterday already.

- There a lot to be said for going with the simple solutions - Segwit itself was far far more complicated than the single-line changing of a constant in the code to increase the blocksize, and Lightning is a whole another level of complexity, and as yet unsolved challenges.

- Also note - if anyone claims that Lightning is 'live'/'ready' already, rather than get all technical on how the implementation of it insofar as it currently exists is nowhere near what it will need to be before it's actually ready to potentially be of any real use, simply point to the fact that Bitcoin is still congested with super-high transaction fees - obviously, if Lightning was working already in any meaningful sense of the word (i.e. working to solve Bitcoin's high transaction fee and congestion problems), then the network congestion would be history. Even the CEO of Lightning Labs recently had to hit back at Blockstream for over-stating the readiness of Lightning, out of fear for users believing them and losing their Bitcoins attempting to use it - https://twitter.com/starkness/status/953437954868785152 .

It's also painful as an engineer to see this approach/philosophy - any modern developer knows deeply the value of small continuous incremental improvements, rather than betting the company on the huge big massive 5 years in the making rewritten new system. Especially when the incremental improvement is so trivial and so beneficial, like it is here.

Finally, it's also a bit bizarre, that the only 'solution' to Bitcoin's problems is basically to require another network ... Using Lightning Network is rather more like just using another altcoin to do your transactions - you transfer your Bitcoin to it, converting your bitcoin into lightning tokens, and do all your transactions with it, and then at some point you can transfer back and convert back to bitcoin (note - I also like analogy of running a tab - a solution rather entertainingly suggested by the Blockstream CEO) ...

- not only is it rather like just using another coin, but it's using another very centralized coin, which really makes the whole decentralization argument against scaling rather bizarre, when the proposed 'preferred fix' is the forcing the vast majority of transactions onto a more centralized sidechain.

- in fact, the only way that using the Lightening chain's 'coin' is really different from just using a random altcoin, at least the only way that it's different in any arguably good way - the pegging of its value 1-1 with bitcoin - is the thing that especially makes it centralized and requiring trust of a third party - a third party that is basically acting as a bank / middleman (arguably rather against the whole vision of bitcoin cutting-out the middle man).

Argument 9 - We need to limit the blocksize in order to increase fees for the miners

https://www.ceddit.com/r/Buttcoin/comments/6ndfut/buttcoin_is_decentralized_in_5_nodes/dk9c27f/

The idea apparently, as put forward by Greg Maxwell - the CEO of Blockstream himself - is that, when in the future the mining reward has dropped such that all or the bulk of the miners' profits come from transaction fees, they'll need high fees in order for mining to be worthwhile, thus we need to keep blocks small.

Now, while having much larger blocksizes than necessary could lead to lower overall fees, even when multiplied by the number of transactions, no one is suggesting this, and it should be clear that by increasing the number of transactions, you also increase the number of fees being paid, so there's an optimum maximum-overall-fees point somewhere, and that *this ideal transaction limit to maximize fees would be a lot lot more than the current limit

i.e. think how much in fees Visa is getting with its current pricing + transaction throughput, and how much they'd be getting if their transaction limit was the same as Bitcoins (i.e. 1000x smaller) - if they tried to make-up for the 1000x less transactions with 2000x higher fees, you can be pretty sure that, very quickly, no one uses Visa any more. Of course, in the very very short term, Visa might make more money, but in the medium to long term, everyone would leave Visa for alternatives. The same applies to Bitcoin.

When the cost of creating more goods is close to zero, like in the case of Bitcoin transactions, the only situation where so massively crippling the number of goods 'sold' in order to drive up prices works long-term to increase your overall revenues, is when you have a very strong monopoly (no other supply alternatives), and relatively little ability for demand to adjust (i.e. reduce in this case) in response to the changing pricing. Think oil + OPEC in the 70's (vs oil + OPEC now - OPEC is totally unable now to manipulate the oil price anymore as there is too much supply in too many different hands now).

This monopoly-plus-fixed-demand case however is clearly not the case here - Bitcoin's refusal to scale has clearly reduced demand - as mentioned, many use-cases for actual real-world Bitcoin usage that were existing and/or planned simply have been dropped for example as they simply don't work with high fees and slow transaction confirmation, and people are simply choosing to either not make transactions at all that they would otherwise have made, or to make them with other methods (other altcoins, or old payment methods rather than cryptocurrencies). It's particularly the existence of these other alternatives that means the optimum blocksize to aim at for Bitcoin, even if purely trying to maximize miner profit, is significantly larger than currently.

Also what's most totally absolutely bizarre here, is that a big part of the Blockstream CEO's 'solution', is precisely to create such an alternative payment mechanism (i.e. increase supply through essentially creating a competitor offering vastly more supply with reduced fees) - instead of increasing the amount of transactions on the blockchain, such that the fees for those thus go to miners, Blockstream's solution is to move most of the transactions to layer-two networks, such that any fees no longer go to the miners at all. This both reduces the number of transactions on the main blockchain, and reduces the fees, and thus reduces miner profits on both fronts, thus absolutely puts a lie to the claim by Blockstream that they're in any way doing this in order to help ensure the miners get more money in fees.

Argument 10 - We need to limit the blocksize to stop spam

Indeed, this argument is why the original blocksize limit was imposed. However, the intent was to impose it temporarily. Spam is a potential issue when blocks are empty, as then there's little to no cost to filling the blocks with meaningless spam. And while a few extra spam transactions are no big deal, if say only 1% of the transactions are legitimate and the rest are spam (which could occur if the blocksize was 100x larger than needed), it does seem reasonable to limit the blocksize in that case in order to reduce the completely unnecessary load on the network. And blocks were indeed that empty at the time. However, blocks are nowhere near close to being empty at the moment, and the intention was always to raise the blocksize long before they got close to being full.

So ... if we're looking at what the optimal blocksize is, given both this point and the previous point, then yes, absolutely, we might want to aim at a blocksize that is not so huge that fees drop too close to zero. We want to prevent totally meaningless spam. And we will eventually want to reward miners through these fees. However ... we also want to make the fees low enough to encourage 'non-spam' usage, and avoiding close-to-zero fees doesn't necessarily imply having fees anywhere near the current levels. Aiming for fees of a few cents (rather than tens of dollars), thus resulting in something providing a cheaper alternative to the cumbersome old technologies like Visa that Bitcoin was intended to supplant, in part by being cheaper, would seem a better equilibrium. Fees of a few cents are already plenty enough to prevent too much meaningless spam ('too much' being when the amount of spam dwarfs the amount of legitimate transactions - not something that will happen unless the blocksize is far greater than necessary, and all we're debating is whether to increase the blocksize to a size closer to being sufficient). And achieving average fees anywhere near close to being in the 'few cents' territory clearly at this point in time requires somewhat larger blocks.

Conclusion

In this article I've tried to simply stick to trying to make clear why simply none of the arguments bandied about for keeping the Bitcoin blocksize so small hold water. I've avoided going into the history + politics too much, i.e. looking how many of the most vocal people against the blocksize increase were previously in the past proponents of it and then mysteriously switched their stance, and what might really be behind that switch and their ongoing stubbornness) .... or looking at the whole nasty situation of all the censorship and attacking of anybody advocating for a blocksize increase in any form ... and for this post have stuck purely to the merits or lack thereof of the arguments.

I've also tried to represent the arguments of the opponents of any blocksize increase fairly and honestly .... if I've misrepresented / undersold any arguments, then please correct me in the comments .... or also if I've missed any arguments, please let me know. If you feel any of the arguments are not ones that are actually being made, i.e. that I'm straw-manning, then please simply ignore my rebuttals of those arguments, and focus on the other arguments - the ones you think are the non-strawman arguments.

It might seem like the sheer large number of arguments made against increasing the blocksize addressed here gives the anti-increase argument some weight, however, I'd argue that it's more a case of advocates grasping at any and every straw that they can come up with. What's more important, is that simply none of the arguments hold up very well, especially when set against the very huge and real already downsides to not increasing the blocksize.

I'm not involved in any way on either of the sides of the debate, except for investing my money into the coins I think are the mostly to succeed, and so using the facts about the situation like those I've presented here to inform this choice. And it's simply painful for me as a developer to watch this Bitcoin scaling standstill - it's akin to having a huge bug in a piece of software you're using which you know is trivially simple to fix, where the cost of fixing it is far far outweighed by the benefits to the users of the fix, a bug which many users are complaining about, and yet for some reason the company behind it for years refuses to fix it ... at some point, even if you've invested a lot into that piece of software, you just have to switch to something else - both because it's simply too costly to use now, and also because going forward you feel you can no longer trust that the company behind it will do a good job at serving its users' needs.

Congratulations @crypt0mike! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPNo matter way you cut it

Scalability needs to happen in order for the world to adopt something. Nobody wants there mcdolands meal payment to take 1 hour.

And with a $20 extra transaction fee cost :)

Congratulations @crypt0mike, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that awesome content will get great profits by following these simple steps, that have been worked out by experts?

Congratulations @crypt0mike! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPMy 100% vote was in vain. Probably too late. Why you have earned nothing with this amount of work, I cant understand.

I like the picture of the room full of calculation machines. Visually we are used to see the shiny golden coins associated with bitcoin. Which one is more real? Times are gone where you could buy a pizza for it. I would like to know what Satoshi might think about the reality of his former great idea.

Thanks :). I presume it's because it was my first post on Steemit, and I'm unfamiliar with how it works and what it takes to get an article noticed, which may be simply having+using a lot of SteemPower. Or the post is just too long ...

Yes maybe you try a bit shorter version. I will resteem it. You will be familiar with this platform soon. Steem on!

Congratulations @crypt0mike! You received a personal award!

Click here to view your Board

Congratulations @crypt0mike! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!