Cryptocurrencies: Beginners Guide - Ways of Making Great Returns

There are many ways that you can make a nice return on crypto, in this post, I will go over few of them that I believe are one of the best and easy ways.

- One of them is Investing, which is pretty much a speculation on the prices of the assets I or you have selected.

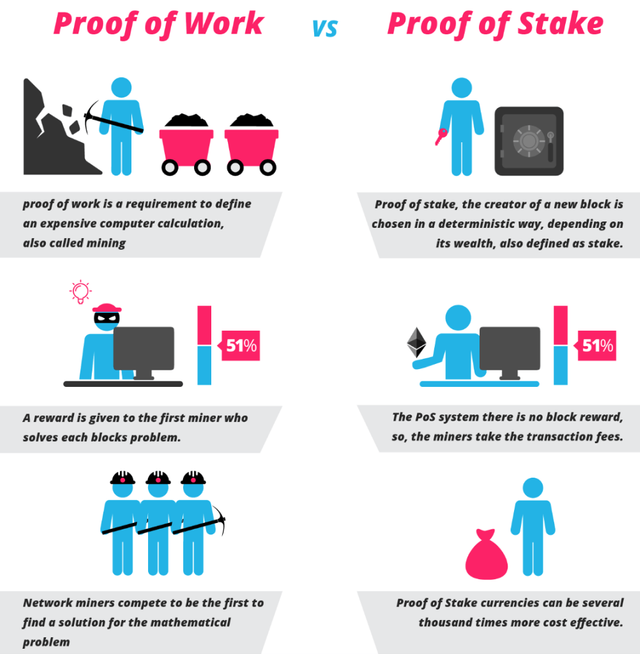

- Another one is what I call supporting the network. Which means that you either mine cryptos that are using POW (proof of work) or stake the ones that are utilizing POS (poof of stake) protocol.

- Last but not least is to lend the crypto assets you already have. I will show few platforms that allow users to do so. And this strategy can be particularly useful If you have a digital asset for a long term, and you don’t have any use for it at the given moment.

So, let’s start by talking about Long-Term investing:

Here, you could invest in the assets that are available to trade. Like any assets listed on your exchange. I use Binance (an Asian exchange based in Tokyo, soon in Malta) and Bittrex (an American exchange based in Nevada) as my trading platforms. Those are also most popular among crypto community, which means that most assets have enough liquidity to execute smooth trading. For the people that are just starting crypto adventure, I would like to say that Binance and Bittrex are not allowing USD to be traded for other crypto coins, which means that you have to have either Bitcoin or Ethereum to trade on that platform. So, one of the way of obtaining such an assets (but not limited to) is by buying bitcoin on Coinbase. Coinbase is an U.S. based platform that allows you to deposit USD and exchange it for major coins like Bitcoin , Ethereum, Litecoin and bitcoin cash. Coinbase is pretty simple to use and very intuitive. Also, their USD wallet is FDIC insured. The one downside of Coinbase is that it has pretty high fees, however those fees are very comparable to other services like Gemini, Kraken and more. If you decided to use Coinbase, please use my link. By using that link and spending your first 100 USD you will get 10 dollars’ worth of bitcoin deposited to your account, which will help you to cover the fees.

Another way is by investing in ICOs

So, what is an ICO? The terms derives from IPO and An Initial Coin Offering (ICO) is used by startups to bypass regulated capital-raising process required by banks. In an ICO campaign, a percentage of the cryptocurrency is sold to early backers of the project in exchange for Bitcoin or Etherium.

To invest in ICO, you would have to research particular project sign up on the website and go through a KYC process. This investment can be very risky (because you can’t be assured if this particular ICO will be the next big coin, over the past some were just simply scams where the developer just took the raised money and run away) but some that are with solid tech and community behind then can generate significant return. Here is just a web page that shows some of the most growing ICOs since the issuance, like NXT or Iota which generated crazy returns for the investors.

Also, by long term investing I mean that you buy this underlying digital asset and hold for a long time, possibly few years before selling, especially in case of ICOs, where those offerings are used to raise money to build a network, which can take years in some cases.

Short term trades (day-trading, range/swing trading)

The other way of generating returns on cryptos is short term trading. Here by utilizing your Technical Analysis (TA) skills you could make a significant return in a short term. This strategy if utilized well can be very good. However, many early investors are losing more money that are they are making, because of the hype FOMO (which stands for fear of missing out) or FUD (which stands for fear, uncertainty and doubt). Basically, greed and fear are the emotions that drive the decisions of early traders. And sometimes those emotions will result in buying something high and selling something low. I know it because it happened to me a lot, at first. In this scenario it is useful to really understand TA. In my opinion if you are inexperience it is better to invest in something long term. Therefore, inexperienced investors would have to separate themselves from impulsive trades and sell only when they are making profit sometime in the future.

Supporting the network - Mining

Alright enough of that. Let’s talk about mining. Mining is a way of verifying transaction and a way of founding new block to a blockchain. By doing so you are rewarded with some coins depending what network you support. Mining or staking have a reward as an incentive to run the network. Without those the network would not be secure and most likely fail. Usually mining requires expensive hardware like ASIC miner, and it doesn’t guarantee the profits because electricity consumption and costs are usually high. In this case you could outsource and do cloud mining. I am using HashFlare for mine, but there are other platforms. Usually you would have to purchase a yearly contract and you can invest as little as $2.20 to purchase 10gh/s in case of bitcoin mining that is using sha256 algorithm. I find this as one of the most stable returns, where your return is not dependent on price speculation, but you can actually see number of coins that flow to your account. Then you could reinvest them and so on. Let’s do some basic calculations here which will calculate your returns in investing in HashFlare. Let’s say you have invested $500 (which would give you 2272 gh/s) your revenue at the end of a year would be about $1000, excluding maintenance fee which is .00035/ per 10gh/s/ per 24h and it assumes that the price of BTC will not grow but stay where it is now. If you would like to use HashFlare you can find a link here.

Supporting the network - Staking

The other way of supporting a network is by staking coins that are on the POS network. Here wallets must be open to support the network in creation and verification of a new blocks.

You can do wallet staking, like NEO which I really like. By staking neo you will get GAS in return. Gas is token in a NEO network that is used to fuel smart contracts. You can read about neo and download their wallet by going to this website.

In some other networks you could purchase master node. Which is just a node or wallet that must have x amount of coins in stake. Those master nodes can generate nice return some even 100% in coin term, excluding their USD price growth. You can check them out here. I know they are pretty expensive like dash (a popular privacy coin), which one coin now cost about $800 and master node more $800,000 but one year ago u could purchase that master node for 10 x less. So, to become a master node you would download a client and deposit the required amount of coins to your wallet.

Lending Platforms

There are some other ways of earning money on crypto by lending your coins on platforms like Ethlend or Salt. Where u could lend your coins to other investors and they would pay you interest on that borrowing. I have not used those platforms yet. But I am planning in the future. I am very interested in trying out Salt. You might be thinking why anyone would want to do that. But know imagine you have a coin for a long term, and you don’t have a use for it but you are just speculating on the price. This makes sense to lend it out to someone that would either use it for a trading, a short-term investment, or maybe use them in some other way, like hedging the investment.

If you don’t have enough money for that kind of investment, some networks allow you to lease your coins to a staking pool like in case of Waves. Where the returns would be shared among people that leased out the coins.

Strategies-Diversification

At the end I would love to talk about some simple strategies, not in depth but just simply explaining basics. I would say in investing in crypto diversification is very important. As in every market.

Diversification strives to smooth out unsystematic risk events in a portfolio, so the positive performance of some investments neutralizes the negative performance of others. Therefore, the benefits of diversification hold only if the securities in the portfolio are not perfectly correlated. The diversification can be hard in terms of crypto, usually altcoins are positively correlated to bitcoin and there is some evidence of Bitcoin/Altcoin market cycles. However, you could still mitigate the systematic risk by buying cryptocurrencies that are aiming towards different solutions. You could diversify your BTC portfolio by including some privacy coins, solution/protocol coins, or by adding some interesting low cap ICOs with huge potential

Of course, you may say that, “wait a second, I could put everything in one undervalued coin and make 10000% return in 2 years”. Well, it could happen, but do you know the coin that will grow that much. You might be lucky and get it right but if your coin fails and it won’t grow at all, what then?

Strategies-Managing Risk

Here, I would like to focus on two spectra of strategies: one end conservative and the other is high risk.

Conservative would be the low and steady return like mining staking and lending

High-risk are definitely low cap coins, like those in between top 300-600place according to Market Capitalization, anything lower than that is super risky, and I wouldn’t recommend them. The other high-risk investment is obviously ICOs.

Also, it might be beneficial to main some low capitalization coin that in the future will gain more momentum and recognition form the blockchain community.

Also, at the end there are few important things to remember:

- Keep track of your portfolio in some way there are plenty of apps, personally I use excel spreadsheet that I am currently developing myself by using APIs.

- Reinvest your earnings from mining, lending or staking

- Remember to spread the risk. One thing I forgot to mention here is that if you go long maybe it is good to have a good wallet, hardware, paper or some solid software wallets. If you have something long term don’t leave it on the exchange where you don’t have access to your private keys and your investment can be stolen by hackers like it happened in Mt GOX or more recently coincheck. Also, if you have some short term investing maybe it would be a good idea to have at least accounts on two different exchanges, so if one gets hacked you won’t lose everything.

This is not a financial advice, just my opininon

Follow me, if you like my content :)

Check out my IG: @crypto.ghost

Help me grow!

BTC: 1Q2cEPr4LPBZMLPWLqKGsSEmfDELepf7jC

ETH: 0xd239798ed983B6863a7e6907bf14584ec44aa704

For future viewers: price of bitcoin at the moment of posting is 7871.80USD