Bloom ICO - Establishing the future protocol for lending and credit verification

Statistics of Average ICO return

According to Business Insider, a blind investment in every initial coin offering (ICO) from Jan. 1, 2017 till Oct. 18, 2017, including those that have failed, would have generated an average return of 1,320% for investors. See No Wonder investors are rushing into cryptocurrencies – average ICO returns are 1,320%, Business Insider, http://markets.businessinsider.com/currencies/news/ico-mangrove-capital-average-returns-crypto-icos-2017-10-1004744154 (visited Dec. 3, 2017).

Introduction to Bloom

Bloom is a future protocol for lending, credit verification, and risk mitigation with an added-layer of security through federated attestation verification and peer-to-peer and organizational credit vouching.

Credit Infrastructure Issues Bloom Aims to Resolve

There are five issues with current credit infrastructure that Bloom aims to address:

Inadequacy of credit assessment - Borrowers lacking credit history are at a significant disadvantage when it comes to obtaining a loan, credit card, or even renting an apartment;

Cross-jurisdiction credit scoring - Credit histories in one jurisdiction do not apply to other jurisdictions, forcing borrowers to re-establish their credit score when they relocate to another country;

Identity theft risks: Currently, borrowers have to provide an extensive amount of personal information to lenders before being approved for the loan. The submission of personal information exposes borrowers to identity theft by hackers;

Limited global reach of lenders: It is often difficult for lenders to assess risks and serve borrowers in underdeveloped markets due to lack of identity and scoring information;

Monopolistic industry: The credit scoring industry is heavily concentrated, resulting in a near-monopolistic market with lack of competition.

Bloom Protocol

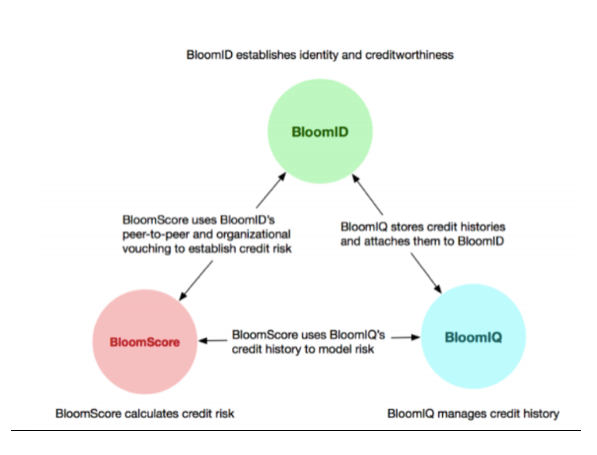

The Bloom protocol is based on three components, which seek to overcome the aforementioned five challenges stated above.

BloomID - Identity attestation enables borrowers to obtain a global secure identity, making it easier for creditors to assess them;

BloomIQ - A credit registry that tracks historical debt obligations associated with a borrower’s BloomID;

BloomScore - The credit score measuring consumers’ creditworthiness.

Potential Markets of Bloom

Over one-third of the world’s population lacks a bank account, and many of them lack access to credit. Thus, Bloom is presented with an extremely lucrative opportunity to link creditors with unbanked populations while mitigating risks for these creditors.

Following Equifax’s massive data breach exposing the private information of 143 million users, the credit industry has been placed under the microscope. Bloom’s platform integrating BloomID, BloomIQ, and BloomScore makes it a much more secure eco-system when compared to existing credit infrastructure.

Bloom is a highly ambitious project that, if realized, will tap into multi-trillion-dollar credit industries and facilitate future lending and credit verification globally.

Bloom Team

The Bloom team consists of members including Jesse Leimgruber, Ryan Faber, Daniel Maren, Alain Meier, John Backus, and Shannon Wu. Many of these team members studied computer science at Stanford University, and have backgrounds in computer science, digital marketing, and blockchain. Furthermore, John Bakcus was a research scientist at the Stanford Bitcoin Group, and there are multiple Thiel Fellows on the team.

Conclusion

Very few ICOs are as highly regarded as Bloom due to impressive technical expertise represented by team members and talented advisory members. Bloom’s massive undertaking has the potential for it to develop into a highly lucrative and world-renown enterprise (like Amazon or Apple), and serve as the model for future credit providers.

The Bloom Token Sale is currently going on and lasts until January 1, 2018. See https://contribution.hellobloom.io/

The strong technical backgrounds presented by this team along with high-caliber advisors clearly make Bloom distinguishable from more than 95% of ICOs. Bloom is an ambitious project that, if realized, will tap into multi-trillion-dollar credit industry and facilitate future lending and credit verification globally.

Thanks for your sharing. Let bet once again on your judgment!!!

Time will tell whether I am right or wrong soon enough, lol.