Why NOW is the Perfect Time to Buy Bitcoin!

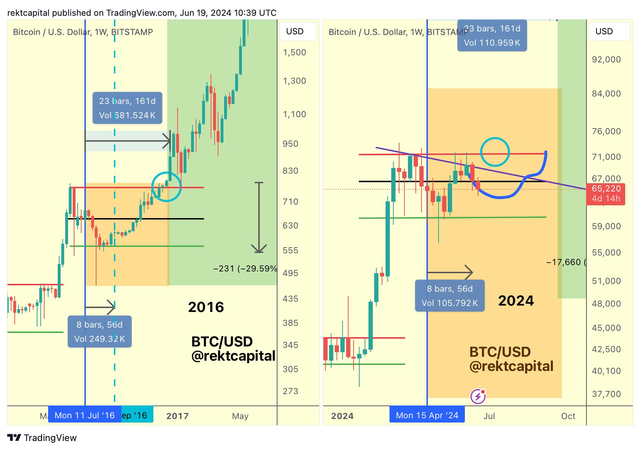

Bitcoin faces a critical juncture as it approaches the end of June, with analysts highlighting the necessity for a closing price above $56,500 to uphold its current uptrend amidst escalating market volatility.

Key Points to Consider

Critical Support Level: Bitcoin's Must-Hold Threshold

Bitcoin's stability above the $56,500 mark is pivotal for maintaining its upward trajectory. Analysts caution that a failure to close above this level could jeopardize the overall bullish trend.

Escalating Market Pressure

As June draws to a close, pressure mounts on Bitcoin with weekly, monthly, and quarterly market closures converging. This convergence intensifies market dynamics and could influence price movements significantly.

Factors Driving Volatility

The upcoming Presidential debate, release of new inflation data, and the culmination of multiple candle closes on Sunday are anticipated to inject increased volatility into Bitcoin's market environment.

Concerns over Order Book Liquidity

Reports from trading resources highlight concerns over potential spoofing activities, where substantial traders manipulate order book liquidity to sway market prices, adding an element of uncertainty.

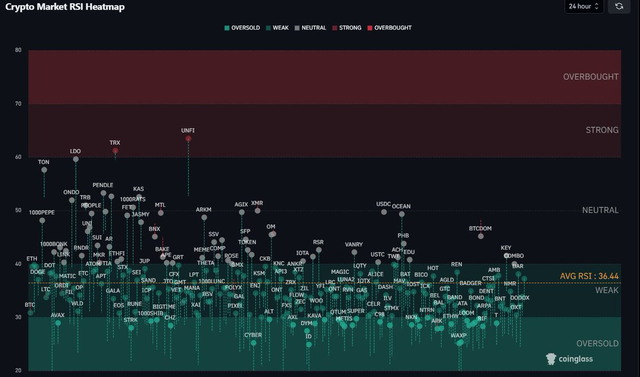

RSI Indicators: Signals of Potential Rebound

Bitcoin's Relative Strength Index (RSI) currently stands at 34.2, suggesting a possible rebound. Analysts view this as historically indicative of market bottoms, potentially paving the way for future growth if Bitcoin leads the charge.

Detailed Analysis

Critical Support Level: Upholding the $56,500 Benchmark

According to insights from trading resource Material Indicators, Bitcoin risks losing its upward momentum should it fail to close June above $56,500. This level serves as a crucial determinant for the cryptocurrency's near-term trend direction.

Market Pressure: Convergence of Closures

The impending weekly, monthly, and quarterly market closures coincide at month-end, heightening market pressures. Such alignments historically influence trading sentiments and could dictate short-term price movements.

Volatility Triggers: Market Events and Data Releases

Anticipated market volatility is expected around key events such as the Presidential debate and the release of inflation figures. Concurrently, the conclusion of multiple candle closes on a single day adds to market uncertainties.

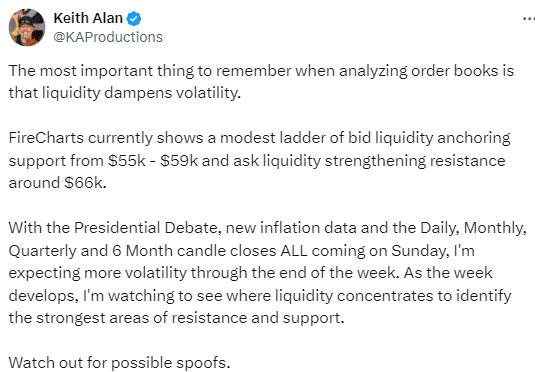

Order Book Liquidity Concerns

Analysts like Keith Alan warn about potential order book spoofing, emphasizing the impact of artificially manipulated liquidity on Bitcoin's price dynamics. Such activities could amplify price swings, necessitating cautious trading strategies.

RSI Levels: Potential Reversal Signals

Bitcoin's RSI at 34.2 suggests a rebound phase, historically linked to market recovery points. This observation underscores the potential for Bitcoin to capitalize on prevailing market conditions for renewed upward movement.

Bitcoin's ability to secure a closing price above $56,500 by the end of June assumes critical significance in preserving its ongoing uptrend amid notable market events and heightened trading pressures. Analysts remain watchful of these developments, anticipating their implications on Bitcoin's near-term price trajectory amidst broader market volatility.