Why Is the Crypto Market Down Today?

Bitcoin recently fell below $59,000, sparking significant concern in the market. The cryptocurrency’s price touched a low of $58,116, marking a drop of over 6%. Several factors contributed to this decline, including large transactions and macroeconomic issues.

Key Factors Behind the Bitcoin Drop

Whale Movements

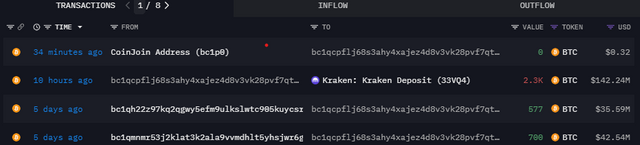

A major factor in Bitcoin's drop was a large selloff by a prominent whale on a leading crypto exchange. This whale transferred 2,300 BTC, worth about $141.81 million, to Kraken. Despite this transfer, the whale still holds roughly $1.07 billion in BTC. If the whale decides to sell more, it could further pressure Bitcoin's price.

Upcoming Earnings Reports

Investors also showed caution ahead of major tech earnings reports. NVIDIA, expected to release its Q2 FY25 results on August 28, was a key focus, along with other tech companies like Salesforce, CrowdStrike, and HP Inc. This uncertainty led investors to hold back on riskier assets like Bitcoin.

Macroeconomic Influences

The market awaited the US PCE (Personal Consumption Expenditures) inflation data to gauge inflationary pressures. Speculation about a potential rate cut by the US Federal Reserve added to the uncertainty. If the PCE data exceeded expectations, it could negatively impact market sentiment.

Additionally, upcoming US job data, due September 6, could influence the Fed’s interest rate decisions. The CME FedWatch Tool indicated a 66% chance of a 25 basis point rate cut at the Fed's September meeting.

Market Reaction and BTC Price Trends

At the time of writing, Bitcoin’s price had fallen by 6.59% to $58,893, with trading volume increasing by 30% to $37.30 billion. The cryptocurrency hit a low of $58,116 and a 24-hour high of $63,210.80. BTC Futures Open Interest (OI) dropped over 7% in the last 24 hours to $31.09 billion. Bitcoin also saw a liquidation of $26.35 million in the past hour, contributing to a total market liquidation of $312.94 million over 24 hours.

Impact on the Altcoin Market

The downturn in Bitcoin had a ripple effect on the altcoin market. As Bitcoin’s price dropped, altcoins also experienced declines. The overall negative sentiment and uncertainty spread through the broader cryptocurrency market, causing many altcoins to follow Bitcoin’s downward trajectory.

Despite these challenges, there is some optimism. A recent Bitcoin price prediction suggested that the cryptocurrency could reach $65,000 if it breaks through a key resistance level.

The recent Bitcoin drop resulted from a mix of whale transactions, macroeconomic factors, and investor caution. Future economic indicators and market developments will likely influence Bitcoin's trajectory in the coming days.