AAVE Price Alert: Massive Drop Followed by Surprise Buy Signal!

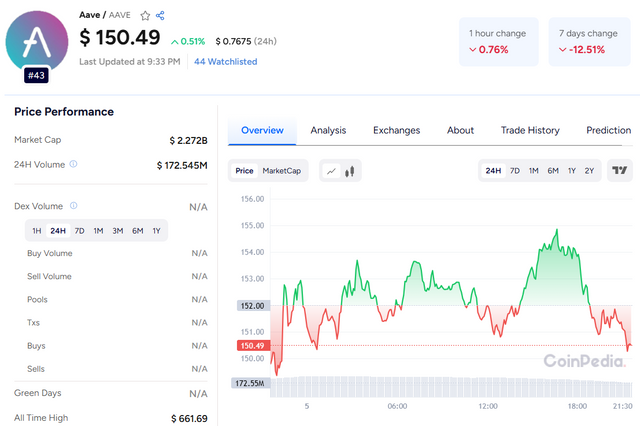

Aave (AAVE) has taken a notable hit in the past week, with the price dropping from around $180 on March 29 to nearly $150.49 by April 5, 2025. While this decline has caught the attention of many investors, analysts now believe that a potential trend reversal could be forming.

AAVE’s Recent Performance: A Sharp Drop

In the short term, Aave has shown a 1-hour decline of 1.6% and a 24-hour drop of 2.1%.

Over the past 7 and 14 days, AAVE has fallen by 15.9% and 16.9%, respectively.

Despite this, some market indicators are flashing signs of a potential turnaround.

TD Sequential Signals a Possible Rebound

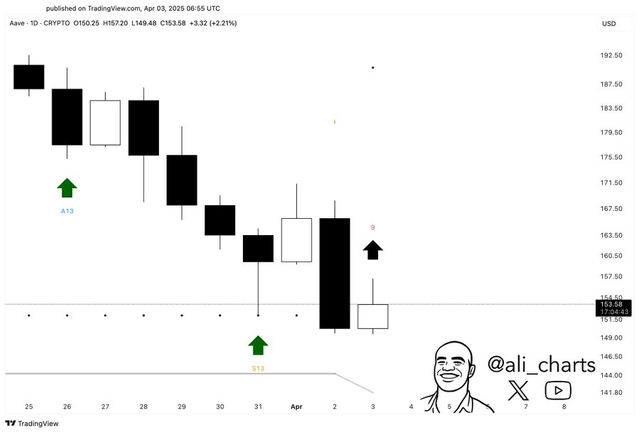

Technical analyst Ali Martinez recently pointed out that the TD Sequential indicator has flashed a buy signal on the daily chart. A “9” on this indicator often signals a trend reversal may be near.

This could mean AAVE is preparing to rebound, but analysts caution that this depends on whether Aave can hold key support levels. If those supports break, the price could continue its downtrend. The next few days will be critical in confirming the signal’s strength.

Aave Dominates Lending on Base Network

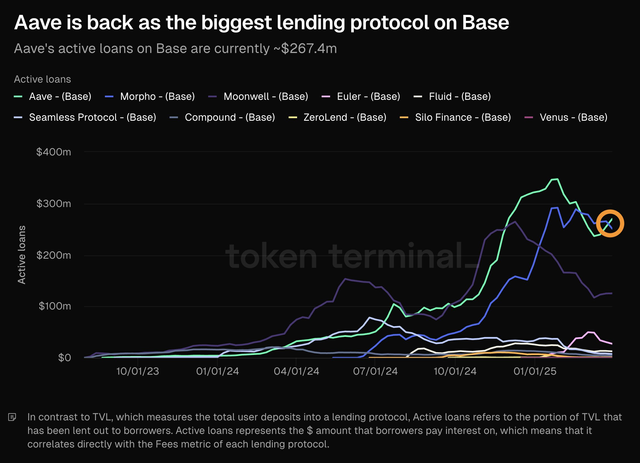

While its price has dipped, Aave remains the leading lending protocol on the Base blockchain. As of the latest data, Aave hosts over $267 million in active loans, far outpacing competitors like Morpho, Moonwell, and Euler.

From January to March 2024, Aave’s lending volume continued to dominate on the Base platform—shown by a steep green line on comparison charts. This strengthens Aave’s role as a key player in the DeFi space.

Whale Transfers Spark Market Speculation

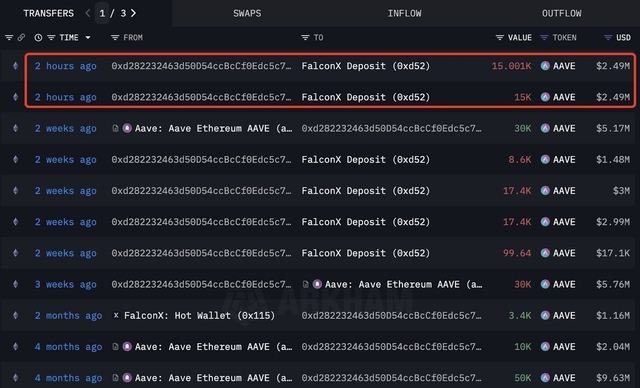

Adding to the intrigue, whale activity involving AAVE tokens has sparked speculation. One wallet recently transferred 30,123 AAVE tokens worth nearly $5 million via FalconX in under two hours.

Previously, the same whale held over 37,000 AAVE tokens (worth $6.3 million), and has reportedly made over $11.8 million in profits from past AAVE positions. These moves have raised eyebrows about potential impacts on Aave’s price direction.

Will Aave Bounce Back?

Despite the recent price decline, Aave remains active and shows signs of strength in both DeFi usage and technical charts. While whale movements introduce some uncertainty, the TD Sequential’s buy signal could mark the start of a rebound—if key supports hold.

Whether this is a short-term relief or the beginning of a broader rally remains to be seen. Traders and investors should stay alert, as Aave’s next move could shape its path for the rest of April.

Read in-depth Aave Price Prediction to discover key levels, expert forecasts, and what to expect this month.

https://coinpedia.org/price-prediction/aave-price-prediction/