Cryptocurrency Investment Tips For Beginners Chapter 1: Getting Started

Before you can invest in cryptocurrencies including Bitcoin and altcoins such as Litecoin and Ethereum you will first need a service that will allow you buy them.

Even though it possible some cryptocurrencies directly with fiat I recommend buying Bitcoins and using those to trade since it is the most popular trading pair allowing you to buy into any cryptocurrency.

Below is a list of services which allow you to buy Bitcoins and sometimes alternative coins like Ethereum and Litecoin.

One of the most well known sites for buying Bitcoin, Coinbase also allows you to buy Ethereum and Litecoin, each currency will be stored inside it’s own Coinbase generated wallet and you will be able to both buy and sell those currencies within the Coinbase website.

You can also instantly sell Bitcoin, Litecoin and Ethereum into Pounds (GBP) and Euros (EUR).

Credit or Debit Cards

Wires transfers

SEPA Transfers

My personal favourite due to its fast and simple credit/debit card buy service, this is also Europe’s most popular service for buying Bitcoins, Ethereum, Litecoin and Dash.

Purchases are calculated in Euros and the page where you enter your card details in written in German but you can easily get Google to instantly translate that page for you.

SOFORT Transfer, VISA/Mastercard, NETELLER, Skrill, GIROPAY/EPS & SEPA Transfer

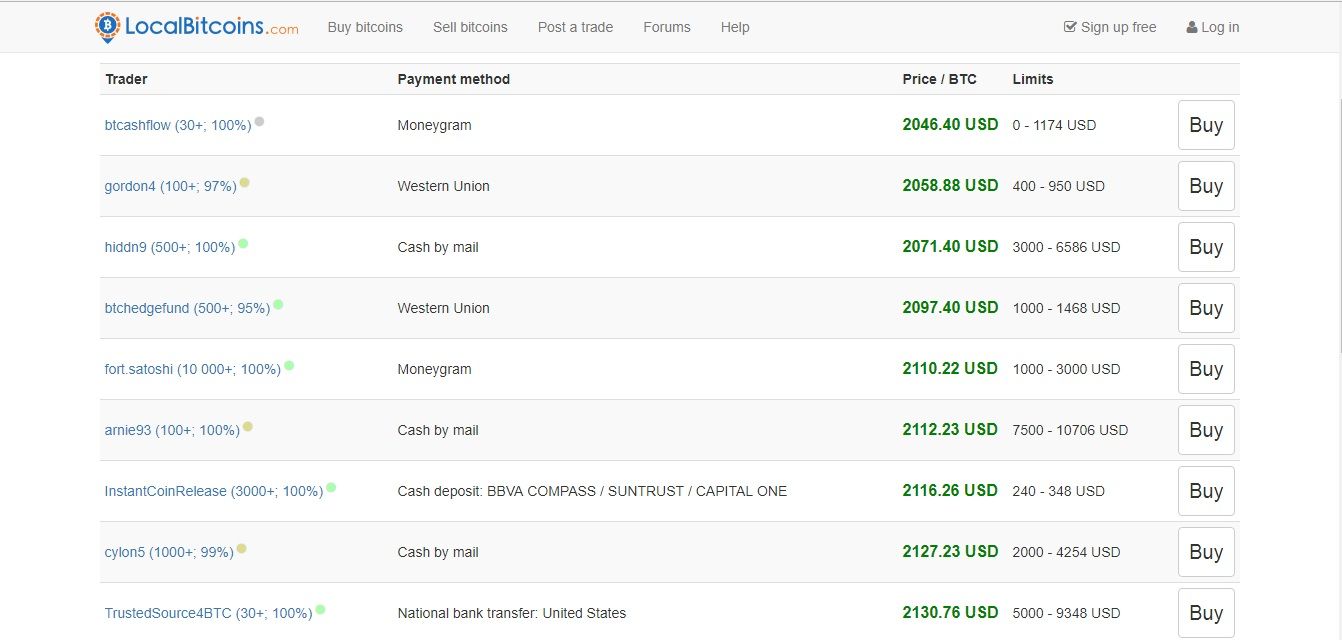

LocalBitcoins.com is a fast and easy way to buy and sell Bitcoins, on LocalBitcoins.com you can trade Bitcoins for traditional currencies through person-to-person trades. This is also known as over-the-counter (OTC) trading.

To buy Bitcoins you simply choose a seller and press “BUY”, you will need to verify your identity before you can purchase Bitcoins from some sellers.

LocalBitcoin’s has a wide selection of payment methods including SEPA, Bank Transfers and Credit Cards, I have listed the methods I personally recommend, other methods include Western Union (not recommended-High Risk) and country specific payment methods which might be suitable for most users.

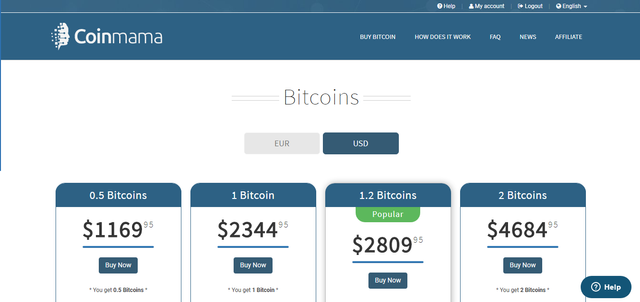

It is very easy to purchase Bitcoins with Coinmama, you can buy Bitcoins using a credit or debit card within minutes! This is another one of my personal favourites due to its simplicity. You can also purchase Bitcoins using cash. You will need a Bitcoin wallet address before you buy coins from Coinmama but there is a built in option to generate a free wallet from Blockchain.info.

Coinmama claims to have additional payment methods but the only one I saw was Credit/Debit Card payments, maybe other payment methods are payment specific.

If you are interested in a wider selection of coins other than Bitcoin you can sign up to an exchange.

One of the most popular crypto exchanges and one of the worlds leading cryptocurrency exchanges, also the exchange where I bought my first alt.coins. Poloniex is a very secure exchange and has one of the highest trading volumes.

• Pros: fast account creation, feature rich, BTC lending, high volume trading, user-friendly, low trading fees, open API, over 100 different Bitcoin currency pairings (BTC/ETH, BTC/LTC etc.).

• Cons: Slow customer service, you cannot withdraw fiat currency, you need to convert to Bitcoin, Ethereum or Litecoin then withdraw to a service like Coinbase or BitPanda then convert to fiat from there, this is a small con as most exchanges are like this.

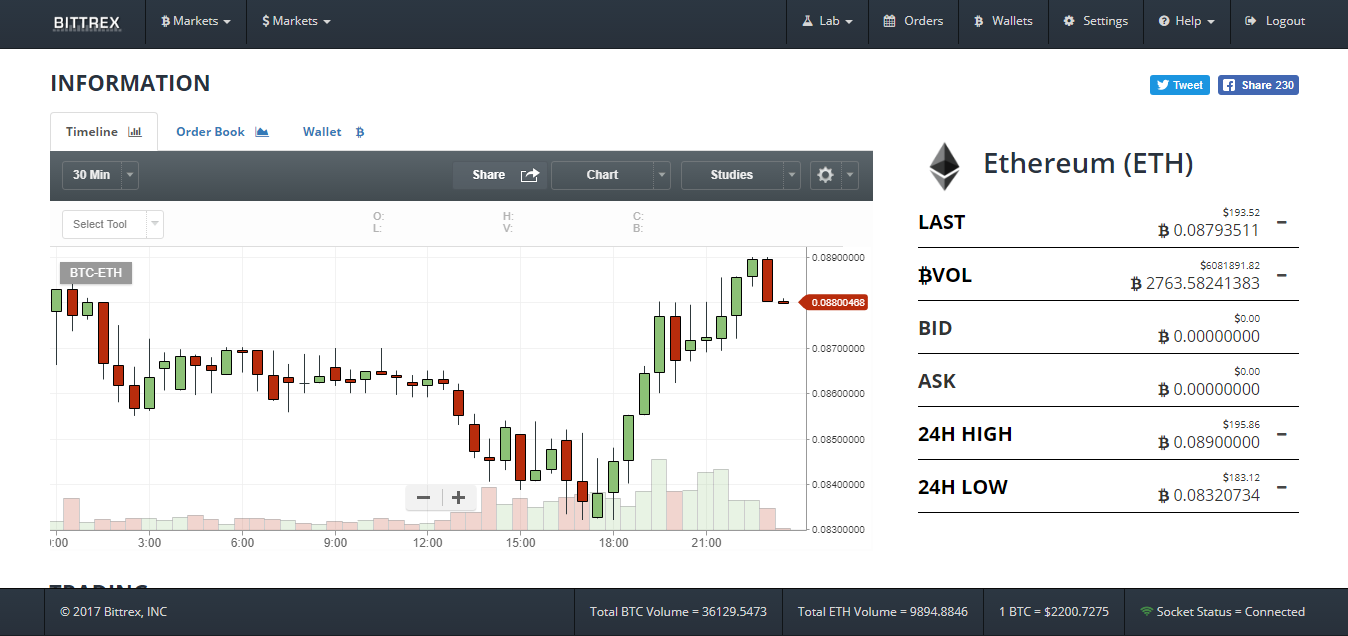

A personal favourite, very popular, has a simple user interface and has a greater selection of coins than Poloniex. Bittrex is a US-based cryptocurrency exchange, offering a massive selection of altcoins for trade.

The founding team has extensive experience in security and development at companies such as Blackberry, Amazon, Microsoft and Qualys.com.

• Pros: Secure platform, fast deposits and withdrawals, reasonable fees, high selection of altcoins, fast to add new altcoins.

• Cons: Like Poloniex you cannot withdraw fiat currency, only cryptocurrency.

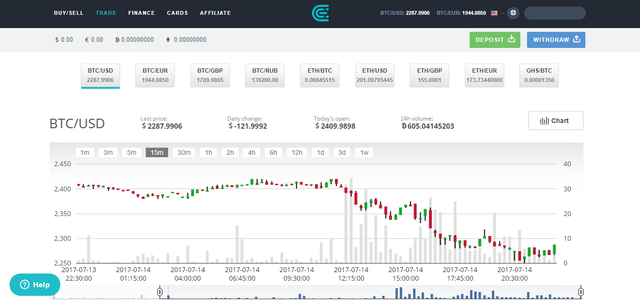

Another popular exchange, simple user interface. Cex.io provides a wide range of services for using bitcoin and other cryptocurrencies. The platform lets users easily trade fiat money for cryptocurrencies and vice versa.

• Pros: Good reputation, great mobile app, credit/debit card support, beginner friendly, decent exchange rates, worldwide support.

• Cons: Average customer support, long verification process, expensive deposits.

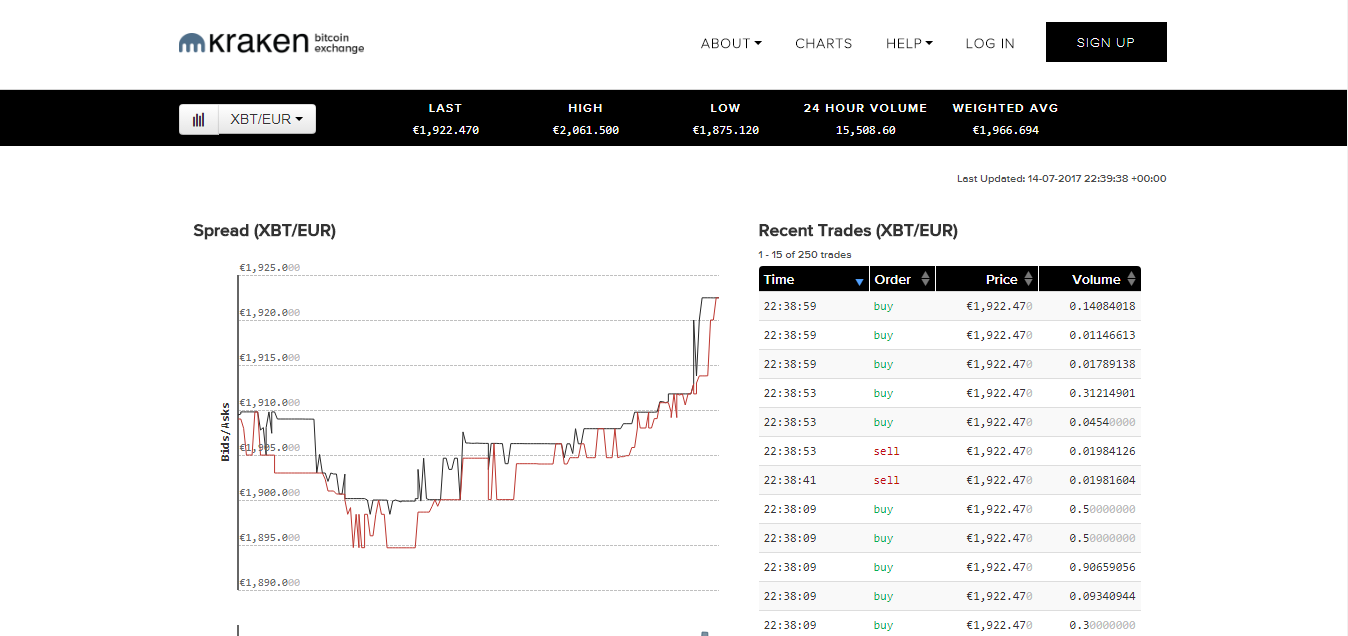

Popular cryptocurrency exchange, largest trade volume in Euros, great user interface. Kraken also lets you trade between Bitcoins and Euros, US Dollars, Canadian Dollars, British Pounds (GBP) and Japanese Yen.

• Pros: Great reputation, multiple fiat currencies, decent exchange rates, low transaction fees, minimal deposit fees, feature rich, great user support, secure, worldwide support.

• Cons: Limited payment methods, not suitable for beginners, unintuitive user interface.

No account needed, you can make simple straight forward crypto-coin trades. You cannot purchase crypto-coins with debit/credit cards or any other payment system.

The platform has a no fiat policy and only allows for the exchange between Bitcoins and other Shapshift supported cryptocurrencies.

• Pros: Good reputation, beginner friendly, sizeable selection of crypto-coins, fast, reasonable prices.

• Cons: Average mobile app, no fiat currencies, limited payment options and tools.

If you are looking for low price and low market cap coins these two exchanges are a good place to look:

Coinexchange has a large selection of low cap altcoins and is very secure, beginner friendly and has a simple user interface.

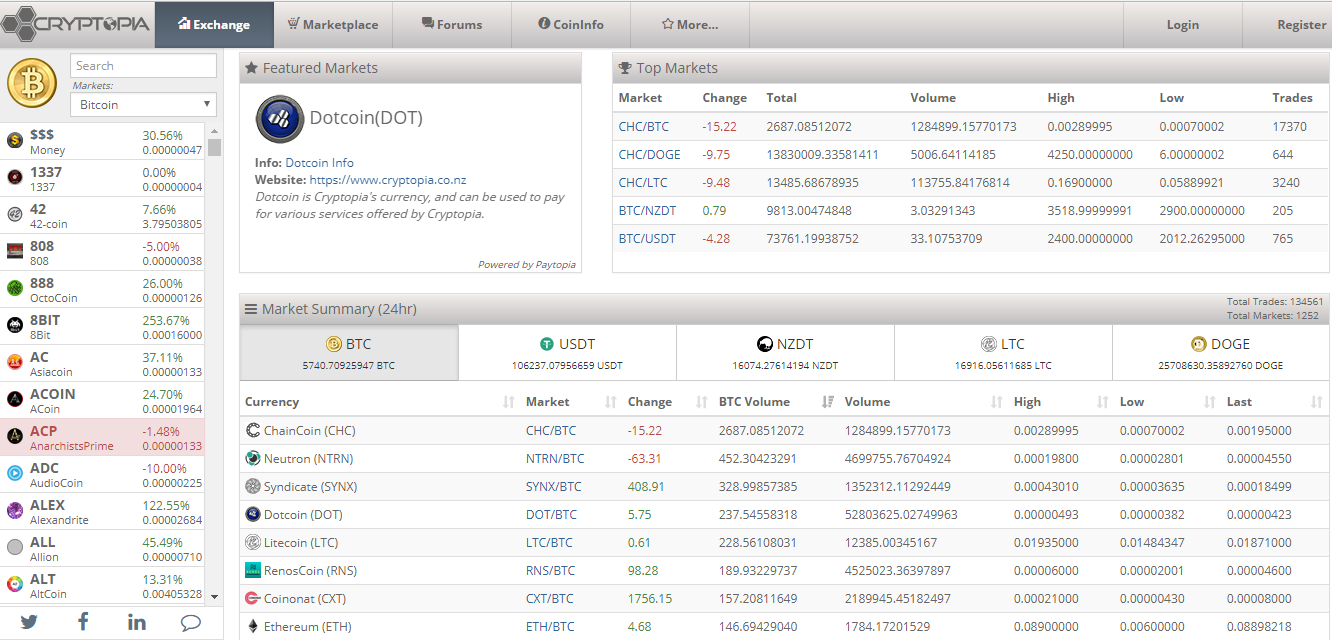

Cryptopia has a very large selection of low cap altcoins and even lets you trade it’s own unique coin called DOT coin.

A decentralised cryptocurrency exchange is simply an exchange where you do not have to trust a third party with your precious coins so you won't need to worry about suspicious activities such as embezzlement or disasters like the Mt.Gox scandal where half a billion dollars worth of Bitcoin allegedly went missing.

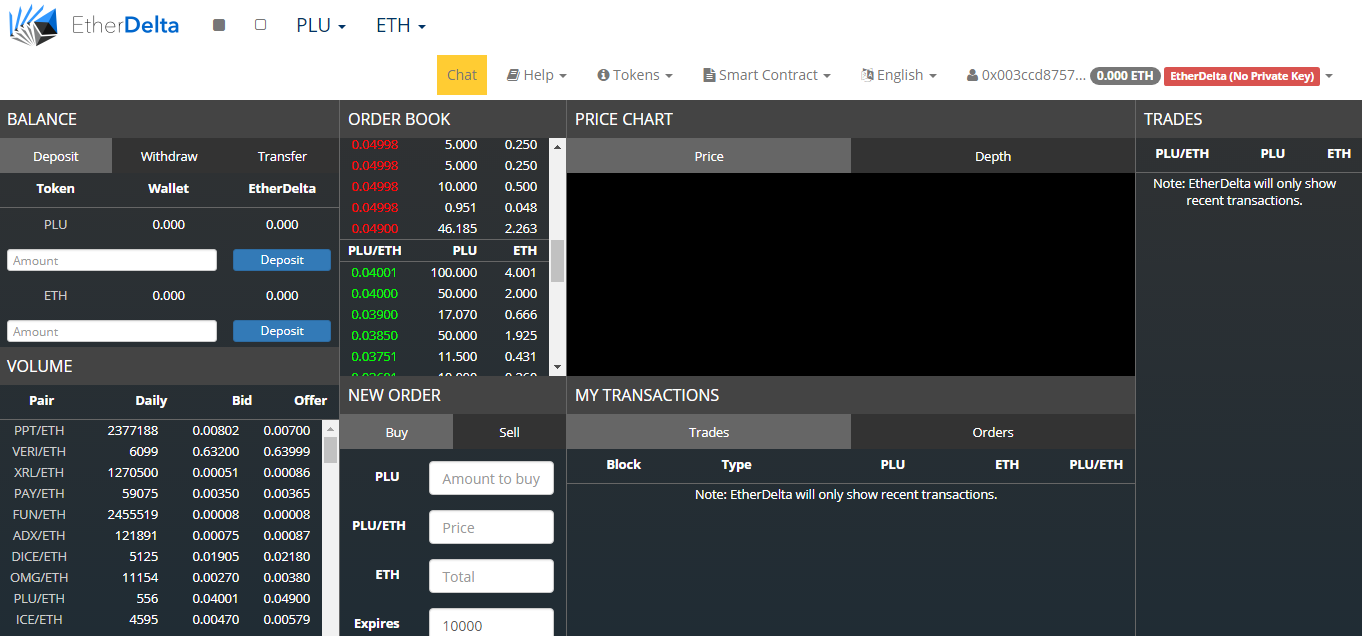

Here is a bonus exchange for you, EtherDelta is a decentralized Ethereum token exchange, brought to you by Etherboost. Here, users can trade any most Ethereum-based tokens such as Iconomi, Augur, 1ST, and others. The exchange currenly has only one fee, which is the 0.3% taker fee. Deposit, withdraw, and maker transactions are all free.

This is was one of the first 3 exchanges to host the Basic Attention Token hours after they were made trade-able so if you miss out on an ICO and want to get in before it hits major exchanges this could be your best bet.

However this exchange is for advanced users and you need a service like Parity to access Etherdelta and to be honest this exchange deserves its own post.

![bitcoin-vault[1]_0.jpg](https://steemitimages.com/640x0/https://steemitimages.com/DQmTtr5SnVbfUcK2MCCVHk81kE9oTkUszETbFX6DmrzXfC4/bitcoin-vault%5B1%5D_0.jpg)

Crypto-coins are stored in “wallets” which are secure digital wallets used to store, send and receive crypto-coins. Cryptocurrency itself is not actually stored in a wallet. Instead, a private key (secure digital code known only to you and your wallet) is stored that shows ownership of a public key (a public digital code connected to a certain amount of currency).

So your wallet stores your private and public keys, allows you to send and receive coins, and also acts as a personal ledger of transactions.

You use the public key to receive funds and the private key allows the coins to be spent, always have your private key stored somewhere safe, preferably offline (on a piece of paper, an external hard drive or offline PC), if someone has access to your private key they have access to your funds.

I recommend using official wallets for every crypto-coin or popular wallets with multi-coin support, in the best case scenario you should use paper wallets or get yourself a Ledger Wallet or Trezor.

A hot wallet refers to a Bitcoin or Altcoin wallet that is online and connected in some way to the Internet, for Bitcoin I would suggest using the Bitcoin Wallet, and for Litecoin I would suggest Litecoin-QT.

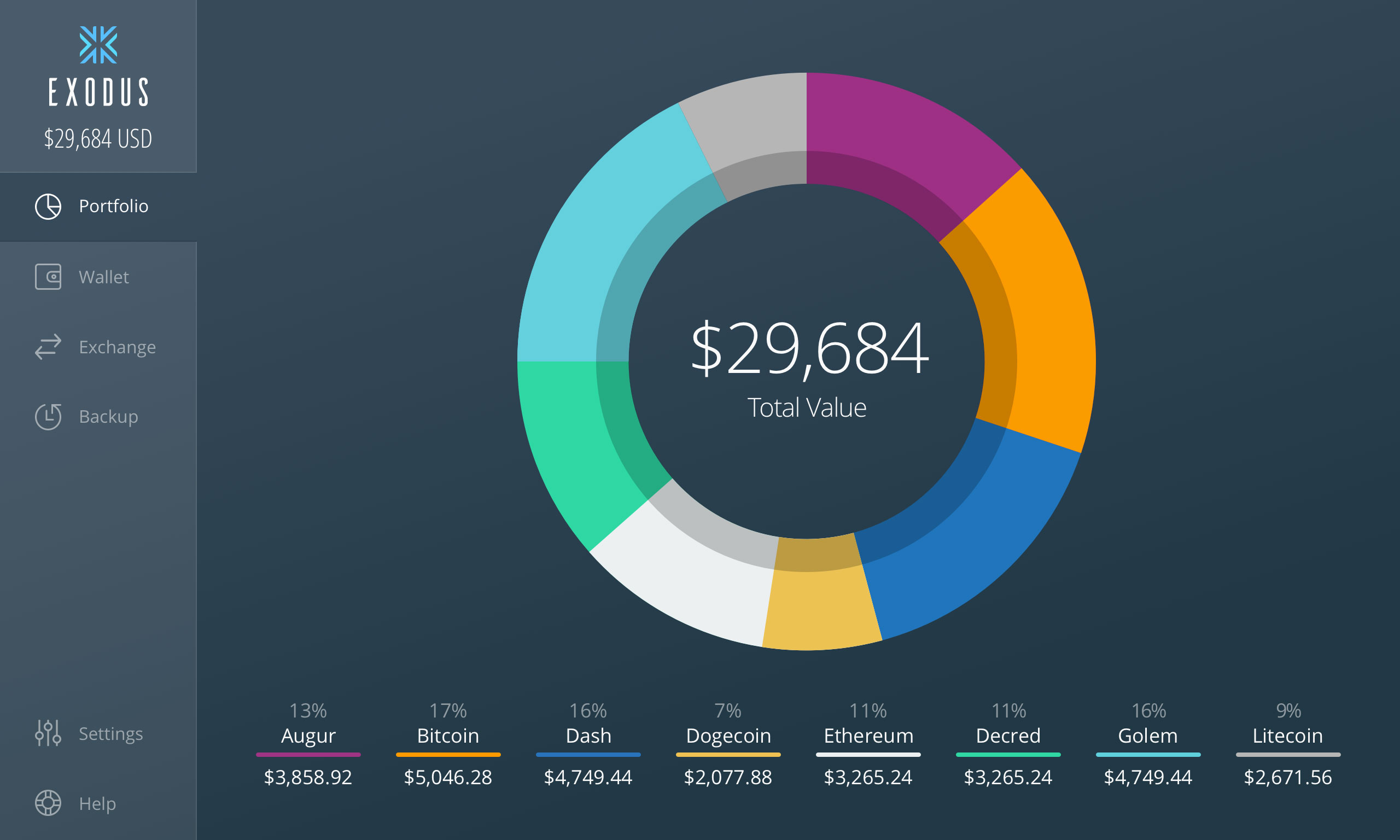

There are also universal wallets that can be used like Exodus & Jaxx.

You can find a list of wallets on 99bitcoins.com.

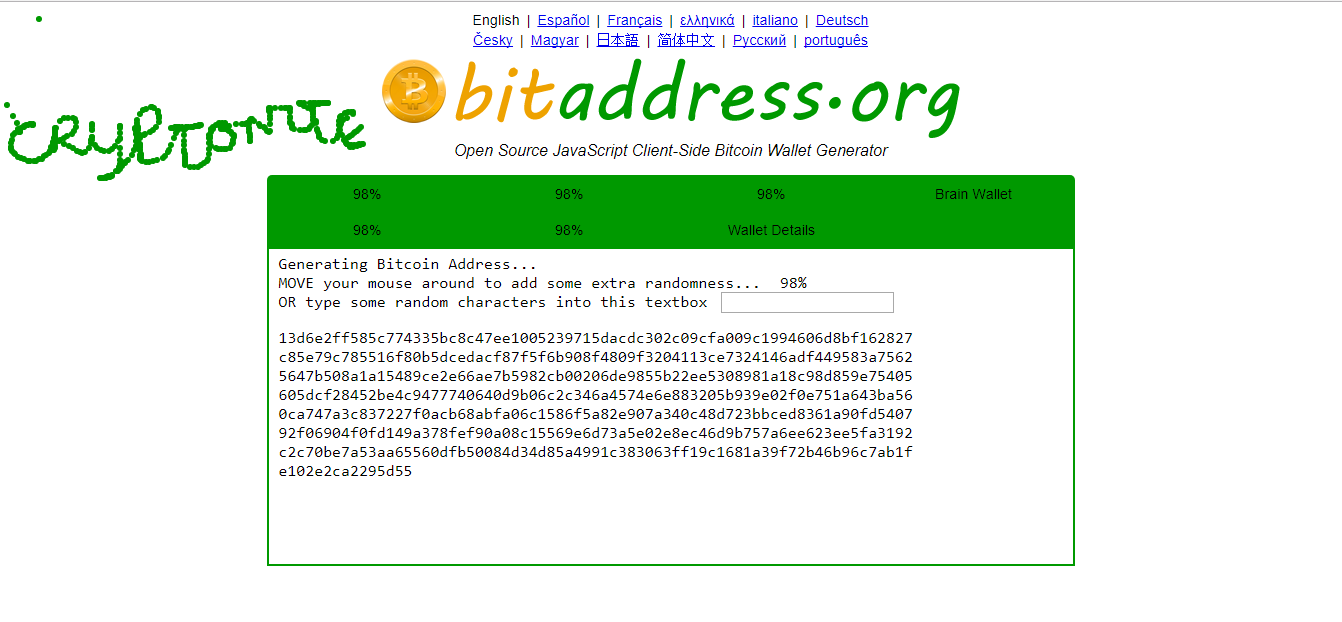

A paper wallet is simply a document that contains your seed, public address and private address, paper wallets are best used for long term storage and each wallet should only be spent once, you should also keep a backup of your paper wallet stored in a separate place or scanned and saved on an external hard drive or offline PC.

I would also recommend laminating your paper wallets.

When creating paper wallets try to stick to official paper wallet generators for the specific coin, for Bitcoin I recommend bitaddress.org due to its mouse movement based random number generator.

A hardware wallet is a special type of bitcoin wallet which stores the user's private keys in a secure hardware device.

They have major advantages over standard software wallets:

• private keys are often stored in a protected area of a microcontroller, and cannot be transferred out of the device in plaintext

• immune to computer viruses that steal from software wallets

• can be used securely and interactively, as opposed to a paper wallet which must be imported to software at some point

• much of the time, the software is open source, allowing a user to validate the entire operation of the device

My recommendations are:

Ledger Wallet: https://www.ledgerwallet.com/r/4c54

Trezor: https://trezor.io/

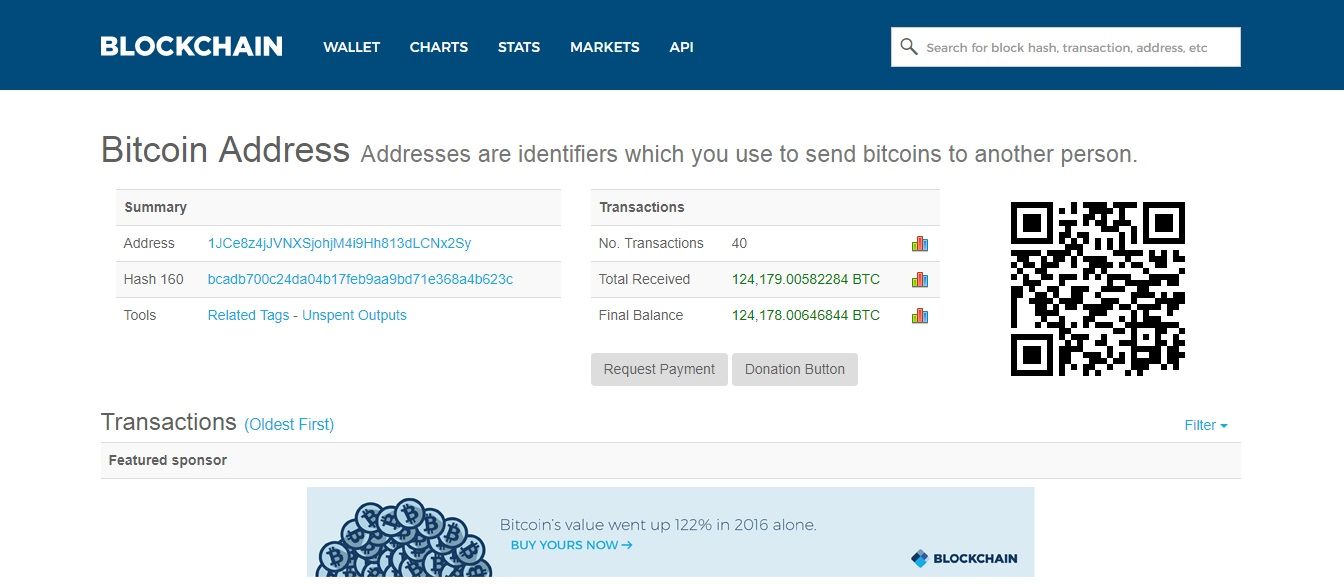

A block explorer is a block chain browser which displays the contents of individual Bitcoin/Altcoin blocks and transactions and the transaction histories and balances of addresses, you can use block explorers to check wallets balances, you simply paste your wallets public address in the search bar, the more popular cryptocurrencies have more than one block explorer site.

Block explorers for popular coins:

Bitcoin: https://blockexplorer.com/ or https://blockchain.info/

Litecoin: https://live.blockcypher.com/ltc/

Ethereum: https://etherscan.io/

It is important to do your own research when picking a cryptocurrency to invest in, I recommend the following sites.

Coin Market Cap – Website listing almost every cryptocurrency in existence, you check the coins rank, market capitalization, 24 hour trading volume, circulating supply, total supply, exchanges where they are traded, official websites, graphs, block explorers etc.

Bitcoin Talk – Online cryptocurrency forum, great for new coin announcements (search for ANN), general discussions and keeping up to date with your favourite cryptocurrencies.

Slack – A team based messaging app, you need an invite to be able to access discussions, you can find invite links on Bitcointalk, Reddit or Twitter or a developer can send you a private message containing an invite, look for accounts and discussions related to your favourite coin for example on Twitter or Reddit you might search “Monero slack channel link”.

Telegram – Telegram is a free cross-platform messaging app available on the web, desktop and mobiles, simply download the app and search for your favourite coin.

Blogs – My favourite blog is CoinTelegraph, some other good blogs are CoinDesk, Crypto Coins News and ETHNews.

Dedicated Forums – Most crypto-coins have dedicated forums, examples include Litecointalk, and Dash.org.

Discord - Discord is a free voice and text chat app designed specifically for gaming but some users have used discord for cryptocurrency related discussions, you will need an invite for Discord channels, you can search Reddit, Twitter and Bitcointalk for those.

Twitter – Great place to follow fellow crypto-enthusiasts, traders and investors, if you want to find out the latest news about your favourite coin find out the ticker and add a dollar sign on the beginning (i.e. $btc for Bitcoin) you can find out the ticker symbol by searching the coin name on Coin Market Cap.

Reddit – A great to join online communities, most crypto-currencies with strong communities have a subreddit where you can browse, post and discuss developments, prices news etc. You can also find general cryptocurrency subreddits like CryptoMarkets for example.

Steemit – I cannot forget steemit, there are so may useful cryptocurrency related posts you can find, plus you can also support the steemit platform (which has it’s own cryptocurrency STEEM) through upvotes and creating posts of your own.

This wraps up the Getting Started part of Cryptocurrency Investment Tips for Beginners, the next article will focus more on strategies, profit tracking and tips for finding the best opportunities.

Hope you enjoyed the article and don’t forget to follow me on Steemit if you want to stay updated.

Cryptonite aka cj900

Great job sharing tips for new investors. Check out my article on Steemit providing tips for new cryptocurrency investors: https://goo.gl/iyrTNC

@cj900 very informative post. Thanks

That is a deep article and covers a lot. Good work @cj900

Create a great day,

@kozan

Thanks

Very informative post...thanks for sharing

Thanks leyla5

Good article... more coming up?

Thanks, I got Chapter 2 coming later this week with detailed investment strategies

Good points in this post. I was about to post a similair post. It's surprising how much uneducated investors the crypto space has. You still see people invest in this shady and scammy coins. We do need to look better at the insights of every coin. What team is behind it, is there any management. How strong is the product, is there any product at all? I really advice people to take a look at: https://www.coincheckup.com Amazing opportunities came to light when I started using this coins to analyze cryptos.

Congratulations @cj900! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPYour post is very useful for beginners like me.

Great Article. I have found a similar article written by a successful investor about how to gain from ico. It may help you to make a decision Take a look : https://steemit.com/crypto/@bijeeshtk/how-i-made-566-gains-by-investing-in-icos

very good article