Don't Trade During The Doldrums

The Doldrums of Trading

Currently the cryptocurrency markets are in what we as traders call - sideway action. Or better known as the doldrums.

What Are The Doldrums of Trading?

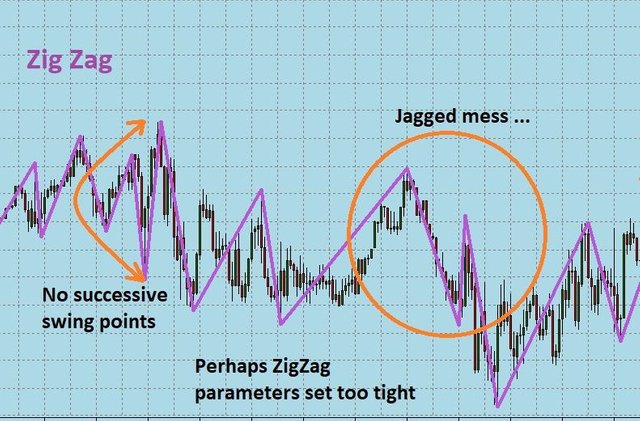

The doldrums are that period of time when nothing of any significance happens and the only thing that really happens is that traders get churned. I’m talking headfakes, prices moves up to you think it’s about to break out again only to turn down to the point that you think it’s about to break down again.

I’ve seen traders lose all their money, ALL THEIR MONEY, trading during the doldrums.

Doldrums usually happen right after a massive move, when making money was easy. You could be wrong a lot but you were right in such a big way that it doesn’t matter. The trader has the feeling that they can do no wrong. They make big sloppy mistakes and still make massive gains.

In normal stock market trading the doldrums are after the open and before the close.

When Are Doldrums?

NYSE hours are 9:30am to 4:00pm

The doldrums are from 11am to 3pm. That is the time when professional traders are not doing anything related to trading. Some of the best traders write books, do online courses, go to the gym, socialize, eat, surf or anything but trade. As well, the summer months and winter holidays are pretty much the lightest volume days of the year. The ones who’ve been in the game longest recognize this and plan their life accordingly. There isn’t a whole lot of trading going on in the South of France or on the slopes in Aspen during that time of year.

Crypto trading is similar, but on a bigger scale

Personally I’m more of a swing/position trader. That means I get into positions that last a few days to a few months. It has taken a long time for me to recognize that about myself, but the financial reward has really reinforced this to me.

The seasons of crypto are far different than those of the US Equity markets.

Crypto does not take a minute off, not one, 24/7/365.

The intraday doldrums of crypto are nothing compared to the multi month doldrums of crypto.

Crypto makes massive multi-month up or down moves. This is where the bulk of the money is made, identifying and jumping on board to these massive expansion or contraction moves and riding them out to the end.

Then guess what? These massive moves (from $6,000 to $20,000 on BTC in two months for example), need time to digest the price.

We call this price discovery. In essence people who were in much earlier, take profits, people who’ve missed out up until now look to buy in, plenty of people are averaging in, some people need cash to pay bills, or just splurge a little bit.

This time frame is usually indicated by very low volume (relative to the more recent big moves), and definite sideways ping-pong action.

There are a couple of key things to do during the doldrums.

Create A Plan

Analyze the charts, and decide what key indicators would signal that you are out of the doldrums and the market is ready for your attention again.

What are your breakout levels, breakdown levels?

What does volume need to look like?

What indicators would help you recognize and confirm the move?

What indicators will give you false hope?

Monitor

Now that you have an idea of what it will look like when the market leaves the doldrums and returns to prime time, make sure you have everything in place to monitor that.

You can setup email or SMS alerts when price or your indicators move to the levels you are monitoring.

Get charts on your phone and make sure they are set to the proper time frame. I personally don’t look at any chart less than a 12 hour time frame, and mostly focus on 3 day charts. That is each candle on the chart represents 3 whole days of price movement. This is extremely helpful in not getting scared out of a trade when a little insignificant spike shows up out of nowhere.

Leave

The final step is to get away from your screens.

Go hiking, fly to Mexico for a week, play golf, surf or whatever. Get active, do something to occupy your mind...and body.

Too many times traders will leave all their charts up and stay connected, overly connected, to the market and get caught up in the ping pong nature of a consolidating market. When you disconnect, get outside, breath deep clean (as best you can based on location), you can let your mind relax a bit, recover and get prepared for the next big up or down move.

Less is truly more when analyzing markets.

Thanks a lot. I almost start depression. Big help for me. Useful information and advice.

hola! I like your post! Thanks for it! I went to jail because of cryptos... lets make steemit together to a better place with our content! I would like to read a bit more about you and maybe do you have some more pictures? I also just wrote a introduce yourself. Maybe you upvote me and follow me swell as I do? https://busy.org/introduceyourself/@mykarma/1-jail-review-bitcoins-3-years-ago

By read this post I've know something new. Thanks for sharing.

thanks @chris-d for informative post. I also waiting prices up since three weeks I hope that the market will get better very soon

Your Post Has Been Featured on @Resteemable!

Feature any Steemit post using resteemit.com!

How It Works:

1. Take Any Steemit URL

2. Erase

https://3. Type

reGet Featured Instantly – Featured Posts are voted every 2.4hrs

Join the Curation Team Here