Bitcoin Testing Critical Supports | Strategy Notes for the Week of May 27

If you’d rather see this presented in video form, you can view the replay of the live stream I host every Sunday night:

From the book “The Elliott Wave Principle”:

“[During wave 2s], the masses are convinced that the old trend is still in force, and pessimism is even worse than the origin of 1. ‘Here we go again.’”

Anecdotally, sentiment among crypto investors is extremely low, perhaps even lower than during the price lows of February and April. Certainly this is in alignment with what we would expect from a wave 2.

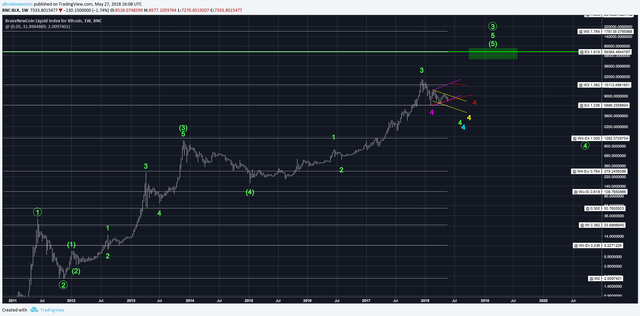

The first chart I will show is the weekly so that you can get a reminder of the bigger picture. It is unclear whether the fourth wave has completed, but the fifth wave afterwards points to prices between $48k and $82k. The point of invalidation for this is $3000.

Zooming into the 6-hour chart, we had a very good setup for a 1-2, with the ideal reversal zone to start wave 3 coming between $7900 and $7500. However, in the past week, after a promising reversal from the top of the range, Bitcoin cruised through and is now sitting above $7100, the critical support that it must hold to maintain the 1-2 as likely.

Because of this deeper retrace, the possibility of a triangle must be considered. Triangles can either be continuations of prior trends or reversals. Continuations are more likely, but given the stance of the rest of the market (sitting above must-hold supports), I have to weigh each of these possibilities equally.

The first sign of the bearish triangle will be further downside no further than $6400 and then a corrective reversal to no higher than $9800.

But Bitcoin mostly stands alone with its deep retrace, most other alts looks similar to Ethereum, which has not dropped even below the 50% retrace and did not make a lower low last night like Bitcoin.

Given all of the above, I do not think it is time to be bearish yet. Only one altcoin I am tracking has broken crucial support (Request Network), but even that is still above its April lows.

However, please do not read this as me being a perma-bull. If we do not get a reversal soon and in the form of impulsive waves, I will have to look down. Until then, things are still looking fine for the bullish case.

In terms of actions, I am holding the coins I have bought and watching the market closely should a sign of further downside emerge.

If this analysis has been helpful and you want to receive it in your inbox every Sunday, you can sign up at https://altcoinmentors.com/strategy. If you would like to support us, please upvote and share this article with someone else who would find it useful!

We faced an issue with the model portfolio where the CMC data feed broke. It should be fixed now, but the historical portfolio statistics are now incorrect because of the outage. We’re currently looking into other options for public portfolio tracking. If you have any ideas, please hit the reply button and let me know.

I greatly appreciated any and all feedback! A few of you reached out saying that I need to focus more on the short term outlook in these emails instead of just repeating the same things for multiple weeks. I will definitely be doing that. Please keep the feedback coming, creating content like this is new to me and I am continually trying to get better.

To keep up with us during the week, we have a Telegram Channel where we post charts, market updates, and trade ideas every day! You can join by going to https://t.me/altcoinmentors.

We also have a model portfolio that contains all of the moves we are making in the market. You can grab that at https://altcoinmentors.com/portfolio.

Happy trading!

Charlie You

Altcoin Mentors, Inc.

twitter.com/iamcharlieyou

twitter.com/altcoin_mentors