Steem Price Prediction for 2021: Will the Social Coin Gain Value?

The Steem price climbed earlier this month as cryptocurrency markets rallied and remains at its highest level since 2018, despite a slight dip – so is it a good buy?

The Steem protocol is a social blockchain database that rewards users for sharing content. It powers social media apps such as the Steemit blogging site. Users become stakeholders in the platform, earning cryptocurrency for their contributions and maintaining control over their data.

Steemit Inc was launched in 2016 by business operation and financial analyst Ned Scott and software engineer Dan Larimer to develop the Steem protocol, though Larimer left the company in 2017. Steemit was the first app to launch on the Steem blockchain.

Steem coins are the native cryptocurrency tokens running on the blockchain. Developers of web applications can create Smart Media Tokens (SMTs) as native digital assets to build incentives for users to participate in the platform and help it grow.

The protocol runs a rewards pool of tokens to incentivise content creation and curation, and there is a voting system that enables the community to assess the value of content and distribute tokens.

Steem calls this 'proof-of-brain', a term based on the 'proof-of-work' concept other blockchains use to validate transactions. This approach, also known as 'proof of stake' (PoS), aims to “emphasise the human work required to distribute tokens to community participants”.

According to the company’s website:

“Proof-of-brain positions Steem as a tool for building perpetually growing communities, which encourage their members to add value to the community through the built-in rewards structure.”

Steem tokens are generated at a fixed rate of one block every three seconds. Unlike the PoW system of distributing tokens, where miners contribute computing power, Steem’s approach incentivises participants to add value to the network.

According to Steem’s documentation, “the rate that new tokens are generated was set to 9.5% per year starting in December 2016 and decreases at a rate of 0.01% every 250,000 blocks, or about 0.5% per year. The inflation will continue decreasing at this rate until it reaches 0.95%, after a period of approximately 20.5 years”.

“Of the supply of new tokens created by the Steem blockchain every year, 75% of those tokens compose the 'rewards pool' and are distributed to content creators and content curators; 15% are distributed to vested token holders, and 10% are distributed to Witnesses, the block producers cooperating inside Steem’s DPoS consensus protocol.”

Steem operates a one-Steem, one-vote model that gives users who have contributed the most to the platform more influence over how contributions are scored.

Steem also provides additional features, such as stolen account recovery, escrow services, a reputation system and savings accounts.

The blockchain is designed to be fast and efficient, which is needed to support the amount of traffic expected on popular social media platforms. It provides three-second confirmation times and free transactions. Steem has surpassed Bitcoin in the number of transactions and can scale up to support more than 10,000 transactions per second.

In early 2020, Steem was in turmoil. Justin Sun, founder of the Tron blockchain, acquired Steemit and took control of the Steem blockchain. Cryptocurrency exchanges staked Steem coins they controlled to vote for new leadership. Steem community leaders, who validate the blockchain, responded by initiating a soft fork that censored the staked tokens that Steemit held.

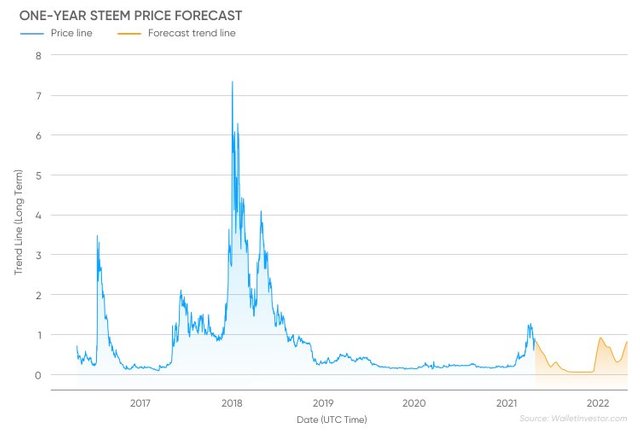

The Steem price ticked up in March 2020 from around $0.12 to $0.38 but then declined to $0.13 by November. More recently, the coin’s price climbed to $1.44 on 11 April 2021 but remained well below the all-time high of $8.57 reached during the cryptocurrency rally in January 2018. The coin has since slipped back to below $1, trading around $0.87-$0.90 on 27 April.

Steem price prediction for 2021: what happens next with the social coin?

Algorithm-based forecasting sites predict Steem’s price will rise in the coming years but remain well below the all-time high.

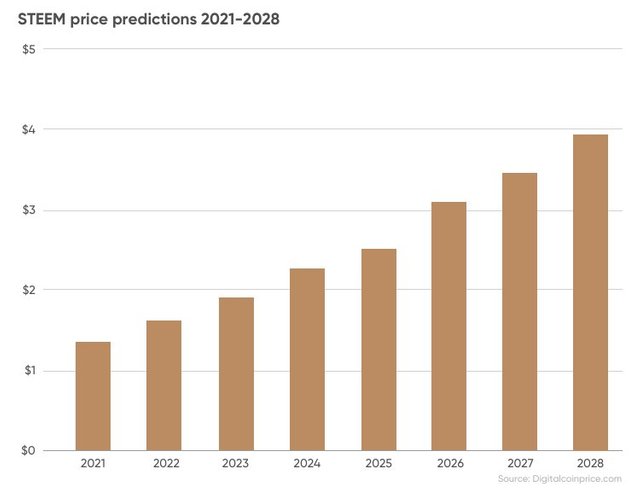

In its Steem coin price prediction, Digitalcoin forecasts that the price will average $1.37 in 2021, rising to $1.63 in 2022 and $2.54 in 2025. It expects the price will average $3.95 in 2028

On the other hand, the Steem price prediction from Wallet Investor expects the price to fall from $0.84 at the start of May to $0.04 by December 2021.

Wallet Investor projects the price will rise to $0.19 in mid-2022 and recover to end the year little changed at $0.64. By 2025 it expects the price to fall to $0.03 but return to $0.61 by the end of December.

The Steem forecast from CryptoGround suggests it could be trading at around $1.07 in six months and $1.12 in a year – but, like Wallet Investor, it predicts the price could crash in 2022. It then expects the price to recover and climb to $3.69 in 2023 and $5.66 in 2025.

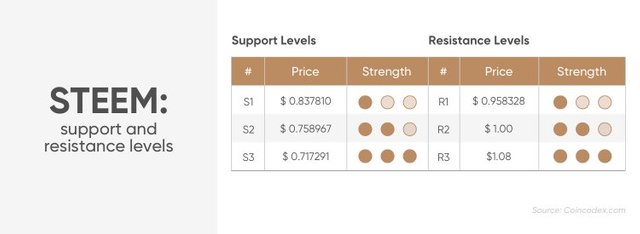

Technical analysis from CoinCodex is bullish on the Steem price in the short term, forecasting trades above the 50-day, 100-day and 200-day moving averages, although it has fallen below the 21-day moving average. There is support at $0.83, with stronger support at $0.71, while there is resistance at $0.96, $ 1.00 and $ 1.08.

Wallet Investor projects the price will rise to $0.19 in mid-2022 and recover to end the year little changed at $0.64. By 2025 it expects the price to fall to $0.03 but return to $0.61 by the end of December.

The Steem forecast from CryptoGround suggests it could be trading at around $1.07 in six months and $1.12 in a year – but, like Wallet Investor, it predicts the price could crash in 2022. It then expects the price to recover and climb to $3.69 in 2023 and $5.66 in 2025.

Technical analysis from CoinCodex is bullish on the Steem price in the short term, forecasting trades above the 50-day, 100-day and 200-day moving averages, although it has fallen below the 21-day moving average. There is support at $0.83, with stronger support at $0.71, while there is resistance at $0.96, $ 1.00 and $ 1.08.

Thanks for reading.

Copied from capital.com

follow me @benjaminelisha for more

S/O to me bosses

@zzan

@cryptokannon

@psicoparedes

@juichi

@boss75

@jesusremaj7

@advhl

@fabio2614

@steemingcuration

@imamalkimas

@seo-boss

@steemchiller

@presse

@red-rose

@mister-omortson

@uruguru

@dobartim

This post is a must read for all steemians