Why do TA? RSI + Łitecoin analysis [Crypopulse podcast]

This post was inspired by the Cryptopulse podcast! Thanks for having me over, its was a fun conversation! To everyone else, go show them some love and check em out here: http://www.cryptopulse.co.uk/

One of the first questions I got during the podcast was, What is technical Analysis, which is understandably a question most of us have asked ourselves! Including me!

TA was actually born more than a 100 years ago believe it or not! Its a study of market movement of price. Dow theory says that the overall market trend reflects business conditions which in turn by gauging through trends/price charts one should be able to see the direction of a particular stock/asset.

Dow theory is a summation of everything that goes into the price of a asset - (Minus) human emotion and all one needs to do is find that human emotion and plug into the price movement and bammmm! You can tell what going to happen For the most part to the market.

The second most important part of dow theory is perhaps about trends, trends last for a minimum of 6 months and can last upto a few years even. Think Bitcoin...thats a bull trend, zooming all the way back even from 2014, BTC has only and ONLY had an uptrend, this even including the crash in Jan (Bloodbath Jan™) has only been an uptrend, as long as we keep above $6400 BTC will remain in the uptrend, the same goes for LTC and in fact the top 10 cryptos on the marketcap list. RIP ALTS though

The next lesson we have primary trends, namely Stealth/smart money, this is the same as early adopters..ask yourself this, where are all the people who were early adopters of BTC, even from 2011..They are all running companies/giving talks/youtube celebs?

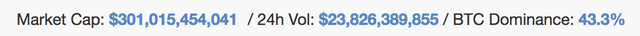

Then comes the Institutional investors, and for the most part this part was squeezed into the mania phase, where everyone, their neighbour and specially their dog wanted a Lambo for themselves, if you didn't guess it yet, we saw than in Dec-Jan 2018. And finally the Blow off phase...where the market crashes, Selling and panic is all people have and money flushes out of the system...Something like $850 bil to $260bil! Congratulate yourself if you managed to hold during this time...and traders, well ouch!

BTC MC

All of the above is based on grounded theory, proved and tested in the housing market boom and crash, in the .com bubble boom and crash, and now the crypto crash! This doesn't mean the market isn't going to recover, IT WILL! And when it does, it will be stringer than ever! I have typed this before and I will type it again, the market needs its confidence back..there needs to be a reentry of risk taking again!

Now we can break down Dow theory into its constituents, get yourself a book on the dow theory or any book on TA, they all sing the same song.

Lets get into some TA, during the podcast we attempted to see what RSI is and how we can read it! Down to the nitty gritty!

LTC 12April RSI

This is the exact chart I was looking at during the podcast, so for anyone who followed along, this is what you should have seen.

We are looking at LTC on a 4h with the RSI indicator, default settings easy and simple.

Looking at a 2 day span, from the 30th March to 1st April, the RSI has gone up showing more strength in the coin while the price has fallen over the same course..that doesn't seem right. There is typically a bull flag, as low and behold we saw the price tick up in a huge white(Buy) candle. A very run of the mill divergence pattern, this is a bull one.

Now you can imagine the exact opposite, for a bear pattern.

The other aspect of RSI, which is the beginners way to trading is whenever the RSI hits above 70-75, thats a sell signal aka over bought, and whenever the RSI hits below 30-25 thats a buy signal (Over sold), Simple? Well yeah, I would say the RSI is one of the easiest and smartest indicators, there is a lot one can go into, I like combining RSI with MACD indicator, that also included by looking at market structure, looking for ('M' or and 'W') pattern also helps you target your trades.

This one was too juicy to not include:

LTC Feb

The one important thing to remember is, traders or indicators don't perform magic...there is no wisdom in using 38 different indicators to help you tell where the price is going to be, you are looking for the needle and by piling up more indicators on a little chart is only making the haystack bigger!

I think the last thing that needs to be typed is that TA shouldn't be your one and only way to know what happening, stay informed, learn and read what happening in the space, news too plays a huge role in the price and cannot be dissed.

The recent price spike we saw in BTC, spike of $1000 cannot be explained by TA and if there is anyone out there should be taking with skepticism.

BTC...Wut?

That buy block doesn't look normal and thats ok, TA will help you make MORE sense of the market not complete sense.