How to get in at the beginning of a trend instead of finding out about it when the trend is nearly finished.

I have been involved in the crypto world for about 18 months now, since I bought my first Bitcoin in 2016. I started out as just a long term investor in BTC and other Altcoins and started to see some pretty decent returns on my investments. Between then and now, I have quit my job and begun to trade cryptocurrencies full-time. I currently live in Thailand where the cost of living is extremely cheap, so I have had the advantage of being able to learn and make mistakes, but not be starving and have a low quality of life while I improve my skills. I am still new to trading, but I have come a long way, and I hope to be able to help others who are learning and give some advice that has really helped me and some tips that have really improved my overall profits.

Today, I am going to focus on how to get into a trend at the beginning instead of finding out about it at the end and all the profit making is basically over. I don’t know about other new traders or even some more experienced ones, but even as my skills at reading and using different technical analysis tools improved, I always seemed to come late to an uptrend and missed out on most of the profits. I might be able to get in on a retracement, but most of the money made in a trend tends to happen near the beginning, and you also want to be able to make multiple trades during a trend by selling at the top or at resistance lines and then buying back in during the retracements so you can make some real profits. For a while I was getting frustrated that I kept missing these because there were so many coins out there, and it was hard to keep track of them all. I am assuming many of you have had the same issue as well.

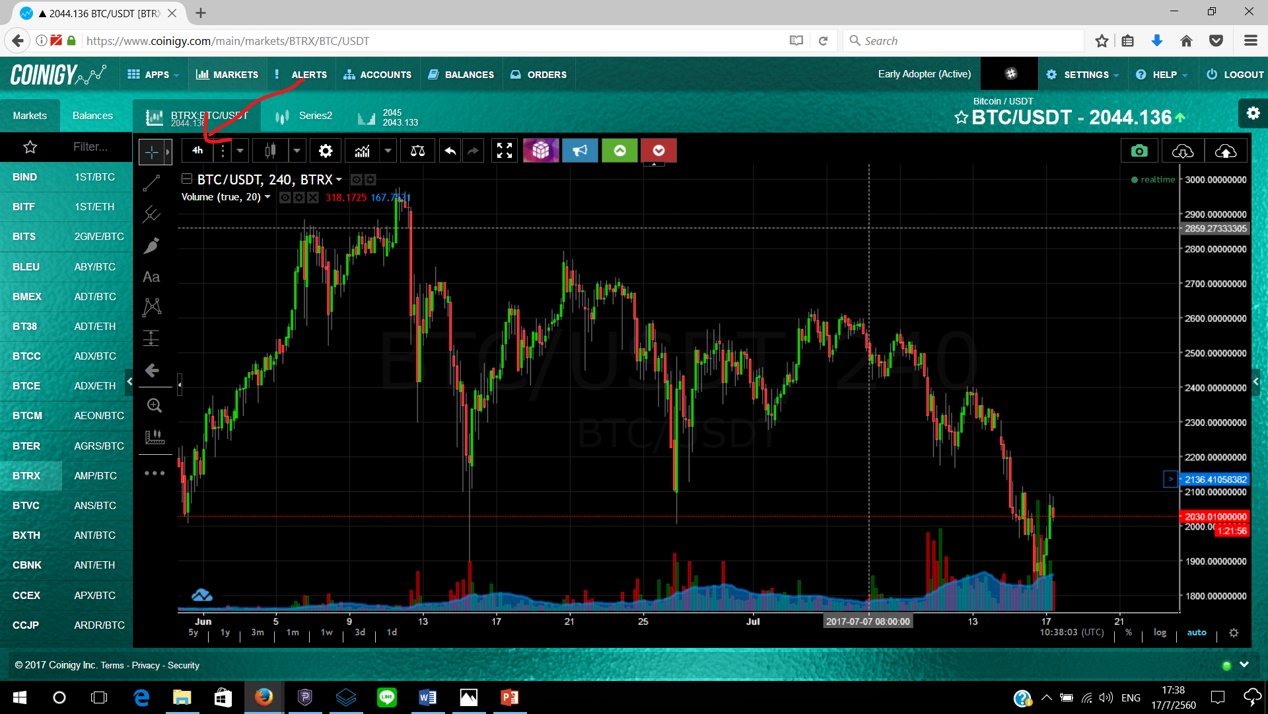

So what is the solution I found to this problem? I have started going through the list of coins and putting price alerts on every single one. How do I determine what prices to set the alerts to? First of all, I use the website Coinigy for all my chart reading needs. This is a paid service, but it is well worth the cost, and you get the first two weeks for free as a trial. I highly recommend it. On Coinigy you can look at the charts for different coins on all the different exchanges. I trade mostly on Bittrex or Poloniex myself. After I pull up a specific coin, depending on the lifespan of the coin, I will usually start by going to the 4 hour chart.

You can see here where you can adjust the time frame for the charts in the top left corner. I’ll be using the BTC/USDT chart from Bittrex in my examples today, but this strategy can apply to any chart. I like the 4 hour because it gives you a bigger picture to begin with and give you more data, and then afterwards I can go down to the smaller times to see the action happening right at that time.

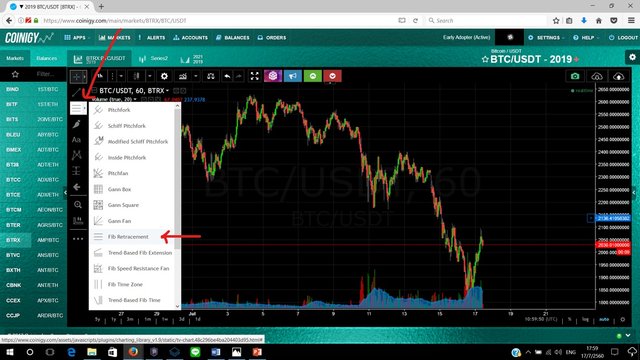

After I have gotten onto the 4 hour chart, I then run a Fibonacci retracement to find support and resistance areas. If you don’t know how to use Fibs or what they mean, that is ok for now. I may do a post later on how to use Fibs, but just know for now that these help you find support and resistance zones.

You can see here where to find the Fib retracement tool, and I have also switched to the 1 hour chart now.

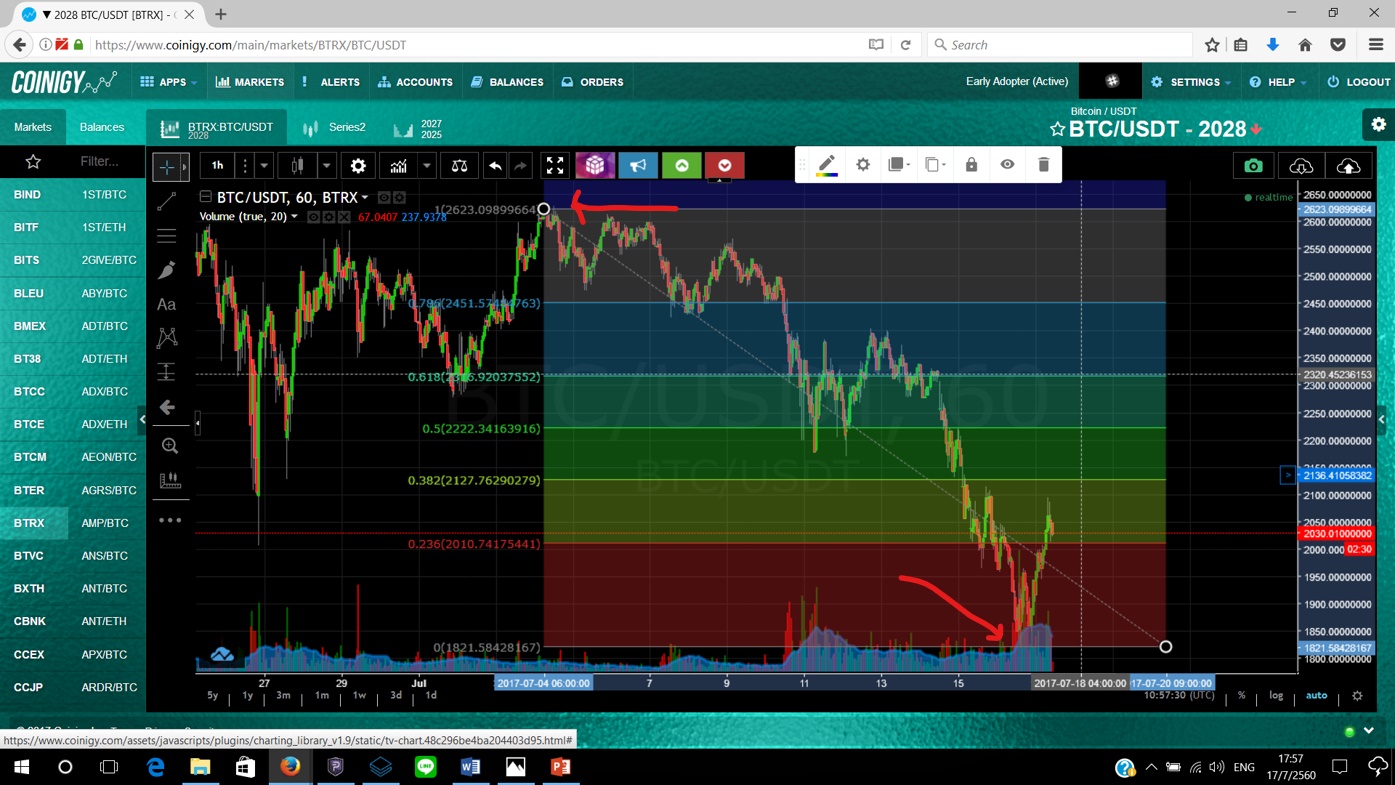

After you have gotten the tool ready. I run the retracement on the most recent trend, which is a downtrend. Starting at the top, the swing high, down to the bottom, the swing low.

At this time I will also look for any trend lines that might be acting as either resistance or support, depending on if it is an uptrend or a downtrend, but I am just going to focus on the fibs for now.

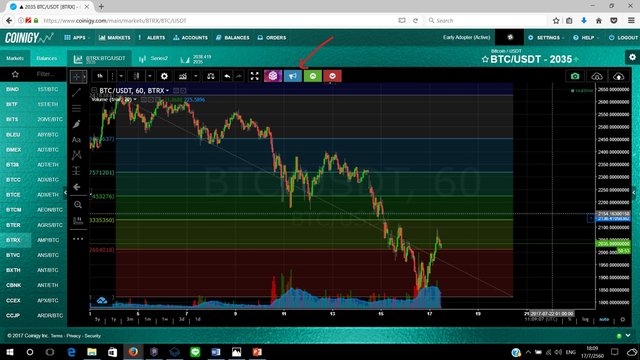

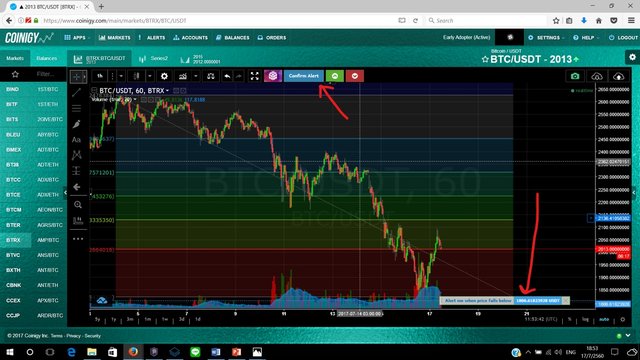

After you have laid your fib. You want to look at where the resistance and support levels are, so you know where to put your alerts. I usually put at least two alerts on each chart, one above the current price at the resistance level that needs to be broken through for an uptrend to occur and one at a support level that needs to be broken for a downtrend to occur.

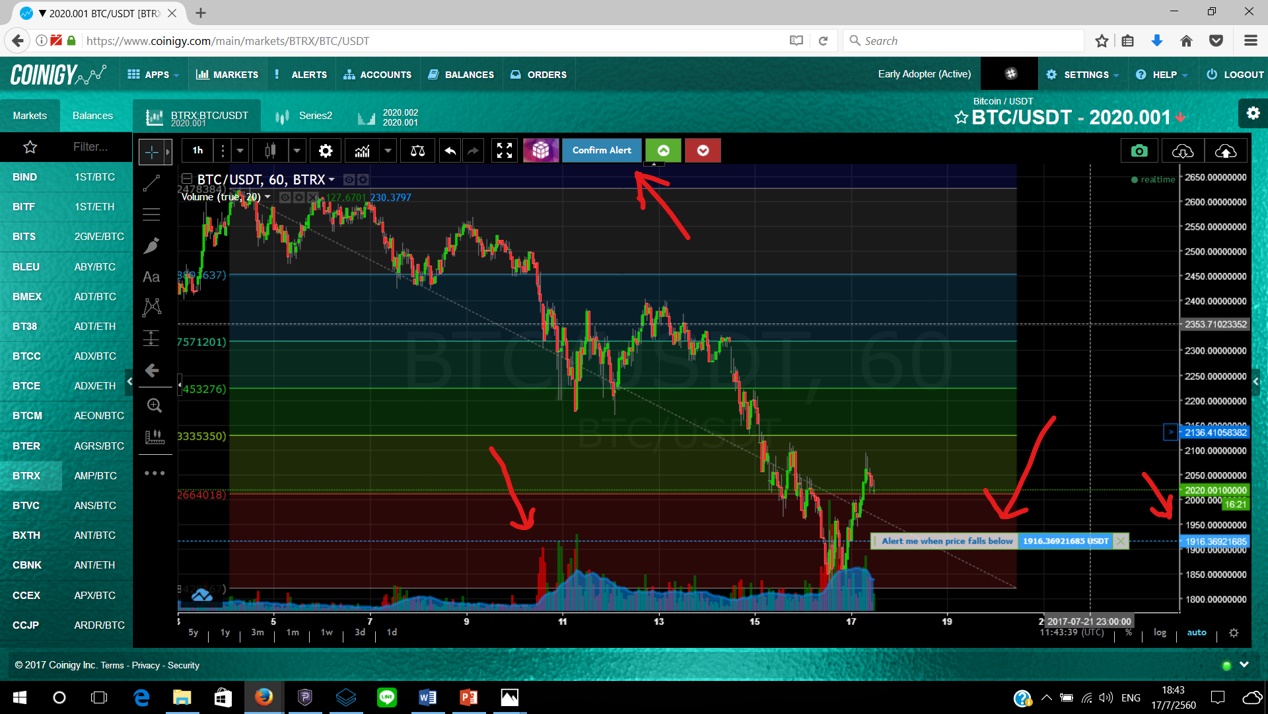

You can turn on alerts using the blue button here.

Next, it is time to set your alerts. After you press the blue button this bar will appear on the chart and the blue button will then say "confirm alert". You move the alert bar by clicking and dragging it to the price that you want, and then you press "confirm alert".

I will put my first alert right here under the last low to be notified if the previous support is broken.

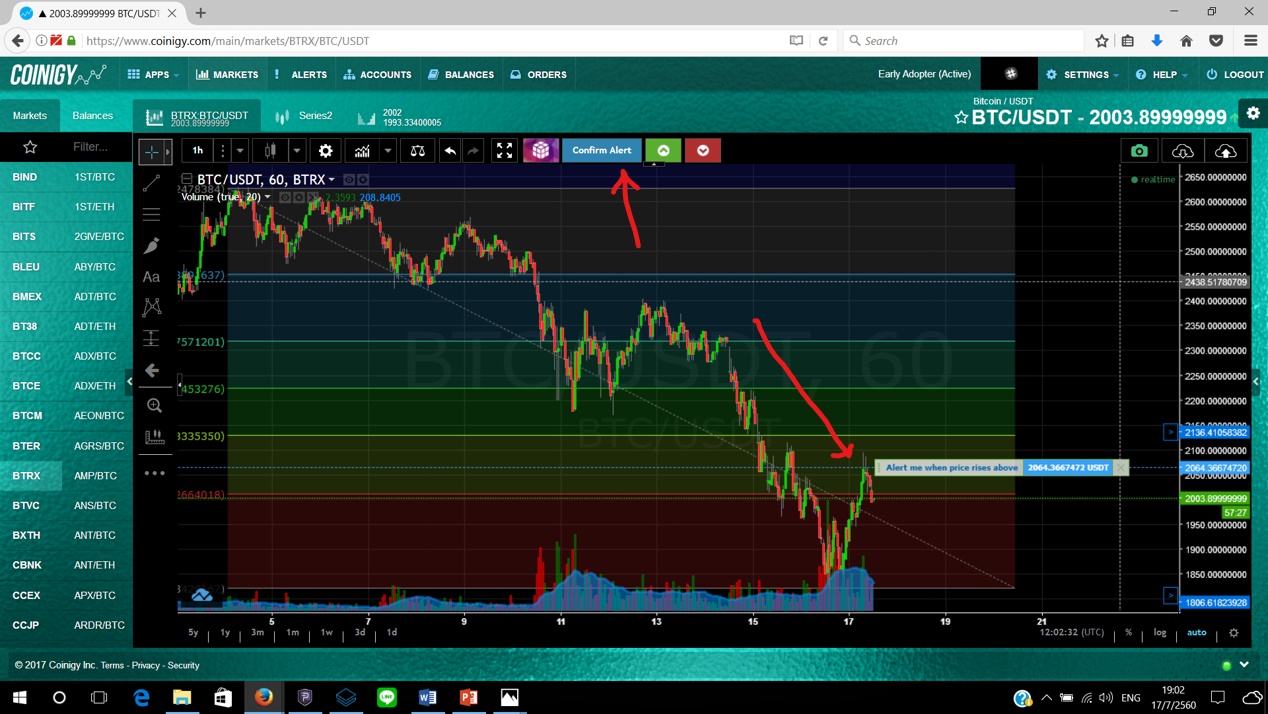

Then I will put my second alert just under the next resistance line to be prepared in case the price breaks through and continues to rise.

So now I will be notified via email, or by a direct pop-up notification if I have Coinigy currently open, which I almost always do.

It is important to note that have an alert going off is not an automatic buy signal. It just lets me know that I need to go back and look at the chart to reevaluate whether I want to enter into a trade or wait for a better confirmation that a trend is occurring.

So, if you have ever said to yourself, "Why can I never be ready at the beginning of any trends?!", I hope this gives you some tools to help you make more profits in the future. If you have any other strategies that you have found useful for yourself, I would love to hear about it in the comments, and if you have any more questions or there was something that I did not make clear enough, please ask those as well. If you found this info valuable, an up-vote and a follow would be greatly appreciated! Thanks for reading and see you next time!

Excellent post. Looking forward to reading more from you. Upvoted & following.

Thanks! I am glad you enjoyed the post and got some value out of it! I'll keep the tips coming as often as I can!

Hey this is the best post for a newbie like me. I just really want to congratulate you on explaining something so clearly.

There is not enough of this type of communication these days. Thanks again!!

I am glad this tip has helped you out some, and I hope it helps you make some more money!

Nice article!

Does anyone know where we can have Fibonacci retracement tool for free ?

A trading platform maybe ? or a way to to do like a Fibonacci retracement with another tool ?

Ok I found how to do it on Bitfinex by using the pitchfork tool. You can then click on the gear and select among the suggested ratios which are : 23.6%, 38.2%, 50%, 61.8% and 100%! --> Fibonacci ratios! ^^

PS: Thanks to whoever upvoted me ^^

Thank you for the tech analysis tips! Upvoted!

Thanks for the upvote! I'll keep the tips coming!

Thanks for sharing, I'm living in Thailand also for 7 years now - great to see another trader coming here! Perfect place to develop skills like you said, exactly why I came here.

Thanks for reading, man! And yeah, Thailand is great. The crypto community is growing for sure. I go to bitcoin meet ups here in Chiang Mai every week, and we have more and more beginners coming to learn. Where abouts in Thailand you spend most of your time?

I found your post helpful. I'm learning TA and just getting ideas on the fibs. Thanks

That's great! I'm glad the post was useful for you!