Impending Volatility Supression = Strong 'Long' Bias for BTC

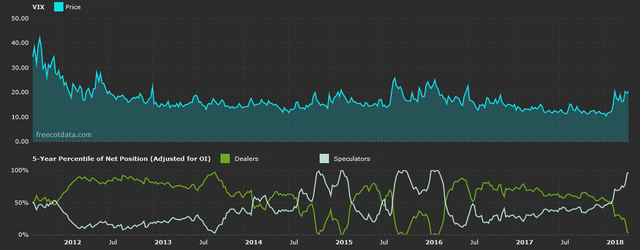

Commitment of Traders report sets liquidity providers in the bottom 4% of their historical 'Long' volatility positioning. This is an extremely strong signal for short volatility which has strongly related to volatility suppression in the past.

Short Volatility = Long Assets. With the recent correlation of 0.85 to global markets, BTC may be seeing reduced implied volatility in the VERY near term. This means LONG BTC and all strongly correlated coins in the near term.

*Near term being the next ~30 days

Congratulations @adzy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @adzy! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!