Bitcoin sinks below $10,000 and is now 50% off all-time high as cryptocurrency sell-off deepens

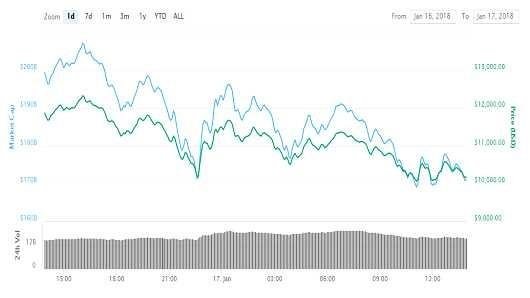

The world's largest cryptocurrency dived as low as $9,199.59 Wednesday morning, according to CoinDesk.

The last time bitcoin fell below the $10,000 mark was November 30.

More than $30 billion was shaved off the cryptocurrency's market value in the last 24 hours.

Bitcoin fell below $10,000 for the first time since November, as a sell-off in cryptocurrencies continued for a second day.

The world's largest cryptocurrency dived as low as $9,199.59 Wednesday morning, falling almost 19 percent within 24 hours, according to CoinDesk data. CoinDesk tracks prices from cryptocurrency exchanges Bitstamp, Coinbase, itBit and Bitfinex. Bitcoin then recovered slightly to $10,123 at 11:56 a.m. ET.

The last time bitcoin fell below the $10,000 mark was November 30. The red-hot digital asset soared to a record high of $19,783.21 on CoinDesk last month, but has since been on a gradual decline. At its current price, it is now down almost 50 percent from that all-time high.

More than $30 billion was shaved off the cryptocurrency's market value in the last 24 hours.

"Focus has shifted to negative regulation with headlines out of South Korea, China, and even minor headlines from France and the U.S.," Ari Paul, chief investment officer at cryptocurrency investment firm BlockTower Capital, said in an email. "These headlines are having an outsized effect because cryptocurrency as a whole was overbought and sentiment reached exuberant levels, setting the stage for the violent correction that we're seeing."

Credit: CoinMarketCap

Ethereum and ripple —

the second and third-biggest digital assets respectively — continued to move lower. According to CoinMarketCap data, ethereum was trading 15 percent lower near $885 a coin, while ripple fell nearly 14 percent to around $1.02.

Cryptocurrencies appeared to sell off shortly after South Korea's Finance Minister, Kim Dong-yeon, said the country was still mulling a shutdown of crypto exchanges. Initial reports of South Korea — one of the biggest cryptocurrency markets in the world — moving to clamp down on virtual currency trading last week sent the price of bitcoin and a number of other major digital assets down sharply.

"The action we're seeing may seem dramatic but is really quite normal for this market," Mati Greenspan, senior market analyst at eToro, told CNBC via email. "All in all, this drop has brought us back to the prices that were traded about a month ago for most coins."

Greenspan said Tuesday that South Korean and Japanese investors often pay a premium of "20 percent or more per coin," but on Wednesday said they appeared to be falling.

"The premiums that were being paid by Japanese and South Korean crypto traders is also coming down, so that's a good sign as well," he said.

'No other justification than fear'

China was also reportedly looking to deepen its crackdown on the cryptocurrency market this week. On Monday, Bloomberg reported that authorities in China were planning to block domestic access to Chinese and offshore cryptocurrency platforms that allow centralized trading. Regulators will also target people and companies that provide market-making, settlement and clearing services for centralized trading, the publication said, citing unnamed sources.

And on Tuesday, a Chinese central bank official reportedly said that authorities should ban the centralized trading of digital currencies, adding weight to concerns of further suppression of the country's cryptocurrency market.

Charles Hayter, chief executive of CryptoCompare, said that many expected the cryptocurrency market to decline.

"The market was very overheated and had significantly dislocated from trend. A large percentage of investors were expecting this correction and reversion to mean."

Hayter said that panic was "leading the herd to sell with no other justification than fear," but added that it was "difficult to say" where the market would be headed next.

Bitcoin and other cryptocurrencies are extremely volatile assets. Many experts believe that the introduction of futures contracts for bitcoin from the likes of CME and Cboe would tame the digital currency somewhat and bring in more institutional money.

— CNBC's Evelyn Cheng contributed to this report.

Original post - https://www.google.co.in/amp/s/www.cnbc.com/amp/2018/01/17/cryptocurrency-sell-off-continues-as-bitcoin-ethereum-sink.html

#doggang

Hey, thanks for this info. I really need this!!

hi! you really have the talent on blogging.. this is a nice article! :)

Lol , i posted the the link of original content in the post :)

oh hahaha