Cryptocurrency News for 1 Sep 2017

Moscow Stock Exchange Plans Trading of Cryptocurrencies

The Moscow Stock Exchange plans soon to begin the trading of digital currencies. The exchange will also list derivatives and exchange-traded funds (ETF) based on different cryptocurrencies. The exchange is currently creating an infrastructure to trade Bitcoin and other virtual currencies as of August 2017. The move comes after Russia seemingly banned ‘ordinary people’ from buying cryptocurrency.

Based on a report by Russian state-owned news agency Tass, the exchange has claimed that a platform for the post-trading of cryptocurrency assets is already in the works.

Part of the exchange’s statement reads:

“We are already working on creating an infrastructure for such [cryptocurrency] trades, in particular, a platform for post-trading services for crypto assets.”

Full story at http://bit.ly/2gl6nvY

Source: CoinTelegraph

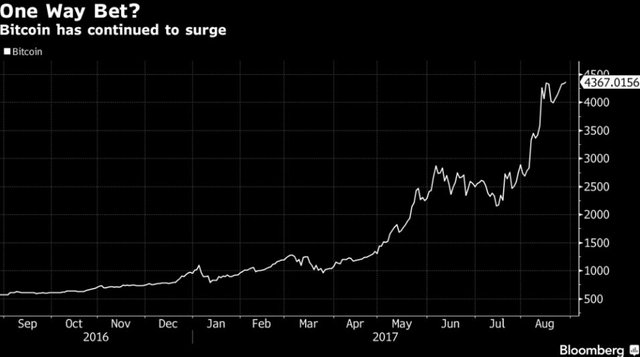

Bitcoin Is Becoming a Popular Investment for Middle-Class Americans

Bitcoin has grown very popular in the U.S. and data shows the region is consistently one of the top three countries leading in bitcoin trade volume. According to a recent study from the Cambridge University Business School’s Centre for Alternative Finance, the U.S. is the fourth leading country utilizing bitcoin for payments and as a form of cross-border money transmission. Further, the country has the third largest number of exchanges worldwide, and USD is one of the most widely supported currencies across a majority of global exchanges. This popularity has spread to American ‘mom and pop’ investors spending a few bucks on cryptocurrency investments that are turning out to be extremely lucrative.

The vast amount of infrastructure in the U.S. and this year’s exponential BTC price spike, has led to middle-class Americans learning how to invest in cryptocurrencies. NBC interviewed a school bus driver, Ryan Williams, who used some of his bitcoin holdings to purchase a new pool for his kids. During the hot summer Williams thought he couldn’t afford a pool, but suddenly remembered he had a stash of bitcoin that gained quite a bit of value. Williams purchased the pool at Wal Mart using his Bitpay card, and now his mother and other family members are investing in bitcoin too.

Another 39-year-old ironworker from New Jersey, Greg Salerno, said he put $1,600 into bitcoin a while back, and now his stash is worth $20,000. Salerno tells the publication that he’s also started to talk about cryptocurrency investments to co-workers. “It’s like being in Apple at 10 cents,” Salerno tells NBC.

"In five to ten years you could be sitting on something nice."

Full story at http://bit.ly/2wrR9gp

Source: Bitcoin News

Gold Losing Safe Haven Status Due to Cryptocurrencies, Monetary Policy

Gold prices jumped 1% on Tuesday morning, fueled by geopolitical and market concerns, with the latest North Korean missile launch being the immediate catalyst.

However, according to Bloomberg, the jump in gold prices is a ‘too little too late’ response to the general state of geopolitics and market uncertainties. The precious metal appears to be losing its ‘safe haven’ status. Traditional models should have gold prices well above what they are now, and there are two things to blame for gold’s relatively poor performance.

Part of the reason gold hasn’t performed as well as expected is because investors are shifting their funds to digital currencies. Currencies such as Bitcoin have held their value quite well during recent crises, such as Venezuela’s hyperinflation.

Unconventional monetary policies by central banks has also eroded a bit of gold’s value. The unwinding of central bank balance sheets which must eventually happen is leaving investors nervous. Some of them are seeking a safe haven in Bitcoin.

Full story at http://bit.ly/2gl5HXC

Source: CoinTelegraph

Central Banks Can’t Ignore the Cryptocurrency Boom

The boom in cryptocurrencies and their underlying technology is becoming too big for central banks, long the guardian of official money, to ignore.

Until recently, officials at major central banks were happy to watch as pioneers in the field progressed by trial and error, safe in the knowledge that it was dwarfed by roughly $5 trillion circulating daily in conventional currency markets. But now as officials turn an eye toward the increasingly pervasive technology, the risk is that they’re reacting too late to both the pitfalls and the opportunities presented by digital coinage.

"Central banks cannot afford to treat cyber currencies as toys to play with in a sand box," said Andrew Sheng, chief adviser to the China Banking Regulatory Commission and Distinguished Fellow of the Asia Global Institute, University of Hong Kong. "It is time to realize that they are the real barbarians at the gate."

Bitcoin -- the largest and best-known digital currency -- and its peers pose a threat to the established money system by effectively circumventing it. Money as we know it depends on the authority of the state for credibility, with central banks typically managing its price and/or quantity. Cryptocurrencies skirt all that and instead rely on their supposedly unhackable technology to guarantee value.

Full story at https://bloom.bg/2wsFoGE

Source: Bloomberg

Tips for Investors: How to Protect Yourselves Against Possible Fraud Schemes

Today the Securities and Exchange Commission (SEC) rolled out an investor alert which advises investors to be careful of trading in the stock of public companies claiming to be related to or asserting they are engaging in, Initial Coin Offerings (or ICOs).

This is the latest twist in the ICO saga where the earlier alerts were more focused on addressing the token sale offerings made by startups or non-public companies.

With this increased focus from the regulators, we may very well see much more detailed oversight of these potential offerings and maturing of the market to ensure that quality projects with high-quality development teams are funded using this new investment mechanism.

It remains to be seen though as to how the future steps are planned by the regulators to ensure that all these offerings continue to abide by the laws of the land and investor community does not suffer.

Full story at http://bit.ly/2glemcz

Source: CoinTelegraph

Why Big Investors Are Betting Real Money on a Kik Cryptocurrency

If there were any doubts about whether Kik would be able to attract investors to its initial coin offering (ICO), it's safe to say they have been put to rest.

In an announcement yesterday, the mobile messaging app provider revealed it has already raised $50 million from investors to launch its new "kin" token, and that it intends to raise a further $75 million in a public token distribution to be held in September.

It's a landmark for the nascent industry, one that finds a mainstream brand with millions of users backing a nascent funding mechanism that has been equally praised and parodied.

And while critics of ICOs, and Kik's particular plan, will remain, investors believe the kin token will boost the value of the company, and they're putting millions of dollars up to back the idea.

Full story at http://bit.ly/2wrRekd

Source: CoinDesk

Going to be interesting to see how globally regulators will react to blockchain technology trying to implement standards. Thanks for another great update @sydesjokes

Upvoted & Resteemed

Wow this is the first brick in the wall to fall and the first cornerstone of the new foundation.

crazy..!

Upvoted! :)

I'm starting follow you @margaritabokusu

Thanks @honeysara I follow you now :)

Yes,bitcoin is very popular in my country,Myanmar. By the way,thanks for your information.

Upvote & resteem. Great job!

Interesting!