China: the digital monetary coup

The technological battle that is playing out before our eyes risks redefining the geopolitical challenges of tomorrow. And for good reason, the governments of the great powers have entered a frantic race for the digital monetary transition. China and its DC / EP (Digital Currency / Electronic Payment) project seems to have gained a head start thanks to the foresight of its central bank and its objective of formal notice of the dollar system.

As usual, the government of Xi Jinping is evasive on the unveiling of the technical properties of this new digital currency. Even if at first glance, DC / EP (Digital Currency / Electronic Payment) is inspired by the fundamentals of blockchain , it is not really one. It is similar to a fusion of a DLT system and a centralized platform like Wechat or Alipay (Equivalent to Apple Pay).

State digital currency programs promise to become a major economic and geopolitical issue : the Chinese example will allow us to analyze the implications of these new tools, both in terms of the consequences for individual freedoms and the new powers conferred on states .

Private companies that have become too bulky

In record time, Chinese citizens have adopted mobile payment as a new standard and companies such as Tencent or Alibaba (Wechat and Alipay) have prospered thanks to the construction of tools merging accessible messaging, e-commerce platform and financial services. via smartphone. This radical change is not to the taste of Beijing, which wants to take control of the control of transactions and counter any attempt to escape money .

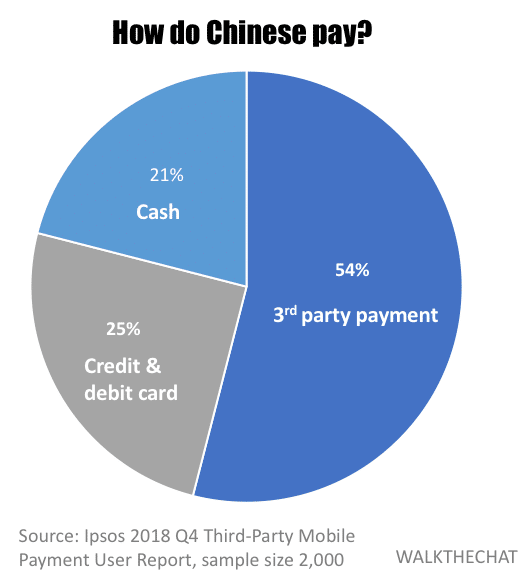

Indeed, it is today more than 54% of the country's financial transactions which are materialized via private entities , making Beijing's access to cash flows more complex. Even if these companies are all obliged to cooperate with the State if the need arises - they also have several members of the Chinese Communist Party who sit within them - the fluidity of access to financial information is insufficient to meet the growing need for government controls, and the hour for response has struck.

Despite the possible obsolescence of these figures observed during Q4 2018, Chinese citizens have overwhelmingly embraced mobile payment systems , which account for 54% of global transactions . In addition, the COVID crisis has radically changed people's perception of cash, which is synonymous with exposure to the virus .

Beijing's objective is therefore clear and quantifiable: digitize the 21% of transactions linked to physical money , but also gain market share allocated to intermediary third parties. The latter, mainly represented by Tencent and Alibaba (94%) know full well that they will not be able to compete in the long term with their own state and that if they risked it, the consequences would be dramatic .

Even if the Chinese government wants to be reassuring by meaning to want to establish a gradual transition to avoid any risk of systemic disturbance , it goes without saying that anyone familiar with the functioning of central banks can understand the major advantages that the DC / EP will naturally have.

Wechat and Alipay are doomed to compete with a new entrant with unlimited monetary powers and legally untouchable , having the luxury of multiplying initiatives to encourage the use of their system without financial imperatives. The Chinese government sees itself starting a process of resumption of the monetary control which will allow it to gradually push aside the private actors of the local fiduciary market.

Between capital controls and economic variables

The Chinese people, having experienced historic economic growth since the 1980s, are renowned for their propensity to save , but also for their thirst for investments . Feeling the geopolitical context becoming tense and global economic growth running out of steam, the Chinese have embarked on a diversifying process which has precipitated an influx of capital beyond their borders .

This trend is anything but the taste of Beijing, which has the economic objective of establishing a transition between the economy of yesterday - based on exports - and the economy of tomorrow based on growth in domestic consumption , demanding safeguarding the capital available locally.

As a reminder, if the maximum value of a Chinese bank note is 100 yuan (about 13 euros), it is to make the disputed transactions and the crossing of borders with large sums highly restrictive . The government has also introduced a cap of $ 50,000 per year per citizen as the maximum amount that can be transferred abroad.

This did not stop most of the individuals concerned from circumventing the system by using nominees in order to avoid the limits imposed. In addition, there is a plethora of services exploiting the gray areas of Chinese law , making accessible the transit of large sums via Hong Kong and its “independent” system.

The DCEP will therefore allow the government to trace in real time all the flows that were previously linked to physical currencies and therefore improve its control over tax evasion.

Even if the Orwellian painting depicted here seems inconceivable for the cantors of anonymity, the immense accumulation of data made possible by the DC / EP will also allow the Communist Party to become increasingly efficient in its economic governance.

The permanent collection of transactions is presented as a key decision support, allowing the authorities to calculate indices such as real-time inflation . Consequently, Beijing will be endowed with a new precious tool which will make it more effective in implementing economic and monetary reforms .

Digital transformation at the heart of internal issues

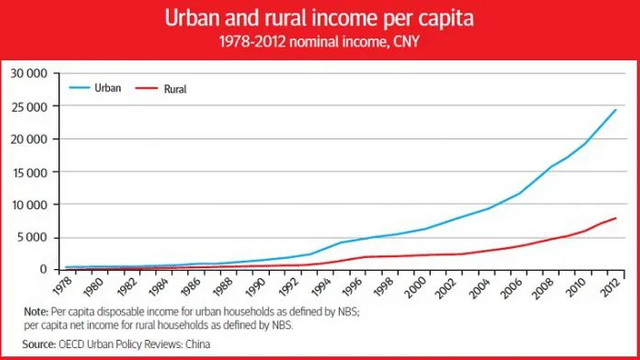

If the status of developing country sticks to the skin of China, it is that despite a frenetic growth of more than forty years, the wealth gap between city dwellers and rural people has remained one of the most pronounced in world.

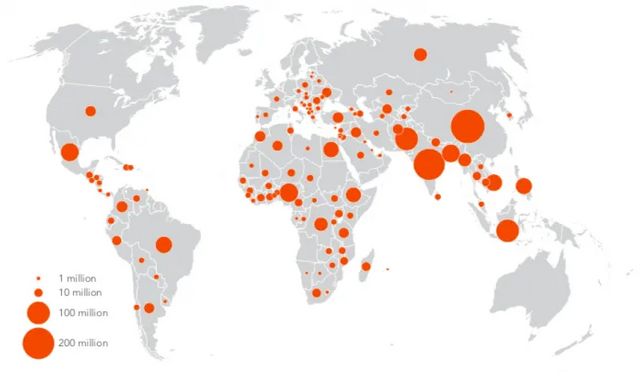

The problem that Beijing is trying to solve is the guarantee of wider access to banking services and a new financing capacity for the most disadvantaged populations. China is the nation with the most unbanked citizens, with an astonishing total of 200 million people.

World map of unbanked populations

In rural areas, access to the Internet is far from being democratized due to the lack of mobile coverage . The creators of the DC / EP wish to remedy this with the introduction of NFC technology which will allow users to carry out transactions without an internet connection .

This NFC technology and its application is of major importance: it allows the exchange of value by a simple telephone-to-telephone contact , without the need to be connected to the network: The image of digital cash takes on its full significance here meaning.

Like Ethereum and decentralized applications, the Chinese central bank will be able to integrate smart contracts allowing the integration of new services linked to the digital Yuan. It goes without saying that the creation of these programs will only be accessible to carefully selected privileged authorities .

However, a balance will have to be found so as not to see integrated smart contracts impact the purely monetary role that this new digital currency is supposed to assume.

The new financial inclusion will, however, have a cost for its beneficiaries, since they will have to swap the freedom of their cash flows for access to a financial system that was once impossible for them. The government nevertheless insisted on the fact that it wished to incorporate an option guaranteeing the anonymity of the transactions , except that this one will be available only for sums not exceeding a certain value (still undefined).

The internationalization of the Yuan and its challenges

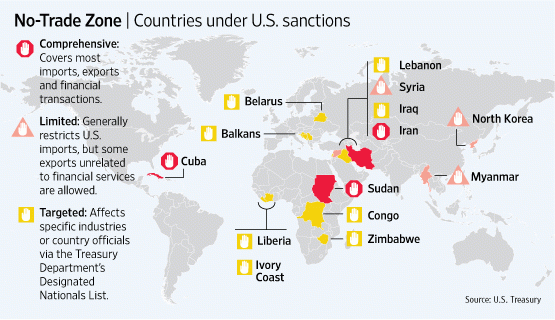

As a second pole of influence, China must absolutely place the internationalization of the Yuan as a priority if it is to balance American influence and offer an alternative to the dollar. Today, more than 63% of central bank reserves are held in dollars, and that is what the Communist Party of Xi Jinping seems to want to fight.

Beijing intends to offer financing and exchange alternatives via the DC / EP to nations that have been excluded from the SWIFT system due to conflict with the American giant.

Map of countries under American sanctions

Despite the tensions linked to the territorial challenges of South East Asia, China remains the economic engine of the region and carries the economic growth of the ASEAN zone . This economic group has supplanted Europe as the main trading partner this year, with growth of 6.1% in the first half of 2020, representing 15.1% of total Chinese volume.

It is a safe bet that in order to maintain the mercantile relations necessary for their development, the ASEAN member countries will be encouraged to consider the use of DC / EP as a new means of exchange in the near future. .

The use of this digital currency in an international context is not only intended to facilitate international transactions, it can also be used to raise funds in a more accommodating manner.

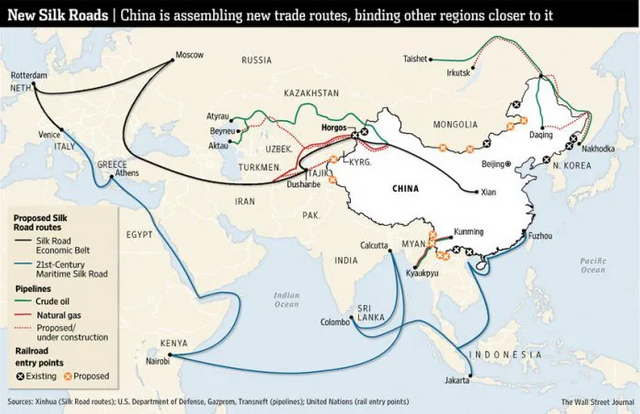

This easier access to the loan echoes the major geopolitical project of the 21st century: the new Silk Road .

Overview of the New Silk Road Project

This considerable project linking 65 countries will allow the construction of new infrastructures facilitating the exchange of goods and investments between the participating countries.

The nations which have given their approval to be part of this program will have to participate in its smooth running in the form of infrastructure financing and will see access to liquidity guaranteed by Beijing thanks to the granting of specific loans . The timing of the exit from the DC / EP seems to be in perfect harmony with this initiative and risks being a sine qua no n condition for access to advantageous loans.

There is however a nuance to bring: the COVID crisis has strongly damaged the image of Beijing internationally. His intentions, judged as bellicose in the West, have increased the distrust of the trading partners involved in the construction of the Silk Road. The palpable enthusiasm of previous years could give way to increased distrust on the international scene.

In addition, the conditions linked to Chinese state loans are often debated because of inequities . The government introduces in the vast majority of contracts a clause in which the borrowing countries, if they were not able to repay their debts in due time, would see their infrastructure pass under Chinese control.

The challenges linked to CD / PE are therefore multiple: between increasing internal monetary control, facilitating access to the economy for the poorest and desire for international affirmation; the communist party seems to have understood before everyone else the implications that could arise from a state digital currency.

Its establishment will be carefully scrutinized by the Western powers, which will have to show ingenuity to adapt this new system to populations more difficult to maneuver, and where individual freedoms are vehemently defended.

In a geopolitical game turned upside down by the COVID crisis, China will however have to reconnect with a diplomatic intelligence that it lacked, in order to extend its influence and assuage its global ambitions.