THE CRYPTO MARKET IS DOWN OVER 50% | SEE WHY

.jpg)

With the current drop in market price of coins in cryptocurrency, one may begin to wonder if there is hope, if this is the end of cryptocurrency or if it is going to bounce back. Most investors I have spoken to are really terrified as seeing their investments not being secured and could well be heading towards a sink hole before their very eyes and there is nothing they can do about it. This alarming trend seems to be growing. And investors no longer seem to find this comfortable. Waking up daily to see market price decreases. This decline may have been caused by some certain factors we hope to find out soon.

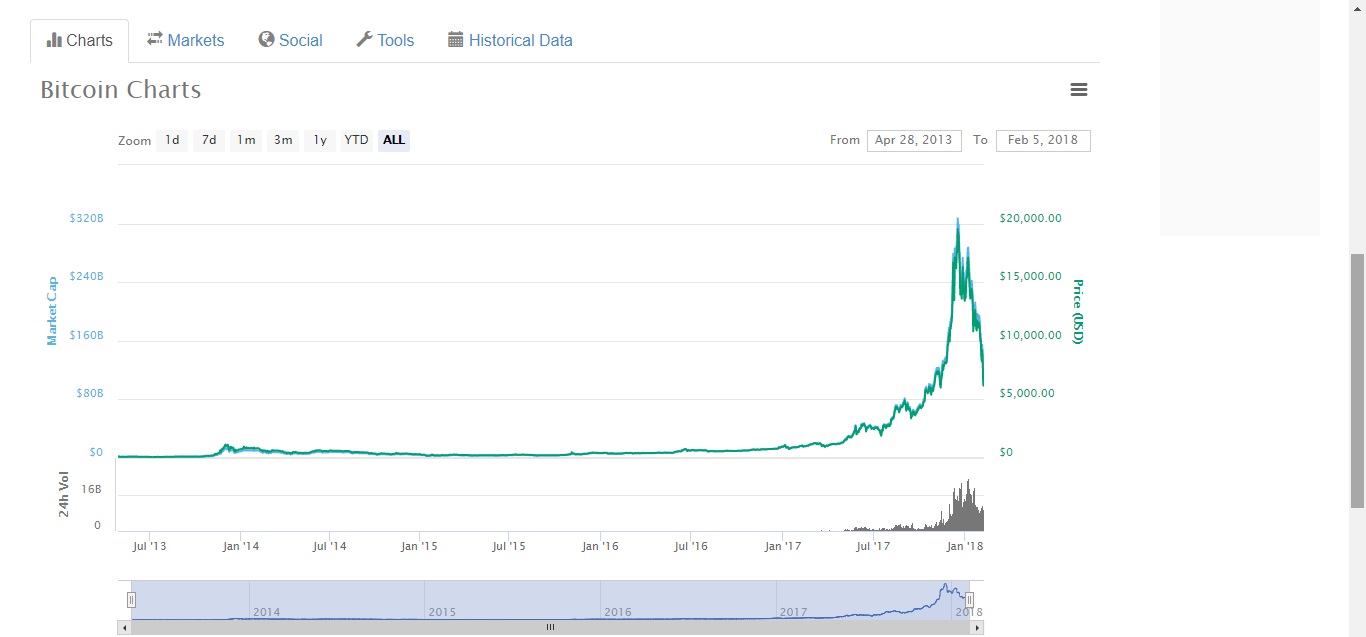

The total value of all publicly traded cryptocurrencies hit a combined $366 billion today, the lowest figure observed for the market since Dec. 4, data from CoinMarketCap reveals.

The more than 60-day low, however, can also be read more bearishly, as it represents a 50 percent drop from the market's all-time high above $830 billion in early January.

Indeed, for the second time in just four days, the market is awash with double-digit declines, as in just a few short weeks a combination of new buyer fatigue and negative news appears to have taken its toll.

This time, "the culprit may be speculation that new buyers may be further discouraged due to reports China could further restrict domestic buyers from overseas market resources, while major credit card issuers across the globe are reportedly restricting access to cryptocurrency buying." - WHY

Still, year-over-year, the figures are less bleak, as the market is up more than 1,800 percent from just $19 billion in Feb. 2017.

As such, traders may be trading the declines and otherwise taking their negative news in stride. Further data analysis reveals the market is still trading above the $355 billion total observed on Friday, when the market saw a similar period of double-digit declines.

Ethereum's ether (ETH) cryptocurrency is trading at $783, a near three-week low. At press time, ETH was trading at its lowest level since Jan. 17.

- XRP

Fresh off securing its status as the worst-performing cryptocurrency of Jan. 2018, XRP, the native cryptocurrency of the RippleNet blockchain dropped 12 percent Monday to $0.76.

Overall, however, it's three-day low, as XRP saw lower lows on Friday when it declined to $0.63.

- BCH

Another one of January's biggest losers, bitcoin cash (BCH), which hit a low of $980.78 on Friday, was last seen trading at $1,026.

Given the cryptocurrency's large China community, though, this response may be encouraging, as it was down 13.26 percent in the last 24 hours but above its more recent lows.

- Cardano

Another relative newcomer to the large-cap cryptocurrency rankings, the asset is nonetheless trading up still from recent lows.

At press time, cardano is changing hands at $0.34 today, up 25 percent from Friday figures.

- LTC

Litecoin is down 12 percent at $137, but still well above last week's low of $105.35.

That said, the situation was markedly different yesterday, when it was one of the top gainers, clocking a high of $173.80. The price rise was reportedly fueled by a fake rumor that LTC was forking. However, the rumor was dismissed by litecoin creator Charlie Lee.

- XLM

STR, the native cryptocurrency of the Stellar network is changing hands at $0.34, up from Friday’s low of $0.28.

- NEO

At $95.65, NEO is close to Friday's low of $91.96.

Still, given its largely China-based community, the crypto asset may be sending a strong signal that the news today, in which the country could further restrict access to the market, may be encouraging.

- EOS

EOS is trading at $8.20 – up 56 cents from last week's low.

- NEM

Notably, NEM was last seen trading at $0.50, up 13 percent from Friday's figure of $0.44. However, it's also notably lower than it was in late January, a time when it was making headlines for its role in a hack on a major Japanese exchange.

please visit source for more info on the drop in crypto currency.

dear @cheetah thats the source below.

70% from 800Mil to 300Mil on coinmarketcap

down "OVER" (more than 50%)