Cash Inflow In Emerging Markets Can Be Positive For Bitcoin

Jamie Anderson, a managing principal at Tierra Funds, seems convinced there is data showing these countries are recovering. At the same time, these inflows are only a drop of water on the boiling plate at this stage.

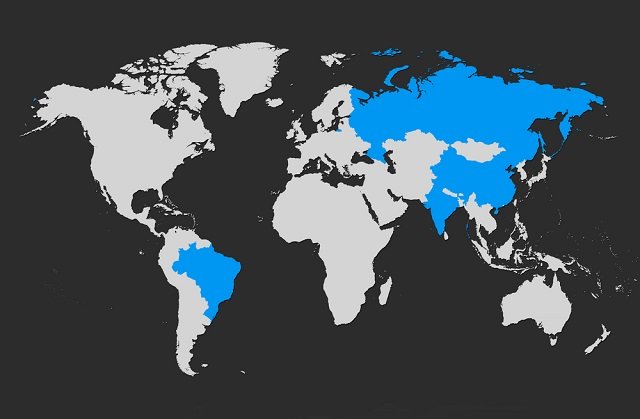

For those people who were dreaming of a cashless future, that situation will not become a reality anytime soon. Emerging markets are suddenly receiving bucketloads of cash, to buy stocks and bonds. Interestingly enough, both emerging markets and developing countries are reaping the benefits of this change. It has to be said, a record amount of cash funds have been flowing to emerging and developing markets over the past week. Emerging markets aw US$4.9bn entering the bonds market, whereas developing countries saw US$4.7bn worth of stocks being purchased. This is quite a change from the cash outflows all of these countries had to deal with for several years.

Emerging Markets And Bitcoin Pick Up Steam

According to some investors, these markets are at a turning point. It is still a bit early to say whether or not this is true, as it depends on many different factors. Unless commodity prices and export pick up in these countries, it is doubtful any significant changes will be happening soon. Jamie Anderson, a managing principal at Tierra Funds, seems convinced there is data showing these countries are recovering. At the same time, these inflows are only a drop of water on the boiling plate at this stage. Investors pulled out a lot more cash out of these regions over the past year than they are putting in right now. Interestingly enough, both US and European stocks are seeing an outflow of funds once again. Both markets combine for US$67bn in outflows for the year 2016 to date, and there are still a few months left on the calendar year. The low-interest rates maintained by the Fed are good news for these emerging markets, as it makes paying back debt less expensive. But that is not all, as it is rather cheap to get involved in emerging markets right now. With stocks trading at prices valued at 12 times their future earnings, it is not hard to see where this renewed interest is coming from. The same could be said for Bitcoin, though, which is still trading at a much lower price than what its value could be right now. This creates an attractive scenario for investors who are looking to keep a finger in the pie across the world. Emerging markets, cryptocurrency, and precious metals seem to be the three go-to investment opportunities right now. Exciting times are ahead for alternative investment options; that much is certain.

Source: newsbtc.com

"Bitcoin may be the TCP/IP of money." - Paul Buchheit