Your Crypto News on Steemit January 16, 2018

- Does Coinbase consume more than half of the Bitcoin Blocks and intentionally harming Bitcoin by delaying Optimizations?

- Russia: Legalization of Crypto Trade announced!

- Venezuela urges neighboring States to accept Petro!

- The Russian Bank Sberbank initiates a Blockchain Lab!

- Is Canada Bitmain's next destination?

- Baidu releases Blockchain Platform!

Last week, Coinbase stopped paying Bitcoin for a short time. In the MemPool this stop was so clearly visible that it was assumed that the largest Bitcoin exchange in the USA consumes more than half of the Bitcoin capacities. Of course, this raises the question of why Coinbase does not optimize these processes. For example, by batching transactions or implementing SegWit. From malice - or are there other reasons?

Oh, it's certainly no picnic, like Coinbase being the largest Bitcoin company in the US. Attention is intense at every step, and like the football coach, everyone seems to know better how CEO Brian Armstrong should do his job.

At the end of last week, it was time again: after a dropout in Coinbase revealed just how much of the scarce capacity of the Bitcoin blockchain Coinbase is really using up, a stir broke out in the community. Why does not Coinbase pack its transactions into packages? Why does not the company lower the fees through SegWit? Does the company want to hurt Bitcoin, as some think? Is it simply poorly managed - or are there other reasons?

The public discussion was strongly influenced by the now unfortunately typical emotions, accusations and conspiracy theories. It is very easy to become an enemy in Bitcoin country. The technical discussion seems to stretch the cart before the donkey and to serve above all the justification of the allegations. Nevertheless, the whole topic is far too interesting not to explain it in more detail.

Does Coinbase need more than half the capacity of Bitcoin?

On Friday, Jan. 11, Coinbase gave a tell-tale hint that might show how much transactions are going into Coinbase's account.

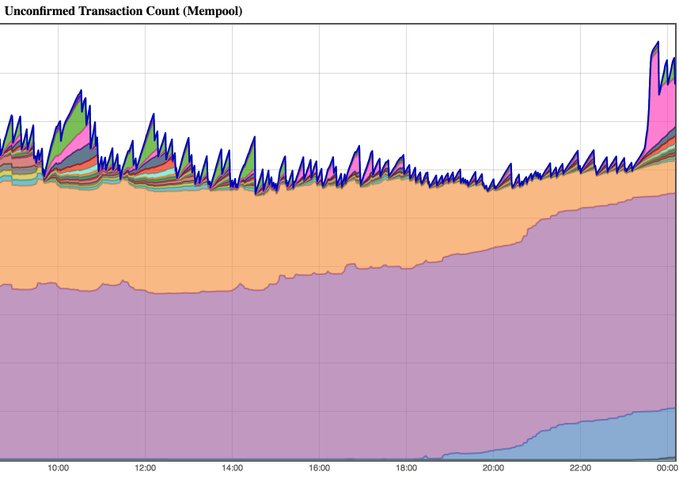

The company has posted a message on its status page that withdrawals have been offline for about a day. Observers have compared these times with the MemPool and found a direct correlation. Allegedly, the number of pre-failure transactions was 2.66 per second - down to 1.11 when Coinbase suspended payouts. In other words, Coinbase is responsible for 58 percent of all transactions.

Of course, these data should be treated with extreme caution. I myself could not understand the clear correlation between the time of suspension and resumption of payments in MemPool. The number of unconfirmed transactions temporarily increased between January 10th and 11th, while temporarily declining after the 12th, when Coinbase was back in full swing.

The share that Coinbase has in the Bitcoin transactions is likely to fluctuate significantly. So the capacity of the network is not constant, but depends on Hashrate and Mining Difficulty. Similarly, there is a temporal fluctuation in the transaction volume, both at Coinbase and at the rest of the network.

The alleged 58 percent of all transactions are likely to be a baseless hyperbole. But the very fact that Coinbase's suspension of payouts is clearly evident shows just how big Coinbase's role is. The big stock market in the US consumes a significant amount of Bitcoin's transaction capacity. It has also been speculated that Coinbase at Ethereum was responsible in the meantime for 70 percent of all transactions.

One should assume that Coinbase does everything in this position to handle the space as sparingly as possible, which the company needs on the blockchain. That this is not the case, has caused the weekend at indignation in the community.

SegWit

Unlike many other companies, Coinbase has not yet implemented SegWit. The protocol upgrade SegWit makes it possible to record the signatures in transactions differently. As the signatures occupy 1/3 to 3/4 space in the transaction, SegWit increases the network's capacity by 50-80 percent. If Coinbase were to use SegWit, the company could significantly lower its transaction fees.

The Bitcoin community has been asking Coinbase to use SegWit for some time. A petition has even been submitted on change.org, which has since been signed by more than 10,000 people. Coinbase, however, has recently stated that SegWit is only a small part of its customer base and that the company will initially focus on bringing Bitcoin Cash to the trading platform. But during the year SegWit will come.

Batching

In addition to SegWit, the Coinbase community calls for transactions to "batchen". This means not to ship each transaction individually, but to pack them into packages that are sent, for example, every 5 minutes. According to a post by David Harding can save up to 80 percent in space (and thus fees), but this seems very optimistic.

To understand what batching means, one has to remember which components make up a transaction: it has (1) one or more inputs, forms (2) one or more outputs, and (3) creates a frame with the header , the ID and other small components. The largest share of a transaction takes the input.

If a crypto exchange no longer forms many transactions with one input and one output, but one with one input and many outputs, it saves a lot of space. The problem is, however, that a purse inevitably has a lot of "Unissued Outputs" (UTXO) through the customers' deposits, which they either have to spend or have to input into transactions. Therefore, one could say that the savings are limited to (3), the header frame, and so forth, which at best would make up 10 percent of the space.

But that would be too pessimistic. Because we still have to integrate the change into our bill. If the input that the stock market takes out of their wallet does not match the output desired by the client, part goes back to the stock market as change. You can imagine this exactly as at the cashier in the supermarket, where you pay with coins or notes. In normal transactions, there is usually an output for the receiver and an output that flows as change back into your own wallet.

Ergo: If Coinbase packs transactions into packages - say, 10 transactions each - the company will make fewer new "unissued outputs" in their own wallet. This in turn increases the batching of transactions and saves massive fees.

Why does not Coinbase do it?

After all that said and the annoying bottleneck at Blockchain, the question arises why Coinbase does not do all that yet. Why does the company unnecessarily pay high fees when using SegWit and Batching Proven means to lower them? Why does Coinbase allow Bitcoin to become unusable for small transactions, while the company could single-handedly ensure that the MemPool calms down and charges drop drastically across the network?

For some of the community, the answer is clear: Coinbase "wants to create the narrative that Bitcoin has become unusable". The company was "bribed by Chinese miners" to promote Bitcoin Cash, and its CEO Brian Armstrong became "the total Bcash idiot" who, along with Roger Ver and Jihan Wu, "represents everything that is not right with obscenity people," and "was paid by the government" and so on. Anyone looking for a new low point in the discussion culture of the social Bitcoin media will have found it on the weekend.

But why did not Coinbase integrate Batching or SegWit? I can not give an exact answer here because I do not know her. One can assume, however, that does not begin with the fact that Brian Armstrong works against Bitcoin, but assume the presumption of innocence.

First, both Batching and SegWit are deep interventions in the Coinbase transactional system. SegWit changes the way addresses are formed and transactions are signed, while batching fundamentally changes the composition of transactions and how payments are handled. It may be easy for small exchanges to implement both - but for a stock exchange like Coinbase, which has been the market leader in the US since 2012 and, as just stated, responsible for a significant portion of Bitcoin's total transaction volume, sees it quite different. It can be a lot of work and also touch sensitive, safety-related areas.

Second, neither Batching nor SegWit promise immediate relief. Coinbase still has the old UTXO (coins) in the wallet. Only when these are replaced by SegWit-UTXO and reduced by batching, the costs for the company will drop significantly. In addition, SegWit and Batching seem to achieve conflicting goals: Batching reduces the number of inputs, while SegWit lowers the cost per input. By contrast, it promises to outsource transactions to other coins such as Bitcoin Cash.

Third, the profits from Batching and SegWit are manageable - while the gains from the introduction of new currency pairs are immense.

Fourth, Coinbase is likely to have hoped by mid-November that the increase in blocksize promised by SegWit2x will come after all, which would, for example, have helped consolidate UTXO's holdings. Since the increase did not occur, Coinbase is now sitting on a push UTXO, of which a certain proportion can not actually be spent, since the fees exceed the value.

Fifthly, the question arises as to why Coinbase should at all ensure that bitcoin fees fall. Both the core developers and parts of the community have made it crystal clear that low-cost transactions are by no means an important feature of Bitcoin. But on the contrary. So why should Coinbase invest resources to make Bitcoin fees cheaper for a while, if they're going to rise anyway in the medium term - instead of solving the problem of expensive transactions with other coins?

All these are possible explanations that do without the usual conspiracy theories. Brian Armstrong has meanwhile tweeted that Coinbase is already working on both Batching and SegWit. But he could not fix the relationship with the community either.

The Russian Finance Minister published a new bill for the legalization of crypto trading on public platforms. He wants to pass it on to the legislature in February.

As Russian media reported last week, Russian Finance Minister Alexei Moiseev supports the legalization of cryptocurrency trading on public exchanges. His statement, however, was as cryptic as the affected currencies. They do not want to restrict or regulate trade entirely, but they want to set some rules. Above all, one wants to standardize the purchase and sale of cryptocurrencies in some way. The basic idea is that the whole thing takes place on public (regulated) crypto exchanges.

Possible legalization in connection with other statements

Russia's opinion on cryptocurrencies has been steadily changing over the last few months. First, there was the announcement of the state-owned cryptocurrency last October. However, Russian President Vladimir Putin warned against the usual concerns (terrorist financing, money laundering, drug trafficking) of employment, especially with the trading of cryptocurrencies.

The introduction of the crypto-ruble should forestall all these possible dangers. As a government-issued and centrally regulated payment option, the currency should initially be the only accepted cryptocurrency in the country. Above all, neighborhoods were being anticipated with this move: "If we do not do so, one of our neighbors from the Eurasian Monetary Union will preempt us." Last but not least, the crypto-ruble was also intended to counteract widespread economic sanctions.

In November, when Bitcoin ATMs were set up in several places in Russia, the Secretary of Communications warned against its use, saying that the use of Bitcoin & Co. was completely outside the legally permissible range

However, this claim to "move beyond the legally permissible range" evidently referred more to the non-existent laws. As in so many other countries, the legal situation was and is not fully understood.

To change that, last December it was announced that it would pass a law regulating ICOs and cryptocurrency trading by the end of March. The introduction of the state-owned crypto-ruble was ultimately controversial by various bank and government officials.

The current announcement by Alexei Moiseev is as contradictory as the previous development of the attitude of the largest country in the world compared to Bitcoin & Co. The "legalization" is limited to controlled platforms and a standardization of crypto-trading. Ultimately, this is an approach that strictly re-centralizes the decentralization of payment transactions.

Nicolás Maduro, president of Venezuela, has proposed to members of the ALBA-TCP trade pact to accept the cryptocurrency Petro. Serving the "brave" and "creative" integration of the 21st century, Maduro sought to convince the governments of the other ten nations of his intentions. Meanwhile, the Venezuelan parliament announced that it would ban Petro because it was not constitutional.

Last Friday, an extraordinary meeting of the Political Council of the "Bolivarian Alliance for the Peoples of America" (ALBA-TCP) was held in Caracas. This is both an economic and a political alliance consisting of a total of eleven states in Latin America and the Caribbean. The alliance founded by Hugo Chávez is intended to counterbalance the US free trade area ALCA. At the conclusion of the Extraordinary Meeting, Maduro proposed to the "fraternal governments" the integration of his proposed crypto-coin Petro. Maduro believes his currency would replace all previous ones that are already traded. The head of state predicted the introduction within the next few days.

The President, however, receives strong headwind from the parliament, which is controlled by the opposition. This has the Petro in advance declared illegal, because this is accompanied by a break in the Constitution. The new cryptocurrency should, in Parliament's opinion, be subject to approval because it is a form of borrowing. Each Petro-Coin should be deposited with a barrel of oil from the reserves of Venezuela. The opposition fumed publicly for selling off the country's fossil fuels. The petro also opened the door to corruption, opposition politicians were quoted in the press. The securities deposited were formerly lapsed, provided that the current head of state should lose the next election. While Maduro's use of cryptocurrency can successfully bypass US sanctions, the ban on investors should significantly reduce the attractiveness of the new coin. With the release of Petro, Maduro hopes to take 5.9 billion dollars to modernize the domestic economy.

Since Maduro's defeat in the parliamentary elections, there is a veritable stalemate, which paralyzed the country. The Venezuelan President has repeatedly ignored the orders of the parliamentary majority because it is protected by the Constitutional Court, which repeatedly blocks the laws enacted by parliament. Therefore, at the present time it is still completely unclear whether the crypto-petro will come in the coming days. One thing is certain: if Maduro's party wants to win the next election, something has to happen. The country suffers from a galloping inflation along with a rapidly spreading food and drug shortage. Whether the Petro hopes to lead the nation out of the deep crisis remains to be seen. Although Maduro tweeted that the ALBA-TCP meeting had strengthened "friendship and cooperation" between nations. However, he did not respond to how he reacted to his proposal last Friday.

Sberbank, one of the largest banks in Russia, has announced it will open a blockchain lab to develop and test blockchain-based solutions.

The new lab aims to generate product prototypes, conduct pilot tests and implement blockchain-based business solutions for the Sberbank Group, a press release said. According to Igor Bulantsev, Senior Vice President of Sberbank, Blockchain can help reshape the Bank's financial market, as well as its activities and services.

Bulantsev said:

Objective of the project:

The project will work with the bank's other labs to develop advanced technologies and plans to work with start-ups and other alliances. Sberbank's Blockchain lab will engage blockchain specialists with experience in building and implementing ideas for existing products as well as new approaches to business activities.

The launch of the project comes one month after Sberbank CEO Herman Gref announced that the wider implementation of blockchain in Russia could take up to ten years. He noted that Russia is "experimenting a lot" with blockchain, adding that the bank will be launching some "big-scale" products this year.

In February of last year, Gref predicted that the use of distributed ledger technologies by banks and other established companies could take only two to two and a half years. Sberbank has launched a number of initiatives in the blockchain ecosystem, including the recent entry into the Enterprise Ethereum Alliance - a corporate-focused consortium. Some of the Bank's blockchain-based pilot projects include joint solutions with Severstal and Federal Antimonopoly Services.

After Bitmain opened a branch office in Zug just a few days ago, the next target for another location of the company could already be established. This time, Canada should be the focus of the company.

According to Reuters, Bitmain, one of the largest mining companies worldwide, is said to be interested in a property in Quebec. In addition, the negotiations with the Canadian power plants should have already begun.

Another facility in Canada could become the company's latest expansion outside of China. Just last week, Bitmain announced it would open a branch office in Zug. The company explained that the location in Switzerland "will play a key role".

Upon further requests from other media, Bitmain confirmed that it has been mining in North America since 2015. However, the company did not specify exact locations.

But Quebec does not only appeal to the Chinese mining company. Other companies in the industry are also interested in the location because of the low electricity prices. Furthermore, the cold climate has the advantage that the mining equipment does not get too hot and thus prolongs its service life.

The Chinese search engine Baidu has released its "Blockchain as a Service" platform (BaaS).

The open platform, whose technology the company has developed itself, is to provide the "most user-friendly" blockchain service.

All transactions can be tracked on the Baidu Trust website. This will facilitate trading in digital currencies, digital invoices, credit management, financial insurance administration and much more.

According to the company, the technology has already been used for the securitization and trading of assets. She is also said to have contributed to the first such project in China.

With the release of BaaS, Baidu follows Tencent's example. Tencent, one of China's largest Internet companies, had already developed its own blockchain platform in April 2017.

Even though Baidu lagged a bit behind BaaS, the search engine was one of the first companies to accept Bitcoin. Already in October 2013, the company announced that it would accept Bitcoin payments for its Jiasule service, which improves the security, speed and performance of websites.

In case you missed my last news just click here!

I wish you all a lovely Tuesday!!!

ⓁⓄⓥⒺ & ⓁⒾⒼⒽⓉ

Best regards

@danyelk

.gif)

A lot here to work with. The gaming of the transactions by Coinbase is not appreciated. They have a virtual monopoly and that always leads to corruption.

Yup totally agree with you :)

I think the coinbase story is a great example of just how slow bicoin is. Bitcoin was a great introductory coin. But now it is just to slow and not economically practical

Yes it's slow but I think because of the price and the status BTC has it will always be a great coin it's just the Bitcoin blockchain which can't compete more with all the new blockchains.

It will change with future upgrades!

I did not know all this, thanks for letting everyone know the updates on Bitcoin and coinbase as well as the rest of the information,

have to give credit where credit is due...Great article!!

Thank you! I glad that my post was giving you some information you didn't had before :)

Gracias a ti amigo.

Thank you for this detailed report! Cheers :)

Thanks a lot for the great research and the compilation! It's interesting to see how countries are desperately trying get hold of cryptocurrencies. Reminds me of a child wants a toy just because all the other children are playing with it.

This is really deep @danyelk. Shoutout homez

Thank you :)

Pleasure

Bitcoin was a great introductory coin

now blockchain are future ceck my last post

Yes blockchain is since 2009 the future :)

Informative , as usual. Thanks.

Your welcome and thanks :)

Great Post....

Thank you :)

Pleasure

Excelente información, coinbase al igual que muchas corporaciones de los estados unidos, lo que buscan es el lucro obtener ganancias para ellos, muy poco les importan los usuarios, el petro es una buena iniciativa del gobierno de Maduro, pero mis dudas estn en la capacidad del gobierno de usar esta moneda correctamente, y que sea un medio mas de corrupción, espero que en verdad contribuya de alguna forma a la situación del país que cada día se vuelve mas critico.

English or German please I don't speak Spanish :)