CRM & FINANCIAL SERVICES

CRM is may be the most important concept for retail banking and other financial services as well. However, implenting CRM system and executing all the operation with orchestrated with other departments is the hard part.

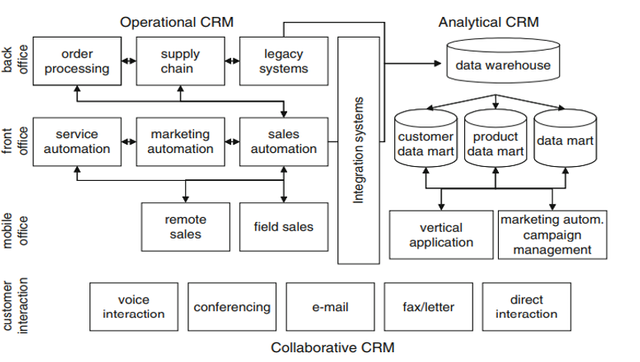

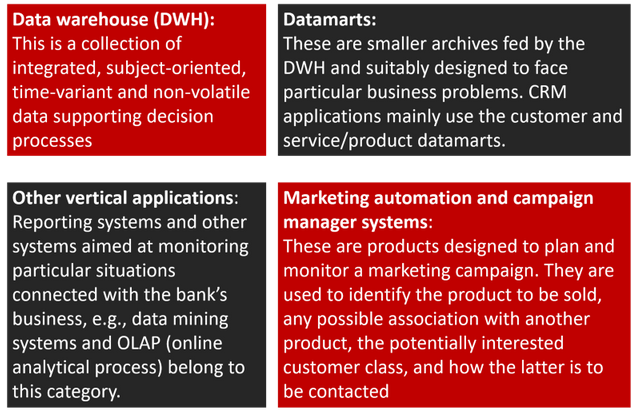

In 2019, data and analytical processes are the core of CRM systems for every industry. However some industries such as banking have higher intensity. We can simply divide the CRM systems into 3 main category like Operational, Analytical and Collaborative. For readers are very new to CRM concept let’s explain some parts of the figure:

But what is the meaning of those 3 components for the banking industry? Time to briefly explain that:

Operational:

Business decisions taken in the analytical context are then carried out in the operational dimension, where operations take place. CRM operational technologies include “customer interaction” applications, integrated within front, back and mobile office. Sales, and marketing automatization takes place in this stage.

Analytical:

Banking and all financial services industry have very high information intensity. Analytical CRM provide insights from data and profile customers in banking. This CRM component may create x-sell and up-sell opportunities to bank.

Collaborative:

Collaborative CRM allows for simplification of customer–bank contacts through definition of the most suitable channels and products/services for each individual customer. For example, credit bureau may feed the marketing for better targeting in order to decrease the NCO rate.For more information about CRM components, really encourage you to read Connected CRM by David S. Williams.

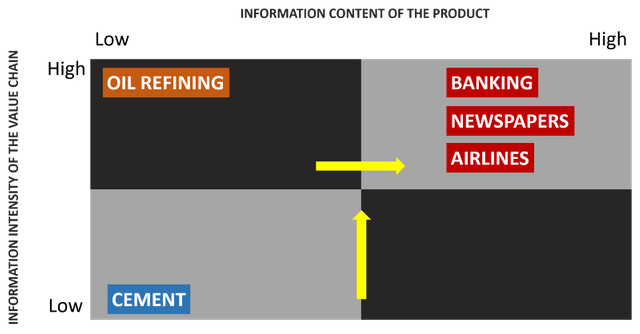

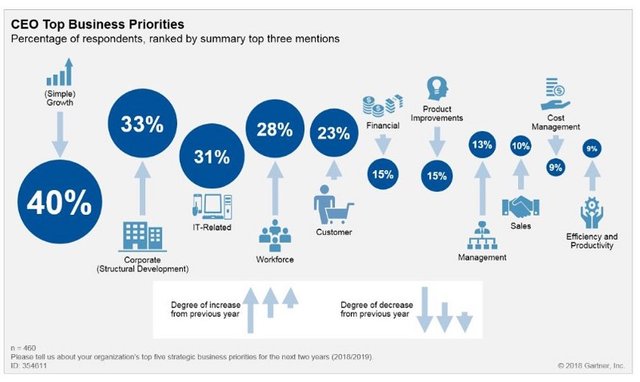

Banks have so much information about their customers. This fact brings high content. Also banks have high potential to extract the value from their information assets. Neither airlines nor newspapers have this power when we compare. However it brings 2 major consequences:Pervasiveness of Automation:For handling high volumes of information, eliminating manual and intermediate stages that need control and adjustment, and thereby reducing costs.Decision Making Tool:The adoption of intensive automation generates information assets that have become the basis for decision-making tools.For highlighting importance of the IT-related activities in CRM (also for other topics) we liked to share a work from Gartner (2018)

In 2018, top priority of CEO’s was still growth with decreasing popularity index. However, corporate culture increase it’s popularity rate and takes the second place in the standing. But what about previous years? Like 2010s?In 2011, new customer acquisition (which is supportive category for growth) was in the second place in standing but we are facing with corporate culture in 2018.In 2010, CEO’s and corporates was cost centric. Reducing cost was in the second line in the standing. But in 2018 IT-Related activities took the third place and cost management in the tenth place in the standing. Technology based activities increase it’s priority each day and effecting every KPI in the standing.

PRODUCT & CHANNEL & PROFITABILITY

Specially in retail banking, there are 2 anchor products: credit & debit cards. However channels and and other type of products are increasing. Adoption of alternative channels throughout the customer life cycle is a key player in the profitability game.When the CRM team decide to build a loyalty program in a financial institution, first they need to decide their core objective. It’s generally same for every bank when it’s about loyalty programs. In a traditional World, we could divide loyalty programs according to their core objectives. By the way, it is still true for some industries like QSR (ex: frequency or average order value)But, let’s try to categorize loyalty program types according to their goals and mechanics.

REWARD PROGRAMS

Mechnics: Awards points for purchases.

Goals: Acquisition, Emotional involvement with increase in AOV, Differantiation

Industry Example: Banking, Telecom

REBATE PROGRAMS

Mechnics: Redeemable gift certificate against new purchases when customer reachs a spending treshold.

Goals: Support buying habits of high frequency customers, Increase sales without reducing perceived brand image

Industry Example: Restaurants

APPRECIATION PROGRAMS

Mechnics: Spending accumulated points in a rewards catalog from company’s product & services.

Goals: Life-time value increase, X-Sell opportunities

Industry Example: Restaurants

PARTNERSHIP PROGRAMS

Mechnics: Rewards a customer’s accumulated purchases with a partner company’s products/services.

Goals: Acquisition, Accessing partner’s database

Industry Example: Telecom

AFFINITY PROGRAMS

Mechnics: Offer special communication, value-added benefits, and recognition to valued customers. Hard to measure.

Goals: Build strong relationship with life style brands.

Industry Example: Hamburger Restaurants

In this categorization there is good distinction about goals and mechanics. Also we can divide programs according to their typical industries. However, it’s not definite for today’s World and business environment. Many banks and financial institutions are using several mechanics in their programs to provide holistic experience to their customers.

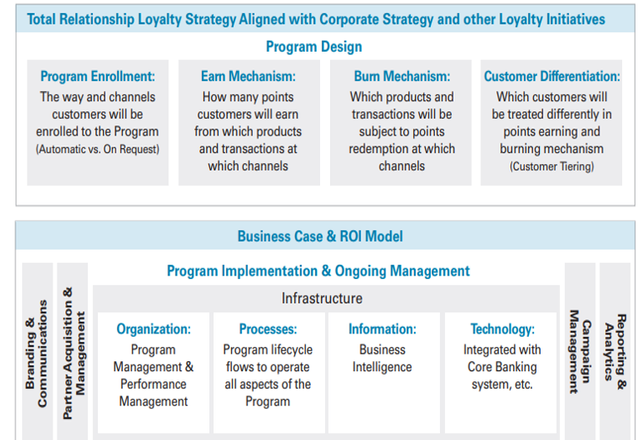

Today’s World, banks are rewarding their customers according to their entire relationship with bank. Total Relationship Loyalty Strategy offered by Pappers&Rogers group simplified the whole process when it comes to create loyalty program mechanism.Typically, a bank loyalty program have 3 core goals:

- Customer value & tenure

- Product ownership & usage

- Desired channel behaviour

Efficient loyalty program should grow the customer portfolio, influence retention and maximize customer value.

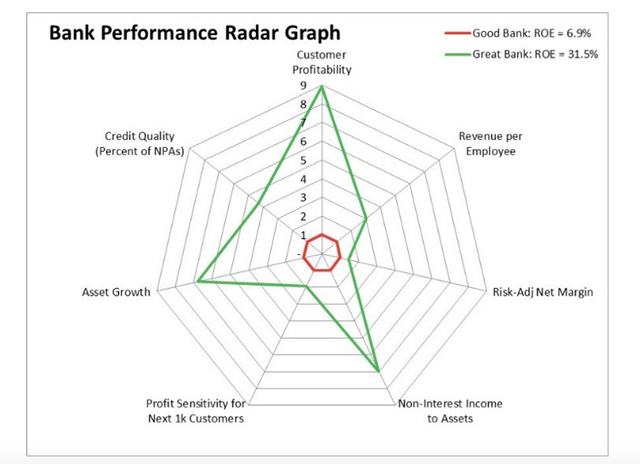

Above figure shows the performance graph of a bank. Distinction between good and great bank. During this article we never mention that how CRM performans affect to core banking performance metrics. However, good CRM system have to directly effect those metrics in some way.Next article :

- We will define the channel behaviors of a bank

- Evaluate the best-in-case bank programs according to our metrics

- Effects on the core performance metrics

www.stavepartners.com

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by mertbarbaros from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post was upvoted by 1 accounts and @interfecto thanks to @mertbarbaros

@interfecto: Selling the cheapest upvotes on Steemit for just 0.001 SBD each! Send any amount 0.001-0.1 SBD with your postlink as memo to @interfecto to buy instant upvotes!

Hey. A wide range of financial products and services tailored to the needs of different customers sets Wells Fargo apart from other banking institutions. Whether a person is looking for a mortgage, personal loan, credit card, or investment account, Wells Fargo has options available. And if the user encounters difficulties when using any of their banking products, then just contact wells fargo let them know about it, and they will quickly fix it, since customers are the most important thing to them.