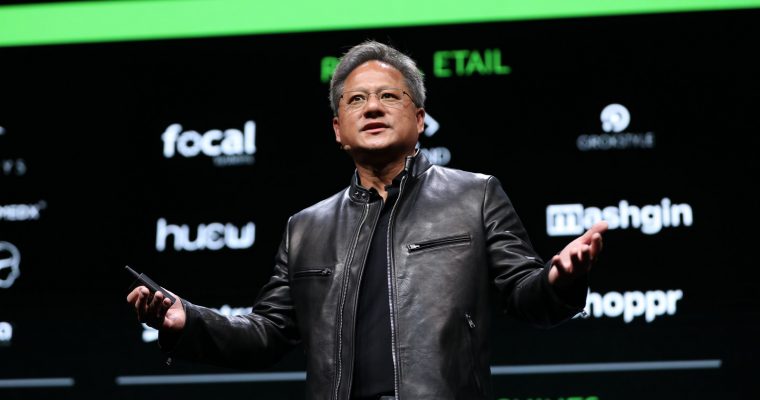

Nvidia’s Huang: Cryptocurrencies Here to Stay, Will Be an ‘Important Driver for GPUs’

Nvidia has never been overly transparent about the impact of bitcoin mining on its business, but now we know the computing company expects to generate revenue from this market for years to come. Jensen Huang, Nvidia’s CEO, told CNBC that despite the recent downturn in bitcoin mining amid a BTC price that’s been under pressure, cryptocurrencies are the wave of the future. He said –

“Cryptocurrency will be here. The ability for the world to have a very low-friction, low-cost way of exchanging value is going to be here for a long time. Blockchain’s going to be here for a long time and it’s going to be a fundamental form of computing” – Hunag on CNBC

Nvidia’s graphic processing units (GPUs) are cards used in the computer servers to mine or create new bitcoin and other altcoins that they earn for solving transaction-fueled puzzles and advancing the blockchain. They are less incentivized with a BTC price under pressure.

In the fourth quarter, when the bitcoin price was climbing higher, “cryptocurrency demand “exceeded” the company’s expectations, comprising a greater percentage of revenue versus the third quarter, as per Nvidia’s CFO on the earnings call.

Yahoo Finance

Bitcoin miners have taken it on the chin of late, with Fundstrat putting the “breakeven” price for BTC mining at $8,000 and the bitcoin price currently trading below $7,500.

Wall Street analysts backed off a little from their cheery outlook on Nvidia’s stock earlier this year amid extreme volatility in the bitcoin price. But that hasn’t dampened Nvidai’s belief that cryptocurrencies will be a mainstay of its business, saying “I expect blockchain, I expect cryptocurrency to be an important driver for GPUs.”

Jockeying for Position

Nvidia isn’t the only player in the bitcoin-mining GPU market, with AMD similarly competing for market share. Also, there may be a new sheriff in town, with Beijing-based Bitmain developing its ASIC product to mine Ethereum, the No. 2 cryptocurrency by market cap.

Rising demand for ASIC-powered mining could dampen GPU use among miners. Analysts cited in CNBC suggest that revenue derived from Ethreum-mining comprise one-fifth and 10% of total sales for AMD and Nvidia, respectively, though the companies have kept these percentages close to the vest. A trio of other companies are also developing Ethereum ASICs, analysts say. But Nvidia’s Hunag doesn’t seem worried –

“The reason why cryptocurrency became such a popular thing on top of our GPUs is our GPUs is the world’s largest installed base of distributed supercomputing,” Huang explained.

Nvidia’s Huang pointed to a diversified portfolio for GPUs whose main drivers are the following categories –

gaming

data center

professional graphics

autonomous capabilities