Financial Crimes in Video Games

Are Video Game Companies Violating US Financial Crimes Laws?

Video Game Virtual Currencies & Financial Crimes – A Complex Problem Often Overlooked

Over the past several months, I’ve written a few articles regarding video game development and how novel technologies may be used in the creation of virtual in-game currencies and even to provide real-world value to in-game tokens for use in purchasing tangible merchandise from in-game stores.

While my previous articles spoke about new innovations in payment processing for the Video Game Industry- this article addresses the issues which revolve how many of those new processes may expose the game developer to liabilities with financial crimes.

Financial Crimes - Know Your Player - Video Games - Compliance - Anti-Money Laundering - Penalties - Pitfalls

Video Game studios are masters at bringing in the best artistic and creative talent to craft the visual universe around captivating and engaging storytelling. Successful games require artists, writers, modelers, animators, developers, QA and a slew of other personnel to come together and create that immersive and magical world where the player is engaged in the game.

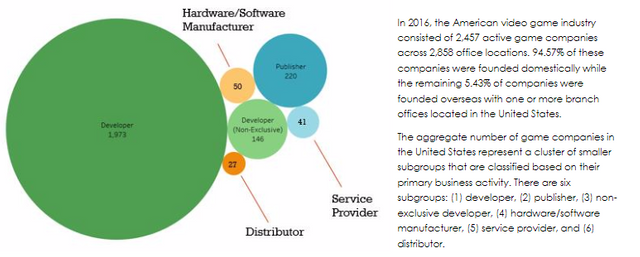

Competition is extreme within game development studios. In 2016, it was estimated that just in the United States alone, the game industry consisted of 2,457 active game studios across 2,858 office locations. 94.5% of these companies were founded domestically, while the remaining 5.4% were founded overseas with one or more branch offices located in the United States. Video game companies are in all 50 US States and the District of Columbia – out of which 29.8% of all game companies are located in California which is the top state of the American video game industry.

With the density of competition in the video game industry, companies are seeking new technologies to create new player experiences and the ability to set themselves apart from their competition.

In-Game Stores

Digital Asset Tokenization

Assigning Real-World Value to In-Game Virtual Currencies

Creating Partnerships With Merchandisers To Accept In-Game Currencies In Exchange For Tangible Goods

But with these new player experiences and technologies comes a slew of potential financial and criminal pit-falls of which game studios may not even be aware they may be violating.

Enter FinCEN

Understanding that game development is a high-overhead and labor-intensive endeavor, it’s a difficult, and often impossible, financial choice for smaller or indie studios to dedicate the time and resources necessary to maintain compliance with financial crimes regulations.

Game development costs can exceeded well over USD $200 million for games such as GTA - which means even the large studios are wary to incorporate compliance staff into the mix of their creative, coding and artistic talent.

But what do financial crimes regulations have to do with the video game industry; and why should game studios have financial crimes compliance experts on staff?

With extreme competition for new player experiences and new monetization processes, the video game industry is expanding into in-game merchandising, in-app purchases and exchanges between virtual and real currencies, and token gifting.

Enter a new dynamic in video game development with Know your Client and Anti-Money Laundering regulations: (KYC/AML) – an area which may require very specific expertise to ensure your studio doesn’t fall into a breach of US Federal law. Good-faith efforts to provide gamers with new experiences may bring into play a tremendous burden for game studios in record-keeping, identity authentication, transaction tracking, and documentation.

Game studios, and even independent developers, should be cautious that in the creation of in-game virtual currencies, they could be in breach of the same rules and regulations which cryptocurrencies such as Bitcoin are subject to with the US Treasury Departments division, FinCEN (Financial Crimes Enforcement Network). Games which allow for the purchasing of tangible goods, or for the conversion of virtual currency into fiat currency may be subject to the Anti-money laundering laws.

But why is this?

FinCEN, in 2013, released the documentation for guidance for virtual currencies. As it turns out, it’s potentially damning to the Video Game Industry, as any individual or company involved in virtual currency transactions could be considered a money transmitter if; (1) it acts as an “exchanger” or “administrator” of the transactions; (2) the virtual currency involved is a “convertible virtual currency”; and (3) the company facilitates the movement of funds between different persons or locations.

So, let’s take a look at how FinCEN defines what an “exchanger,” is and how they look at “convertible virtual currency,”– as these definitions can dictate whether a game studio is potentially subjecting themselves to some serious legal jeopardy.

EXCHANGER: This is a person (or entity) engaged as a business in the exchange of virtual currency for real currency, funds OR other virtual currency. More specific to game studios, an exchanger is an entity that issues a virtual currency and has the authority to redeem the virtual currency. A game studio that issues a virtual currency can include the service of providing game players virtual currency, even for free, or in exchange for real currency or as a type of promotion. The redemption process includes withdrawing the virtual currency from circulation regardless of whether or not it’s in exchange for in-game or in-app items (skins, devices, upgrades) real-world goods or services or real currencies.

CONVERTIBLE VIRTUAL CURRENCY (CVC): FinCEN defines a CVC as a virtual currency that either (1) has an equivalent value in real currency or (2) acts as a substitute for real currency.

As an example, most everyone can identify with; Bitcoin is considered to be a CVC because it has an established exchange rate with multiple fiat currencies and is accepted as a payment method by many merchants in exchange for goods and services. Cryptocurrencies such as Bitcoin, Ethereum, LiteCoin and the thousands of others were developed for the specific purpose of substituting for real currency and are clear examples of CVCs.

If a game studio creates a virtual currency with these same capabilities, it could be considered a CVC and subject to FinCEN regulations. However, this definition is surrounded by a lot of gray and isn’t such a straightforward definition when the currency is for in-game/in-app use only and not intended as a decentralized fiat substitute. For the most part, this will typically depend on the types of activities the developer permits. If a game studio allows a game player to exchange that in-game virtual currency for fiat and vice versa, or if the studio enables players to purchase real-world goods and services with those virtual currencies, then the virtual currency is most likely a CVC.

Compounding these regulatory issues are the policies of FinCEN which may require a game studio to be registered as a "money transmitter." In the legal code of the United States, a money transmitter, or money transfer service is a business entity that provides money transfer services or payment instruments. These entities fall under a larger group of companies called money service businesses or MSBs. Under US Federal Law 18 USC § 1960, businesses are required to register for a Money Transmitter license where their activity falls within the state definition of a money transmitter.

On top of this confusion, forty-nine of the 50 US states, with the exception of Montana, regulate money transmitters, although the laws vary from one state to the next.

So, how would you know if your game, your game studio or your game idea would require compliance with FinCEN regulations? While laws are constantly evolving, the below four examples would most likely require a game development studio to operate under the FinCEN regulations of a money transmitter:

Merchandise: If a studio develops a game wherein a player may purchase, with actual currency, "rewards points" or whereby they gain those points from using certain features of the game, and whereby the game studio has an arrangement with a merchant to offer real-world, tangible merchandise within the game (or via an external purchase portal), and lists the price of various items in either real currency or in reward points - FinCEN would likely determine that the game studio has facilitated the movement of funds between users and merchants and would require the adherence to all applicable regulations.

Gifting: If a developer creates a game which allows players to purchase tickets, tokens, or other digital assets which are used to access premium content, and if those tickets, tokens or digital assets can also be cashed back out into real currency - an MSB license will most likely be required. For example, if there are two players of the same game who wish to use the premium content together, but only one has the required ticket/token, and the game permits player one to gift those tokens to player two, by debiting the tokens from player one's account and crediting the account of player two - then the game studio has facilitated the movement of funds between users and would be likely require registration as an MSB to avoid FinCEN violations.

User-Generated Content: If a game features a virtual world which allows players to purchase tokens which can then be spent on virtual items to customize their character (skins, accessories, weapons), and those upgrades are user generated by other players through a process the developer creates to allow the uploading and selling of that content, (sold for and purchased with in-game virtual currencies) then the developer has facilitated the movement of funds between the player purchasing the virtual item and the player to designed and sold the virtual item.

Game Marketplaces: We've all seen this one, and it's most likely the most common potential regulatory trap any game studio can fall into: a studio develops a game which features a marketplace where gamers can buy, sell, or exchange virtual items they've acquired during gameplay. Perhaps the game features two different virtual currencies, "gold", and "gems." Players acquire the gold through in-game achievements such as slaying a boss in a fantasy game or scoring a hole-in-one on a golf game. The gems, on the other hand, are purchased with real currency. Players can also upload custom player-created items and sell those items on the marketplace in exchange for the gems - and can exchange those gems for real currency. In this case, the developer is likely to be found as a facilitator of the transfer of funds between buyers and sellers through the marketplace and is subject to FinCEN regulatory compliance.

Under the Bank Secrecy Act (BSA), 31 U.S.C. 5311 et seq., FinCEN may bring an enforcement action for violations of the reporting, record-keeping, or other requirements of the BSA. Civil money penalties may be assessed for record-keeping violations under 31 C.F.R §1010.415 (formerly 31 C.F.R. §103.29), or for reporting violations for failing to file a currency transaction report (CTR) in violation of 31 C.F.R. §1010.311

The Solution - Avoidance, In-House Compliance or 3rd Party Management?

Avoidance - any game studio can maintain compliance with FinCEN through simple avoidance. Prevent the virtual currency from being returnable, exchangeable or refundable, either for real currency or for real goods and services. Even if a virtual currency can be purchased with real currency, your game's terms of use could clearly spell out that there is no method which allows for it to be "cashed out." Additionally, simple things such as making certain that your game's virtual currency is only a limited, non-transferable, non-exclusive license and that it doesn't represent a property interest of any kind - and ensure you make clear that the virtual currency has no value in any fiat currency. However, as with everything, consult with your legal counsel for confirmation.

But so much for creating new player experiences, creating new monetization platforms, revenue lift, and increasing your player base through loyalty points, digital asset marketplaces and in-game merchandising. Avoidance means no innovation. No new strategies. No new player engagement methods. While this is the safe option - your players are evolving, and so are their wishes for new engagements.

In-House Compliance - Hiring just one single person to oversee your FinCEN compliance will add approximately $120,000 USD per year to your overhead in salary alone. Glassdoor reports that a FinCEN compliance Project Officer commands between $119,000 to $129,000 in annual salary. On top of this, your studio will need to bring, in-house, the KYC/AML integration specialists to comply with the digital record keeping in processing your game players when they register an account. The creation of transfer limits along with the integration of manual and automated verification processes will incur a tremendous development cost in time and funding as well. Developing the framework and the compliance processes and integrations required for in-game marketplaces which merge traditional currencies with cryptocurrencies, virtual currencies and decentralized exchanges allowing for a studio to process currency conversion orders and payments in real-time can take years of development. Additionally, each blockchain network utilized adds a layer of code complexity to your project and increases your overall go-to-market time.

3rd Party Management - Video game players are the most passionate and engaged fans in the world and game developers capitalize on this by monetizing their games through digital products. But FinCEN regulations can stifle this innovation by overburdening game studios with complex compliance mandates. While all the solutions exist from multiple vendors in varying states of capacity and capability, Video Game Studios would be well served by looking to integrated solution providers with multiple integrations that address everything from Single Sign-On, Player to Authenticated ID Matching, and Digital Transaction Processing.

Integrated solution providers enable game developers to continue to make the best games possible while building on a platform which simplifies KYC/AML regulation compliance and helps to ensure compliance with the law. Many of these companies integrate with exchanges to facilitate tracking of in-game trades and reconciliations with fiat and digital assets. Integrated Solution Providers are a tremendous advantage to game studios looking to simplify processes and engage players in new experiences and monetization models, compliance with KYC/AML regulations are never accomplished through a single solution. I always recommend utilizing legal counsel for compliance reviews, especially in regards to FinCEN mandates.

Congratulations @taoofrandom! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!