The WeWork Bubble -- Overvalued and Underperforming: Is there a future for the WeCity?

Over the past two years, WeWork has become unavoidably synonymous with co-working, millennials and technology start-ups. Offering companies and individual freelance workers flexibly-leased office space with conference rooms, kitchen areas and lounge spaces, WeWork is simultaneously generating revenue and proliferating a vision of work, culture and city life. As a brand, it has penetrated not only our vocabulary but our urban fabric, currently boasting offices in 113 locations in 33 countries. WeWork can be thought of as the epitome of the sharing economy. It is built on a method of value exchange that vaguely exists outside of the company’s own marketing-speak, which claims to be a value proposition that is enabling a “We Generation.”

Besides their penchant for utopian language, the defining feature of companies that are part of the Sharing Economy is a focus on crossing software technology with real space, while concurrently avoiding the need to have any ownership of physical and tangible assets. AirBnB is now the world’s largest hotel service and Uber is now the world’s largest Taxi service, though neither company actually owns a hotel or taxi. While WeWork is commonly presented and perceived as a real estate developer disrupting the real estate industry, it in fact follows the Sharing Economy axiom: it is the world’s largest co-working company without owning any real estate.

But in several crucial ways, WeWork is different from its sharing economy contemporaries. AirBnB and Uber become more resilient to competition when more users join their networks, because users access the assets of other users. In sharp contrast, WeWork first rents office space from land lords, then invests money to renovate it, and finally leases parts of the office to companies. Rather than a network, WeWork operates like a centralized hotel service providing amenities for co-working spaces.

WeWork’s staggering valuation at $16 billion dollars makes it one of the most valuable startups in the world, but it also prompts a host of bubbly questions: What is really backing this valuation? What services does WeWork really offer, what is the company’s vision, and is it going to have a real impact on the future our cities?

Though the co-working business is booming, in 2016, despite its optimistic investor valuation, WeWork has had a slew of bad news. When WeWork was founded in 2010, it had a monopoly on the market as a first mover, but today it faces an increasingly competitive landscape. Throughout the United States, the number of co-working spaces has grown from 250 in 2010 to nearly 3,000 in 2015. Yet, at WeWork, daily memberships, selling for $45 a day, have failed to take off as a source of revenue. The company has overextended its finances, and finds itself constrained in its ability to renovate further spaces.

Delays in the opening of new locations, construction costs going over budget, and subsidies from landlords proving difficult to obtain are hurting the company’s optimistic projections and service fees. Rents have fallen from $750 to $550 for one-person monthly offices as locations struggle to fill up. In 2015, the company projected $1 billion in revenue by the end of 2016; in 2016, with that goal unachieved, the company projected $1 billion in revenue by the end of 2017, which appears to still be hopeful. Further, the 2016 profit projections were cut an alarming 78% (to $14 million from $65 million). Then, earlier this year, WeWork fired 7% of its staff and put out a hiring freeze. (In related news, it recently lost a labour dispute, which found that the company was discriminating against janitorial workers who wanted to join a labor union.) The company is profitable, still, but its ability to remain relevant and successful has seriously fallen into doubt.

The basics of WeWork’s business model are this: the company creates an individual LLC for a new location and signs a long-term lease with the office building. The company then is required to pay a year’s rent in cash upfront in order to pursue extensive renovation that will make the space like all other WeWork locations. WeWork applies a strict company aesthetic and design (a prime example of what Carles Buzz called the contemporary conformist design aesthetic: “Wood. ‘Weathered.’ Exposed Brick. Zany Light Fixtures. Hints of Metal. Plants (but not generic flowers).”) The individual offices are then subleased to start-ups and freelancers at an enormous markup. What is concerning about this model is that WeWork fronts a substantial cost upfront and retains no ownership in the physical asset of real estate, the very space it claims to provide in its company mission. As such, WeWork depends on constant economic growth. A downturn would lock the company, which has no assets to sell, into lease obligations, leaving it with no tangible value to fall back on. WeWork is betting that the customer they have designed for — the start-up worker, precarious by nature — will become the cultural standard. In the meantime, co-working and co-living spaces are capital-intensive processes the company must endure.

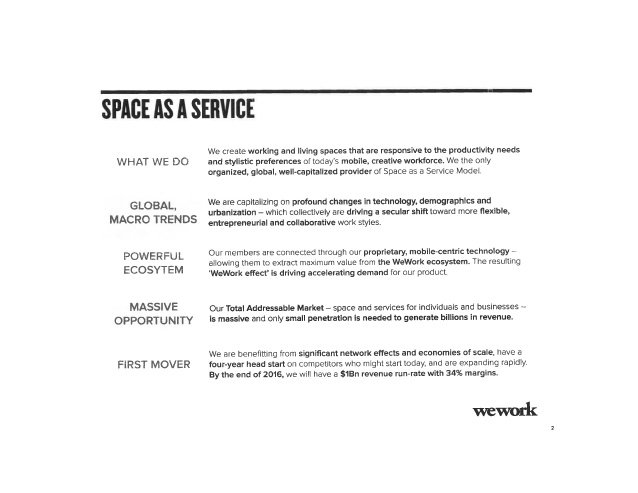

The main value proposition of WeWork is something that is called Space as a Service (SaaS), a play on Software as a Service. SaaS means providing working and living spaces that align with the productivity and stylistic needs of a new mobile, creative workforce by empowering flexible, entrepreneurial and collaborative styles of work. The “WeWork” effect comes from the proprietary mobile app technology that is supposed to fuel the WeWork ecosystem. Space as a Service sounds extremely similar to what Architects and designers have been offering in analog for decades.

With its rigid business model, the company’s $16 billion dollar valuation seems like a bubble inflated with hype — projections and visions that are increasingly incompatible with reality. The company’s superfluous valuation has come under scrutiny and been the subject of debate among investors. While real estate tycoons Mort Zuckerman and Bill Rudin are among the firm’s largest investors, other investors call bullshit. Investor Barry Sternlicht, who runs the largest commercial mortgage Real Estate Investment Trust in the United States, has pronounced WeWork overvalued: “When these things go down they do not go from $16bn to $14bn, they go from $16bn to $2bn. There is no elevator down, you hit the floor.”

Believers in WeWork, meanwhile, do not just see the company as a leasing service, but as a global community of valuable innovators. WeWork mantains that their value lies in their brand’s appeal among millennials, and their network — the so-called physical social network. WeWork President Artie Minson states: “Things that will continue to differentiate WeWork are having the most robust community, the best employees and the most innovative technology, design and service. Coupling these with our strong balance sheet make us a great partner for landlords.”

WeWork’s other purported advantage lies in its technology. The company has released an in-house app for community members, a sort-of Facebook-meets-Linkedin where users can post events, connect with each other, and schedule meetings. The company had near-utopian expectations for the app’s success, but a leaked report shows that only 17% of members have posted more than once on the network. The company that leaked the report was a data-tracking service that worked from within a WeWork. The company was evicted after the leak for an ostensible violation in terms of services.

WeWork seems to have a habit of missing the picture of what their customer and the market actually want, the clearest example being WeLive, the company’s co-living endeavor. WeWork describes WeLive as: “a new way of living built upon community, flexibility, and a fundamental belief that we are only as good as the people we surround ourselves with…From mailrooms and laundry rooms that double as bars and event spaces to communal kitchens, roof decks, and hot tubs, WeLive challenges traditional apartment living through physical spaces that foster meaningful relationships.”

WeLive follows the same approach as WeWork: space is leased long-term, renovated and then subleased, except this time as high-end dormitory-style community living. WeLive relies on the same value proposition as WeWork: according to its logic, the rate of rent can not be calculated by square foot, but by the value of community and building amenities. If WeWork has seriously missed the mark with this project, the reason seems to be that they have fundamentally overestimated the amount of tech-working millennials that can afford the luxury of their services. Private studios at WeLive begin at $2000 a month; for $1,375 a month, you get a community murphy bed that pulls out in a communal living room, with only a curtain for privacy.

This business model is based on the myth of the millennial as an affluent young person who does not want to pay for space but wants to pay for communal experiences, communities, and other perks of the sharing economy. However, actual millennials earn $2,000 less than their parents did at a equivalent age and are overwhelmingly cash-strapped. With WeLive, the total WeWork vision of a ‘we’ economy of services appears to rest on foundational assumptions that are proving wrong. To date, 2 WeLive locations have opened, instead of the projected 14.

At its core, WeWork is a company pursuing an all-encompassing tech-utopian vision for how we work, live and build our social communities. It imagines itself as a tech company at the nexus of start-ups, emerging industries and the millennial generation. In fact, WeWork today is looking less like a tech company and increasingly like a subleasing company charging high rates for an ambiguous community of value. WeWork’s founder Adam Neumann sees the company as a real estate operating system that will eventually offer shipping, software, credit cards, payroll, banking and company training all through the company’s app. Neumann states that WeWork will next move into creating full WeNeighborhoods and then WeCities. “It’s a when, not an if,” he says, with characteristic modesty.

As the news of WeWork’s financial setbacks and continued discussion of its overvaluation spreads, the company continues along a path of attempted technology to affect architectural planning, programming, design, and illusory community. Beyond the in-house app, WeWork has obtained technology through its acquisition of the architectural consulting firm CASE in 2015, which specialized in building information modeling (BIM). Now, when scouting new locations, WeWork uses a $120,000 LIDAR 3D scanner to create a highly-detailed model of each floor and lay out the renovations. WeWork’s Times Square location hosts a “beta floor” where the newest innovations are tested, such as environmental temperature sensors, the internet of things, and wall-mounted beacons that track the members’ movements. The company says the data could help them adapt their design to the habits and preferences of their clients.

The sharing economy, meanwhile, continues to evolve and adapt. AirBnB is pursuing formal partnerships with landlords, while Uber and similar services move closer towards an entirely new economy of self-driving vehicles. Yet, as 2016 comes to an end, the image and service of WeWork has begun to seem dated, marketed as it is to a demographic that does not exist, at least in the price range in which the company currently operates. More spaces are starting to offer co-working services without needing companies like WeWork as a middle-man. For example, a new company created by two of WeWork’s former employees aims to enter the market space with an entirely different business model to streamline the proliferation of local and individual co-working spaces. WeWork touts their use of technology and space, but new companies are emerging that actually implement the technology that WeWork only uses as a marketing ploy. All this calls to mind a popular historical trope: any entity that makes all-encompassing claims to society and the city is surely going to fall short of those claims. That is how we actually work.

Perfectly!

Congratulations @foamspace! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @foamspace! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!