Stop Loss and Trailing Stop Loss in Cryptotrading

Stop-Loss

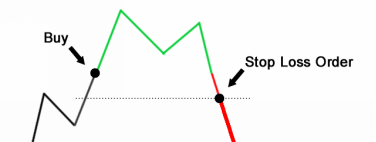

Stop-loss by definition is an order placed to buy or sell once the security reaches a certain price. A stop-loss is designed in such a way that it limits an investor's loss on a security position. Setting a stop-loss order for 5% below the price at which you bought the security will limit your loss to 5%.

For instance, let's say you just purchased Bitcoin at $6000. Right after buying the security you enter a stop-loss order for $5990. This means that if the security falls below $5990, your Bitcoin contracts will then be sold at the prevailing market price.

Picture Credits – Google Images

Trailing Stop Loss

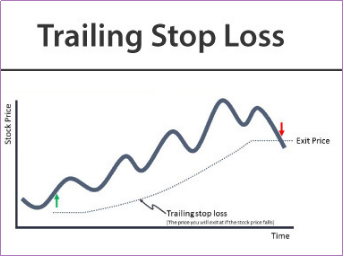

Stop-loss orders are traditionally thought of as a way only to prevent losses. But another use of this tool is to lock in profits, which is referred to as a "trailing stop". Trailing stop loss is a type of stop-loss order which combines both risk management and trade management.

They are also known as profit protecting stops as they help lock in profit achieved on trade while also doing the work of a stop loss that is stopping the amount that will be lost if the trade doesn't work out. Trailing stop-loss can either be set up on your trades with a single click of a button in most of the trading websites can be manually implemented by the trader.

How does a Trailing Stop Work?

A trailing stop-loss is initially placed in the same way a regular stop-loss order. A trailing stop for a long trade would be a sell order and should be placed at a price that was below the trade entry. The fundamental difference between a conventional stop loss and a trailing stop-loss is that the trailing stop-loss is dynamic. That means it can move as the price moves. For every pip the price moves, the trailing stop would also move a pip. For instance, if the price moves a cent up, the trailing stop loss will also move a cent.

Trailing stops only move in direction of the trade, so if you are long and the price moves 15 cents, the stop-loss will also move up 15 cents.

Picture Credits – Google Images

But the beauty of the trailing stop-loss is that if the price starts to fall the stop loss doesn't move. If a long trade is entered at $50, a ten cent trailing stop would be placed at $49.90. If the price then moved up to $50.10, the trailing stop would move to $50.

If the price continued up to $50.20, the trailing stop would move to $50.10. If the price then moved back down to $50.15, the trailing stop would stay at $50.10. If the price continued down and reached $50.10, the trailing stop would exit the trade at $50.10, having protected ten cents of profit.

Trailing stop-loss works the same way for a short trade. The only difference is that when we short, we are expecting the price to drop. Hence, a trailing stop loss is initially placed above the entry price. If a short trade is entered at $30 with a 10 cent trailing stop-loss and if the price moves to up $30.10, we are stopped out with a 10 cent loss.

If the price drops to $29.80, our stop loss will drop to $29.90. If the price rises to $29.85, our stop loss stays where it is. If the price falls to $29.70, our stop loss falls to $29.80. If the price rises to $29.80 or higher we will be stopped out of the trade with a 20 cent profit.

Some traders use trailing stops with every trade they take and some traders never use trailing stops. It is up to you to use them or not in every trade you make. Profit target is also a feasible exit and can be used instead of trailing stop loss. You can also combine both of them as per your trading activity. Set a stop loss to move automatically or manually adjust the stop-loss yourself.

Do not set a trailing stop loss too close to the entry as that may result in a premature exit. Understand that the basic purpose of the trailing stop loss is to lock in profits as the price moves in favor of your direction and to get you out if the price is potentially reversing.

Finally, we can conclude by saying Stop-loss is a type of insurance policy. You hope you should never use it but if at all the odds are against you, it will help you in protecting from incurring major losses.

Learn more at

https://covex.io