SLC | S21W6 | Costs for Entrepreneurs - Cost Structure.

Hi everyone, i am glad to participate in this weekly task again, i have participated consecutively all weeks and learned many new things and also revised a lot of stuff from my post graduation syllabus anyways lets get started.

Cost structure and importantance for entrepreneurship

In my understanding, cost structure is a systematic arrangement of categorization of all expenses which are incurred by a business for producing goods or deliveries services.

It includes both fixed costs such as rent, salary etc and variable costs such as raw materials, labor etc. The main idea of a cost structure is to provide a detailed and clear understanding of division of the resources on how they are being used and based on the data how financial planning can be done in a better way and effective decision making.

As we know entrepreneurs businesses have limited resources and more uncertainties, a clear understanding of your business cost structures allows a business to efficiently allocate all the limited resources and make rational decisions for their business.

Importance & Benefits

Effective pricing - With the help of detailed cost structure analysis, business get to know the cost incurred for producing each unit of output and with that they can determine the minium selling price to cover the costs and set up required margin to get the desired profit.

Efficient allocation of resources- Detailed cost structure analysis allows the entrepreneurs to find out the waste expenses and re allocate the resources in an effective manner so maximise the output from the limited resources.

Scalability and Growth - With the help of cost structure, the businesses can plan scalability and future expansion of their business, because they can understand the production cost, determine profit and plan growth for their business.

Examples of business that use cost structure methods

Luxury symbol Rolex Watches - Luxury watch makers like like Rolex company, they have adopted a cost structure driven by value of their product in the market.

They focus on craftsmanship, elegance, exclusivity, genuine materials, which makes their product a status symbol for customers rather than a utility, because of that the customer are willing to pay a higher premium price for the associated value and prestige with their purchase of luxury watch.

Discount Retail Chain - Zudio It's a discount retail chain brand in India owned by tata & sons, their retail store sell good quality products at a significant lower price, as compared to their competitors, their stores works on a low cost operating structure.

They focus on bulk purchasing, private label products and no marketing expenses, their main marketing is done by word of mouth itself, they open retail stores in tier 1 2 and even 3 cities but at a normal location which is cheaper as its a normal place, so they do maximum saving and operate on low cost, they target price sensitive customers, who look for value in everyday goods, with this model they maintain profitability even by selling at low prices.

High Technology Brand Apple- Brands like apple invest heavily in the research and development design and branding for their different products.

They focus on superior build quality and overall aesthetics physical appearance of their product to be premium. They offer latest innovative features and technology to the users, mainly because of their ecosystem like apple do, mac, ipad, iPhone, apple watch etc a full network to streamline work.

By focusing on innovation, quality and smooth user experience they build customer loyalty and typically position themselves as industry leaders, customer willingly pay higher prices because of the positioning of the brand and value perceived by the customer on their investment is worthy for them or at least they think it is.

Elements of Cost Structure

The elements of cost structure can be divided into 4 various cost which are discussed below in details.

Direct Costs- These are costs which are directly associated with the production of a good or service, considering the example of a bakery business, direct costs will include raw materials such as flour, sugar eggs since they are directly associated with the production of the cake.

Indirect costs- These are the costs which are not directly associated with the production but support the production operations from backend. The simplest example can be the electricity or rent for a production factory

Fixed Costs- These are the costs which are tend to remain constant irrespective of change in volume of production, this will not change with the change in the production. For Example Monthly lease payments for a office will remain same irrespective of its use.

Variable Costs- These are the costs which are tend to change as their is change in the production volume, variable cost will increase if the production is higher and will decrease if they production is less. For Example - Packaging materials if the production is less the requirement will be less and if the production is higher the requirements will be higher.

CASE SOLUTION

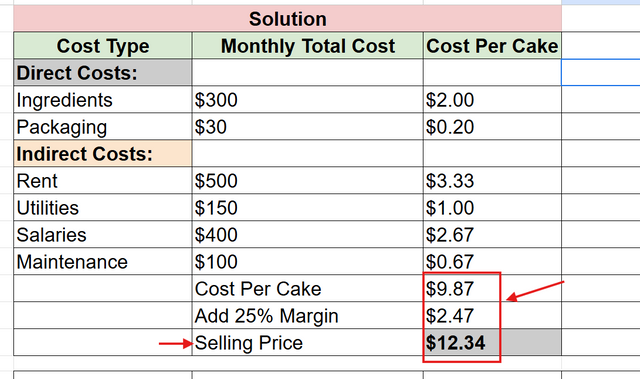

As per the case we have to produce 5 cake per day and set a 25% profit margin, for this we need calculate all the costs for per unit of cake produced. Also assuming a monthly data of 30 days.

- Direct Costs

Ingredients: $300

Packaging: $30

Total 300+30 = 330$

- Indirect Costs

Rent: $500

Utilities: $150

Salaries: $400

Maintenance: $100

Total Indirect Costs = 500+150+400+100 = 1150$

Total Cost:

Direct Cost + Indirect Cost= $330 + $1150 = $1480

Cost Per Cake Production

Total Monthly Costs ÷ Monthly Production = $1480/150 = $9.87 (approx)

Selling Price Per Cake (including 25% Profit Margin)

Cost Per Cake × (1 + Profit Margin) = $9.87 × 1.25 = $12.33 (approx)

- Conclusion - Our Cost per cake is 9.87$ approx and we need to add 25% profit margin so multiple with the margin the cake should be sold at 12.33$ per cake approx to earn the desired profit.

I invite my friends @ahlawat @senehasa @awesononso

Greetings @rishabh99946

1.- You have shared the concept and importance of the cost structure for the enterprise, highlighting that it allows to control the resources invested in a productive process.

2.- You have mentioned acceptable examples of companies that adjust to the cost structure methods. You have provided the description of each of these methods, allowing the analysis of all the costs involved.

3.- You have presented the elements of the cost structure, with their respective examples; these allow us to identify the expenses in each functional area of the company.

4.- You have developed the proposed exercise acceptably, performing in detail each of the calculations. We would have liked to see a little more analysis of the results.

Thanks for joining the contest