SLC | S21W6 | Costs for entrepreneurs - Cost structure

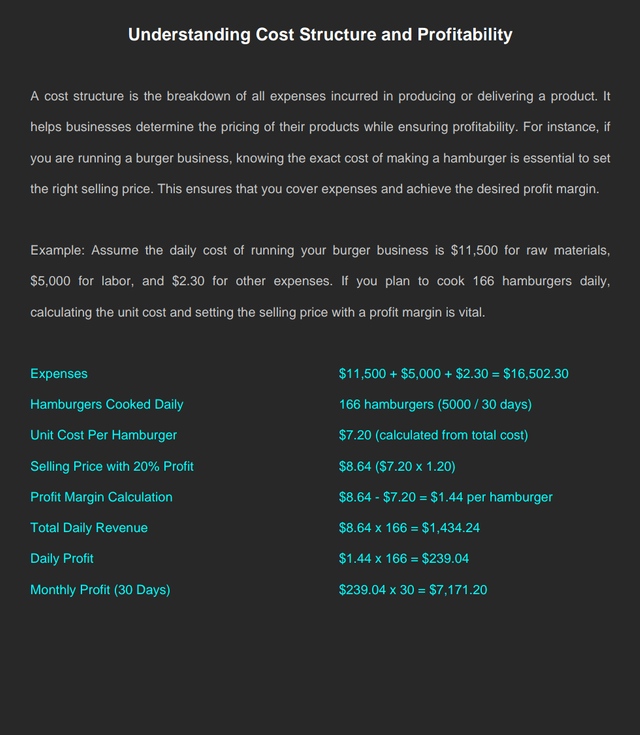

Canvas source A cost structure is akin to a recipe showing everything it takes to run your business. From raw materials to staff salaries, it lists every expense involved in making and selling products.

It is like your business GPS, guiding you in the proper setting of prices to ensure that you are not accidentally selling at a loss or pricing too high to scare away customers.

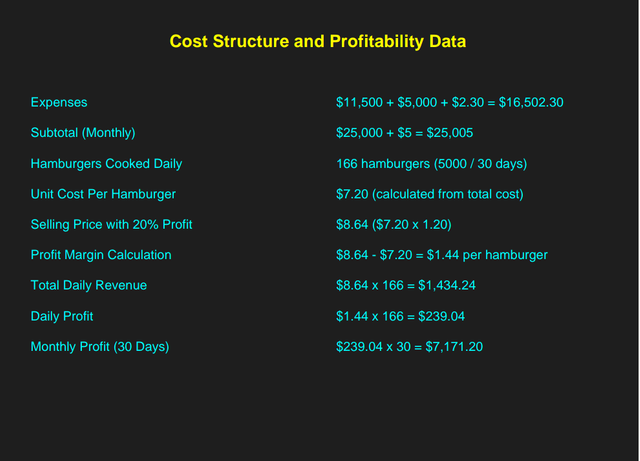

For instance, if it costs you $7.20 to make one hamburger, you know that is how much to charge for it. Add a 20 percent profit margin, and you will need to sell the hamburger at $8.64.

Without this knowledge, pricing is guesswork. Think about selling hamburgers for $6 and then discovering later that you lose money every time a customer takes a bite.

Entrepreneurs who know their costs are like the best chefs in terms of knowledge about their ingredients: they only produce sustainable recipes to success, not just delicious meals.

So, whether you are cooking burgers or launching a tech startup, knowing your cost structure could make all the difference between long-term profitability.

Cost Structure Cost Structure |

|---|

Solid grounding Solid grounding |

|---|

Businesses of all types use cost structure techniques to control costs, determine price, and maintain profitability. Here are some examples of businesses that use these techniques, along with an explanation of each:

Fast Food Restaurants Fast food chains such as McDonald's or a local burger joint heavily depend on cost structure analysis in determining their product prices. They measure the raw materials such as meat, buns, and vegetables against labor, utility bills, and marketing. For example, if it takes them $7.20 to make one hamburger, they may set a price of $8.64 for the purpose of taking home a 20% profit. It becomes profitable while maintaining a competitive price. Economy of scales is what fast-food businesses use to scale down their cost where they purchase ingredients in a huge quantity to reduce the per-unit cost.

Manufacturing Companies

Car manufacturers such as Toyota use cost structure methods to compute the cost of producing each car. This includes the cost of materials such as steel and electronics, labor, factory maintenance, and shipping. In this case, if the car costs $20,000 to produce, they may add a profit margin of 30% so that they sell it at $26,000. In a competitive industry, accurate cost calculations can help avoid overpricing or losses while maintaining quality.

E-Commerce Businesses

Cost structure analysis is used by online retailers like Amazon to price their products while incorporating storage, packaging, delivery, and website maintenance costs. For instance, if the total cost to fill an order is $15, Amazon may charge $18, which gives it a 20% profit margin. They also analyze data to minimize operational costs, such as using optimized packaging to save on shipping.

Tech Startups

Zoom is a SaaS company that calculates its cost structures using server costs, software development, customer support, and marketing. For instance, if it costs them $10 in terms of monthly operational costs for every customer, they will have to charge $15 to be in profit. SaaS businesses usually operate on a subscription model, and knowing the exact costs per customer helps them stay profitable and invest in growth in the future.

Retail Stores

Supermarkets like Walmart use the cost structure approach to run the price management of their business. They compute the costs of buying the inventory, storage, employee wages, and the store maintenance. For example, if it costs $5 for procurement and storage, then they sell it at $6.50. In this case, a 30% markup is earned. They also track the sales volume and price management to stay within the competitive retail market.

Event Management Companies

Event planners apply cost structure methods to charge for their services, which in this case include venue, decoration, catering, staffing, and transport. For example, if one intends to organize a wedding at $20,000, they may charge $25,000, with a 25% profit margin. When a cost structure is correct, event managers can offer a package in line with customer budgets yet leaving room for profits.

Why Cost Structure Methods Matter

These examples show the importance of cost knowledge to any business, whether burgers, cars, or services. With the assessment of costs and desired profit margins, firms will always have sustainable operation with value delivered to their customers. In addition, good cost management helps organizations adapt to the market forces, eliminate unproductive expenditure, and base decisions on data for a long run.

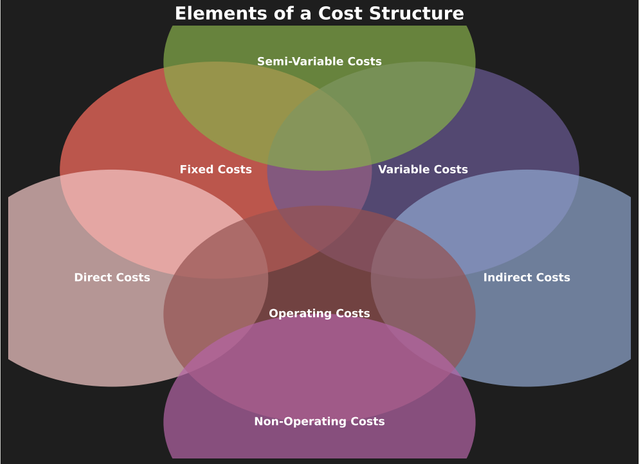

Elements of a Cost Structure

A cost structure is composed of many different elements that help companies to understand and group their costs. It aids in budget planning, pricing, and profitability maximization. The main elements include the following:

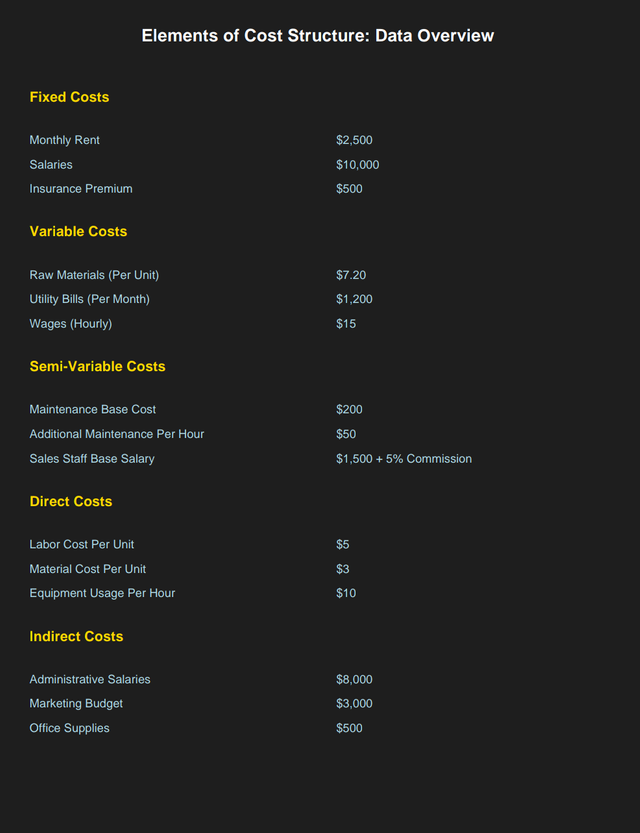

1. Fixed Costs

Fixed costs are costs that remain constant regardless of the level of production or sales. These costs do not vary with business activity levels.

- Examples:

- Rent for office space or factories

- Salaries of permanent employees

- Depreciation of machinery and equipment

- Insurance premiums

- Subscription fees for software tools

For example, a bakery may have to pay $2,000 monthly rent,, regardless of whether it sells 10 or 1,000 loaves of bread.

2. Variable Costs

Variable costs fluctuate with production or sales levels. They increase as more products are made or services are delivered & decrease when production slows.

- Examples:

- Raw materials (e.g., flour for a bakery, steel for a car manufacturer)

- Utilities like electricity or gas,, which increase with usage

- Wages of hourly or contract workers

- Shipping and packaging costs

A restaurant, for instance, spends more on ingredients like vegetables & meat during peak seasons and less when sales decline.

3. Semi-Variable Costs

These costs have both fixed and variable elements. They are constant at one level of activity but increase as the production increases.

- Examples:

- Maintenance costs for machinery (a fixed monthly fee plus additional costs for extra usage)

- Utility bills with a fixed base charge & variable rates for higher usage

- Sales staff salaries (a base salary plus commissions based on sales)

For example,, a retail store might pay a fixed monthly fee for electricity but see increased charges during holiday shopping seasons due to higher energy consumption.

4. Direct Costs

Direct costs are directly attributable to the production of goods or services. These costs vary based on the number of products made or services offered.

- Examples:

- Labor costs for production workers

- Raw materials like fabric for clothing manufacturing

- Equipment used specifically for production

A furniture company might include wood, nails, and glue as direct costs for producing a chair.

5. Indirect Costs

Indirect costs are not directly tied to the production process but are necessary for running the business.

- Examples:

- Office supplies like paper and ink

- Administrative salaries

- Marketing & advertising expenses

- Security & cleaning services

For example, a tech company might include its office utilities and internet as indirect costs while developing software.

6. Operating Costs

Operating costs encompass all costs involved in the daily operations of a business,, including both fixed and variable expenses.

- Examples:

- Rent, salaries, and utilities

- Equipment maintenance

- Raw materials & inventory costs

A retail store’s operating costs might include rent, staff wages, & electricity for running lights and cooling systems.

7. Non-Operating Costs

These are expenses unrelated to the core business operations but still affect profitability.

- Examples:

- Interest on loans

- Losses on investments

- Legal expenses

For instance, a manufacturing company may incur non-operating costs like interest payments on a loan taken to expand its factory.

Conclusion

Understanding the elements of a cost structure helps businesses better allocate resources, decide which products or services are profitable, and make wise financial decisions. For example, a bakery might want to reduce waste in raw materials (variable costs) or negotiate better terms for rent (fixed costs) in order to increase profitability. Companies can maintain the balance between expenses and revenue by identifying and managing these elements.

Element of a cost Structure Element of a cost Structure |

|---|

Elements of costs structure Elements of costs structure |

|---|

Solution Introduction:

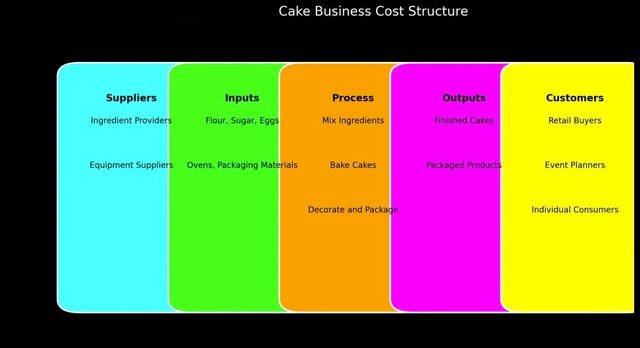

When establishing a cost structure for a business dedicated to making cakes, it is first important to identify all costs involved in the production process. A cake-making business must account for fixed and variable costs. These are costs that remain the same regardless of how many cakes are produced and variable costs that vary with levels of production. By doing all that calculation, the company is capable of finding the whole production cost for a cake to fix a selling price above break-even point.

In this case, the company manufactures five cakes per day. The critical task is to find fixed and variable costs, and then to compute the unit cost per cake. Then, using the profit margin that is desired as 25%, the company can fix the price of each cake such that the business reaches the targeted profit while also recovering all its expenses. This task requires straightforward computation of cost and application of the desired profit margin.

It's crucial for expense management, where a cake business must set a competitive price but ensure the business does not lose its profitability. When this is followed, then the business will have an accurate financial structure supporting sustainable growth and profitability.

Mathematical Breakdown:

Let’s break the cost structure into its components and calculate the required price based on the given production rate and profit margin.

1. Fixed Costs

These are costs that do not change regardless of how many cakes are produced.

- Rent for shop: $500/month

- Salaries of staff: $2,000/month

- Utilities (electricity, water): $100/month

Total Fixed Costs = $500 + $2,000 + $100 = $2,600/month

2. Variable Costs

These costs change depending on the number of cakes produced.

- Ingredients (flour, sugar, etc.): $3 per cake

- Packaging: $1 per cake

- Labor (Hourly wage): $5 per cake

Total Variable Costs per Cake = $3 (ingredients) + $1 (packaging) + $5 (labor) = $9 per cake

3. Total Monthly Production

The business produces 5 cakes per day, which means:

Daily Production = 5 cakes

Monthly Production (assuming 30 days in a month) = 5 x 30 = 150 cakes

4. Total Monthly Variable Costs

Since each cake has $9 in variable costs:

Total Variable Costs per Month = 150 cakes x $9 = $1,350

5. Total Monthly Costs

This includes both fixed and variable costs:

Total Monthly Costs = Fixed Costs + Variable Costs = $2,600 + $1,350 = $3,950

6. Price per Cake

Now, to achieve a profit margin of 25%, we calculate the price per cake as follows:

Desired Profit Margin = 25%

Profit per Cake = Total Cost per Cake x Profit Margin = $26.33 x 0.25 = $6.58

Selling Price per Cake = Total Cost per Cake + Profit per Cake = $26.33 + $6.58 = $32.91

Therefore, to achieve the desired 25% profit margin, the business should sell each cake for approximately $32.91.

Cake business cost structure Cake business cost structure |

|---|

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!

Greetings @artist1111

1.- You have shared the concept and importance of the cost structure for the enterprise, highlighting that it allows to control the resources invested in a productive process.

2.- You have mentioned acceptable examples of companies that adjust to the cost structure methods. You have provided the description of each of these methods, allowing the analysis of all the costs involved.

3.- You have presented the elements of the cost structure, with their respective examples; these allow us to identify the expenses in each functional area of the company.

4.- You have developed the proposed exercise acceptably, performing in detail each of the calculations. We would have liked to see a little more analysis of the results.

Thanks for joining the contest

Your writing style and method of analysis is admirable. Thank you for explaining the matter in a simple way.