SLC | S21W4 | Costs for entrepreneurs - Budgets

Hello Everyone

I'm AhsanSharif From Pakistan

Greetings you all, hope you all are well and enjoying a happy moment of life with steem. I'm also good Alhamdulillah. |

|---|

Design On PosterMyWall

Budgeting

Budgeting is a plan through which we assess our business. In this business, we look at our total cost and all our expenses and estimate our monthly, six-month, or annual income. Using this method, we can get rid of our high-cost items, organize them well, and make more profit.

The budget includes our various expenses, including our rent, utility bills, and the salaries of other people who work here. It also includes our income, such as our salary or sales revenue. The main purpose of a budget is to cover all our expenses with our income and, if possible, leave us room for the next task and also give us savings.

Relationship B/W Budgeting & Costing

These two are closely related because we have to resort to cost for budgeting. Cost provides us with data to make an accurate budget. Let's see how it works:

Inform Budget:

Through costing, we get help in our business with production and expenses, so this information is essential for the budget. Only then can we estimate our work in our company and how many expenses we need, and based on this, we prepare our budget. For example, any manufacturing company makes a budget to estimate its business. This budget should accurately estimate labor, machinery maintenance, and all the goods.

Cost Controlling:

A budget is a means of controlling all the expenses in our business, or once we have an idea of the total cost of our business, we then further set limits on the expenses through our budget. Once we know our actual cost, we can use this cost to estimate the expenses in our business to see if they need any adjustments or if they are better within the same range.

Forecasting & Planning:

In our business, we use costing to identify all of our future expenses, while budgeting helps us plan for these expenses. Accurate costing ensures that the budget reflects real financial needs. It helps us plan and estimate our debt and helps us make financial decisions.

Profit & Decision Making:

Budgeting helps us compare our costs with the profit potential of our revenue-generating projects. If our costs are higher than we estimated, then we may need to make some adjustments to our budget. Or we may need to handle business expenses and find ways to increase revenue.

Setting Financial Goal:

A budget sets a financial goal by forecasting all of our future expenses, taking into account costing data. In all businesses, budgets are used for investments, to set our pricing strategies, and to plan various types of expenses, and it also sets us apart for our further new product development.

All these points show us how costing and budgeting are interconnected.

Budgeting plays an important role in business to manage its costs. Budgeting ensures that we have reduced all our unnecessary expenses and how to use them efficiently. We are going to explain why a budget is necessary in determining expenses.

Cost Estimate:

Through budgeting, we can estimate our fixed and variable costs for a specific period of time and it helps us in this task and helps us predict how much we will have to spend on labor and overhead, marketing, and various types of expenses in our business. Fixed costs, which include salaries, etc., are very easy to estimate. But a budget helps us estimate changes in our costs.

Variable costs, which include our raw materials and commissions, often fluctuate in production, but the budget gives us the assurance that we have a good plan in place to handle these uncertainties. Without a budget, we can push our costs back and forth, which can lead to low profits and cash flow problems.

Cost Control:

Once we have our cost structure in place for the budget, it becomes easier to track the expenses in our business against the budgeted amount. Then we compare the items where the expenses are higher than our expectations. For example, if any company compares its actual expenses with its budget and finds that the expenses are higher, then it will need to make changes to its budget. Either they will look at reducing waste or they will have some discussions with suppliers. By regularly looking at, monitoring, and adjusting our costs, we can keep our costs within our limits, thus avoiding unnecessary expenses.

Prioritize & Resource Allocation:

Budgeting gives us more priority in our business towards the things that are most important, such as our production, marketing, or research. It also makes us more inclined to spend on the things that are most important. And it ensures that we spend less on the resources that are less essential. Effective budgeting helps the company focus on what is most important and avoids overspending on unnecessary items.

Help in Setting Price & Goal:

To set prices, we need to understand all the costs associated with producing our goods or services. Through budgeting, companies can accurately calculate the cost of their production and ensure that any product covers these costs at a fixed price that can provide a profit for them. With a clear budget, the company can estimate its costs to ensure that they are sufficient to make a profit and cover the cost of the item in a good way.

Forecast Future Cost:

Budgeting predicts all our future expenses and it is best for a long period. For example, if any company wants to expand its products, through this it will predict all expenses for us. The cost estimates we have for our businesses will help us assess whether they are a good fit for investment or how to fund them.

Cash Flow Management:

Budgeting can help businesses manage their cash flow by matching income with expenses. It helps businesses save time. A good, clean budget can save us from running out of cash and ensure that we have enough to meet all our needs when needed.

To accurately determine expenses, we need to budget because it shows us the cost of all our future expenses and helps us avoid cash flow.

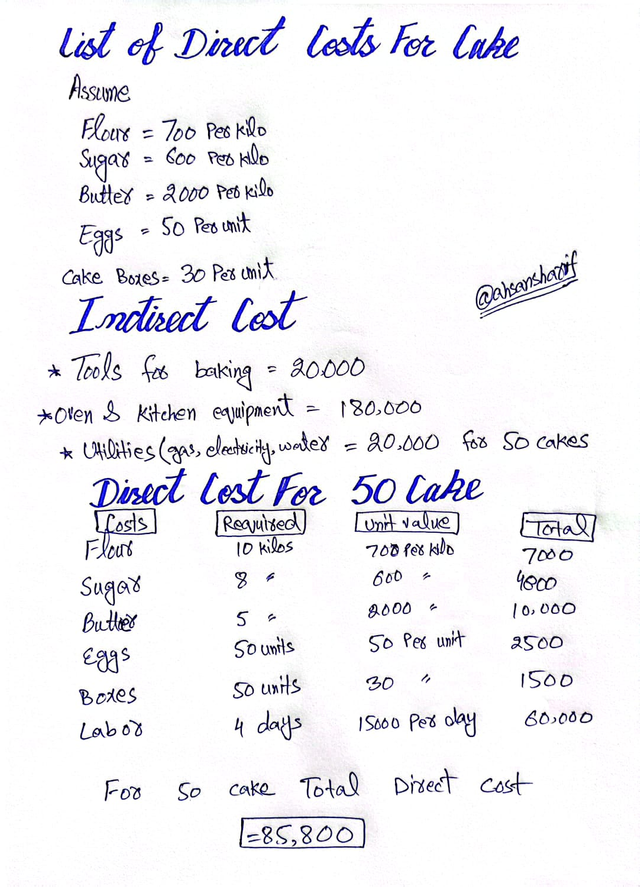

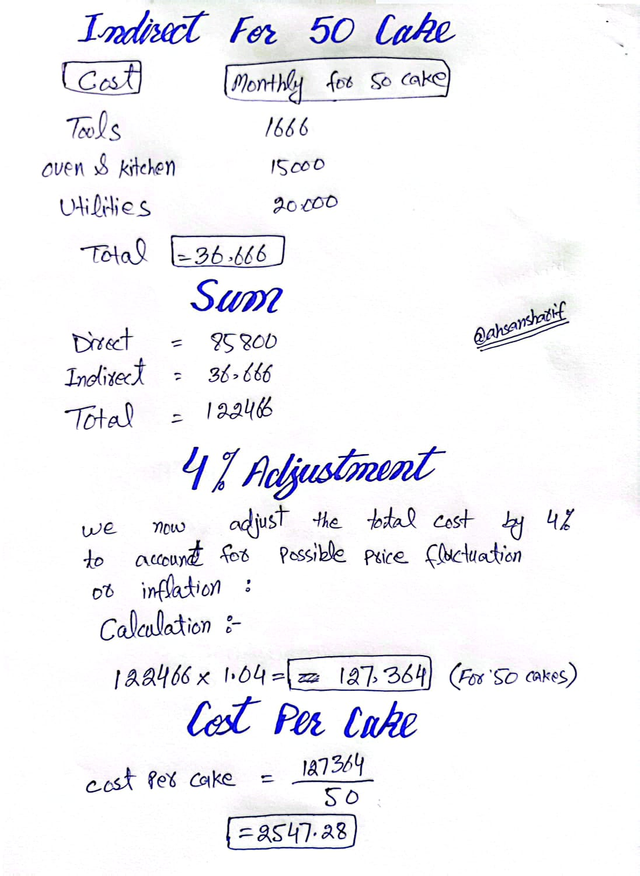

Prorating Indirect Cost:

Now, add indirect costs.

We assume 20,000 will cover the utilities and oven costs for 50 cakes.

The tools (20,000) and oven (180,000) costs are significant.

So, we will spread them over time. Let's assume the tools last for a year, we can prorate these over 12 months.

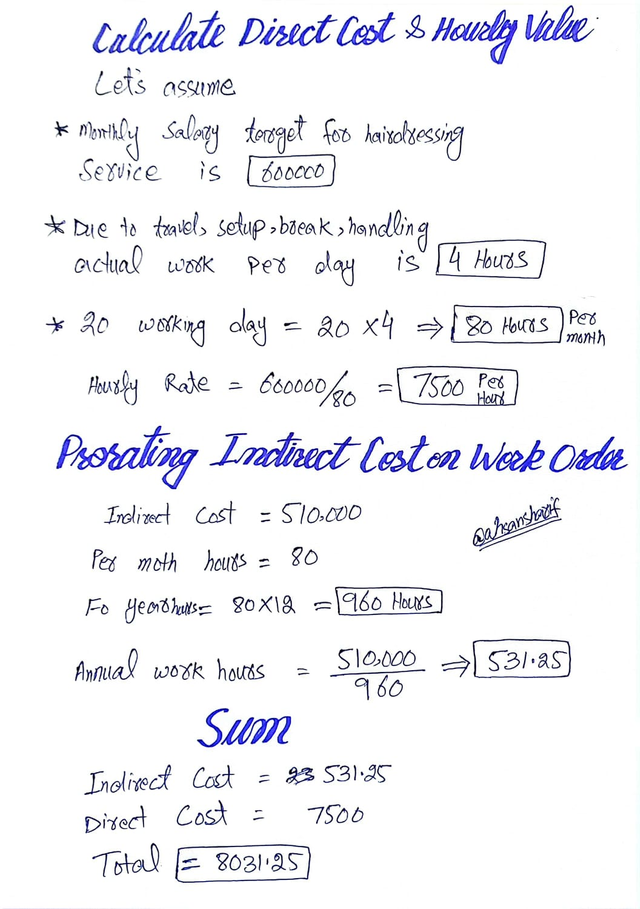

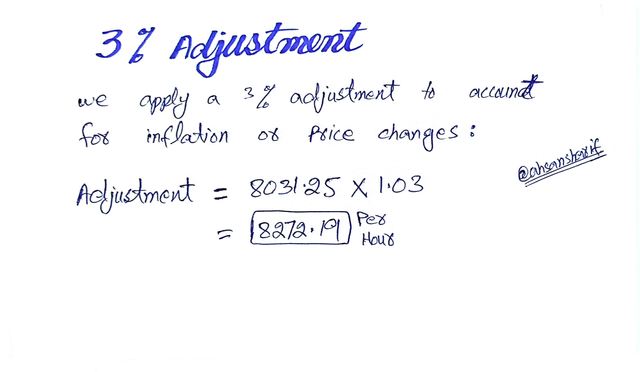

Indirect Costs for Hairdressing Service

| COST | TYPE OF COST | AMOUNT |

|---|---|---|

| Tools | Indirect | 150,000 |

| Products | Indirect | 120,000 |

| Setup | Indirect | 200,000 |

| Advertising | Indirect | 40,000 |

| TOTAL | 510,000 |

So that's all my task. I hope you like it. Thanks all guys for staying here. I would like to invite my friends @suboohi, @josepha, @bossj23, and @abdullahw2 to join this challenging task.