SLC | S21W3 | Costs for entrepreneurs - Costing methods.

What are the costing methods and what is their importance? |

|---|

Costing methods are ways to find out how much a product or service costs. They are crucial for businesses when setting prices. These methods help companies see the costs of making products, which aids in pricing, profit margins, and spotting areas that need improvement.

Some costing methods includes;

Unit Costing: It is known as single output costing. This method is used for costing products that are measured in the same units and is ideal for products made through continuous processes. Examples include cement production, dairy processing, and mining.

Job Costing: Costs are determined for each work order individually since each one has its own details and requirements. This costing method also applies to custom-made products. For example, it includes tasks like building repairs and painting.

Process Costing: It is used for products that undergo various steps. For example, in making cloth, there are several stages like spinning, weaving, and creating the final product. Each stage produces an output that can be sold as a finished product. This is why process costing helps determine the cost at each production stage.

Contract Costing: This method is used for jobs that require a lot of money and take a long time, often at various locations. It is also known as terminal costing. For example, this includes building roads, bridges, and buildings.

Batch Costing: This method calculates costs for items made in consistent batches with the same design. For example, pharmaceuticals.

The nature of the business determines the costing method.

Importance of costing methods

Costing methods are crucial as they allow businesses to figure out the expenses involved in making a product or providing a service, which helps them make informed decisions. Some of them include;

• Pricing: Many companies set their prices based on their estimated costs for each unit. Pricing is a choice, while cost is a calculation. Choosing prices is one of the key factors that can lead to business success or failure. Although setting your price is always a choice, there are times when the customer has the upper hand. They may dictate what they are willing to pay, leaving you in a difficult position to take a decision.

• Business Development: A business owner looks at their expenses and realizes that costs are too high to earn a profit at prices customers can afford. To keep the business running, the owner needs to rethink their operations: how they purchase supplies, how they create value, their investments in equipment or other resources, and how they compensate their staff. Knowing the costs is essential for this assessment.

• Capital Expenditure: Capital expenses, like buying new machines, buildings, or software, usually affect costs. The expected cost savings can make these purchases worthwhile. On the other hand, spending on capital to boost production will also influence costs, and knowing the complete effect of these costs can help in deciding whether to go ahead with these expansions.

• Making Informed Decisions: Costing methods give management the data needed to decide on production amounts, future investments, competitive strategies, and other important areas.

Explain the difference between the costing method for work orders and processes. |

|---|

Job order costing tracks costs for each individual product or job. In contrast, process costing is used for mass production, where costs are calculated based on the total units produced.

The key difference between job order costing and process costing lies in the kind of product or service created and the method used to allocate costs.

| Job order costing | Process costing |

|---|---|

| • Job costing is often applied in areas like construction, custom manufacturing, and consulting services. | • On the other hand, process costing is typically used in food and chemical manufacturing industries. |

| • Job costing helps track costs more accurately and shows how profitable each job is. | • Process costing helps businesses find the cost of each product unit, aiding in pricing and production decisions. |

| • Keeping records is important but can be hard in job costing since you need to track time and materials for cost calculations. Casting simplifies recordkeeping because it combines the costs into one total. | • Process costing uses one cost record for each process or department. Costs are tracked as they move from one stage to the next, with each stage contributing its share of labor, overhead, and materials. |

| • In job costing, expenses are linked to specific jobs or projects and monitored according to what each job needs. | • In process costing, expenses are linked to a particular production process and distributed equally among all the products made in that process. |

Investigate and explain according to your understanding two costing methods, different from those explained in this class. |

|---|

Batch Costing

Batch costing is a method used in cost accounting by companies that make goods in groups. The production is split into batches, and the costs for each batch are tracked individually. This approach helps businesses enhance their operations by offering cost data that supports better decision-making.

The batch costing method helps companies accurately assign budgets to each production lot, giving important information about material, labor, and overhead costs. It can reveal inefficiencies in production, enabling managers to reduce waste, defects, and rework expenses. With batch costing, businesses can set appropriate prices for their products, ensure quality control, and make the best use of their resources.

Batch costing is commonly used in industries that create large amounts of products in one go. It helps businesses figure out the cost per unit and make necessary changes to pricing or production levels. Additionally, batch costing allows companies to quickly identify any quality control problems.

Contract Costing

Contract costing is an accounting approach used to monitor all costs associated with a particular contract. This method is especially important in fields such as construction, shipbuilding, and engineering, where every expense must be recorded. The main goal of contract costing is to accurately calculate and keep track of the total expenses for a specific contract. This data is essential for evaluating the contract's profitability, supporting billing to the client, and guiding important decisions during the project's duration.

Carry out the costing for work orders, as explained for a cake manufacturing venture |

|---|

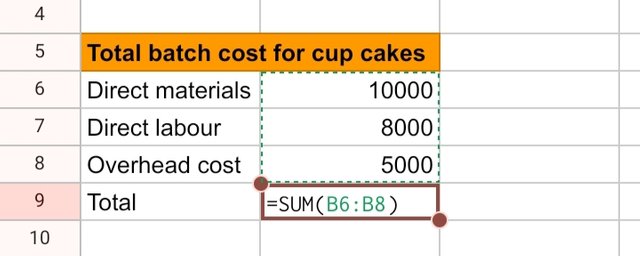

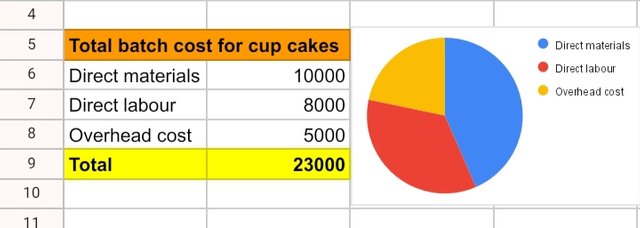

Using the batch costing in terms of cost order.

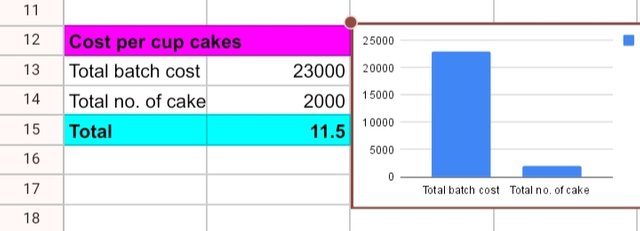

Example: For Nina's cake company to produce 2000 pieces of cup cakes, the following would be looked into;

Direct Materials (all ingredients including sugar, butter, flavours)

Direct Labor (all cake decorations and workers including security)

Overhead (utilities, packaging cost, electricity)

To get the total batch cost will be;

Direct materials= 10000

Direct Labour= 8000

Overhead= 5000

This will be DM(10000)+ DL(8000)+ OC(5000)

Total batch cost will be =23000

I have demonstrates it below using a chart

|  |

|---|

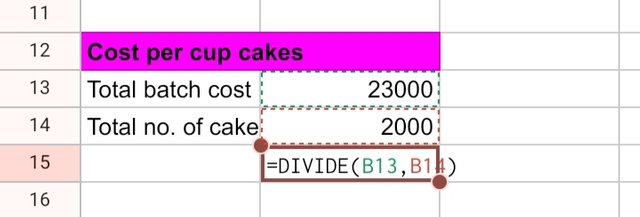

To get the cost per cake;

Total batch cost(23000)/ Number of cup cakes(2000)

So cost per cake = 11.6 which is approximately 12

I have demonstrated it below 👇

|  |

|---|

Using contract costing in terms of cost order.

Direct materials(ingredients)

Direct labour (decorations, workers)

Overhead (indirect labor cost, packing)

Additional cost( taxes, fuel, etc.)

Direct materials= 20000

Direct labor= 10000

Overhead= 5000

Additional cost= 2000

To get the total contract cost;

DM(20000)+ DL(10000)+ OC(5000)+ AC(2000)= 37000

To get profit or loss

Let's say the contract price is 40000, then the profit or loss will be Contract price(40000)- Total contract cost(37000)= 3000

Profit/loss= 3000

I hope my explanation is clear! I invite @ruthjoe @mariami @pandora2010

Greetings @ninapenda

1.- You have explained very well the definition of costing methods, explaining some of them highlighting their importance, emphasizing that they are a set of specific procedures used to determine a cost.

2.- You have explained some of the aspects that differentiate job order costing and process costing, indicating the specific differences in them and how both are linked to the way of production.

3.- You have explained two other types of costing such as batch costing, which is similar to job order costing, since it assigns costs to each order, and contract costing, indicating the main characteristics of them and how their implementation is useful. .

4.- You have provided the cost calculation of the production of cakes, according to the work order method. The calculations made are in accordance with what was explained in class.

Thanks for joining the contest