SLC | S21W3 | Costs for entrepreneurs - Costing methods

What are costing methods and what is their importance?

Costing methods are methodical approaches that companies apply to estimate, record and analyze the costs related to their production or service operations, whether they are mass-produced products or customized services, these methods allow to allocate expenses accurately and are essential to understand in detail all the financial resources required at each stage of production, this facilitates a complete evaluation of the profitability of products and services and allows companies to make more strategic and well-informed financial decisions.

On the other hand, process costing is better suited to companies that produce goods in large quantities and a standardized manner, such as in the chemical or food industries, where products go through several stages of production, in this case, costs are distributed to each department or process and then divided by the number of units produced to obtain an average cost, this method helps companies assess overall production costs while ensuring that each stage contributes in a balanced way to the final cost per unit.

Another commonly adopted method is activity based costing, known by the name of ABC which allocates indirect costs based on specific activities and this method provides a more accurate allocation of overhead costs by associating costs with activities such as quality control or machine tuning, which allows companies to understand more deeply where indirect expenses lie and optimize operations to reduce costs without compromising quality.

Also we find the standard cost method relies on the use of predetermined costs for labor, materials and overhead to facilitate the creation of a realistic budget and the measurement of variances between costs estimated and actual costs by allowing businesses to monitor and adjust their financial performance over time.

These methods have an importance that lies in their ability to provide companies with a deep understanding of their cost structure allowing them not only to control expenses by identifying resource-intensive areas and making adjustments to control costs but also to define appropriate pricing strategies that take into account all costs and ensure sustainable profitability. These costing methods also support budgeting by providing clear financial benchmarks for performance criteria and expense tracking, they improve profitability analysis by allowing companies to identify the best-performing products or segments and direct decisions towards them for strategic growth. Ultimately, they strengthen decision-making by providing accurate and reliable data that guides choices regarding resource management, planning and product development, thereby ensuring stable financial management and increased competitiveness in the market.

Explain the difference between the job order and process costing methods.

Here is a detailed version of the comparison table between the job costing method and the process costing method:

| Aspect | Job costing method | Process costing method |

|---|---|---|

| Production type | Suitable for unique, customized or small-batch goods or services, where each product is distinct and manufactured to the specific customer's request. | Suitable for mass production for standardized and homogeneous goods, produced continuously or in large quantities without major variations between units. |

| Application sectors | Mainly used in sectors requiring a tailor-made approach, such as construction companies, consulting firms, craft production workshops, and manufacturers of customized products. | Used in industries with high production scale and continuous processes, such as food processing, chemical production, oil refinery, and pharmaceuticals. |

| Cost Accumulation | Costs are accumulated individually for each order or project, meaning that each order has a specific cost sheet where expenses are recorded separately to ensure accurate tracking of each component used. | Costs are accumulated for each department or production stage over a given period, such as a month or quarter, without distinction between products, as they all go through the same processes and consume similar resources. |

| Cost Allocation | Each order has costs assigned individually: labor, materials, and overhead are assigned directly based on the resources actually consumed by each project, ensuring an accurate calculation for each unique order. | Costs are distributed evenly across all units produced in a process, calculating an average cost per unit, as the units produced are homogeneous, making it easier to allocate costs on a large scale. |

| Unit Cost Calculation | Unit cost is calculated individually for each order or project by adding together the specific costs (materials, labor, overhead) for that order. This helps determine the exact cost for each custom-made product. | Unit cost is an average obtained by dividing the total costs for a process or department by the total number of units produced during the period, thus providing a uniform cost for each unit produced in a series production. |

| Cost Tracking | Uses separate cost sheets for each order, where costs are recorded as they are incurred for each project. This detailed tracking helps keep accurate track of expenses for each specific order, often used for invoicing and project profitability analysis. | Uses a single cost sheet for each process or department, where costs are recorded at each stage. Costs are added as products move through the production chain, allowing for centralized management of production costs for each processing stage. |

| Cost Accuracy | Provides high accuracy for unique and customized projects, as costs are directly related to the resources used by each order. This allows for accurate pricing for customized products, essential for profitability in highly customized industries. | Provides an average cost per unit for uniform and standardized products, which is effective for large-scale productions, where individual precision is not necessary due to the homogeneous nature of the products. |

| Adaptability | Ideal for limited productions and specific customer requests, as each order can be adjusted according to unique requirements, making the method flexible for small series or special orders. | Suitable for continuous production where volumes are high and products go through the same manufacturing steps, making the method optimal for production lines where operations must remain constant and predictable. |

Research and explain, to the best of your understanding, two costing methods different from those explained in this class.

I chose to talk about Activity-Based Costing (ABC) and Target Costing

Activity-Based Costing (ABC)

The activity-based costing method, often called ABC, is a particularly accurate technique for assigning indirect costs by associating them directly with the specific activities that generate them, rather than distributing them broadly by departments or processes, thus, instead To distribute overhead costs evenly across all units produced, the ABC method traces each indirect cost to specific activities, such as machine adjustments, quality inspections, equipment maintenance or new product design, in using for each a "cost driver", that is to say a factor which determines the cost such as the number of machine hours, production runs or quality control interventions required for each product.

This approach is particularly useful in complex and varied production environments, where products consume resources to different degrees and where it is therefore necessary to be able to identify the real costs associated with each step or each process, for example, if a product requires intensive quality control while another requires only basic verification, the ABC method allows the costs of inspections to be allocated directly to the product concerned, ensuring great transparency and increased precision in cost accounting.

Target Costing Method

The target costing method is a proactive and anticipatory approach to cost calculation, focused on defining production costs taking into account the competitive market price and the desired profit margin from the initial phases of product design, instead of simply estimate costs after production, in this method we start by analyzing the realistic and competitive selling price for the product in the market, then we set a profit margin target which will then be subtracted from this market price in order to establish a “target cost”, the maximum allowable cost so that the company can guarantee the profitability and financial viability of the product while meeting market requirements.

After setting the target cost, the production and design teams work together to adapt the manufacturing processes, select materials and refine the design in order to keep expenses within the established cost, this work involves continuous optimization at each stage of production to ensure maximum efficiency while strictly respecting budgetary constraints. The target costing method is particularly suited to highly competitive markets, where consumer expectations strongly influence price levels and profit margins are often narrow, it is widely used in industries such as electronics, automotive and consumer packaged goods, where customers seek high-quality products at competitive prices.

Perform the costing by work orders, according to what was explained for a cake manufacturing business,

Here is a detailed breakdown of the costing by work orders for a cake manufacturing business, presented in tables for each component to cover all relevant costs, including indirect and variable costs, which provides a comprehensive view of the final cost calculation.

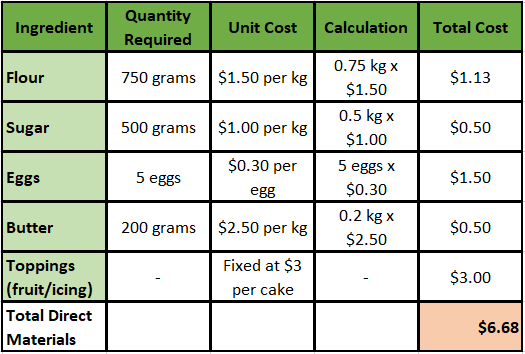

1. Direct Materials Cost

The direct materials for each cake are broken down by ingredient with exact quantities and unit costs to ensure precision.

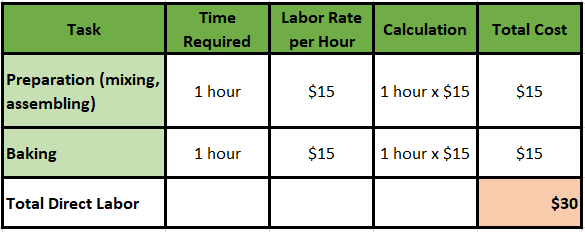

2. Direct Labor Cost

Direct labor is calculated based on the time required for each task, with a set hourly labor rate. This includes preparation, baking, and finishing.

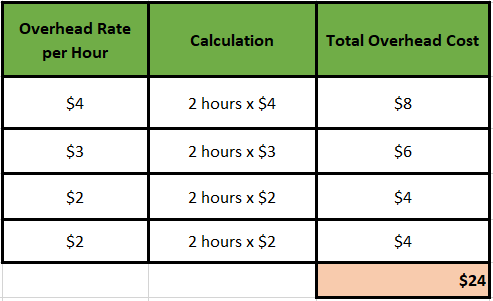

3. Overhead Cost

Overhead costs include indirect expenses such as utilities, equipment depreciation, and facility maintenance. These are allocated based on time used in production.

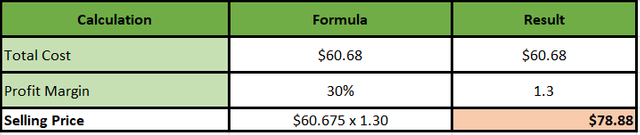

4. Total Production Cost per Cake Order

The total production cost is calculated by summing up the direct materials, direct labor, and overhead costs, giving a complete picture of the cost per cake.

5. Final Selling Price with Profit Margin

To set a final selling price that includes a 30% profit margin, we calculate as follows:

By adjusting the costs of materials, labor and overhead, the final selling price for a cake was reduced while maintaining a 30% profit margin. The quantity of some ingredients was reduced and less expensive alternatives were chosen which lowered the cost of materials to $5,281. In addition, an optimization of the production process reduced labor time, bringing labor costs down to $27. Indirect costs, such as utilities and maintenance, were also adjusted to a total of $18. In the end, the total cost of production is now $50,281, and the recommended selling price, with the desired profit margin, is set at $65.37. This approach ensures sustainable profitability while allowing the company to offer a more competitive selling price.

Thank you very much for reading, it's time to invite my friends @sahar78, @stream4u, @fombae to participate in this contest.

Best Regards,

@kouba01

Greetings @kouba01

1.- You have explained very well the definition of costing methods, explaining some of them highlighting their importance, emphasizing that they are a set of specific procedures used to determine a cost.

2.- You have pointed out the difference between job order costing and process costing, indicating the specific differences in them and how both are linked to the way of production.

3.- You have explained two other types of costing such as activity-based costing and target costing. Very well explained the methodology used by these methods, their characteristics and examples.

4.- You have provided the cost calculation of the production of cakes, according to the work order method. The calculations made are in accordance with what was explained in class.

Thanks for joining the contest