SLC | S21W3 | Costs for entrepreneurs - Costing methods

Hello Everyone

I'm AhsanSharif From Pakistan

Greetings you all, hope you all are well and enjoying a happy moment of life with steem. I'm also good Alhamdulillah. |

|---|

Design On Canva

What are costing methods and what is their importance? |

|---|

The costing method is a technique in our business through which we evaluate our business and make our calculations. We check the costs involved in the production of our business and set the prices of all our items. Calculate the budget To manage all these things, we have to resort to costing methods.

There are some main costing methods that I am going to explain here that will help us understand this.

Job Costing:

We often assign costs to our jobs or projects within those jobs. This is often used when we customize our products or when we make them in small quantities.

An example of this method is that there is a construction company that keeps separate accounts for each project and calculates their costs accordingly.

Process Cost:

Any cost is accrued over a specific period. Then we divide that by the number of total units we produced. It is often used in industries where our products are similar and are produced in large quantities. An example of this is a food production company.

ABC:

ABC stands for Activity Based Costing. We track costs from activities that increase our costs. As in any company, we know the cost by determining the machine or labor used.

For example, any manufacturing company examines the cost of production in any of its firms by first looking at machine hours or by looking at labor hours.

Standard Costing:

We use our product's default costs as a benchmark. Then we Thenthe actual prices with these standards, thus determining the variances. For example, a factory compares the actual cost of its product with its standard.

Direct Costing:

Direct costing refers to the costs associated with our production, including our labor and the raw materials we allocate to our products. For example, any company that calculates the cost of its product includes only those items that are directly attached to that product.

Importance

- Decision: To know how much it costs us to purchase anything, we can confirm how much we will price it. This will guide us according to the profit as to how much price we should keep.

- Budget: All costing methods help us in our business by managing all the costs and telling us about our future earnings.

- Analysis: We will compare our business's income with our expenses. This will allow us to identify our profit and all our departments in which our results have been good.

- Control: We can control our expenses in our business in that we can monitor our actual cost. In which we can simplify our work by reducing the unnecessary. And can reduce our expenses which will give us more profit.

- Decision Making: We can assess the costing method in our business and decide what is giving us more profit. What do we have to increase production and what do we have to take out of our control?

Explain the difference between the job order and process costing methods. |

|---|

| Difference | Job Order Costing | Job Processing Costing |

|---|---|---|

| Nature of Production | Job order costing is used when we have to do custom work in which batches of products are different, we track each item separately, and each item has a separate cost. | Process costing is used when all items are identical and a large number of items are being produced. Their costs accumulate over a period of time and then we divide them with our total units. |

| Cost Accumulation | In this, all costs are collected for the order. And to do any work we use direct materials or labor. And everything is tracked separately. | In this, all the expenses are accumulated by a department for a certain period. In this period, all the materials that labor directly obtains are spread out. |

| Cost Assignment | Costs are assigned to individual jobs and each job has a separate sheet. When that job is completed, all costs are incurred. | Costs are assigned to the departments and then in the process all the units are costed and then each one is given the same cost. |

| Types of Industry | It is used in industries where our products are manufactured in different batches such as small batches. | They are used in industries where we manufacture our product on a large scale or where everything is the same. |

| Unit Cost Calculation | Unit Cost = Total Job Cost / Number of Units In The Job | Unit Cost = Total Process Cost / Number of Units Produced |

| The complexity of Cost Tracking | It is more complex because we have separate documents for each job and each has a separate cost. So here we do more specific tracking and it's different for every job. | It's easy to manage because it's costing multiple units, so we track the entire process rather than individually. |

Research and explain, to the best of your understanding, two costing methods different from those explained in this class. |

|---|

We will explain two additional methods here that are different from job order costing and process costing.

Pixabay

ABC

ABC is a costing method that stands for Activity Based Costing. This is a method that assigns costs to the cost-enhancing activities in our business according to their products. It not only allocates overheads to labor hours or machine hours but also examines the activities within the business. According to these activities the costs to them based on resources.

The ABC method has some main functions that make it more popular. The first of these main functions is that it identifies the activities. First of all, it identifies the things that incur costs such as our quality production or distribution and so on.

Another main function of ABC is that it assigns costs to products based on the actual cost of each activity's resources.

It gives us an accurate solution to our costs because it contracts with the activities responsible for generating those costs.

Advantages

We get some advantages of using the ABC method based on which we use it more.

- Accuracy: It gives us more accurate costing because it links overhead costs to direct activities, thus giving us an idea of our final costs and a better estimate of our profits.

- Cost Control: Another major benefit to us is that it specifically helps managers identify high-cost activities, prompting us to reduce unnecessary things in our work. And helps us find them and gives us more profit.

Disadvantages

There are some benefits and some disadvantages to doing them. There are some things in this work that we don't benefit from. It has some disadvantages which are listed below.

- Complexity: Using it can cost us more because it is also time-consuming. Because it requires specific drivers to identify and track activities.

- Not Suitable: ABC is not suitable for all industries as they require a complex environment. And they are more useful in complex environments.

Marginal Costing

Marginal costing is also a costing method where the cost of the variable is included in the cost of the product. The fixed costs involved in it are treated as period costs. Rather than assigning them to individual products.

Marginal costing also has some features, which it is known as follows.

The main function of marginal costing is that it separates the cost. As variable costs separate them from fixed costs. But it includes the variable cost with the cost of the product.

Its second major function is contribution. This method focuses on the contribution margin. Which differentiates between our sales revenue and variable cost. This makes it much easier for us to understand the contribution margin as it gives us confirmation of how much money we have available to cover our expenses and make a profit.

Advantage

- Decision: Marginal costing is very useful in decision-making because it allows us to estimate and evaluate which units we have to produce or which orders we have to accept. And what are the products we want to discontinue?

- Analysis: It makes analysis easier in our business as it helps us to analyze all the effects of changes in the cost of sales volume in our business.

Disadvantage

- Ignore Fixed Cost: Since we do not assign fixed costs to our products, this approach can reduce our total cost of production. As a result, the pricing we do may be inaccurate.

- Long-Term Planning: This we cannot use for the long term because it does not account for marginal cost and may cause us problems later on with fixed costs.

Perform the costing by work orders, according to what was explained for a cake manufacturing business, |

|---|

The purpose of using job order process costing in the cake manufacturing business is that we have to track each cake separately. We have to track each batch separately. Because this cake can be for different customers or different events.

Let's see how we can implement the job order costing to create a cake business.

Identify the Job:

In our business, each cake order is and is treated as a separate job. For example, a customer orders a customized birthday cake with a specific flavor and a specific design.

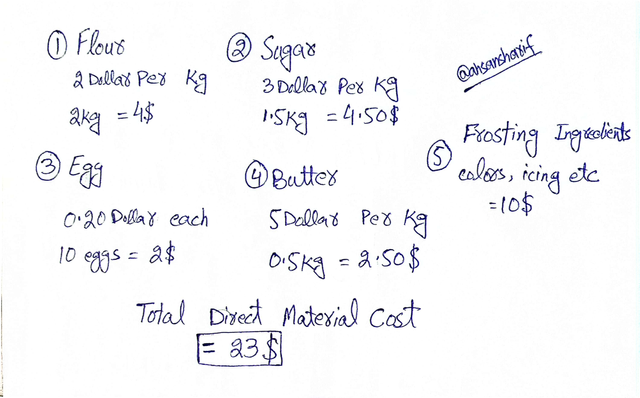

Direct Material

Here is a list of all the raw ingredients to make your cake. Here are the measurements of each of these materials and their cost as well.

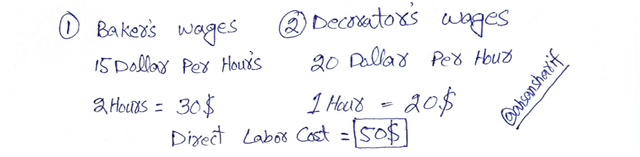

Direct Labor:

Here it refers to the wages of the employees directly paid by us while preparing the cake. For example, if we see that one who is a baker and one who is a decorator work for three hours to prepare this cake.

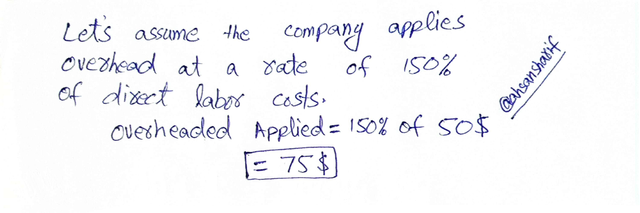

Manufacturing Overhead:

These include the indirect costs that we cannot track directly because they include all the costs of running utility bills and maintaining the equipment.

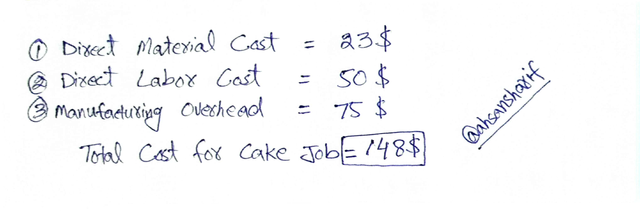

Total Job Cost:

Unit Cost:

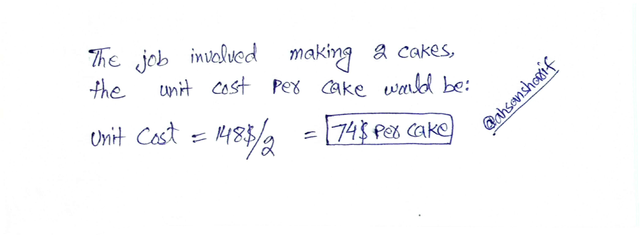

If we produce more cakes here or we get more orders, the cost per cake can be calculated by dividing the total labor cost by the number of cakes.

Thank you so much for staying here. I would like to invite my friends @josepha, @jyoti-thelight, and @abdullahw2 to join this challenge.

Greetings @ahsansharif

1.- You have explained the importance of costing methods and explained their classification, but we would have liked you to give a definition of what are costing methods, which are related to a set of specific procedures used to determine a cost.

2.- You have pointed out the difference between job order costing and process costing, indicating the specific differences in them and how both are linked to the way of production.

3.- You have explained two additional types of costing such as ABC and marginal, very well explained the methodology used by these methods and the advantages of their application.

4.- You have provided the calculation of the cost of the preparation of a cake according to the work order method. The calculations made are in syntony with what was explained in the class.

Thanks for joining the contest

Thank you so much for the verification and the valuable feedback.

Upvoted! Thank you for supporting witness @jswit.

X:

https://x.com/AhsanGu58401302/status/1856273841565380699