SLC | S21W2 | Costs for Entrepreneurs - Cost Elements

Hi everyone, i am glad to participate in the second week of this educational task, the reason is simple. I have studied these things and it feel good to learn in more details and check my understanding of the topic.

What is the relationship between costs and financial accounting?

In my opinion costs are fundamental elements of financial accounting because they help businesses get a better understanding of the profitability and based on that allocation of the resources in an effective manner, let's understand a bit more in details.

Determine profitability

Costs simply allow business to calculate the cost for manufacturing the product and set a adequate selling price to earn a profit.

It's also necessary to get a better understanding of both direct and indirect costs as both helps in setting appropriate selling price and gain profit.

Financial Planning

With the help of cost analysis businesses can easily forecast their upcoming or future expenses and allocate the limited resources in an effective and efficient way.

Decision Making

By analysing cost, businesses can figure out the crucial areas which require improvement such as the areas which can be optimised to reduce cost, Optimum utilisation of the resources.

The top management of the businesses rely on this cost analysis information to make changes in their productions such as volume adjustments, pricing strategies, budget allocation etc.

Direct cost and indirect cost

Direct cost - These are the type of cost which is directly associated to the production of the production and such costs can be easily connected to each unit produced.

Indirect cost - Indirect costs are such expenses which indirectly supports the production but can not be directly linked to a product or specific product unit produced.

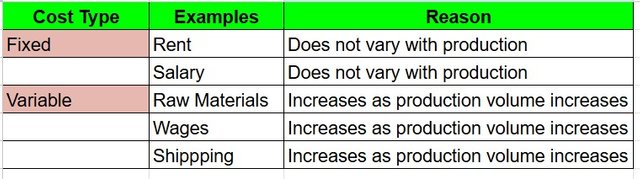

Difference between fixed costs and variable costs

In simple terms, fixed costs are the main expenses that remain constant irrespective the volume of production. Such costs do not change with the change in the volume of production.

Example -

Rent: Monthly rent will remain same whether the company produce 100 units or 1000 units.

Employee Salary:Salary of the staff which are not tied to production level will remain same and will not change with the change in the production.

Variable costs are such costs which changes with the change in the volume of the production, the more units are produced, the higher the variable costs.

Examples -

Raw materials:The cost of raw materials will change with the change in production, for producing more units more raw materials will be required and hence it will change with the level of production.

Wages: Wages which is paid to the production workers directly involved with the production like hourly or weekly pays.

Shipping & Delivery Cost: This cost will be changed with the higher production as more goods will be shipped and the cost will vary with the orders.

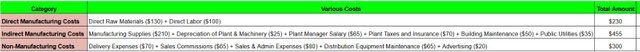

First let's categorize each cost. These are the costs which are directly associated with the manufacturing of the product. Direct raw materials - $130 These are the type of costs which indirectly supports the production but can not be specifically divided into a unit of production. Manufacturing supplies - $210 Total indirect manufacturing costs = 210+25+65+70+50+35= $455 These are the costs which are not related to production, these are mainly termed under selling or administrative expenses. Delivery Expense - $70 Total Non-manufacturing costs = 70+65+80+65+20 = $300 In order to find the total manufacturing cost, we only need to add the direct manufacturing cost and indirect manufacturing costs Direct manufacturing cost - 230$ Total Manufacturing Cost - 685$ PS- Non - Manufacturing cost will not be added into the total manufacturing cost calculation. I hope i was able to mention all the required task details, it was great experience.. I also invite my friends @ahlawat @senehasa @awesononso

Q3 - Real or hypothetical case analysis

1.Direct manufacturing costs

Direct Labor - $100

So the total direct manufacturing cost is 130+100 = $2302. Indirect manufacturing costs

Depreciation - $25

Plant Manager Salary - $65

Plant taxes and insurance - 70$

Building maintenance - $50

Public utilities for production - $353. Non - Manufacturing costs

Sales commission - 65$

Sales & Administrative expenses - $80

Equipment maintenance - $65

Advertising Expenses - $20

Calculate Total manufacturing cost

Indirect manufacturing cost - 455$

Greetings @ rishabh99946

1.- You have roughly explained the relationship between costs and financial accounting. You mostly talked about the importance of costs; we would have liked you to talk about how costs become an important source of information for finance, and their respective reporting.

2.- You have pointed out the difference between fixed and variable costs, giving examples of each of them. We would have liked you to give examples for a specific type of business.

3.- In your publication you have not presented a real or fictitious case in which you have identified the cost elements in the manufacture of a product or the provision of a service.

4.- You have classified each of the costs incurred by the Steemians company, making the proper distribution of them and their behavior.

Thanks for joining the contest

Thank you for the review, the translation for the topic was vague i couldn't understand properly, i thought we have to divide the thing in steemians company only.

Thank you for this tho.