SLC | S21W2 | Costs For Entrepreneurs - Cost Elements

Hi friends, it is a pleasure to welcome you here as we discuss these vital entrepren eural matters.

Source Source |

|---|

There are a few variations between cost and financial accounting. While cost accounting refers to the system that maintains track of costs Incurred by a business, financial accounting concentrates on the financial stand of the business.

As the two record historical cost, the predetermined costs are recorded solely by cost accounting. While cost accounting is the inner reporting of the finances of the business, financial accounting is useful to both inner and external stakeholders to comprehend the business position and decisions about its future.

Financial accounting statement assists in maintaining financial transaction records, while the essence of aim of completing cost procedures is to mitigate and control costs. A few additional differences between cost and financial accounting is based on the reporting prerequisites.

While cost accounting is solely obligatory for manufacturing businesses, every business must generate financial accounting statements. While the two vary, both play a part in the accounting activities of a business.

The table below illustrates the differences between Fixed Costs and Variable Costs.

| 1. | Expenditures that remain the same despite how much a company produces | Expenses that changes as a result of changes in the company's productions and sells |

| 2. | Usually doesn't depend on a company's specific business activities | Directly proportinal to the company's production volume |

| 3. | Not associated with company's hence, considered unavoid costs | Associated with company's products and are considered avoidable costs |

| 4. | Drops when production increases | Increases as production increase |

| 5. | Changes based on the number of products a company produces | Tend to stay flat |

| 6. | Happens regularly and barely change over time | Influenced by the volume of production |

The examples of fixed costs and variable costs is shown in the table below

| 1. | Lease and rental payments | Labor |

| 2. | Insurance | Commissions |

| 3. | Interest payments | Raw materials |

| 4. | Property tax | Packaging |

| 5. | Certain salaries | Utility expenses |

| 6. | Depreciation | Inventory costs |

Production costs are all the direct and indirect costs faced by businesses from providing services or manufacturing products. Production cost includes varied expenditures like raw materials, labor, consumable manufacturing supplies, as well as general overhead.

Production costs can include a variety of expenses, such as labor, raw materials, consumable manufacturing supplies, and general expense of the business not directly assigned to goods or services provided.

Production cost also referred to product costs, are Incurred by a business in the course of manufacturing products or providing services and includes a diversity of expenditures.

For instance, Manufactures have Production cost associated to materials and labor required to generate products. Service industries on the other hand incure production cost associated to the labor needed to carry out the service as well as the cost of materials involved while the service is delivered.

Royalties a resource-extraction company owns or government-levied taxes are also handled as production costs.

Total cost of production can be ascertained by summing up the total direct materials, cost of labor and the sum of manufacturing overhead costs.

Production contracts both direct and indirect costs. For instance, the direct cost for producing automobile could be materials such as plastics and metals, and also worker's salaries. Indirect cost could include overhead like rent and utility expenditures.

Total production cost can be ascertained by summing up the sum of labor and direct materials cost as well as the sum of manufacturing overhead costs.

To ascertain the product cost per unit of product, the sum is divided by the number of manufactured unit in the time frame covered by the those costs.

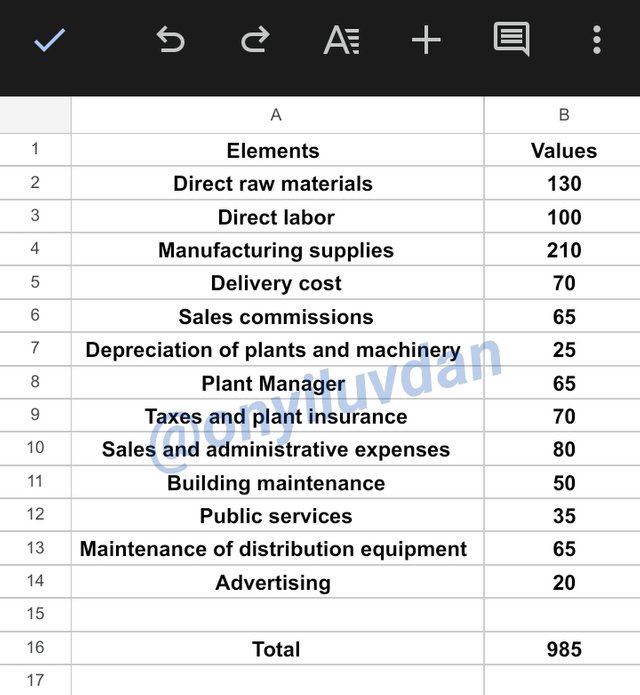

Direct raw material | 130

Direct labor | 100

Manufacturing Supplies | 210

Delivery costs | 70

Sales Commissions | 65

Depreciation of plant and machinery | 25

Plant Manager | 65

Taxes and plant insurance | 70

Sales and administrative expenses | 80

Building maintenance | 50

Public services | 35

Maintenance of distribution equipment | 65

Advertising | 20

You Are Asked To Separate Direct Costs From Indirect Costs And Non-manufacturing Costs, And Also Calculate The Total Direct And Indirect Manufacturing Costs.

You Can Present The Example Using Google Sheets.

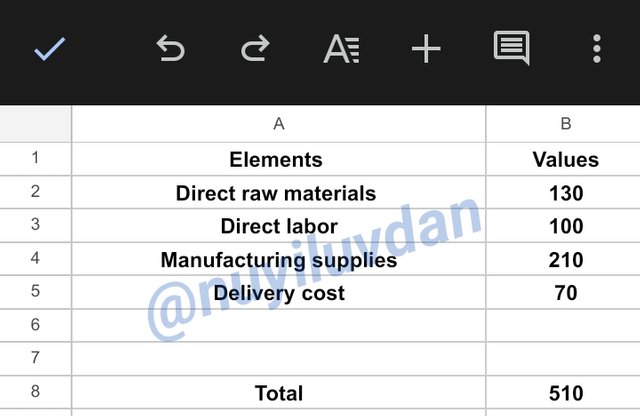

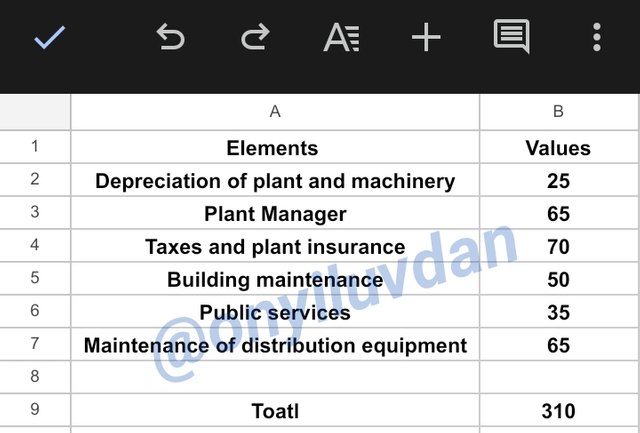

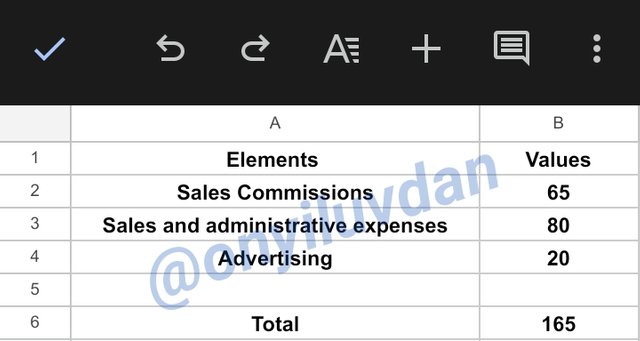

The table below shows the Direct Costs, Indirect Costs as well as the Non-manufacturing Costs and their respective values.

| Direct Costs | |||

|---|---|---|---|

| 1. | Direct labor – 100 | Depreciation of plant and machinery – 25 | Sales Commissions – 65 |

| 2. | Manufacturing Supplies – 210 | Plant Manager – 65 | Sales and administrative expenses – 80 |

| 3. | Delivery costs – 70 | Taxes and plant insurance – 70 | Advertising – 20 |

| 4. | Building maintenance – 50 | ||

| 5. | Public services – 35 | ||

| 6. | Maintenance of distribution equipment – 65 | ||

| Total | 380 | 310 | 165 |

The above can be carried and shown in Google Sheet as displayed below:

Overall Total Of Elements

Total of Direct Costs

Total of Indirect Costs

Total of Non-manufacturing Costs

| Written by @onyiluvdan |

|---|

Congratulations, your post was upvoted by @supportive.

Greetings @onyiluvdan

1.- You had a slight confusion regarding the information requested, since you had to share the relationship between costs and financial accounting, instead of their differences; However, references for general culture are valid.

2.- You have presented the differences between fixed and variable costs. Both are an important part of the company's operation, however, one is directly related to production, while the other is inherent to the company's general activity.

3.- You have generally identified the cost elements of a fictitious case, it is important to be clear about how the costs are structured to know the performance of the company.

4.- Has desarrollado el ejercicio propuesto, presentando una aceptable organización. Debe tener en claro que los costos de envío son costos indirectos.

Thank you for joining the contest.

Thanks for reviewing my entry