SLC | S21W2 | Costs for entrepreneurs - Cost elements.

What is the relationship between costs and financial accounting?

|

|---|

Costs in financial accounting are important to a financial accountant cots, serve as the basis for recording and reporting the financial transaction of an organization and below 👇 are the relationship between costs and financial accounting

Cost Measurement and Allocation:

Financial accounting uses the information obtained from cost far to measure and allocate expenses across different departments, activities, or products. For instance, the cost of goods sold in financial accounting is calculated to match the costs of production with revenue for profitability.Expense Recognition:

In financial accounting, costs are recognized as expenses in the period when they contribute to generating revenue for an entity, which is the "matching concern" principle. This helps the accountant to report accurate net income for a period for an entity.Historical Cost Principle:

Assets are often recorded based on their original historical cost, instead of market value to maintain objective and verified data in financial accounting.

In a simple understanding, financial accounting is more concerned with providing information about the financial performance of a business entity in a given period which is mainly yearly, and the financial position of the business entity at the of that period. Whereas cost accounting is more concerned with identifying the cost of things which if we are to go further to look at this will end up comparing costs and financial accounting as we have discussed briefly below.

Financial Accounting

Prepared accounting information to meet regulatory or legal requirements.

Used to prepare financial statements for shareholders, stakeholders, and other external users.

The content of accounting information is usually specified by the regulatory framework

Financial accounting records, expenditure, revenue, assets and liabilities.

Cost Accounting

Prepared information to meet the needs of the management of an entity.

Used to prepare information for internal management only.

The content of cost accounting is specified by the management of an entity.

Cost accounting, records the cost of activities and is used to provide detailed information about cost, and profit for specific products, revenue, activities, and operations.

Establish the difference between fixed costs and variable costs, providing examples of each.

Both fixed and variable costs are the types of costs companies inquire about in the production of goods. This should be looking at their differences and examples.

Fixed Costs

Fixed costs are simply items that remain constant (costs that remain the same) in total during a period no matter how many units are produced regardless of the volume of scale activity. Fixed costs are costs that don't vary with the volume of goods or services produced which means they must be paid even if products are not made.

Fixed Costs Examples:

The rental cost of the building of my business is ₦50,000 per month. The rental cost is fixed for a given period as ₦50,000 per month or ₦600,000 per year.

The salary costs of my worker who is paid ₦30,000 per month. The fixed costs are ₦30,000 per month or ₦360,000 per year.

Variable Costs

Variable costs are costs that increase, usually by the same amount, for each additional unit of production that is made or each additional unit that is provided. The thing about variable cost is that, as production increases, that is how variable costs rise proportionally and vice versa.

Variable Costs Examples;

The cost of my buying raw materials is ₦5000 per liter regardless of our purchase quantity. The variable cost is ₦5000 per liter which will be applied as The total cost of my buying 100 liters is ₦500,000.

The rate of pay for hourly-paid workers is ₦200 per hour. This means 100 hours of labor would cost me ₦20,000

The time that is needed to produce an item or product is 10 minutes and labor is paid ₦500 per hour. This means the direct labor is a variable cost and the direct labor cost per unit producer is

₦500 * 10/60 = 83.4.

In a real or fictional case, identify the cost elements in manufacturing a product or providing a service.

Here I will be talking about a fraction case of a company XYZ, that is into manufacturing and selling coffee and other tea products I have highlighted the main cost elements in producing and selling coffee ☕.

Direct Costs

These are the costs that are directly tied to the production of each unit of coffee produced by XYZ and they can easily be traced.

Direct materials: This involves all the raw materials that are used to make the coffee, coffee beans, bag, milk, cream, etc.

Direct labor This involves the wages of workers directly involved in the manufacturing process, process, like for those who assembled or operate the machine. This type of claw increases as the production volume for coffee rises.

Indirect Costs

These are the costs that can't be directly attributed to each unit of production but are important for the overall production of example coffee.

Factory rent: The cost of using the manufacturing facility. This is known as a fixed cost, as it does vary with the volume of production.

Utilities: This involves costs like water, heating, electricity bills, and others which are all known as; semi-variable costs.

Overhead Costs

This is the type of cost that involves the general operations that are indirectly related to the production of, for example, coffee but important for the business. It includes the following;

Administrative salaries such as salaries for workers (office staff).

Marketing and Advertising: This is the cost for promoting XYZ company which is also known as fixed cost.

Depreciation: This means the wear and tear of fixed assets or the gradual reduction of the value of manufacturing items.

Selling Costs

These are costs that are associated with selling the coffee to customers which if we are to separate or categorize selling costs they will be talking about; sales commissions and distribution costs..

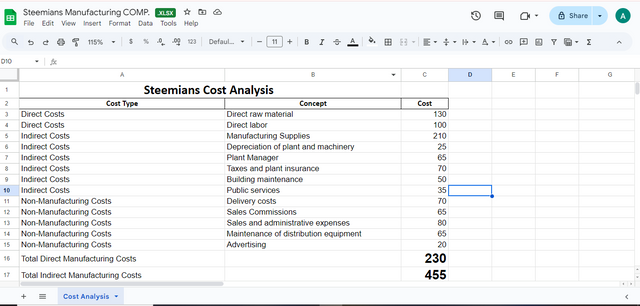

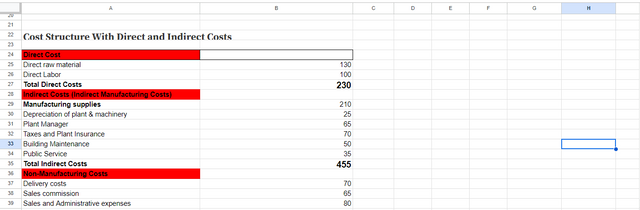

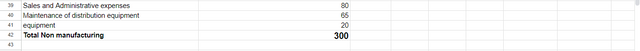

The company Steemians manufactures a single product. During a given period, the following costs were incurred:

Summary

Based on the given information we have the following as our direct, indirect, and total non manufacturing costs.

| Total Direct Manufacturing Costs | 230 |

|---|---|

| Total Indirect Manufacturing Costs | 455 |

| Total Non-Manufacturing Costs | 300 |

The above information helps management to understand the costs associated with production versus that of other business operations, which is valuable for pricing and budgeting decisions as I have stated in the video record.

I am inviting; @dove11, @simonmwigwe, @lhorgic and @ruthjoe

Cc:-

@yolvijrm

NB: All images besides the freepik image are products of mine

Greetings @josepha

1.- You have shared the relationship between costs and financial accounting. Companies are required to keep a record of their expenses to be able to visualize the return on their investment. Financial statements are not only shared between the company's internal departments, they are also made public in the registry.

2.- You have named the differences between fixed costs and variable costs. Both are fundamental parts of the operational and administrative functioning of a company. It is important to check the labor cost, especially if we have 2 different rates, ₦200 and ₦500.

3.- You have shared, through an example, the cost elements. The distribution of resources in the cost structure can occur logically depending on how they affect the production process, however, we must always ensure their application.

4.- You have developed the exercise and presented it in a spreadsheet, where the results are clearly seen.

Thanks for joining the contest

Thank you for your review.

Wow so detailed to actually understand with ease. It seems like you are already a business man with how you were actually able to explain every single detail and with explanation. I love it

I appreciate your support. However, I am not into business but I have an idea because I studied accounting in school.

Wow you have presented a well detailed post about the cost elements. You have implemented the difference between the fact zed and variable cost in a great way. Moreover the video explanation of the work is very interesting. Thanks for sharing.

Thank you so much for your support.

You are welcome 🤗

Wao! You have really proven you're an accounting student who really understands how this things work. What is running through my mind right now is how am going to do mine, I hope the time shows up to do something as beautiful as yours. Weldone brotherly.

Sure you can do better than me.