How CASPIAN can help Crypto currency adoption among individuals as well as institutions

Who is Caspian? (Sure does sound like a powerbroker to me, but Caspian isn’t human.)

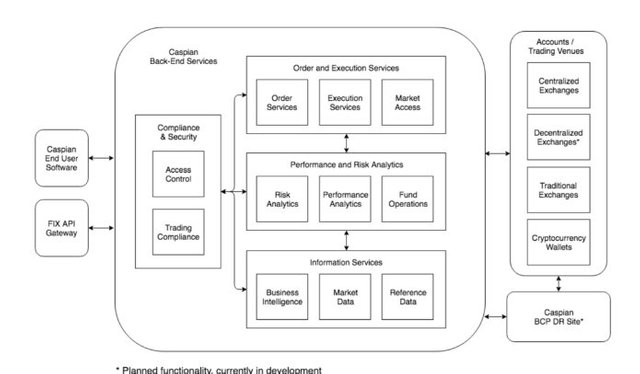

Caspian is an ecosystem designed to solve the problems facing crypto investors using a single, user-friendly interface. It achieves this by providing sophisticated connectivity and interoperability across various digital asset exchanges.

A little insider about the digital asset exchange market and the problems involved.

As of April 2018, the average daily trading volume across all digital asset exchanges exceeded 18 billion USD equivalents; with total estimated market capital for block-chain instruments surpassing 325 billion USD equivalent.3 Market analysts expect that number to grow to 10 trillion USD equivalent by 2033.4 While the size of the crypto space remains small compared to traditional asset classes, the growth in this sector is unparalleled. More than 200 exchanges are currently active.5 of these, five exceed 1 billion USD equivalents in daily trading volume, and 19 have more than 100 million USD equivalent daily trading volume.6 it would be almost impossible to attempt to list all of the tokens that have been issued to date. The top 16 coins alone each have market caps of over 1 billion USD equivalent, and among those, four coins see a daily volume of more than a billion USD equivalent7. It is therefore reasonable to expect fragmentation of both tokens and exchanges to be a persistent feature of block-chain markets in the near to medium term. The major problems traders have faced so far include:

The large number of crypto currency exchanges helps increases the growth of the market while simultaneously aggravating its challenges.

At present, crypto investors are obligated to choose among numerous exchanges when performing various trades. Often, portfolios develop positions on multiple trading platforms with different user interfaces and functionality. Executing orders across these various exchanges is often strenuous, thereby making Position and risk management more challenging by the diversity of platforms that must often be used to trade for a single portfolio. Due to the difficulty in coordinating the outputs of different platforms, meeting reporting and compliance requirements can present significant hurdles for crypto investors as well.

What individuals and institutions stand to gain with CASPIAN

Caspian effectively aggregates prices, bid/ask information, orders, positions, accounts, and executions from multiple crypto exchanges and other sources, presenting the information on a single platform. It allows users to act on this information by sending orders to exchanges individually or using a Smart Order Router based on existing Tora technology. The benefits of the Caspian platform can be organized into three overarching categories corresponding to the current needs of the crypto-trading space: Execution, Position Management, and Compliance.

Execution

● Access to selected major digital asset exchanges through a single interface. For each specific exchange, OEMS enables access to all order types, asset types, and ticket sizes supported by a given exchange.

● Ability to view prices, bid/ask, and depths for each exchange to the smallest available ticket size.

● Ability to stage, send, and amend orders in multiple ways, including single-click orders sent directly from the price depth; user-defined order shortcuts; and order staging and slicing.

● Choice of whether and how to use Caspian’s SOR.

● The Messaging functionality for each order-related action and communicating any potential compliance breach.

● Ability to view and manage margin across multiple exchanges.

● Ability to view the progress of each order or ‘order slice’. Users can receive alerts about slippage or time-to-fill allowing them to take action depending on market conditions.

● Position information for each crypto pair or instrument, enabling traders to quickly react to market conditions using Caspian liquidation features.

● Ability to utilize workflows across multiple distinct users and user roles. A single organization can assign different roles to its members, e.g., portfolio managers, traders, compliance officers.

Smart Order Router (SOR): This module enables users to view all exchanges as a single pool of liquidity. The Smart Order Router sends an order with a given objective- for example, sell ETH and buy BTC within a certain price limit - to multiple exchanges at once in order to achieve quick execution even in the case of large orders. The SOR algorithm is smart enough to prioritize exchanges based on criteria including price, liquidity, and commission so that the best outcome can be achieved with as little slippage as possible.

Algorithms: Caspian builds upon Tora’s algorithm framework and Kenetic’s trading expertise to provide institutional-grade algorithms from day one. Each order can be assigned to a particular algorithm, which can then route slices across multiple exchange venues using Caspian’s smart order routing logic. Traders can control the behavior of a trading algorithm by applying set parameters, and can monitor its performance throughout the lifecycle of the order. At the same time, more sophisticated traders can also closely monitor all orders that the algorithm engines slice to the market. They can manually override order parameters in order to fine-tune the behavior of a given algorithm.

User-built strategies: In addition to the predefined complex strategies offered in Caspian’s algorithm suites, end users will have the ability to define their own strategies for managing orders using a simple rule-based language. For example, a user could create an order that executes if the price of an asset increases by 10% or more in an hour.

Alerts: Caspian offers a built-in mechanism allowing clients to configure alerts, which can appear as pop-ups or be delivered as emails. Clients have the freedom to define the conditions under which such alerts are triggered, combining indicators, order parameters, position data, and market data. This logic is built on top of a proprietary coding language similar to Excel functions.

Position & Risk Management

PMS and RMS: Caspian’s PMS and RMS together allow users to monitor their positions, P&Ls, and exposures and to maintain detailed records of each. They sit downstream from the OEMS, which sends them all execution and order information. While the OEMS is designed to be light and nimble for fast trading, the PMS and RMS record and track every piece of data in perpetuity. This allows an investor to view all of its positions and historical data at any time. Using these features, users can maintain a complete book of records for a given trading entity and can view the data in real time or historically. In the future, existing risk features from the Tora platform will be ported to Caspian, including value at risk, shift scenarios, and stress test scenarios.

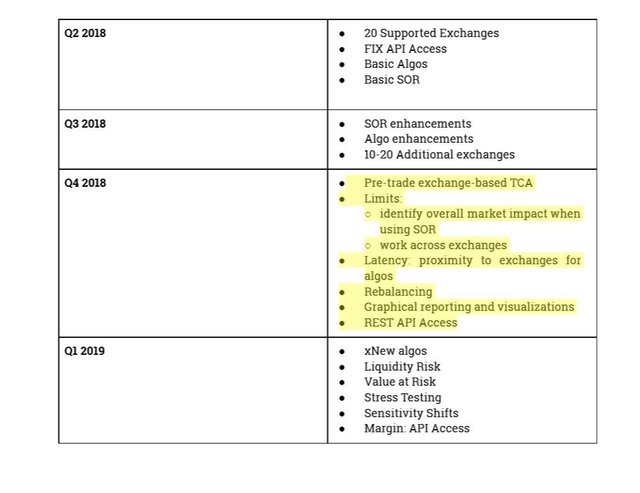

Rebalancing: This function, currently being ported over to Caspian as part of the company’s short-term roadmap, applies to multiple scenarios. For example, when a fund needs to invest or divest funds without altering the relative allocation of each asset within the vehicle, a separate order must be created for each instrument. Alternatively, a fund may employ a strategy dictating a certain ideal level of exposure per currency or per exchange. Inevitably, funds drift from those targets, and rebalancing can help generate orders that continually bring the fund back in line with its objectives.

Allocation engine: The allocation engine allows trading through a single order and a single exchange account, even if the result of the trade is intended to be distributed to different funds, portfolios, strategies or other business units. The allocation engine transparently handles all aspects of the distribution of the outcome of a trade into corresponding business units, allowing the trader to focus on achieving the best execution for the order. The allocation engine covers a wide range of use cases, including:

● Static order allocation, which enables the allocation logic of an order to be defined on a per-share, percentage, or per-NAV basis.

● Dynamic position-based allocation, which allocates trades in line with rules applied to whole portfolios and business units.

● Ensuring a fair price distribution across business units.

Compliance and Reporting

Compliance Engine: The compliance engine is based on Tora’s proprietary technology, which offers extremely low latency and extensive functionality, as well as a robust framework that allows Caspian to implement new limits and compliance rules quickly and efficiently. The compliance engine provides multiple levels of functionality to address user defined limits and rules covering both pre-trade and post-trade workflows.

● Pre-trade limits, which include simple limits as well as more complex portfolio or trading parameters such as exposure limits. These limits can delay order execution until compliance checks are complete. They can be triggered at various stages of a trade, including staging, sending, or amending an order. There are three levels to the limits: warning limits, which can be overridden by the user; approval limits, which require a supervisor to approve the order before it can be sent to market; and absolute limits, which cannot be overridden.

● Post-trade compliance includes alerts, monitoring, and reporting. Alerts and reports can be delivered to users via email or other mechanisms, either on a schedule or as they occur.

Reporting Engine: From day one, Caspian will feature robust reporting capabilities, consisting of simple “flat file” reports such as trade files, snapshot reports, position data, audit reports, and compliance reports. These options offer flexibility in preparing graphical reports and other external-facing materials.

Importation of Data: Caspian’s various modules import the data provided by each exchange via its protocols and APIs, focusing the information into a single portal which users can use as a “one-stop shop.” This includes execution data, instrument information and instrument prices (both real-time and mark-to-market), margin and account information, and volumes and liquidity information.

Technical Summary

CONCLUSION

The benefits of having all your trading portfolios in one space cannot be overemphasized, making access to assets more convenient to manage. As an organization, you expose your clients to a variety of investments as well as attract new clients who are interested in fund managers who specialize in crypto-currencies. We would love to hear your CASPIAN story.

Team

Roadmap

For More Information

Caspian Website

Caspian WhitePaper

Caspian YouTube

Caspian Telegram

Caspian Videos

Caspian Blog

Caspian News

Caspian Management

Reference

Caspian Website

Caspian WhitePaper

Caspian YouTube

Caspian Videos

CNBC

Image Reference

Caspian Website

Caspian WhitePaper

This article was written as part of

@originalWorks writing contest.

To take part of the contest click here

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!