Life after Consensus2018

So, Consensus ended, and, here we are, holding our bags. Many, including myself, bought into the repeated story about Consensus being a bull run starter, at least on the past years.

With an audience of around 8K, many specialists were expecting a price spike on the major currencies. Truth be told, the market cap moved 10% down while Consensus was developing.

For such a new market, as the Crypto market is quite naive to expect that just with four years of previous Consensus editions, to build up a solid theory, where depending on the growth of the conference, a correlation can be easily made with a rally on the whole market.

Well, almost everyone is naive enough to buy in. I suppose the conference was already priced in from the weeks before. Recently a video from Palm Beach Confidential was released where even TK admitted that was a little silly. Still, his point was valid, a continuous bull run would've been quite unhealthy for the market. After the lows of Q1, we recovered quite a lovely part of the loses, so a non-stop run was not expected.

One of the most excited analysts on Consensus was Tom Lee. As reported back on 10th of May in this article, he was expecting a 70% jump in overall prices.

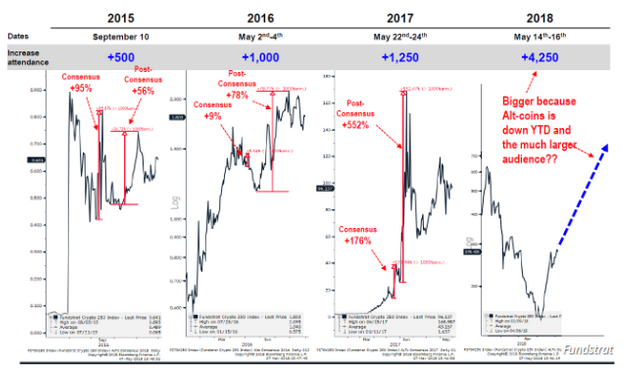

If you were reading the crypto news in the last weeks, you would recognize the graph here on the right. Actually, this was spread by Fundstrat to back up Lee`s story on Consensus.

Unfortunately for traders, the story proved not to be as accurate as the last graphic, showing that not only the market did not climb up to 70%, but actually, did it on the negative territory. The whole Market cap went down from a high of USD 425 Bn. to a low of USD 365 Bn. last Friday, May 18th. A lose close to 20% on a week.

It can be that the market is taking a little time to react. Also, what if the institutional money that is coming in is creating new rules in this game. I do not see big investors buying in into FOMO or fake news stories like the Fundstrat chart above. Cryptos until last year used to be mainly community driven, but with a new changing environment that looks skeptically into prices and regulations, it makes much more sense hat the short Consensus rule does not apply anymore.

Investors need to be cold when analyzing and distrust news that seems too good to be true. Times are changing for everyone in the crypto space. I foresee that as long the market keeps maturing, volatility will decrease as it does also chance to have a whole market swing in a matter of days.

A consensus on Consensus 2018 was apparent, but let's not rush into big conclusions, even the charts show that the moves after the conference started around 20 to 30 days after the event.

Historically the market has moved at large on the second half of each year. Consensus or not, we are still going through the early stages of a completely new market. Trying to apply maximalist rules on it is too pretencious, there is a lack of historical data to make valid comparisons.

@Santana33 @Santana33 | ||

|---|---|---|

| ||

| ||

|

Hi, thank you for contributing to Steemit!

I upvoted and followed you; follow back and we can help each other succeed 🙂

P.S.: My recent post

Seriously?

quite normal these days ...

Reading about the conference on Reddit, it seemed like a massive waste of time where people echoed a desire for big finance to enter the market. Add to this the huge ticket price (payable only in fiat), the conference was a weak cry focusing on those outside the crypto community, instead of addressing the talk towards more inner-circle committed supporters of crypto.

This is what I hope for. Yeah, an occasional 10% rise is great. But I'd be happy with a stable month or two if that means less volatility in the long run. Give me slow growth over crazy pump/dumps