Do you have enough money?

Did you know that in most states you have to be a millionaire in order for you to legally invest in a hedge fund? Fortunately, you don't have to be rich to get excellent returns. As Warren Buffet predicted over the past decade or so low cost index funds have outperformed hedge funds, primarily because the fees for a hedge fund are too high.

I essentially run my own mini hedge fund on Collective2. Obviously, I could be falling into the same trap as hedge funds - seeking above average returns only to under perform the average. I realize the odds are against me. To at least mitigate the odds a bit, I have a general rule that I will not invest in my own stock strategies if the fees are going to cost over 5% of the invested assets each year.

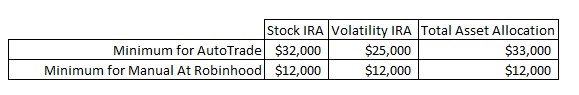

Of course, I would be willing to make exceptions in rare circumstances, but it does seem to be a helpful guideline. So, I want to give a few examples of the minimum amount of money I would use to trade my strategies. (Collective2 comes up with their own number of $5,000 for each of my strategies, but I believe that is too low.)

For Volatility IRA it can certainly be traded with as little as $5,000 as Collective2 states. However, that would not meet the 5% rule if I were a subscriber and AutoTrading. Collective2 will charge $49 to use their AutoTrade license. My strategy costs $50 a month, and Interactive Brokers charge about $10 per month for the trading. Therefore to follow my rule I would need about $26,400 to AutoTrade Volatility IRA.

For Stock IRA, to meet 5% rule I set for myself I could do so with just $12,000 by using the broker Robinhood and trading manually. This strategy is my easiest to manually trade because it trades just once a week at a set time. Also, if you use Robinhood they will charge you $0 per stock trade. I have used Robinhood for over a year and couldn't praise them enough. They have saved me so much money! Also, if you use my Robinhood link you and I will both get free stock! Did I mention there is no minimum to open an account with them?

For Total Asset Allocation to fully follow the system on AutoTrade, I would not do it myself without $33,360 to meet the 5% rule. Now if there were no AutoTrade fees and I used Robinhood, the only fee I would have to pay is the $50 subscriber fee each month. That means I would be able to start with only $12,000 and still meet the 5% rule I set for myself. The only downside is the the volatility trades inside of Total Asset Allocation can be pretty time sensitive. Therefore manually trading will reduce the gross return. By how much? It is hard to say, but if I were going to trade Total Asset Allocation manually, I would simply sign up for Robinhood to get free trades, trade the stock signals at the open of the first trading day of the week, and follow the XIV and VXX signals whenever I received them by email or even just once a day 5 minutes before the close.

Now you know what I would do. You should note though that there are some nuances. For example, if you have the top tier account with Collective2 you don't have to pay an additional fee to AutoTrade an additional strategy. Things like that would obviously change the results.

As some of you know, I do actively trade the markets. If you would like to find more information like this I encourage you to follow my blog, twitter, steemit, or Collective2.

Also, if you use my Robinhood link you and I will both get free stock!