Q2 2020 Quarterly Cryptocurrency Report: Full Report

Hey, Steemit!

We are DeFi-nitely proud to announce that we have just published our Q2 Quarterly Cryptocurrency Report!

Download the full report here

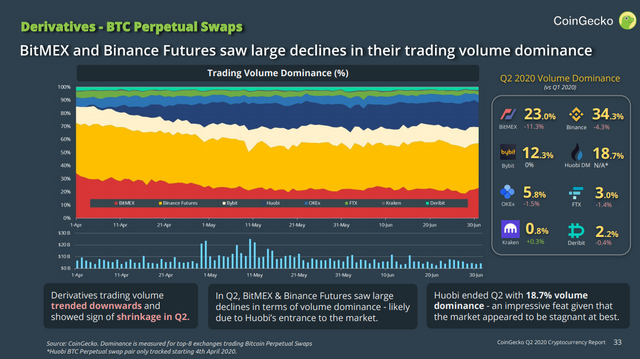

Derivatives Trading Volume On A Downward Trend

For Bitcoin’s perpetual swap, both BitMEX and Binance saw heavy declines (11.3% and 4.3% loss respectively) in terms of volume dominance.

Whereas, Huobi ended with an 18.7% volume dominance – Pretty impressive for a newcomer.

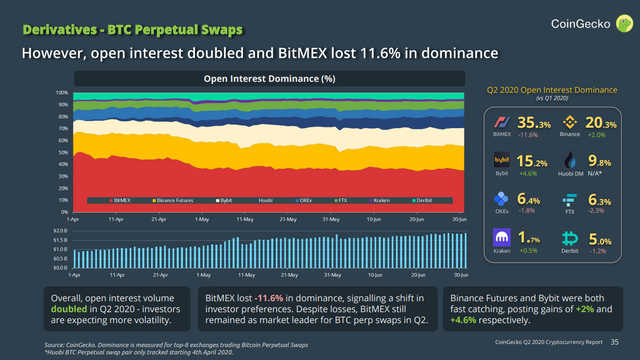

Open Interest On The Rise

Despite the overall decrease in volume for BTC perpetual swap derivatives trading, open interest volume doubled in Q2 as investors expected more volatility.

BitMEX lost 11.6% in dominance while Binance Future and Bybit caught up, gaining 2% and 4.6% in dominance respectively.

Even so, BitMEX still remained as the market leader. If we were to look closer, BitMEX’s open interest grew $204M (44%) despite its decrease in market dominance.

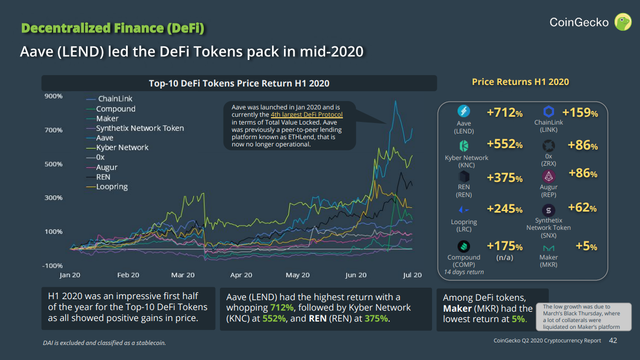

Tokens That Are DeFi-ying The Odds

We can safely say that Q2 was extremely DeFi-centric. The price return of 4 out of 5 DeFi tokens was higher than other Top-5 cryptocurrencies and Top-5 exchange tokens.

Aave’s price return was the highest among the Top-10 DeFi tokens with a whopping gain of 712%. This was impressive as Aave was only launched in Jan 2020 and it’s now the 4th largest DeFi protocol in terms of Total Value Locked. However, Aave’s trading volume was still relatively small compared to the other DeFi tokens.

Nevertheless, we can see that more users are now active in trading DeFi tokens. Compound (COMP), which only went live on 20th June 2020, has quickly risen to the Top-30 coins in terms of market capitalization.

DeFi Highlights

What led to the increase in trading of DeFi tokens? It may be due to the Yield Farming and Liquidity Mining craze.

To put it simply, yield farming is when you put in your assets to generate returns, much like how you’re able to earn interest off of your cash in the bank.

Liquidity mining is when you provide liquidity to essentially lend to the platform and in return, you’ll earn tokens of the protocol you deposit in.

Basically…

Yield Farming 👩🏼🌾 + Liquidity Mining 💧 = 🤑💰🤑💰🤑💰

Keep Updated on DeFi

Wow! Just like that snaps fingers the first half of the year has flown past. What an interesting quarter! What do you think about it? Let us know in this 1-minute survey.

We here at CoinGecko are excited to see what the next quarter may bring. As usual, we’ll keep you updated through our daily newsletter so be sure you sign up to stay on top!

CoinGecko Virtual Meetup

In conjunction with the release of our second Quarterly Report for 2020 and recent Trust Score update with cybersecurity metrics, CoinGecko is back with Virtual Meetup #4!

Join in the Discussion, Free!

Be sure to sign up to the Meetup here