Anonymous Coinbase Users Sued the IRS (and won!)

Shakedown Street

Back in January, the IRS sent a broad, sweeping summons ordering Coinbase to hand over information on all of its U.S. customers. Thanks to a couple of anonymous heroes, the IRS is now scaling back those demands - but not eliminating them completely.

Ever since receiving the summons in January, Coinbase has been in talks with the IRS about its demands. The company said that it was seeking the best way to cooperate while protecting customers' privacy. The IRS demands included getting the account passwords and security settings for all of the company's customers within the target time period.

The unusually broad and invasive summons even received a stern letter of disapproval from members of Congress. Asserting their "exclusive jurisdiction over federal revenue matters", the legislators accused the IRS of overstepping its authority:

"...we strongly question whether the IRS has actually established a reasonable basis to support the mass production of records for half of a million people, the vast majority of whom appear to not be conducting the volume of transactions needed to report them to the IRS. Based on the information before us, this summons seems overly broad, extremely burdensome, and highly intrusive to a large population of individuals."

The letter asked the agency to explain its actions (by June 6).

As of July 11, the IRS has not responded.

John Doe to the Rescue

I like to think Coinbase is being honest about working to protect the interests of its customers, but so far the only legal challenge has been mounted by two John Doe account holders who hired an attorney to prevent the intrusion. Coinbase has said it plans to file its own objection, but they must be waiting for just the right moment because so far they have not done so.

Users who filed the 'Motion to Intervene to Quash Summons'

chose to remain anonymous.

The IRS was specifically interested in the period from January 2013 to December 2015. During this time, bitcoin had some serious growth in both price and public interest, climbing from a low of about $13 to a peak of just over $1100. As one of the more popular bitcoin exchanges in the U.S., Coinbase also received a huge influx of users during this time.

But the IRS received only 802 tax returns that reported income from bitcoin trades. It sounded to them like a few were missing, so the agency went straight to the decentralized currency's prime centralized point of failure: the most popular bitcoin exchange in the agency's jurisdiction.

To give credit where it's due, Coinbase did not just roll over and hand the IRS everything it asked for. Many companies do this with customer data without a second thought, so for Coinbase to stand up to the IRS at all is remarkable and worthy of appreciation. Coinbase's negotiations with the IRS no doubt also had an effect on the eventual outcome.

Still, it was anonymous Coinbase users who mounted the only actual legal challenge to the summons, and judging by the revisions to the summons that soon followed, it appears they succeeded in greatly limiting the scope of the summons.

Key Points of Compromise

The IRS filed a Notice of Narrowed Summons in court on July 6, 2017.

The first big change to the summons is that the information demanded no longer includes account security information like passwords and other security settings.

The second big change is the limitation criteria outlining which customers they want to see the information for. Rather than broadly labeling all users of the service suspects and demanding everyone's records, the IRS has narrowed its demands to seek information only on U.S. Coinbase customers with cumulative buys, sells, or transfers totalling $20,000 or more over the period in question.

By establishing this ground floor level of concern, the IRS seems to be saying it is only after relatively big fish. Approximately 90% of Coinbase's customers would be unaffected. So it seems casual users will get a pass this time around, although the agency includes a back door for itself to order more information regarding any individual accounts at a later time.

It's tempting to assume this $20,000 minimum is based on some sort of reporting requirement threshold - but is it really? That's less clear.

Improved Regulations - Now Clear as Mud

A key issue in the enforcement measure is that the documentation requested covers time periods preceding any statement of applicable regulations for virtual currency of any type. The original IRS summons sought documents going back to January 2013, while the IRS only issued its guidance on virtual currency in March of 2014.

Complying with rules that do not yet exist is difficult, to say the least.

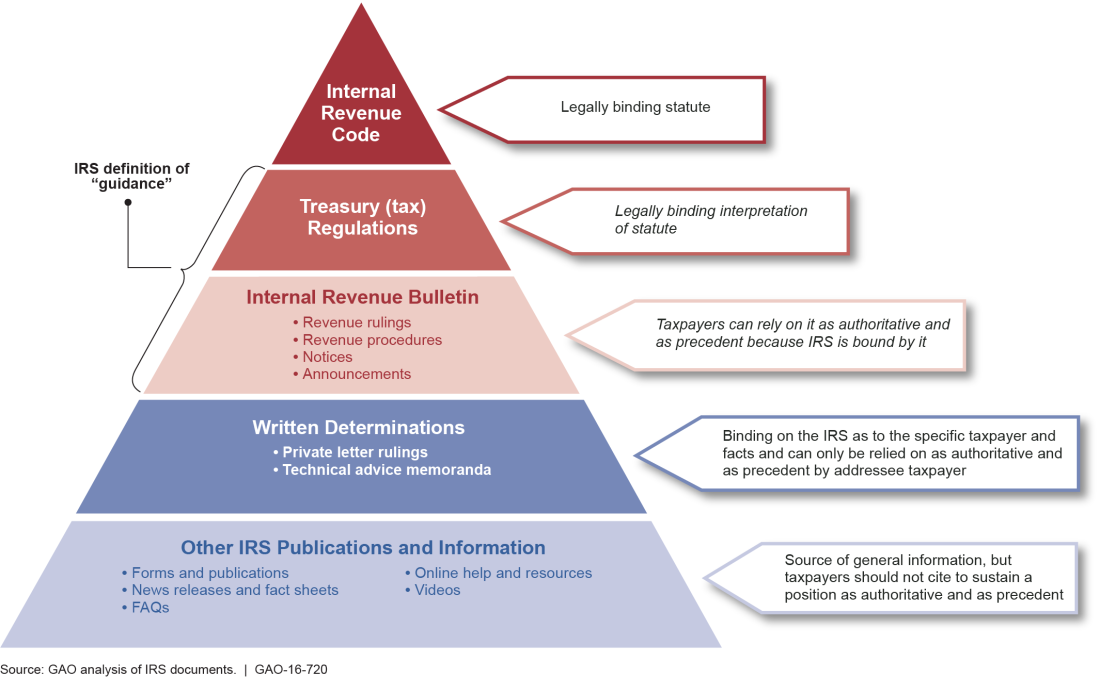

Furthermore, as agency spokespersons explained at the time, guidance is not rule making. If the guidance is not a rule, is it legally binding? When is IRS guidance something taxpayers should follow? Is it ever a rule?

How it's supposed to work, but doesn't actually.

Contrary to their own federal infographics, last year a 51-page report from the Government Accountability Office found numerous flaws and inconsistencies (and indeed, rule-breaking) in the guidance and rule-making process used by the IRS. If you don't have time to read all 51 pages of the report, here are some highlights from an excellent analysis of the damning report:

"In its review of IRS non-regulatory guidance—such as revenue rulings, revenue procedures, and notices—issued between 2013 and 2015, the GAO did not find a single instance in which the IRS determined that such guidance constituted a rule—let alone a “major” rule—under the CRA.

Rules are legally binding; that's why they need review and approval. The IRS likes to skip those steps.

Yet at the same time, the IRS published substantive rule changes in the form of innocuous documents like FAQs on their website, again violating requirements for public comment on new rule-making. Many times those FAQs were later removed from publication during routine website maintenance, leaving taxpayers with no way to determine which regulations apply to them.

"Sometimes the IRS’s substantive rules are cloaked in other forms of guidance... This secret rulemaking process makes it difficult for taxpayers and practitioners to track the changes in the rules, and it largely disenfranchises them from having a voice in rules that directly affect them.

The IRS guidance on bitcoin is a prime example of the agency violating its own procedures.

According to their own description - Notices are binding; FAQs are not. How, then, should a dutiful citizen consider the agency's "guidance" on bitcoin tax rules?

"The Internal Revenue Service today issued a notice providing answers to frequently asked questions (FAQs) on virtual currency"

According to their own explanation of what their documents mean for legal purposes, the IRS bitcoin guidance is either an authoritative but non-legally-binding "Notice" or else it is a non-authoritative general information FAQ. They use both words, so it's hard to know. The only thing their explanation makes clear is that it is not legally binding, except that they are currently issuing summons to make a federal case out of it, so WTF???

Another issue may help explain the present mess - the IRS rulemaking process has operated with essentially no outside oversight for decades. The analysis of the GAO report levels a hilariously understated jab:

"The 1983 agreement between Treasury and OMB determined—without explanation—that tax regulations are not subject to independent scrutiny. This agreement is suspect. In particular, it is not clear how Treasury and OMB can override a Congressional mandate and Executive Orders that contemplate independent review of tax regulations."

So Congress and the President give orders, and IRS bureaucrats just say no?

Seems legit!

What Does It Mean?

The John Doe opposition to the IRS's Coinbase summons did not receive a ruling in the end. Rather than face actual defeat, the IRS backed down and amended its summons voluntarily. This leaves key issues brought up in the hearing unaddressed. In particular, the IRS had argued that Coinbase customers had no standing to oppose the release of their information, since only Coinbase itself was named in the summons, and the customers could not prove actual injury.

That is an issue where the judge in the case, U.S. Magistrate Judge Jacqueline Scott Corley, seemed sympathetic to the plight of users:

"I have to say I find it troubling that the IRS is working so hard just to keep them from having their voice heard. I think it would be pretty extraordinary to say that the government getting …information that you claim they don't have a right to get is not an injury."

Now we wait to see if Coinbase will actually mount the opposition they announced. Will the company file an objection in court to this amended summons? Or is the amended summons the result of talks leading to this compromise?

All of this remains to be seen. The actions of Coinbase (and the IRS) in this case will establish legal precedent, even while the applicable tax regulations remain murky at best. This case, and any audits or other legal arguments that arise from it, will likely form the basis of U.S. tax law regarding cryptocurrency. All of us, especially in the U.S., have an interest in ensuring the case is handled properly, and the proper way to handle this case is to drop it.

Make Rules First, Then Enforce Them

Before attempting to enforce regulations regarding cryptocurrency, the government needs to create those regulations, including a fully democratic process of commentary and review before enacting them.

That radical idea should be obvious to even the most casual observer. Proposed rules should be reviewed by other agencies and the public, with commentary and revision until a sensible, agreed-upon set of rules emerges. Without a clear set of rules to determine taxes owed, even those people who WANT to pay their taxes in full are unable to do so.

The case against even the remaining Coinbase users affected by the revised summons should be abandoned until a clear set of applicable rules for taxes on cryptocurrency gains is determined. Those rules should be consistent with existing rules, and what that means exactly needs public input in order to claim any validity.

Does the claim in the non-rule-making IRS guidance (that cryptocurrency is a commodity) have any validity? Doesn't the opposite fundamental basis for its treatment have broader acceptance?

That cryptocurrency is currency, and therefore should be treated like any other currency is a truth accepted not only by millions of users worldwide, but also by other governmental bodies, including not only by the EU, but also by other divisions of the U.S. Treasury Department. Even the department's own internal audits criticize the IRS decision, prompting more Congress members to call on the IRS to make the changes to their rules that have been recommended by their own department.

The IRS has a responsibility to justify its fundamental assumptions about cryptocurrency (which have been widely rejected all over the world). With public input, which has been missing so far, the agency can enact rules that reflect the reality of cryptocurrency usage. Those rules need to exist before they can be justifiably enforced.

Thanks for covering this issue. I always assumed Coinbase was in the IRS pocket, but had no idea this was all going on. I just avoid using Coinbase ;-)

It's enough, to make me want to sell BTC, on Craigslist, the way I bought it in the first place ;-)

Yeah, I think that being so popular just makes them a tempting target.

Great article!

Thanks for reading

Good info @olyup, upvoted.

I'm glad you enjoyed it

I wonder how the IRS would treat all those who took loses on their crypto investments this year?

It's considered a capital asset. If your capital losses exceed your capital gains, the excess can be deducted on your tax return and used to reduce other income such as wages, up to an annual limit of $3000, or $1500 if you are married filing separately

Wow. How did you get 12 votes in 28 minutes replying to a 3 day old post!?

What magic do you know Santa with a machine gun?!?

An yes you got it exactly, i just wonder if they actually honor it. I dont know anyone that has actually declared capital loses on crypto.. seems hard to prove.... try explaining it to a 9-5 accountant who has never heard of bitcoin!

dunno how I got that many votes, but I'll take it LOL

They should get a deduction, right? if they claim it

maybe, see my reply to cryptoindex

great article! really informative.

One has to remember that the irs is the new world order. The international monitory fund. Aka banksters. They have made it impossible to get a copy of the actual income tax act. Instead you get a carefully written blend of the act over written with policies. Unless you got a copy years ago you will have no idea what is law and binding or what is current policy and not binding.. Legal disseption at it's best. The truth is in there good luck finding it though. When the inevitable adjustment comes we need to not alow banksters from taking us down the same path of destruction. We need to put our faith in sustainable approaches. Not a system that works only for the few at the top.

That's pretty crazy to hear.

This was great, following because of the quality!

Thanks, I appreciate that!