For what reason is Bitcoin viewed as a place of refuge resource in the US market?

In the US market, Coinbase, which gives encoded advanced cash exchanging, will be recorded for exchanging on April 14. Coinbase accomplished incomes of US$1.8 billion in the principal quarter of 2021, outperforming the US$1.3 billion for the entire of a year ago. The benefit roof in the main quarter may arrive at 800 million US dollars. 56 million enrolled clients, in excess of 43 million in the past quarter. With this development rate, the size of income and benefit far surpasses that of existing stock trades. Coinbase's fundamental exchanging item is Bitcoin, which shows how mainstream the market is for Bitcoin.

Notwithstanding the Coinbase posting factor, other market practices additionally show that the market is exceptionally worried about Bitcoin. Some notable insurance agencies, for example, Mass Mutual, New York Insurance Company, Liberty Mutual and Starr have started to together create Bitcoin-based protection items. Notable speculation banks in the United States have likewise started to give bitcoin-related administrations. The most revolutionary of these is Morgan Stanley. Morgan Stanley is putting vigorously in Bitcoin's market framework, while likewise giving Bitcoin-related administrations to its abundance customers. Moreover, starting today, 9 applications for the foundation of Bitcoin-based ETFs in the US market have been submitted to the US SEC. These and different advancements in the market demonstrate that the US market is progressively focusing on the estimation of Bitcoin.

In the market's decisions on the different qualities of Bitcoin, one of them is to view it as a place of refuge resource. Furthermore, this view has its rationale.

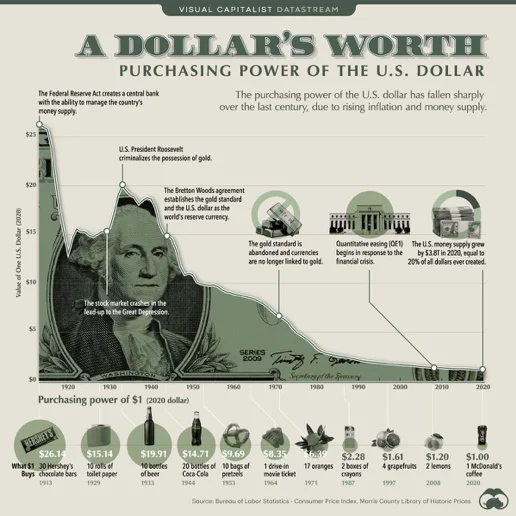

The fast expansion in the cost of Bitcoin can be said to have begun in March 2020. The money related strategy carried out by the Federal Reserve to save the emergency achieved by the pandemic has prompted a huge expansion in the issuance of US dollars. The extra issuance of the U.S. dollar will unavoidably achieve the deterioration of the U.S. dollar and the swelled estimation of all U.S. dollar-evaluated resources. These resources incorporate land and stocks. For institutional financial backers, they should consider how to manage the real deterioration of their own resources achieved by such market improvement. They started to examine elective resources that can support against such market chances. Among the accessible resources, the place of refuge estimation of Bitcoin has progressively been perceived by the market. With this increment in acknowledgment, an ever increasing number of establishments and people started to hold Bitcoin. The place of refuge estimation of Bitcoin is encapsulated in the accompanying aspects.First of all, Bitcoin was planned as an electronic money. Its plan object is to give a money arrangement notwithstanding the current legitimate cash. In its plan, the aggregate sum of Bitcoin is sure. This maintains a strategic distance from the component of extra issuance of lawful money. Besides, the working system of Bitcoin is programmed activity and isn't constrained by any organization or person. The aggregate sum of Bitcoin should be utilized and the component for acquiring use is currently programmed. In the previous 12 years of improvement, because of the expanding prominence of Bitcoin exchanges, an immediate trade exchange among Bitcoin and lawful cash has been shaped. Bitcoin can hence be valued dependent on different legitimate monetary standards. As Bitcoin's utilization and exchange become increasingly well known, it is currently turning into a store of significant worth and installment device. Because of the above qualities, particularly the most essential trait of a specific measure of bitcoin, it can keep away from the instrument of extra issuance of lawful cash, subsequently shaping a separated rivalry with legitimate money. When there is an issue with the lawful money on the lookout, the assets in the market will normally stream to a separated serious item like Bitcoin.

Regarding separated rivalry with fiat monetary standards, in explicit practice, Bitcoin progressively shows its separated qualities. At the point when the monetary standards of certain nations experience high swelling, the nearby Bitcoin exchange volume has risen essentially. This is valid in districts like Argentina, Turkey and Nigeria. This shows that the market is tolerating Bitcoin as a device to contend with existing legitimate monetary forms.

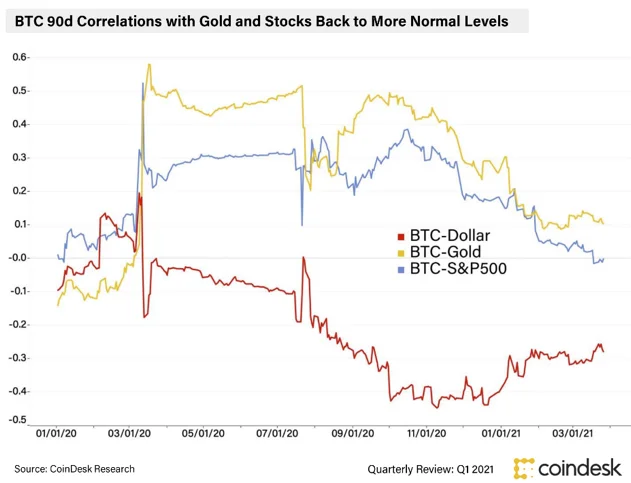

Another fundamental prerequisite as a place of refuge resource is its frail relationship with other standard resources. The more modest the connection, the higher its worth as a place of refuge resource. As per a new report by Coindesk, the relationship among's Bitcoin and gold and S&P500 is currently getting increasingly zero, and a negative connection with the U.S. dollar is likewise starting to show up. Thusly, as far as its pertinence to different resources, Bitcoin has progressively supporting worth.

In the current U.S. market, the ceaseless issuance of the U.S. dollar has caused far reaching worries about the devaluation of the U.S. dollar. Subsequently, the market's normal choice can support the danger of the devaluation of the dollar. The market's new development in revenue in silver and uranium is demonstrative of this supporting pattern. Bitcoin has likewise become a place of refuge resource decision for certain people and foundations. These days, the normal act of monetary establishments is to utilize 0.5% to 1% of their resources for hold bitcoins, to support the market hazard of the whole venture portfolio. Obviously, for monetary foundations with bigger volumes and more traditionalist tasks, like Mass Mutual and Black Rock, the quantity of bitcoins they hold is a more modest extent of their speculation portfolios. At the other limit of the market, there are likewise wonders like MicroStrategy CEO Michael Saylor getting to hold a lot of Bitcoin. At the other limit, there are normally countless institutional and individual financial backers who are not hopeful about Bitcoin, and pick gold or a few kinds of bonds as place of refuge resources. In this manner, in the US market, regarding picking Bitcoin as a place of refuge resource, the client's decision is as yet on a limit continuum. Nonetheless, in light of the current market advancement in the United States, an ever increasing number of assets will stream into Bitcoin.