Coinbase Review – Is Coinbase Safe?

Coinbase is one of the most popular exchanges currently available and is known for its ease of use and accessibility for new crypto enthusiasts. It’s a massive company, supporting an impressive 10M+ users and a staggering $50B+ in digital currency has been exchanged. The exchange site launched in San Francisco in 2012 and became the highest funded Bitcoin startup by 2013. It now supports 32 countries, and allows users to invest a total of US$10,000 per week in multiple cryptocurrencies including Bitcoin, Ethereum Bitcoin Cash and Litecoin.

If you’re looking to buy Bitcoin or other cryptos, then Coinbase is a great place to start. But if you’re looking for something else, we have another post that goes into more detail on how to buy Bitcoin with alternative payment methods, such as using cash and Paypal, two options that Coinbase don’t offer.

Ease of Use

In our opinion Coinbase is one of the more straightforward exchanges available and the best one for beginners. Here is a step by step guide to setting up a Coinbase account:

Sign up to Coinbase – Create an account on Coinbase by signing up using our referral link. This will give you a FREE $10 worth of Bitcoin and also help to support Cryptos Decoded. When signing up you’ll start by entering your email address, a password and your name. After they ask you to confirm your email address, you will have to decide if your account is individual or business.

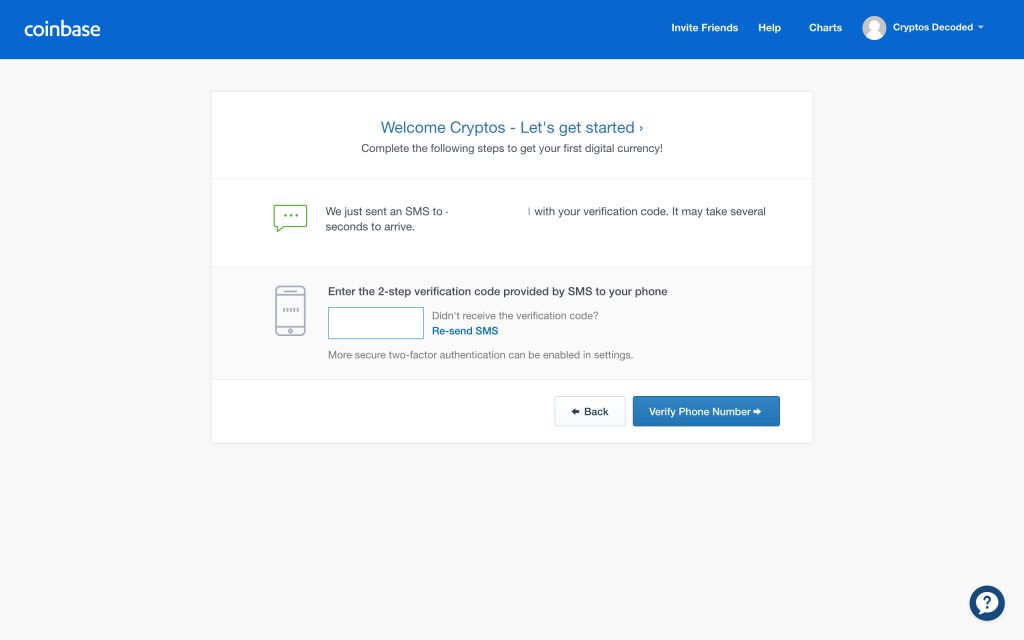

Verify your phone number – in order for your account to have another level of security, you will need to set up 2-factor identification. This is done by verifying your phone number, and from this point on each time you log into your account you will need to provide an additional pin number. You can use Authenticator on your phone.

Verify your identity – You will need to show proof of who you by taking a picture of some form of identification. Don’t worry, this is perfectly secure and is just to confirm you are who you say your are. This is the longest part of the process and may take a little while.

Set up a payment method – Coinbase has two options here, bank transfers or Credit/Debit Cards. Bank transfers are in general more time consuming, and while setting this up Coinbase will do one or two transactions to and from your account to verify its legitimacy. Furthermore the entire process of buying cryptocurrencies can take up to 5 days. Credit/Debit Card purchases will require a picture of your card however will give you an instant transaction. Both of these methods require you to have verifed your identity.

Buying cryptocurrency – Once all this is done and you have the correct funds in your account, go ahead and buy some cryptocurrency! This will be deposited in your Coinbase Wallet.

The Coinbase website is also generally very user friendly. It has a simple, clean layout that’s very easy to read and yet has a lot of information. In addition to this, Coinbase have one of the best mobile apps available for buying Bitcoin and other cryptos from your phone.

Coinbase Fees

The Coinbase Conversion Fees vary from 1.49% to 3.99%. This depends on multiple factors such as: location, payment method and other circumstances. In general standard bank transfer fees have a cheaper Conversion Fee than Credit Card transaction fees, this is because Credit Card companies charge extra fees. In some cases your bank may charge additional fees for transfers between your bank account and your Coinbase account, so watch out for these. Furthermore your bank could charge additional fees for purchases on Coinbase made through Credit Cards. To avoid these fees, switch to debit card or bank account.

Another way that Coinbase make money is through the “spread”. The spread is the difference in price that Coinbase will buy and sell cryptocurrencies. This can sometimes be quite large and means you won’t get as much of the crypto as you would expect. There’s not much you can do about this and it will happen on all coin exchanges as it is dependent on the amount of people trading. If you’d like to know more about trading terms and general cryptocurrency information, then check out our post – The Ultimate Beginners Guide to Cryptocurrencies.

Supported Countries

At the time of writing this post, Coinbase is offering its services in United States, United Kingdom, Singapore, Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Finland, France, Greece, Hungary, Ireland, Italy, Latvia, Liechtenstein, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, Switzerland.

Safety – Is Coinbase Safe?

So, the big question for crypto beginners – Is Coinbase safe? As far as cryptocurrency exchanges go, Coinbase is definitely one of the most trusted ones. Coinbase is a regulated and licensed company, and is one of the oldest exchanges around. Coinbase is also US based so this means it has to comply with US State and Federal Law, in comparison with some of its competitors who are based in countries that have lighter regulations, this is definitely a good thing.

The 2-factor authentication mentioned previously allows for another level of security. In addition to this, Coinbase provides added security with the Coinbase Vault. This Vault allows you to share an account with two other users, meaning any transaction asking to be sent out of the account will require the approval of the two other users as well as you. Also, to give you even more peace of mind, the transaction has a 48 hour delay, so you will have plenty of time to catch a potential unauthorised transaction. However Coinbase does track how users spend their Bitcoins, and this can be seen as a good or a bad thing. If you are dealing with controversial things like adult services or gambling, they are within their rights to freeze your account regardless of any levels of security.

If you are worried about the company itself, they are relatively open about their methods. In the event of insolvency, Coinbase would not have any rights to customer funds as it separates any held customer funds and company operational funds.

At the end of the day, users are still liable if their accounts are breached, and we recommend keeping your digital currencies in an external, offline wallet, you can check out our recommended Ethereum wallets for more information on why it’s important to keep your crypto off of exchanges.

Transactions and Withdrawals

Transaction Limits

Transaction limits vary from country to country, and you can find out your current transaction limit by going to the Settings page, then it’s under Limits. You are able to apply for higher limits but these higher limits in general are not applicable to Credit Card transactions.

Wallet Address

Sending money via Coinbase is very straightforward – all someone needs is your Coinbase email address. However if someone wants to send you Bitcoins, or any other cryptocurrency that Coinbase supports – but let’s talk in Bitcoins for the sake of simplicity – and they’re not on Coinbase, then they will need your public Bitcoin address. In Accounts there’s a section in Your Accounts with all of your crypto wallets, simply click Receive on Bitcoin and you will have your public Bitcoin address.

To send digital currency to another wallet you can just click Send and use the email address that the other user has linked to their Coinbase account by clicking Email Address. To send to a wallet that is external to Coinbase you can click Wallet Address and enter the external wallet address that you intend to send the money to.

Customer Support

You can access the Coinbase customer support via email or by reading through their FAQ. Typically response times from email are between 24-72 hours, however there is no concrete wait time for an email response especially due to the increase in traffic on their site over the past year, which has led to wait times increasing.

Final Thoughts

Coinbase definitely has its pros and cons. The biggest pro is that it is incredibly straightforward for new users and beginners to start their journey into the crypto world. The simplistic and clean user interface and easy payment methods make it a smooth experience either on the web or one mobile.

The main cons are that you are not in complete control over your purchases as you never have access to the private keys. This is the same for almost all exchanges and we would highly recommend keeping you crypto on a desktop or hardware wallet rather than the exchange itself. In addition to this, the fact that Coinbase track your transactions is generally considered a con by most. Some people have also reported having trouble changing crypto back into fiat currencies (USD, EUR etc) but we’ve never experienced that problem ourselves.