Cofound.it (CFI) Analysis Shows Two Paths but Same Destination

SUMMARY

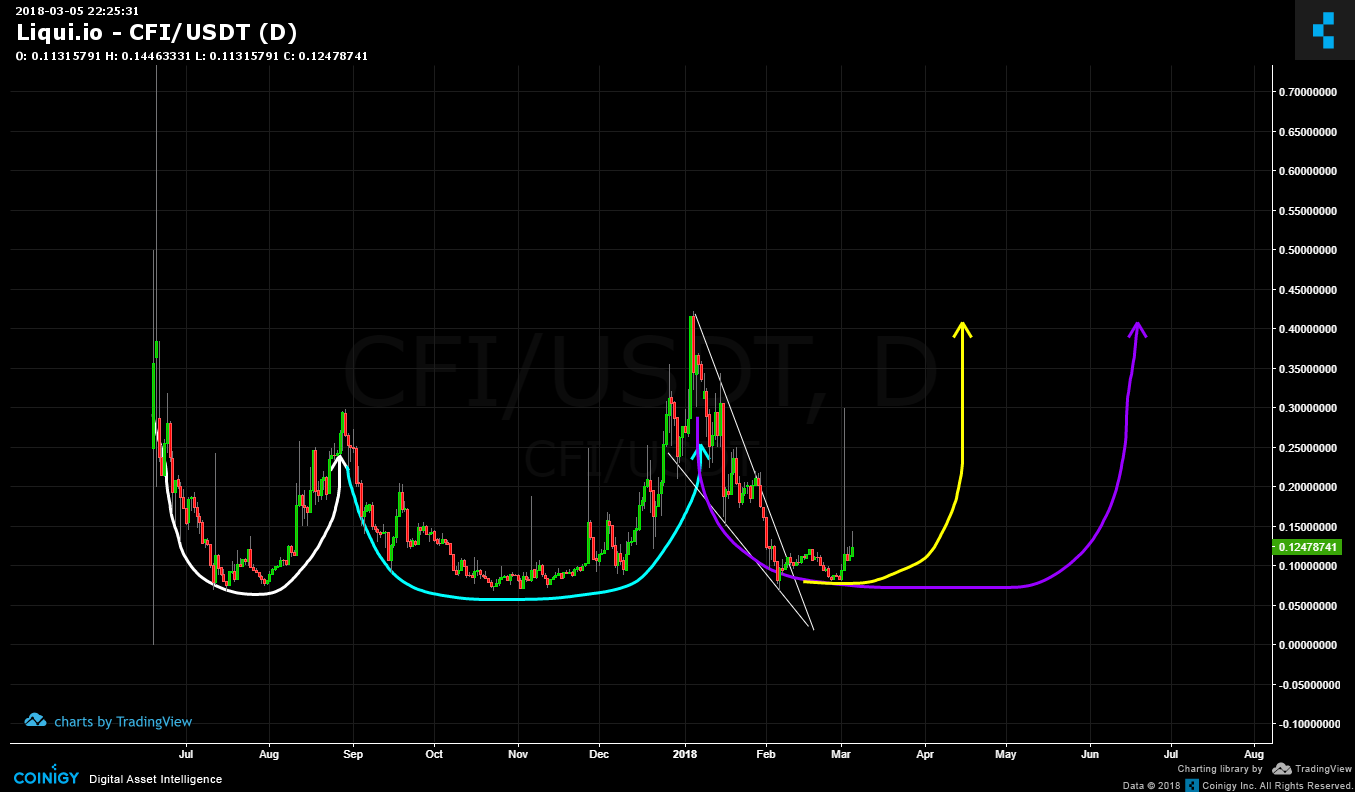

Here is the Cofound.it (CFI/USD) pair and from the first sight, the double rounded cup formations can be easily spotted. When you have a twofer, it strengthens the bullish projections. The descending wedge also compounds the bullish attribute of current correction. Having now three pattern factors, this is when the wave 3 extends 3.618 or even more and this is also when the subsequent price breakouts also go vertical. IF correct, the breakout will be breathtaking!

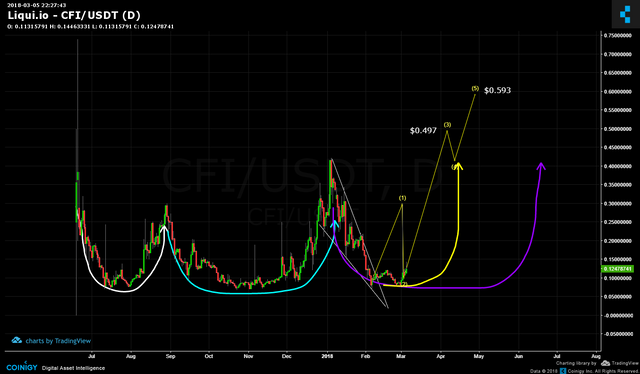

There are two paths projected for CFI in the next coming months. The purple represents the longer execution of the Hurry Up & Wait model and is clearly on the probable table. The more probable is the yellow and likely, the third cup formation is more than half complete. IF the blue cup is used as a guide; the completion of the wedge signals the half point, the next soundways movement of price would prep for a potential breakout.

So, after pattern analysis, adding Elliott Waves is the next step. In pursuit of the yello pathway, the impulse waves show $0.593 as the target for wave 5. Whether the yellow or the purple pathway is taken, the price target destination of wave 5 would remain about the same. Technical Analysis often plays out this way; different pathways but same destination.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

https://steemit.com/abuse/@transisto/open-letter-to-ranchorelaxo-and-haejin

Mr Haejin sir,

Why did you downvote me HERE at 100%???

IF you disagree with anything I said in the post, why not comment?

My post is based in facts. 3-5% for one Steemian is not able to be supported by STEEM. It will break the system if just a handful of other Steemians do the same thing.

You are able to change your Posting behaviour, or even refuse Payout on a number of posts, in order to share the Rewards with everyone.....

If you disagree, please explain yourself? Why go around flagging any and every post that disagrees with you? That seems like your attempt at CENSORSHIP.

IF you disagree with my Post, please REPLY in the COMMENTS why you disagree. No need to go straight to flag!!

Haejin upvoted me the other day at 100% then took it away!!! Has he ever took away a 100% vote to any76 of you guys/

No. But nor has he upvoted me.

Nice analysis, good job