On "Ghost Cities" in China & Managing an Economy With 1.4 Billion People

Today I want to step away from cryptocurrency and investing and highlight/update a bit one of my favorite pieces I've written in the past few years. Before I found Steemit, I wrote extensively on Quora. I think it was because they used this cryptoeconomic-like reward system, which they have now abandoned. I never understood why. It, like Steemit and Reddit, rewarded you for posting stuff that other people upvoted. As you accumulated more Quora points, you got more sway in the ecosystem. Hey! It's better than Facebook, where you post every intimate thing for free and get nothing in return but spam and political trickery. If you're interested in reading the original book review, that's the link. Here we go. Let's start with a little picture I took while wandering around Nanjing.

A recent picture of Nanjing being rebuilt.

Ever since I moved to China in 2011, I have wanted to read a book like Wade Shepard’s Ghost Cities of China: The Story of Cities Without People in the World’s Most Populated Country, published by Zed Books in 2015. Since living these past six years in Beijing and Shanghai, I have developed the habit of going on long, meandering walks through unfamiliar parts of the city. During these excursions, I quickly noticed that the older, decaying communities near where I lived, the very enclaves that gave my adopted hometowns their unique character, often transformed into piles of rubble without notice.

I was left to wonder… Where did that noodle shop go?

What happened to that great jianbing guy?

How about those kids that were playing in the street just last week?

Sometimes in the week after the destruction of an urban village, masons would build a wall around the newly "freed" land. Sometimes the lot just lied in ruin for months. And sometimes construction workers and equipment immediately swooped in and began the process of transmogrification into vertical gray-black office spires. White collar workers then spent their day there, perhaps grabbing a coffee at lunch in the overpriced branded cafe on the first floor, and vacated the premises at the end of the business day in favor of apartments in newly built skyscraper boxes on some other newly "freed" land plot, perhaps over an hour or two away in the suburbs. A neighborhood that once teemed with activity at all times of the day and night was left eerily empty in the dark.

What is the logic behind this process?

I knew that Chinese real estate was ridiculously expensive, but never quite grasped all of the complex machinations that facilitated its development from communal property into a quasi-private form of individual financial asset for the laobaixing. Thankfully, Wade Shepard provides a thorough primer on the subject. Because approximately one-fifth of China’s GDP is related to the real estate industry, anyone interested in the contemporary Chinese economy should read this thoroughly entertaining and highly informative book.

Wade Shepard is an experienced freelance journalist. His crisp and clean writing style reflects years on the beat for Forbes, South China Morning Post, and countless other reputable sources. The book is based on two-plus years of research, travel, and interviews with experts and people on the ground. His clear, no-nonsense approach is a welcome reprieve for this professor, who probably reads too many academic articles and dissertations converted for publication.

Ghost Cities comes in at just over 200 pages and is comprised of ten mostly narrative-based chapters. The first and last chapters serve as introduction and conclusion without being termed as such.

Chapters 2 through 9 address the variety of topics needed to understand the unprecedented and uniquely Chinese phenomenon of large-scale urbanization. “Clearing the Land” (Chapter 2) describes the nature and necessity of local government land sales to private developers. Some cities are so desperate for the cash and recognition that accompany GDP growth that they have literally moved mountains in order to create higher-value marketable land. “Powering the New China” (Chapter 8) explains the monumental task of providing electricity to one billion urban dwellers. Though China is poised to become a leader in alternative energy for decades to come, it has an insatiable demand that dictates a long-term reliance on dirty coal power as well. By 2030, the country will have installed over 2,500 gigawatts of annual electricity supply production - an installed base that is approximately two-and-a-half times that of the United States.

The first time I read about Chinese "ghost cities" was in the seminal Time photo essay where this photo comes from, about Ordos' new Kangbashi district in Inner Mongolia, which ironically is where Bitmain would later set up huge bitcoin mines.

Other chapters describe in detail the nature of the “ghost city” appellation so eagerly employed by Western media outlets like 60 Minutes, Business Insider, and Time. In fact, Shepard successfully argues that the term “ghost city” itself is a misnomer. With connotations inherited from America’s old Wild West, it implies the depopulation of a formerly thriving center of commerce.

When you say “ghost city” in America, thoughts turn to old mining towns, abandoned Catskills mountaintop resorts, and strip hotels along Route 66.

But the character of “ghost cities” in China is exactly the opposite. As you can see in the Time photo essay, a Chinese "ghost city" is not an ancient relic, but rather a modern dream that represents the hope of things to come.

In this sense, the Western media offers a criticism that is woefully misplaced. Zhengdong New District in Zhengzhou, Nanhui in Shanghai, Tianjin’s Ecocity, and the previously mentioned deserted desert district Ordos Kangbashi have all seen millions of people inhabit these areas after their embarrassing "ghost city" exposure. If you pause to think about it for just a second, that is the way it should work. These cities are built in anticipation of a flood of new residents. They are not going to reach capacity in a year. They probably will not even reach capacity in a decade.

In a country where only one-fifth of its 1.4 billion people lived in cities at the beginning of Deng Xiaoping’s grand hybrid capitalist experiment and which has literally only just reached the halfway point in its goal of having one billion urban citizens by 2050, how else is this process going to work? This Field of Dreams “build it and they will come” philosophy is absolutely necessary. It may look awfully strange to Western observers, but those G20 citizens just do not live in a country that has to manage 1.4 billion people.

The Party perceives Chinese urbanization as a priority for a variety of reasons. The primary reason is quite simple. Urban dwellers consume more. Thus, they contribute significantly more to GDP in the long run than self-sufficient farmers. In the short run, permanent construction offers a temporary super boost to GDP. Shepard lists a variety of other reasons as well. Another reason perhaps is to limit the chance of rural revolt by reversing the Mao maxim “the countryside surrounds the city.” In future China, it is clear that “the city surrounds the countryside” (90). Thus, for ambitious Party leaders, rapid urban development is a good way to earn a promotion.

This immutable aspect of human nature - the desire to succeed in one's individual career - explains a lot about the nature of China’s local debt problem. Indeed, various sources cite Chinese net debt (not only from government sources but also from private companies as well) as more than $36 trillion. The success of temporary city leaders increasingly relies on the undertaking of grandiose projects like the creation of endless central business districts, shopping malls, and Western-style suburbs.

These projects require extensive financing, forcing cities to become ever more dependent on land sales for income to service these massive debts. But Shepard points out what should be obvious to Western China doomsayers like Gordon Chang, who wrote The Coming Collapse of China... in 2001! Party-operated locales mostly owe debt to Party-operated financial institutions. These same banks and funds have consistently shown a willingness to restructure this debt to accommodate the successful realization of government goals.

Not all of these new infrastructure investments are sunk cost leviathans. They do earn money. For example, the current Prime Minister Li Keqiang initiated a $25.8 billion investment in Zhengzhou’s Zhengdong New District in 2003 (48). However, in a scant ten years later, its economy was growing at a healthy clip - around 13% - and already returning $1.22 billion in annual tax revenues to Beijing (55). For economists like myself who prefer to take the long-term view, that’s a pretty healthy return on investment! Aside from Shenzhen and Shanghai’s Pudong District, the classic examples of Chinese development success, this book provides many examples of flourishing urban planning. These type of projects will probably earn fine returns in first-tier cities, in what is called BeiShangGuang (meaning Beijing, Shanghai, and Guangdong province supercities Guangzhou and Shenzhen). But realizing acceptable rates of return on investments in third-tier cities and below is looking increasingly questionable.

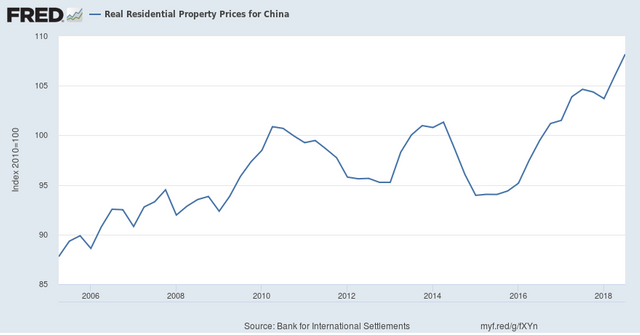

The only aspect of this book that I found fault with was the author’s claim that the Chinese “housing market is readjusting and topping out” (204). In 2016, Chinese real estate prices increased an average of 19% nationwide. In 2018, we are at even higher price levels in first-tier cities, but have started to see significant price declines in less desirable parts of the country. So my main criticism of Ghost Cities may well yet be proven unfounded. But even if real estate prices remain elevated, that does not disprove the main thesis of Shepard's outstanding book.

With just a little patience, most but probably not all of China’s “ghost cities” will likely be accretive to GDP and contribute to the “grand strategy” of Chinese leadership. Sadly, the West often lacks these qualities - the ability to think in decades instead of quarters, the ability to execute and complete large-scale projects - when it comes to finance and economics. Yeah, it looks like China may soon face its first significant economic correction since kaifang but this is merely representative of the cyclical nature of capitalism and should not merit a full-throated condemnation of leadership.

At least, that's what I thought at the beginning of 2017 and what I still believe to be true, in the long run at least, here at the end of 2018.

A little “boots on the ground” perspective goes a long way.

Thank you so much for participating the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Great post. I too have often enjoyed going on a long walk to a random part of Hangzhou to find a random run-down area. These days here Hangzhou is growing so quickly that it is hard to find a lot of ghost apartments but when I was in Weifang city I found a lot which was cool (strangely enough) to see.

Walking lost is the best way to get found in China.

Hangzhou got that BABA money that is transforming it by the day.

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOP@shanghaipreneur purchased a 77.72% vote from @promobot on this post.

*If you disagree with the reward or content of this post you can purchase a reversal of this vote by using our curation interface http://promovotes.com

You got a 30.57% upvote from @brupvoter courtesy of @shanghaipreneur!